Medigap Insurance

Medigap insurance, also known as Medicare Supplement Insurance, plays a crucial role in the American healthcare system, offering additional coverage to individuals enrolled in Medicare. With an ever-evolving healthcare landscape, understanding Medigap's role, benefits, and limitations is essential for those navigating their Medicare options. This comprehensive guide aims to delve into the intricacies of Medigap insurance, providing a detailed analysis of its functionality, benefits, and potential impact on healthcare consumers.

Unraveling Medigap Insurance: An In-Depth Exploration

Medigap insurance serves as a vital supplement to original Medicare, filling in the gaps left by Medicare Parts A and B. These gaps often include deductibles, coinsurance, and copayments, which can become significant financial burdens for individuals without supplementary coverage. By offering a range of standardized plans, Medigap provides a safety net for Medicare beneficiaries, ensuring they can access the healthcare services they need without worrying about unexpected costs.

Standardized Plans: A Clear Advantage

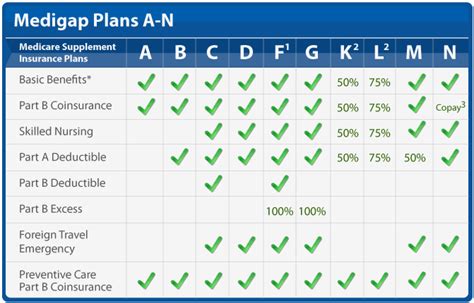

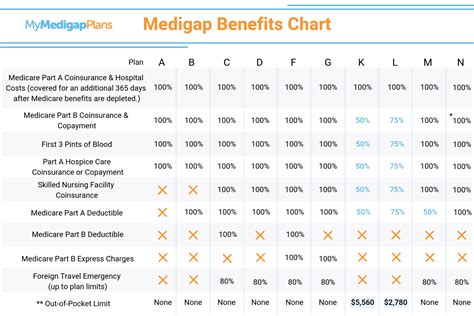

One of the key advantages of Medigap insurance is its standardized plans. Unlike other types of health insurance, Medigap plans are standardized by the Centers for Medicare & Medicaid Services (CMS), ensuring that each plan type offers the same set of benefits regardless of the insurance company providing it. This standardization simplifies the comparison process for consumers, making it easier to understand the benefits and choose the plan that best suits their needs.

The Medigap plans are labeled with letters A through N, each offering a unique combination of benefits. For example, Plan F, one of the most popular Medigap plans, covers all Medicare Part A and Part B deductibles, copayments, and coinsurance, as well as the cost of the first three pints of blood each year and the Medicare Part A deductible when admitted to a hospital.

| Medigap Plan | Key Benefits |

|---|---|

| Plan A | Covers basic benefits like Part A coinsurance and hospital costs. |

| Plan F | Comprehensive coverage, including all Part A and B deductibles. |

| Plan G | Similar to Plan F, but without the Part B deductible coverage. |

| Plan N | Offers lower premiums but with some cost-sharing for Part B coinsurance and excess charges. |

The availability of these plans may vary by state, and it's essential for individuals to check with their state insurance department to understand which plans are offered in their area.

Eligibility and Enrollment

Medigap insurance is available to individuals who are enrolled in original Medicare, which consists of Medicare Part A (hospital insurance) and Part B (medical insurance). To be eligible for Medigap, one must be enrolled in both Part A and Part B. It’s important to note that Medigap policies are sold by private insurance companies, and not by the federal government.

The enrollment process for Medigap insurance is often time-sensitive. The best time to enroll is during one's Medicare Initial Enrollment Period (IEP), which is a 7-month period that begins 3 months before the individual's 65th birthday month and ends 3 months after. Enrolling during this period ensures that the individual can choose any Medigap plan available in their state without undergoing medical underwriting. Medical underwriting is the process where insurance companies can deny coverage or charge higher premiums based on an individual's health status.

Outside of the IEP, individuals may still be able to enroll in Medigap, but they may face additional challenges. Insurance companies may require medical underwriting, which could result in higher premiums or even denial of coverage. However, certain circumstances, such as losing employer-sponsored health insurance or moving to a new state, may trigger a Medigap Guaranteed Issue Right, which guarantees coverage without medical underwriting.

Cost and Premiums

The cost of Medigap insurance can vary significantly depending on several factors, including the plan type, the insurance company, and the individual’s age and health status. Premiums can be paid monthly, quarterly, semi-annually, or annually, and they can increase over time due to factors like inflation and the individual’s advancing age.

Medigap plans do not cover all healthcare expenses. For instance, they typically do not cover long-term care, dental care, vision care, hearing aids, or private-duty nursing. Additionally, Medigap plans cannot be used for services covered under Medicare Part D (prescription drug coverage), except for certain limited exceptions like insulin injections and oral anti-cancer medications.

Medigap vs. Medicare Advantage: A Comparative Analysis

When exploring Medicare supplement options, individuals often encounter both Medigap and Medicare Advantage (Part C) plans. While both types of plans aim to enhance Medicare coverage, they differ significantly in their structure and benefits.

Medigap plans, as mentioned earlier, are designed to supplement original Medicare (Part A and Part B) by covering the gaps in Medicare's coverage. They do not provide additional health benefits beyond what Medicare covers, and they do not offer prescription drug coverage. Medigap plans are typically more straightforward, with a focus on providing comprehensive or specific supplementary coverage for original Medicare.

On the other hand, Medicare Advantage plans are an alternative way to receive Medicare benefits. These plans are offered by private insurance companies that contract with Medicare to provide at least the same benefits as original Medicare, but often include additional benefits like prescription drug coverage, vision, dental, and hearing services. Medicare Advantage plans may also offer additional benefits like fitness programs or wellness initiatives.

The choice between Medigap and Medicare Advantage depends on an individual's specific needs and preferences. Medigap plans offer a more traditional approach to Medicare supplementation, providing a straightforward way to cover the gaps in original Medicare. In contrast, Medicare Advantage plans offer a more comprehensive, all-in-one approach, often with additional benefits and services.

The Future of Medigap Insurance: Potential Changes and Trends

The landscape of Medigap insurance is not static, and it is influenced by various factors, including changes in Medicare policies, shifts in the healthcare industry, and legislative actions. While it’s challenging to predict the future with absolute certainty, we can explore some potential trends and changes that may impact Medigap insurance in the coming years.

One potential trend is the increasing focus on cost-sharing and high-deductible health plans. As healthcare costs continue to rise, there may be a push towards plans that encourage cost-conscious behavior among beneficiaries. This could lead to Medigap plans with higher deductibles and cost-sharing, which could impact the premium costs and the overall appeal of these plans.

Additionally, the ongoing debate around Medicare for All or similar universal healthcare proposals could have significant implications for Medigap insurance. If such proposals were to be implemented, they might render Medigap plans unnecessary, as comprehensive healthcare coverage would be provided to all individuals regardless of their insurance status. However, it's important to note that these proposals are complex and face significant political and logistical challenges, making their implementation uncertain.

On a more immediate scale, changes in Medicare policies and regulations can also impact Medigap insurance. For instance, adjustments to Medicare Part B premiums or the introduction of new Medicare benefits could influence the structure and benefits of Medigap plans. Insurance companies may need to adapt their Medigap offerings to align with these changes, potentially leading to new plan designs or modifications to existing plans.

Conclusion: Empowering Healthcare Choices with Medigap Insurance

Medigap insurance is a powerful tool in the healthcare landscape, offering a safety net for individuals enrolled in original Medicare. By understanding the intricacies of Medigap plans, eligibility, and costs, individuals can make informed decisions about their healthcare coverage. While Medigap insurance provides a range of benefits, it’s essential to consider individual needs and the potential changes in the healthcare industry when selecting a plan.

As we navigate the complex world of healthcare, Medigap insurance stands as a reliable option, providing peace of mind and financial protection to those who choose it. With its standardized plans and clear benefits, Medigap continues to play a crucial role in ensuring Americans can access the healthcare services they need without financial strain.

Can I enroll in Medigap if I have a pre-existing condition?

+Yes, Medigap plans cannot deny coverage or charge more based on health status during your Initial Enrollment Period. Outside of this period, you may face medical underwriting, which could result in higher premiums or denial of coverage.

Do all Medigap plans cover prescription drugs?

+No, most Medigap plans do not cover prescription drugs. If you need prescription drug coverage, you should consider enrolling in a Medicare Part D plan.

Can I have both Medigap and Medicare Advantage plans simultaneously?

+No, you cannot have both Medigap and Medicare Advantage plans at the same time. These plans serve different purposes and are not designed to be used together.