Home Insurance Definition

Home insurance, often referred to as homeowners insurance, is a vital form of financial protection designed specifically for homeowners and residential property owners. It provides coverage for a range of potential risks and liabilities associated with owning a home, offering peace of mind and ensuring that policyholders are financially equipped to handle unexpected events and damages.

The Comprehensive Nature of Home Insurance

Home insurance policies are crafted to address a multitude of scenarios, including but not limited to damage caused by natural disasters, accidental events, and even liabilities arising from injuries on the insured property. These policies can also extend coverage to personal belongings and valuable items within the home, ensuring that policyholders are not left vulnerable to financial strain in the event of a loss.

Key Components of a Home Insurance Policy

A typical home insurance policy consists of several critical components, each designed to address specific aspects of homeownership:

Dwelling Coverage

This is the cornerstone of any home insurance policy, providing financial protection for the physical structure of the home itself. It covers repairs or rebuilding costs in the event of damage caused by covered perils, such as fire, windstorms, hail, and more. It’s important to note that this coverage often comes with limitations and exclusions, so policyholders should carefully review their policy to understand what is and isn’t covered.

| Peril Covered | Description |

|---|---|

| Fire | Coverage for damage caused by fire, including smoke and fire-fighting expenses. |

| Windstorm | Protects against damage from strong winds, including hurricanes and tornadoes. |

| Hail | Coverage for damage caused by hailstones, which can be especially destructive to roofs. |

| Other Perils | Depending on the policy, this may include coverage for events like vandalism, riot, explosion, and more. |

Personal Property Coverage

This aspect of home insurance provides protection for the personal belongings within the insured home. It covers a wide range of items, including furniture, electronics, clothing, and appliances, against damage or loss due to covered perils. However, it’s important to note that there are often limits and exclusions, and high-value items like jewelry or artwork may require separate endorsements or riders to ensure adequate coverage.

Liability Coverage

Liability insurance within a home insurance policy is designed to protect the homeowner from financial loss in the event of an accident or injury that occurs on their property and for which they are held legally responsible. This coverage can include medical expenses, legal defense costs, and settlements or judgments awarded to an injured party. It’s a critical component, as it can help safeguard the homeowner’s financial stability in the event of a liability claim.

Additional Living Expenses

In the event that a home becomes uninhabitable due to a covered loss, this coverage kicks in. It reimburses the policyholder for the additional living expenses incurred while they are temporarily displaced, such as hotel stays, restaurant meals, and other necessary costs until they can return home or make other living arrangements.

Optional Coverages and Endorsements

Home insurance policies often offer a range of optional coverages and endorsements that can be added to the base policy to provide more comprehensive protection. These might include coverage for specific risks like flood or earthquake, or additional protection for high-value items like jewelry or fine art. Policyholders should carefully consider their specific needs and risks to determine which optional coverages are most beneficial for their situation.

Understanding Home Insurance Premiums

The cost of home insurance, often referred to as the premium, is determined by a variety of factors, including the location and size of the home, the level of coverage chosen, and the policyholder’s claims history. It’s important for homeowners to shop around and compare quotes from multiple insurers to ensure they are getting the best value for their insurance needs.

The Importance of Regular Policy Reviews

Home insurance policies should be reviewed regularly to ensure they remain up-to-date and provide adequate coverage. Life changes, such as renovations, additions to the home, or the acquisition of valuable new possessions, can impact the level of coverage needed. Regular reviews also provide an opportunity to discuss any changes in personal circumstances or risks with an insurance professional, ensuring that the policy remains tailored to the homeowner’s needs.

The Role of Home Insurance in Financial Planning

Home insurance is a critical component of any comprehensive financial plan. It provides a safety net against unexpected financial losses, ensuring that homeowners can maintain their financial stability in the face of adversity. By protecting the investment in their home and belongings, home insurance allows homeowners to focus on their long-term financial goals with peace of mind.

The Future of Home Insurance

The home insurance industry is evolving to meet the changing needs and risks of modern homeowners. With advancements in technology and data analytics, insurers are increasingly able to offer more personalized and targeted coverage options. This includes the use of smart home technology to monitor and prevent risks, as well as the development of innovative products to address emerging risks, such as cyber threats and climate-related disasters.

What is the average cost of home insurance in the United States?

+The average cost of home insurance in the U.S. varies significantly depending on factors like location, the value of the home, and the level of coverage chosen. According to recent data, the national average for annual home insurance premiums is around 1,300. However, this can range from as low as 500 to over $3,000, based on individual circumstances and the insurer.

What factors influence the cost of home insurance?

+Several factors influence the cost of home insurance, including the location of the home (with higher costs in areas prone to natural disasters or crime), the age and condition of the home, the level of coverage chosen, and the policyholder’s claims history. Additionally, the size and value of the home, as well as any special features or high-value items within the home, can impact the premium.

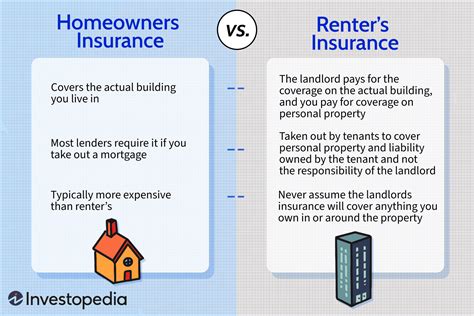

Can I get home insurance if I rent my home?

+Yes, renters can purchase renters insurance, which is a form of home insurance specifically designed for tenants. Renters insurance covers personal belongings and provides liability protection, but it does not cover the structure of the building itself, as this is the landlord’s responsibility.

What should I do if I need to file a claim on my home insurance policy?

+If you need to file a claim on your home insurance policy, it’s important to act promptly. Contact your insurance provider as soon as possible to report the claim and provide them with all the necessary details. Be prepared to provide documentation, such as photos or videos of the damage, and be sure to keep all receipts for any temporary repairs or additional living expenses you incur. Your insurance provider will guide you through the claims process, which may involve an inspection and an assessment of the damage to determine the amount of coverage you’re entitled to.