Landlord Insurance Requirements

Landlord insurance is a specialized form of property insurance that protects rental property owners from a range of risks and potential liabilities. Understanding the requirements and the scope of coverage is essential for landlords to ensure they are adequately protected and to navigate the complex world of property management with confidence.

The Importance of Landlord Insurance

Landlords face unique challenges and responsibilities when it comes to managing rental properties. From property damage to tenant-related issues, the potential risks can be diverse and costly. Landlord insurance acts as a financial safety net, providing coverage for various scenarios that may arise during the course of renting out a property.

The specific requirements and coverage offered by landlord insurance policies can vary depending on factors such as location, the type of property, and the insurer. Let's delve into the key aspects that landlords should be aware of when considering their insurance needs.

Understanding Landlord Insurance Coverage

Landlord insurance policies typically offer a comprehensive range of coverages to address the unique risks associated with rental properties. Here are some of the key components that landlords should expect from their insurance policies:

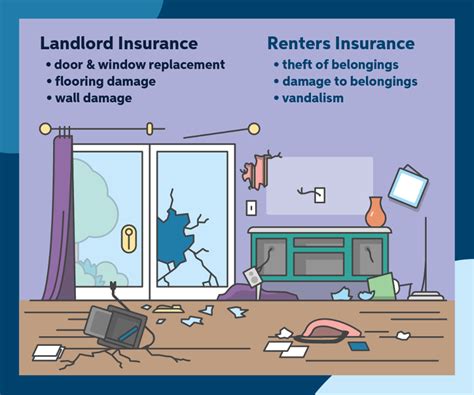

Property Damage Coverage

This coverage is one of the fundamental aspects of landlord insurance. It protects the physical structure of the rental property, including the building itself, any attached fixtures, and any permanent structures on the property. It provides financial protection in the event of damage caused by perils such as fire, storms, vandalism, or burst pipes.

| Peril | Description |

|---|---|

| Fire | Coverage for damage caused by fire, including smoke and ash damage. |

| Storms | Protection against damage from storms, including high winds, hail, and lightning. |

| Vandalism | Coverage for intentional damage to the property by tenants or third parties. |

| Burst Pipes | Financial assistance for water damage caused by frozen or burst pipes. |

It's important to note that flood and earthquake damage are typically excluded from standard landlord insurance policies and may require additional coverage.

Liability Protection

Landlord insurance policies also offer liability coverage, which is crucial for protecting landlords from potential lawsuits and legal expenses. This coverage provides financial assistance if a tenant or visitor is injured on the rental property and decides to take legal action. It covers medical expenses, legal fees, and potential compensation payouts.

Loss of Rental Income

In the event that a rental property becomes uninhabitable due to a covered peril, landlords may face a loss of rental income. Loss of rental income coverage steps in to provide financial support during this period, helping landlords maintain their cash flow and cover ongoing expenses.

Optional Coverages

Landlord insurance policies often offer a range of optional coverages that landlords can tailor to their specific needs. These may include coverage for personal property left behind by tenants, identity theft protection, and coverage for rental properties that are vacant or under renovation.

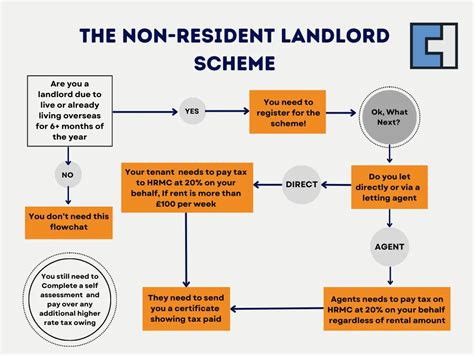

Legal Requirements for Landlord Insurance

While landlord insurance is not legally mandated in all jurisdictions, there are specific scenarios where it is a legal requirement. Understanding these requirements is crucial for landlords to avoid potential legal complications and financial liabilities.

Mortgage Lender Requirements

If you have a mortgage on your rental property, the mortgage lender may require you to maintain landlord insurance. This is a common practice among lenders, as it protects their investment in the property. Failure to maintain the required insurance coverage can result in penalties or even foreclosure.

Local Regulations

Certain localities or municipalities may have specific regulations or ordinances that require landlords to carry insurance. These regulations may vary widely, so it's important for landlords to research and understand the local requirements. Non-compliance with these regulations can lead to fines or other legal consequences.

Lease Agreements

Lease agreements often include clauses that require tenants to maintain tenant insurance. However, it's essential for landlords to understand that tenant insurance primarily protects the tenant's personal belongings and liability risks. It does not cover the rental property itself, which is the responsibility of the landlord.

Selecting the Right Landlord Insurance

With a solid understanding of the coverage and legal requirements, the next step is to select the right landlord insurance policy for your needs. Here are some key considerations to keep in mind during the selection process:

Coverage Limits

Review the coverage limits offered by different insurance providers. Ensure that the limits align with the value of your rental property and the potential risks it faces. Higher coverage limits may result in a higher premium, but they provide more comprehensive protection.

Deductibles

Deductibles are the amount you, as the landlord, are responsible for paying out of pocket before the insurance coverage kicks in. Consider your financial situation and choose a deductible that you can comfortably afford. Higher deductibles can lower your premium, but they also mean you'll pay more in the event of a claim.

Insurer Reputation

Research the reputation and financial stability of the insurance provider. Choose a reputable insurer with a track record of paying claims promptly and fairly. Customer reviews and industry ratings can provide valuable insights into the insurer's reliability.

Policy Exclusions

Carefully review the policy exclusions to understand what is not covered. Common exclusions include flood damage, earthquake damage, and damage caused by pests. If these risks are relevant to your rental property, consider additional coverage or take preventive measures to mitigate these risks.

Best Practices for Landlords

In addition to selecting the right insurance policy, there are several best practices that landlords can adopt to further protect their rental properties and reduce the likelihood of claims:

Regular Property Maintenance

Implement a proactive maintenance schedule to ensure that your rental property is well-maintained. Regular inspections, timely repairs, and preventive measures can help identify and address potential issues before they become costly problems.

Tenant Screening

Thoroughly screen potential tenants to minimize the risk of tenant-related issues. Check references, perform credit checks, and consider background checks to assess the tenant's rental history and financial stability. Well-vetted tenants are less likely to cause damage or default on rent payments.

Clear Lease Agreements

Draft comprehensive and legally binding lease agreements that outline the rights and responsibilities of both the landlord and the tenant. Clearly define the terms of the tenancy, including rent payment, maintenance expectations, and any restrictions or rules specific to the property.

Prompt Communication

Encourage open and prompt communication with your tenants. Address maintenance requests and repair needs in a timely manner to prevent small issues from becoming larger, more expensive problems. Regular communication can also help identify potential issues early on.

FAQs

Is landlord insurance mandatory for all rental properties?

+

Landlord insurance is not mandatory in all jurisdictions. However, it is highly recommended to protect your investment and manage potential risks. Additionally, mortgage lenders often require landlord insurance as a condition of the loan.

What happens if I don’t have landlord insurance and a covered incident occurs?

+

If you don’t have landlord insurance and a covered incident occurs, you will be responsible for covering the costs of repairs or replacements out of pocket. This can be financially devastating, especially for larger-scale damage. Landlord insurance provides peace of mind and financial protection in such situations.

Can I get landlord insurance for my vacation rental property?

+

Yes, you can obtain landlord insurance for vacation rental properties. However, the coverage and premiums may differ from traditional rental properties due to the unique nature of vacation rentals. It’s important to discuss your specific needs with an insurance provider to ensure adequate coverage.