Aarp Supplemental Medicare Insurance

Navigating the world of Medicare coverage can be complex, especially when it comes to supplemental insurance plans. One of the leading providers in this field is AARP, which offers a range of insurance options to enhance Medicare benefits. In this article, we'll delve into the specifics of AARP's supplemental Medicare insurance, exploring its coverage, benefits, and the impact it can have on your healthcare experience.

Understanding AARP Supplemental Medicare Insurance

AARP, known for its advocacy and services for older Americans, extends its expertise into the realm of insurance with a comprehensive set of plans designed to complement original Medicare (Parts A and B). These supplemental insurance plans, often referred to as Medigap policies, fill the gaps left by Medicare’s standard coverage, ensuring a more robust and personalized healthcare experience.

Coverage and Benefits

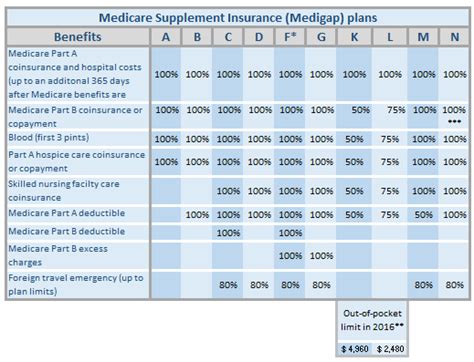

AARP’s supplemental Medicare insurance, or Medigap, offers a variety of plans to suit different needs and preferences. Each plan is labeled with a letter (A, B, C, etc.) and provides a specific set of benefits. Here’s a breakdown of some of the key features:

- Plan A: This basic plan covers some of the costs not covered by original Medicare, including copayments and coinsurance for Part A hospitalization and Part B medical services. It also covers the first three pints of blood each year.

- Plan F: Often considered the most comprehensive, Plan F covers all Medicare Part A and B deductibles, copayments, and coinsurance, including the first three pints of blood and even the Medicare Part B excess charges. It's an ideal choice for those seeking complete peace of mind.

- Plan G: Similar to Plan F, Plan G covers all Medicare Part A and B deductibles, copayments, and coinsurance, except for the Medicare Part B deductible. This plan offers a slightly lower premium compared to Plan F and is a popular choice for those who prefer a balance between coverage and cost.

- Plan N: A cost-effective option, Plan N covers Medicare Part A and B copayments and coinsurance, excluding the first three pints of blood and some other Part B services. It also has a copay requirement for office visits and emergency room visits.

Each plan has its own unique benefits and limitations, and the choice depends on individual healthcare needs and budget considerations. AARP's supplemental insurance plans are guaranteed renewable, which means the insurer cannot cancel your policy as long as you pay your premiums.

| Plan | Coverage Highlights |

|---|---|

| Plan A | Basic coverage for copayments and coinsurance |

| Plan F | Comprehensive coverage, including excess charges |

| Plan G | Extensive coverage, excluding the Part B deductible |

| Plan N | Cost-effective option with some copay requirements |

Enrolling in AARP Supplemental Medicare Insurance

Enrolling in AARP’s supplemental Medicare insurance is straightforward. You can apply during specific enrollment periods, which include:

- Initial Enrollment Period: This period begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B, and it lasts for six months. Enrolling during this time ensures you won't be charged a higher premium due to pre-existing conditions.

- Open Enrollment Period: This annual period typically runs from October 15 to December 7, providing an opportunity to review and switch your Medigap plan without medical underwriting.

- Guaranteed Issue Rights: Certain life events, such as losing your current Medigap coverage, can trigger a Guaranteed Issue Right, allowing you to enroll in a new plan without medical underwriting.

During the enrollment process, it's crucial to provide accurate and complete information. Misrepresentation can lead to policy cancellation or denial of claims. Always consult with an insurance professional to ensure you make an informed decision.

Cost and Premiums

The cost of AARP’s supplemental Medicare insurance varies based on the plan chosen, your location, and your age. Generally, premiums are higher for those who enroll after their Initial Enrollment Period, as they may be subject to medical underwriting. However, certain plans, like Plan G, often have lower premiums compared to Plan F, making them a more budget-friendly option.

The Impact on Your Healthcare Experience

By opting for AARP’s supplemental Medicare insurance, you gain enhanced coverage and financial protection. Here’s how it can benefit you:

- Reduced Out-of-Pocket Costs: With supplemental insurance, you can minimize the financial burden of copayments, coinsurance, and deductibles, ensuring your healthcare expenses are more manageable.

- Peace of Mind: Knowing that your insurance covers a wider range of services can provide a sense of security, allowing you to focus on your health and well-being without worrying about unexpected medical bills.

- Customized Coverage: AARP's Medigap plans offer a variety of options, ensuring you can choose a plan that suits your specific healthcare needs and budget.

Future Implications and Considerations

As healthcare landscapes evolve, it’s essential to stay informed about potential changes. Here are some considerations for the future:

- Plan Availability: AARP may introduce new plans or adjust existing ones to meet changing healthcare needs. Staying updated on these changes can help you make informed decisions about your coverage.

- Premium Adjustments: Like many insurance policies, AARP's supplemental Medicare insurance premiums may increase over time. Understanding the factors that influence these adjustments, such as inflation and healthcare costs, can help you budget effectively.

- Medicare Changes: Medicare itself is subject to changes in coverage and benefits. Staying informed about these changes can ensure you maintain adequate coverage and avoid any gaps in your healthcare protection.

Expert Insights

Navigating the world of supplemental Medicare insurance can be complex, but with the right guidance, you can make informed decisions. Consider consulting with an insurance professional who specializes in Medicare to ensure you choose a plan that suits your unique needs. Remember, your healthcare is a personal journey, and the right insurance coverage can make all the difference.

Can I enroll in AARP’s supplemental Medicare insurance at any time?

+While you can apply for AARP’s supplemental insurance at any time, there are specific enrollment periods that offer more advantages. These include the Initial Enrollment Period, the Open Enrollment Period, and Guaranteed Issue Rights. Enrolling during these periods ensures you won’t face higher premiums or medical underwriting due to pre-existing conditions.

What happens if I miss my Initial Enrollment Period for Medigap?

+If you miss your Initial Enrollment Period, you may still be able to enroll in Medigap, but you might face higher premiums or be subject to medical underwriting. However, certain life events, like losing your current Medigap coverage, can trigger a Guaranteed Issue Right, allowing you to enroll without medical underwriting.

How do I choose the right Medigap plan for my needs?

+Choosing the right Medigap plan involves considering your healthcare needs and budget. Plans with more comprehensive coverage, like Plan F or G, offer more peace of mind but may have higher premiums. Plans like Plan N are more cost-effective but may require some out-of-pocket expenses. Consulting with an insurance professional can help you make an informed decision.