Car Insurance By Mileage

Welcome to an in-depth exploration of the innovative concept of Car Insurance by Mileage, a revolutionary approach to automotive insurance that's rapidly gaining traction in the industry. This model offers a unique twist on traditional insurance plans, promising significant savings for drivers with low mileage and a more tailored, cost-effective coverage experience.

In today's dynamic world, where the way we use our vehicles is constantly evolving, it's essential to have insurance options that adapt to our individual needs. Car Insurance by Mileage is a prime example of this evolution, providing a fresh perspective on automotive coverage that considers not just the vehicle itself, but how and how often it's driven.

Understanding the Mileage-Based Insurance Model

Mileage-based insurance, also known as pay-as-you-drive or usage-based insurance, is a modern take on automotive insurance. It’s a dynamic system that calculates insurance premiums based on the actual distance driven, rather than the standard factors like age, gender, and vehicle type. This innovative approach offers a more accurate and personalized insurance experience, catering to the diverse needs of modern drivers.

The premise is simple: the less you drive, the less risk you pose to insurance companies, and therefore, the lower your insurance premiums. This model rewards drivers who drive less frequently or for shorter distances, often resulting in significant savings. It's a departure from the traditional insurance model, which often results in overpaying for coverage, especially for low-mileage drivers.

How It Works

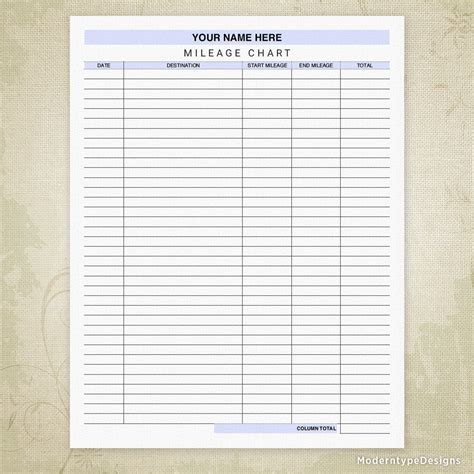

Implementing a mileage-based insurance plan typically involves the use of telematics technology. This technology, often in the form of a small device installed in your vehicle or an app on your smartphone, tracks your driving habits, including the distance traveled. This data is then used to calculate your insurance premium, ensuring a precise and tailored coverage plan.

Some insurance companies offer a pay-per-mile option, where you're charged a fixed rate for every mile driven. Others may offer a discounted rate for drivers who agree to install a tracking device, with the potential for further discounts based on safe driving habits. The specific model can vary between insurance providers, but the underlying principle remains the same: your insurance premium is directly linked to your mileage.

| Mileage-Based Insurance Types | Description |

|---|---|

| Pay-Per-Mile | Charges a fixed rate for every mile driven. |

| Discounted Rate | Offers a discounted premium for drivers who install a tracking device, with further discounts for safe driving. |

Benefits of Mileage-Based Insurance

- Cost Savings: This model is particularly advantageous for low-mileage drivers, as they can significantly reduce their insurance costs compared to traditional plans.

- Flexibility: It provides a more flexible insurance option, allowing drivers to tailor their coverage to their actual driving needs.

- Eco-Friendly Incentive: By encouraging less driving, this model can indirectly contribute to environmental sustainability goals.

- Safety Incentive: Some plans offer discounts for safe driving, providing an incentive to drive more cautiously.

Exploring the Impact and Advantages

The introduction of mileage-based insurance has had a notable impact on the automotive insurance landscape, offering a range of benefits that extend beyond just cost savings.

Safety and Environmental Considerations

One of the most significant advantages of this model is its potential to improve road safety and reduce environmental impact. By incentivizing drivers to drive less, it indirectly encourages safer driving habits and reduces vehicle emissions, contributing to a more sustainable and eco-friendly transportation system.

Additionally, the tracking technology used in mileage-based insurance can provide valuable insights into driving behavior. This data can be used to identify and address unsafe driving habits, helping to reduce the risk of accidents and improve overall road safety.

Financial Benefits for Drivers

For drivers, the financial benefits of mileage-based insurance are hard to ignore. Low-mileage drivers, such as those who primarily use public transportation or work from home, can see significant savings on their insurance premiums. This model offers a fairer and more personalized approach to insurance, ensuring that drivers only pay for the coverage they need based on their actual driving habits.

Furthermore, the potential for discounts based on safe driving habits provides an additional incentive for drivers to maintain a safe and responsible driving record. This not only reduces the risk of accidents but also helps drivers save money on their insurance premiums.

Industry Innovation and Competition

The introduction of mileage-based insurance has also spurred innovation and competition within the automotive insurance industry. Insurance companies are now investing in new technologies and strategies to offer more tailored and cost-effective coverage options. This competitive environment benefits consumers, as it drives down prices and improves the overall quality of insurance services.

Real-World Examples and Success Stories

Mileage-based insurance is not just a theoretical concept; it’s already making a significant impact in real-world scenarios. Let’s explore some success stories and practical examples of how this model is benefiting drivers and the industry.

Case Study: John’s Story

John, a retired professional living in a suburban area, found himself paying high insurance premiums despite driving only a few thousand miles per year. With the introduction of mileage-based insurance, John was able to switch to a pay-per-mile plan, reducing his insurance costs by over 30%. This significant savings allowed him to allocate more funds towards other retirement expenses.

Industry Impact: Metro City’s Experience

In Metro City, a densely populated urban area, the implementation of mileage-based insurance led to a notable reduction in vehicle miles traveled. This decrease in driving not only contributed to reduced traffic congestion but also led to a significant improvement in air quality. The city’s experience highlights the broader societal benefits of this insurance model.

Insurance Provider Perspective: XYZ Insurance

XYZ Insurance, a leading provider in the automotive insurance space, has seen tremendous success with its mileage-based insurance offering. By attracting a large number of low-mileage drivers, the company has been able to expand its customer base and increase overall profitability. The model has also allowed XYZ to differentiate itself in a competitive market, attracting new customers with its innovative and cost-effective approach.

Future Implications and Industry Insights

As the automotive insurance industry continues to evolve, the role of mileage-based insurance is expected to grow significantly. Let’s delve into some future implications and industry insights that highlight the potential of this innovative model.

The Rise of Telematics Technology

The widespread adoption of mileage-based insurance is closely tied to the advancement and accessibility of telematics technology. As this technology becomes more sophisticated and cost-effective, we can expect to see a greater number of insurance providers offering mileage-based plans. This technology not only enables accurate mileage tracking but also provides valuable data for risk assessment and fraud detection.

Potential for Wider Adoption

While mileage-based insurance is currently more prevalent among low-mileage drivers, there’s a growing interest from other driver segments as well. As the model becomes more established and understood, we can anticipate a broader adoption across different driver profiles, including those who drive more frequently.

Incentivizing Sustainable Transportation

Mileage-based insurance has the potential to play a crucial role in promoting sustainable transportation options. By encouraging less driving and rewarding drivers for using eco-friendly modes of transportation, this model can contribute to a greener and more sustainable future. Insurance providers can further enhance this impact by offering additional incentives for drivers who utilize public transportation or adopt electric vehicles.

Challenges and Considerations

Despite its numerous advantages, mileage-based insurance also presents certain challenges and considerations. Privacy concerns, for instance, are a significant factor, as drivers may be hesitant to share their driving data. Additionally, the accuracy and reliability of tracking technology need to be continually improved to ensure fair and precise premium calculations.

Conclusion: A Transformative Insurance Model

Car Insurance by Mileage represents a transformative shift in the automotive insurance landscape. By offering a more personalized and cost-effective approach, this model caters to the diverse needs of modern drivers. With its potential to improve road safety, reduce environmental impact, and provide significant cost savings, mileage-based insurance is poised to become a prominent feature of the future insurance industry.

As we continue to embrace innovative technologies and adapt to changing transportation trends, mileage-based insurance stands out as a shining example of how the industry can evolve to better serve its customers. It's a model that not only benefits individual drivers but also contributes to a broader societal goal of sustainability and safety.

How accurate is the mileage tracking technology used in mileage-based insurance plans?

+The accuracy of mileage tracking technology has improved significantly in recent years. Most providers use advanced GPS systems or smartphone apps that provide precise mileage readings. However, it’s important to note that the accuracy can vary based on the specific technology used and the provider’s tracking methods.

Are there any privacy concerns with mileage-based insurance plans?

+Yes, privacy is a valid concern with any technology that collects personal data. Insurance providers are required to handle this data securely and in compliance with relevant privacy laws. It’s important for drivers to understand how their data is being used and to ensure that their provider has robust privacy and data protection measures in place.

Can mileage-based insurance plans be combined with other insurance types, like comprehensive or collision coverage?

+Absolutely! Mileage-based insurance can be part of a comprehensive insurance package that includes other types of coverage, such as comprehensive, collision, or liability insurance. The specific combination of coverages will depend on your individual needs and the options offered by your insurance provider.