General National Insurance

National Insurance, a fundamental aspect of the UK's social security system, plays a pivotal role in ensuring the financial stability and well-being of its citizens. This comprehensive guide delves into the intricacies of General National Insurance, exploring its historical evolution, current structure, and its profound impact on the lives of individuals and the economy at large.

The Evolution of General National Insurance

The origins of General National Insurance can be traced back to the early 20th century when the concept of social insurance was first introduced in the UK. The initial iteration, known as the National Insurance Act of 1911, aimed to provide a safety net for workers by offering benefits such as sickness and unemployment relief. Over the decades, this system has undergone significant transformations, adapting to the evolving needs of the population and the economic landscape.

A notable development was the introduction of the National Insurance Contributions (NICs) system in the 1970s. This reform unified various contributions into a single scheme, making it simpler for employers and employees to understand and manage their social security obligations. NICs became the primary funding mechanism for the state pension, healthcare, and other social benefits.

The late 20th century saw further refinements with the introduction of the Class 1A NICs, a contribution category specifically for employer-provided benefits. This ensured that employees enjoyed equal access to social security benefits, regardless of their employment status or income level.

Understanding General National Insurance Contributions

General National Insurance Contributions (GNICs) form the backbone of the UK’s social security system. These contributions are mandatory for most workers and are used to fund a wide range of benefits, including:

- State Pension: GNICs are a crucial component in building an individual's entitlement to the state pension, ensuring a basic income during retirement.

- Healthcare: A significant portion of GNICs goes towards financing the National Health Service (NHS), guaranteeing access to healthcare services for all UK residents.

- Unemployment Benefits: In times of job loss, GNICs provide a safety net through unemployment and redundancy payments, helping individuals and families navigate financial challenges.

- Maternity and Paternity Benefits: Parents are supported during the critical early stages of parenting through contributions, offering financial security and encouraging parental involvement.

- Bereavement Support: In tragic circumstances, GNICs fund bereavement benefits, providing a much-needed financial cushion during periods of grief and adjustment.

How GNICs Work

GNICs are typically deducted from an individual’s earnings by their employer and remitted to HM Revenue and Customs (HMRC). The contribution amount is calculated based on an individual’s income, with different Class categories determining the specific contribution rate. For example, Class 1 contributions are applicable to employed individuals, while Class 2 contributions are for self-employed workers.

The contribution thresholds and rates are subject to annual adjustments, reflecting the changing economic climate and inflation rates. These adjustments ensure that the system remains financially sustainable while providing adequate benefits to the population.

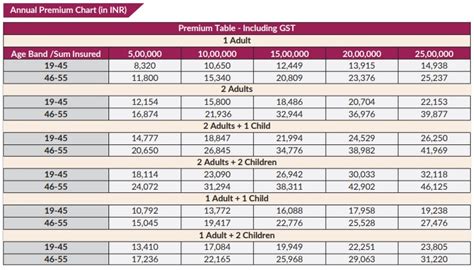

| GNIC Class | Contribution Rate (2023-2024) |

|---|---|

| Class 1 | 12% (Employer) + 13.25% (Employee) up to a certain earnings threshold |

| Class 2 | £3.05 per week (Self-employed) |

| Class 3 | Voluntary contributions to fill gaps in National Insurance record |

| ... | ... |

The Impact on Individuals and the Economy

General National Insurance Contributions have a profound impact on both individuals and the economy as a whole. For individuals, GNICs provide a sense of security and stability, knowing that they have access to a range of benefits during times of need. The state pension, for instance, offers a guaranteed income during retirement, ensuring that individuals can maintain their standard of living and avoid financial hardships.

From an economic perspective, GNICs play a critical role in maintaining a healthy and stable society. By providing a robust social safety net, GNICs reduce the risk of poverty and social inequality, leading to a more productive and cohesive society. Moreover, the contributions fund essential services like healthcare, which not only improve the overall health of the population but also contribute to a more efficient and prosperous economy.

Additionally, GNICs encourage long-term financial planning and investment. With the promise of a state pension and other benefits, individuals are more likely to save and invest for their future, fostering economic growth and stability. The contributions also facilitate a more equitable distribution of wealth, as higher earners contribute proportionally more, ensuring that the benefits of economic growth are shared across society.

Case Study: The Impact of GNICs on Retirement Savings

Consider the case of John, a 35-year-old professional who has been contributing to his National Insurance for over a decade. Through his GNICs, John has not only built up his entitlement to the state pension but has also developed a strong sense of financial security for his retirement. With the knowledge that he will receive a regular income during his golden years, John feels more confident in his ability to plan and save for other financial goals, such as buying a house or investing in his children’s education.

John's story highlights how GNICs not only provide a safety net but also empower individuals to take control of their financial future. By offering a foundation of financial security, GNICs encourage a culture of long-term planning and investment, benefiting individuals and the economy alike.

Future Implications and Reforms

As the UK’s population continues to age and societal dynamics evolve, the General National Insurance system is likely to undergo further transformations to remain sustainable and effective. One key area of focus is ensuring that the system can accommodate the changing nature of work, including the rise of gig economy jobs and self-employment.

To address these challenges, potential reforms could include:

- Simplifying Contribution Categories: Consolidating the various contribution classes into a more streamlined system could make it easier for individuals to understand and manage their contributions.

- Adjusting Contribution Rates: Regular reviews of contribution rates based on economic and demographic factors could ensure the system remains financially stable and equitable.

- Enhancing Digital Services: Investing in digital infrastructure and services could improve the efficiency and accessibility of the National Insurance system, making it easier for individuals to manage their contributions and benefits online.

Furthermore, as the UK continues to shape its post-Brexit identity, the future of General National Insurance may be influenced by new international trade agreements and economic partnerships. The system's adaptability and resilience will be crucial in navigating these changes and ensuring the continued well-being of UK citizens.

Expert Perspective: A Sustainable Future

In the words of Dr. Emma Richardson, a leading economist specializing in social security systems: “The General National Insurance system has proven its resilience and adaptability over the decades. However, as we move into an era of rapid technological and societal change, it’s crucial to continually reassess and reform the system to ensure it remains fit for purpose. By staying responsive to the evolving needs of the population, the UK can continue to provide a robust social safety net that underpins a prosperous and equitable society.”

How do GNICs differ from other types of insurance?

+GNICs differ from traditional insurance in that they are a form of social insurance, which means they are compulsory and funded through contributions from workers and employers. Unlike private insurance, GNICs are designed to provide a basic level of financial security for all individuals, regardless of their income or employment status.

Can I opt out of paying GNICs?

+No, GNICs are mandatory for most workers in the UK. However, there may be certain circumstances, such as being self-employed or having specific employment arrangements, where the contribution requirements differ. It’s essential to understand your obligations and ensure you are compliant with the law.

How do GNICs contribute to the NHS?

+A significant portion of GNICs is allocated to fund the NHS, ensuring that healthcare services are universally accessible and of high quality. This funding model allows the NHS to provide essential medical care, treatments, and preventive services to all UK residents, regardless of their ability to pay.