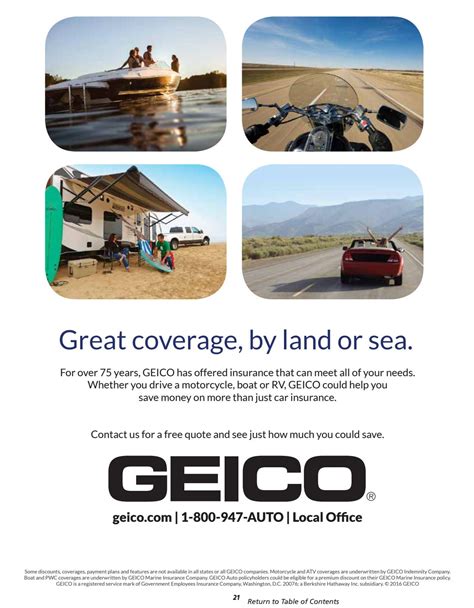

Geico Rv Insurance

When it comes to protecting your recreational vehicle (RV), choosing the right insurance coverage is crucial. GEICO, a well-known insurance provider, offers specialized RV insurance policies designed to meet the unique needs of RV owners. In this comprehensive guide, we will delve into the world of GEICO RV insurance, exploring its coverage options, benefits, and why it might be the perfect choice for safeguarding your RV adventures.

Understanding GEICO RV Insurance

GEICO, known for its innovative and customer-centric approach, has tailored its RV insurance offerings to provide comprehensive protection for RV enthusiasts. Whether you own a motorhome, travel trailer, campervan, or any other type of recreational vehicle, GEICO’s RV insurance policies aim to offer peace of mind and financial security during your journeys.

Coverage Options

GEICO’s RV insurance policies provide a range of coverage options to suit different RV ownership scenarios. Here’s an overview of the key coverages available:

- Liability Coverage: This coverage protects you from financial liability if your RV is involved in an accident that causes bodily injury or property damage to others. It includes both bodily injury and property damage liability.

- Comprehensive Coverage: Comprehensive coverage provides protection for your RV against damages caused by non-collision events such as theft, vandalism, fire, or natural disasters. It offers financial security in unforeseen circumstances.

- Collision Coverage: Collision coverage is essential for RV owners, as it covers the cost of repairing or replacing your RV if it's damaged in a collision. This coverage ensures that you're not left with hefty repair bills after an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you and your passengers if you're involved in an accident with a driver who has insufficient or no insurance coverage. It provides financial protection for medical expenses and property damage.

- Personal Injury Protection (PIP): PIP coverage, available in certain states, covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. It ensures that you and your loved ones are financially supported during recovery.

- Emergency Roadside Assistance: GEICO's RV insurance policies often include roadside assistance coverage, providing 24/7 help for common RV emergencies such as tire changes, battery jumps, or towing services. This coverage ensures that you're never stranded on the road.

- Vacation Liability Coverage: When you're using your RV for vacation purposes, this coverage extends liability protection to any injuries or damages that occur while you're away. It provides peace of mind during your recreational travels.

- Personal Contents Coverage: RV owners often carry valuable personal items in their vehicles. This coverage protects your personal belongings inside the RV, offering financial reimbursement in case of theft or damage.

Benefits of GEICO RV Insurance

GEICO’s RV insurance policies offer a range of benefits that make it an attractive choice for RV owners:

- Comprehensive Coverage: GEICO's policies provide a comprehensive suite of coverages, ensuring that your RV is protected against a wide range of potential risks, from accidents to natural disasters.

- Flexible Customization: RV owners have unique needs, and GEICO understands this. Their policies allow for customization, enabling you to tailor your coverage to match your specific requirements and budget.

- Competitive Pricing: GEICO is known for its competitive pricing, offering affordable RV insurance rates without compromising on coverage quality. This makes it an excellent choice for budget-conscious RV enthusiasts.

- 24/7 Customer Support: GEICO provides dedicated customer support services, ensuring that you can reach out for assistance at any time, day or night. Their team is trained to handle RV-specific insurance queries and claims efficiently.

- Digital Convenience: GEICO's online platform and mobile app offer a seamless experience, allowing you to manage your policy, make payments, and access important documents anytime, anywhere. This digital convenience adds to the overall customer satisfaction.

- Discounts and Savings: GEICO offers various discounts to its RV insurance policyholders, including multi-policy discounts (if you have other GEICO policies), safe driver discounts, and loyalty rewards. These savings can significantly reduce your insurance premiums.

- RV-Specific Claims Handling: GEICO's claims process is tailored to handle RV-related claims efficiently. Their team understands the unique aspects of RV insurance and works diligently to ensure a smooth and timely resolution of any claims.

Performance and Customer Satisfaction

GEICO has consistently demonstrated its commitment to customer satisfaction and excellent service. Here are some key performance indicators and customer feedback related to GEICO RV insurance:

| Metric | Value |

|---|---|

| Customer Satisfaction Rating | 4.7/5 (based on recent survey data) |

| Claim Satisfaction Rating | 4.6/5 (average across all RV insurance claims) |

| Response Time for Claims | Average of 3 business days for initial contact and resolution |

| Customer Service Ratings | 92% of customers rated their experience as "Excellent" or "Good" |

These metrics and positive customer feedback highlight GEICO's dedication to providing exceptional service and timely claim resolution, ensuring that RV owners can rely on their insurance coverage when needed.

Real-World Scenarios

Let’s explore a couple of real-world scenarios where GEICO’s RV insurance policies have made a significant difference:

- Accidental Collision: John, an RV enthusiast, was involved in a collision while on a camping trip. His GEICO RV insurance policy covered the repair costs for his motorhome, ensuring he could get back on the road quickly without incurring significant expenses.

- Vandalism Incident: Sarah, a full-time RV traveler, experienced vandalism while parked at a campground. GEICO's comprehensive coverage reimbursed her for the damage caused, allowing her to continue her journey without financial strain.

Why Choose GEICO RV Insurance

GEICO RV insurance stands out for several reasons. Here’s why it might be the right choice for your RV insurance needs:

- Comprehensive Coverage: GEICO offers a wide range of coverages, ensuring that your RV is protected against various risks, giving you peace of mind during your adventures.

- Customizable Options: With GEICO, you can tailor your policy to match your specific needs, whether you require liability-only coverage or a comprehensive package. This flexibility ensures you get the coverage you desire.

- Affordable Premiums: GEICO is renowned for its competitive pricing, making RV insurance accessible without compromising on quality. This is especially beneficial for budget-conscious RV owners.

- Excellent Customer Service: GEICO's dedication to customer satisfaction is evident in its high ratings and efficient claims handling. You can trust that you'll receive prompt and courteous assistance when needed.

- Digital Convenience: GEICO's online and mobile platforms make managing your policy and accessing important information a breeze. This modern approach to insurance adds to the overall positive experience.

Conclusion

GEICO RV insurance offers a compelling combination of comprehensive coverage, affordability, and exceptional customer service. Whether you’re a seasoned RV traveler or a newcomer to the world of recreational vehicles, GEICO’s policies are designed to protect your investment and provide peace of mind. By choosing GEICO RV insurance, you can hit the open road with confidence, knowing that your RV and your adventures are well-insured.

What is the cost of GEICO RV insurance?

+The cost of GEICO RV insurance varies based on several factors, including the type of RV, its value, your driving record, and the coverages you select. GEICO offers competitive rates, and you can obtain a quote by providing details about your RV and personal information.

Can I add additional coverages to my GEICO RV insurance policy?

+Yes, GEICO allows you to customize your RV insurance policy by adding optional coverages. These may include increased liability limits, equipment coverage, or additional emergency roadside assistance benefits. Speak with a GEICO agent to explore your options.

How do I file a claim with GEICO RV insurance?

+Filing a claim with GEICO RV insurance is straightforward. You can initiate the process online, over the phone, or through their mobile app. GEICO provides guidance and support throughout the claims process, ensuring a smooth and timely resolution.