Cash Value Life Insurance Definition

Cash value life insurance is a versatile financial product that combines long-term protection with an accumulating cash value component. It offers policyholders both a death benefit for their beneficiaries and the potential for savings or investment growth. This type of insurance policy has been a popular choice for individuals seeking to secure their loved ones' financial future while also building personal wealth. Understanding the definition, key features, and advantages of cash value life insurance is essential for making informed decisions about your financial security and planning.

The Definition of Cash Value Life Insurance

Cash value life insurance, also known as permanent life insurance, is a long-term insurance policy that provides coverage for the entirety of the policyholder’s life, assuming they meet the premium payment obligations. The defining feature of this type of insurance is the accumulation of cash value within the policy. The cash value component acts as a savings or investment account that grows over time and can be accessed by the policyholder through loans, withdrawals, or policy surrenders.

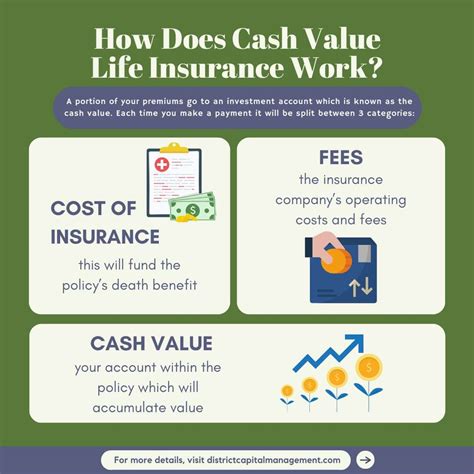

The policyholder pays regular premiums, a portion of which is used to cover the cost of insurance (COI), while the remaining amount is invested by the insurance company. The investments are typically in a range of assets, including stocks, bonds, and money market instruments. The growth of these investments contributes to the cash value of the policy.

The cash value component of the policy offers flexibility and financial planning opportunities. Policyholders can use the cash value to supplement their retirement income, pay for large expenses like a child's education, or even take out a loan against the policy's cash value. However, it's important to note that loans and withdrawals reduce the policy's death benefit and may have tax implications.

Key Components of Cash Value Life Insurance

Cash value life insurance policies consist of several key components that work together to provide long-term financial protection and savings opportunities:

- Death Benefit: This is the primary purpose of life insurance, providing a financial payout to the beneficiaries upon the policyholder’s death. The death benefit can help cover funeral expenses, pay off debts, and provide income for the family.

- Cash Value: The cash value component is a unique feature of permanent life insurance. It grows over time and can be used for various financial needs or emergencies. The growth rate of cash value depends on the policy’s investment performance and the insurance company’s crediting rate.

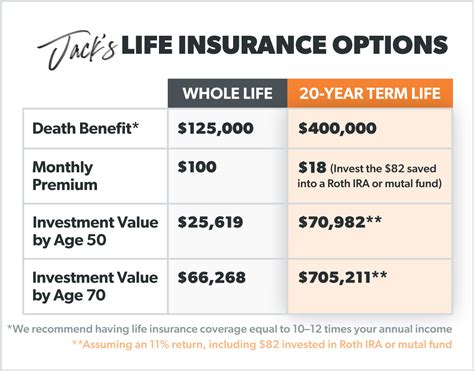

- Premiums: Policyholders pay regular premiums, which are typically higher than those of term life insurance. A portion of the premium goes towards the cost of insurance, while the rest is invested to build the policy’s cash value.

- Investment Options: Many cash value life insurance policies offer a range of investment options, allowing policyholders to choose the level of risk and potential return they are comfortable with. These options can include fixed interest accounts, mutual funds, or separate accounts with varying levels of investment risk.

- Flexibility: Cash value life insurance policies provide flexibility in terms of premium payments and policy management. Policyholders can adjust their premium payments, access the cash value through loans or withdrawals, and even change the beneficiaries or death benefit amount.

Advantages of Cash Value Life Insurance

Cash value life insurance offers several advantages that make it an attractive option for individuals seeking comprehensive financial protection and long-term savings:

Long-Term Protection

One of the primary benefits of cash value life insurance is its ability to provide lifelong protection. Unlike term life insurance, which offers coverage for a set period, cash value life insurance remains in force as long as the policyholder pays the premiums. This ensures that the policyholder’s loved ones are financially protected throughout their lives, regardless of their age or health status.

Building Wealth

The cash value component of the policy acts as a savings or investment vehicle, allowing policyholders to build wealth over time. The growth of the cash value can be significant, especially when the policy is held for an extended period. This accumulated wealth can be used for various financial goals, such as funding retirement, paying for a child’s education, or starting a business.

Flexibility and Customization

Cash value life insurance policies offer a high degree of flexibility. Policyholders can choose from a range of investment options, adjust their premium payments, and even take out loans or make withdrawals from the policy’s cash value. This flexibility allows individuals to tailor their policy to their specific financial needs and goals.

Tax Advantages

The cash value component of the policy can offer tax advantages. Growth in the cash value is typically tax-deferred, meaning it is not subject to annual taxation. Additionally, withdrawals or loans taken against the policy’s cash value may be tax-free, depending on the policy’s terms and the policyholder’s tax situation.

Estate Planning

Cash value life insurance can be an essential tool for estate planning. The death benefit can be used to pay estate taxes, cover funeral expenses, and ensure the financial well-being of the policyholder’s beneficiaries. The policy’s cash value can also be passed on to beneficiaries tax-free, providing a valuable inheritance.

| Key Advantage | Description |

|---|---|

| Long-Term Protection | Cash value life insurance provides lifelong coverage, ensuring financial protection for loved ones. |

| Wealth Building | The policy's cash value accumulates over time, offering a valuable savings or investment opportunity. |

| Flexibility | Policyholders can customize their policy, choose investment options, and access cash value through loans or withdrawals. |

| Tax Benefits | Cash value growth is typically tax-deferred, and withdrawals or loans may be tax-free. |

| Estate Planning | The death benefit and cash value can be used for estate planning purposes, providing financial security for beneficiaries. |

How does cash value life insurance differ from term life insurance?

+Cash value life insurance, or permanent life insurance, provides lifelong coverage and accumulates cash value over time. Term life insurance, on the other hand, offers coverage for a set period, typically 10, 20, or 30 years, and does not have a cash value component. Term life insurance is generally more affordable but offers no savings or investment opportunities.

Can I access the cash value of my policy during my lifetime?

+Yes, you can access the cash value of your policy through loans, withdrawals, or policy surrenders. However, it’s important to note that loans and withdrawals reduce the policy’s death benefit and may have tax implications. Policy surrenders terminate the policy and may result in tax consequences.

Are there any tax benefits associated with cash value life insurance?

+Yes, cash value life insurance can offer tax advantages. Growth in the cash value is typically tax-deferred, and withdrawals or loans may be tax-free, depending on the policy’s terms and your tax situation. It’s important to consult a tax advisor to understand the potential tax implications.