Affordable Health Insurance Plans For Individuals

In today's healthcare landscape, finding affordable health insurance that meets your individual needs can be a challenging task. With a myriad of options available, it's essential to understand the market and make informed choices. This comprehensive guide aims to shed light on the best affordable health insurance plans tailored for individuals, offering insights into coverage, costs, and key features to help you make the right decision for your healthcare needs.

Understanding Individual Health Insurance Plans

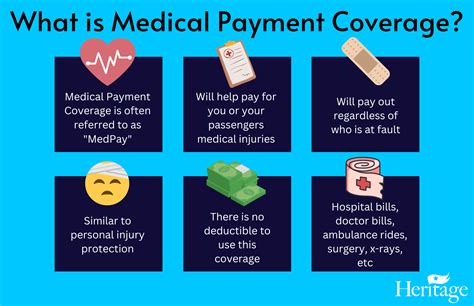

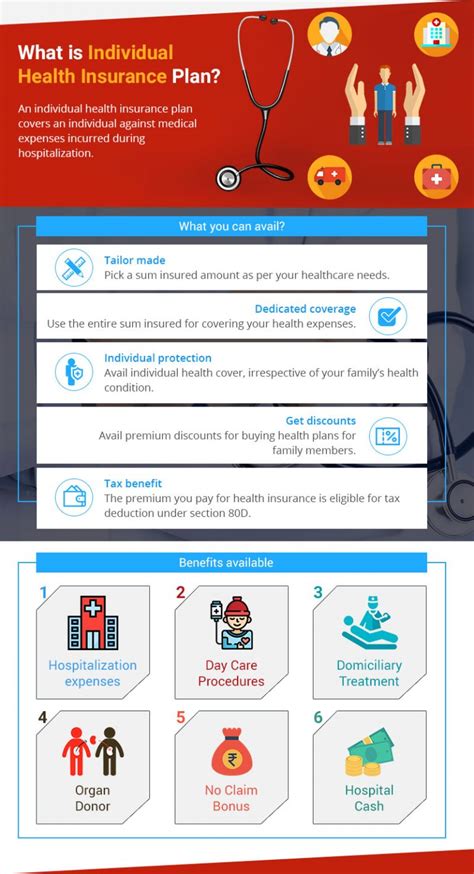

Individual health insurance plans, as the name suggests, are tailored for people who are not covered by employer-provided plans or other group health insurance schemes. These plans offer a range of benefits and coverages, ensuring that individuals can access the healthcare services they require without incurring excessive costs.

The market for individual health insurance has evolved significantly over the years, with the introduction of the Affordable Care Act (ACA) in the United States bringing about notable changes. The ACA, often referred to as Obamacare, aimed to make health insurance more accessible and affordable for all Americans. As a result, today's individual health insurance market offers a variety of plans with standardized benefits and essential health services.

Key Considerations for Affordable Individual Plans

- Coverage Options: Affordable individual plans offer a range of coverage options, from basic plans that cover essential health services to more comprehensive plans that provide additional benefits like dental, vision, and prescription drug coverage.

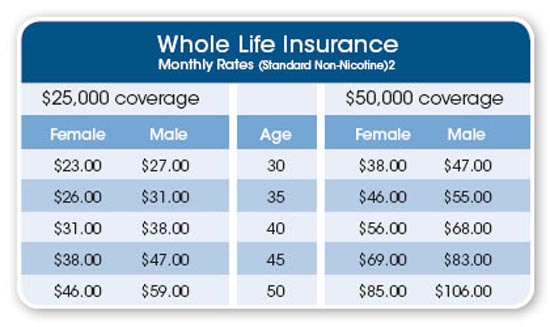

- Premium Costs: Premiums, the amount you pay monthly for your health insurance, are a crucial consideration. While affordable plans aim to keep costs low, factors like age, location, and tobacco use can influence premium rates.

- Deductibles and Out-of-Pocket Costs: Understanding deductibles and out-of-pocket maximums is vital. Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in, while out-of-pocket maximums represent the most you’ll pay in a year for covered services.

- Network of Providers: Affordable individual plans often have preferred provider networks. It’s essential to check if your preferred healthcare providers are included in the plan’s network to ensure you receive the best rates and coverage.

- Additional Benefits: Some affordable plans offer extra benefits like wellness programs, disease management services, or discounts on health-related products and services.

Exploring Affordable Health Insurance Options

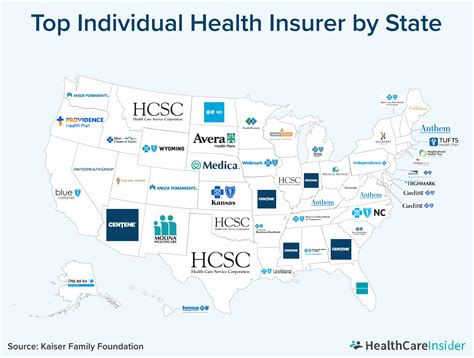

When it comes to affordable health insurance for individuals, several providers offer competitive plans. Here’s a closer look at some of the top options available in the market.

ACA Marketplace Plans

The Affordable Care Act Marketplace, also known as the Health Insurance Marketplace, is a platform where individuals can compare and purchase health insurance plans. These plans offer a range of benefits, including coverage for pre-existing conditions and no lifetime limits on coverage. The Marketplace also provides financial assistance in the form of tax credits to help make insurance more affordable for eligible individuals.

Key Features of ACA Marketplace Plans:

- Standardized Benefits: All Marketplace plans must cover essential health benefits, including hospitalization, emergency services, and prescription drugs.

- Cost-Sharing Reduction: Some plans offer cost-sharing reduction, which reduces deductibles, copayments, and coinsurance for eligible individuals.

- Open Enrollment Period: The Marketplace has a specific open enrollment period each year, but individuals may also qualify for special enrollment periods due to certain life events.

| Plan Type | Premium | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| Bronze Plan | $350/month | $6,000 | $7,500 |

| Silver Plan | $420/month | $4,000 | $6,800 |

| Gold Plan | $580/month | $2,000 | $5,000 |

Short-Term Health Insurance Plans

Short-term health insurance plans are designed to provide temporary coverage for individuals between jobs, during gaps in coverage, or for those who don't qualify for other plans. These plans typically offer lower premiums but have shorter coverage periods and may not cover pre-existing conditions.

Key Features of Short-Term Health Insurance Plans:

- Flexible Coverage Periods: Coverage can range from a few months to a year, depending on the plan and state regulations.

- Lower Premiums: These plans often have lower monthly premiums compared to comprehensive plans.

- Limited Benefits: Short-term plans may not cover certain services or conditions, and may have restrictions on pre-existing conditions.

Catastrophic Health Insurance Plans

Catastrophic health insurance plans are designed for young adults under the age of 30 or individuals who qualify due to hardship exemptions. These plans provide basic coverage for major medical expenses but have high deductibles.

Key Features of Catastrophic Health Insurance Plans:

- Low Premiums: Catastrophic plans typically have lower monthly premiums compared to other plan types.

- High Deductibles: These plans have high deductibles, which means you'll pay more out-of-pocket before your insurance coverage kicks in.

- Limited Coverage: Catastrophic plans only cover three primary care visits per year before the deductible applies.

Tips for Choosing the Right Affordable Plan

Selecting the right affordable health insurance plan requires careful consideration of your healthcare needs and financial situation. Here are some tips to guide you in making the best choice:

- Assess Your Healthcare Needs: Consider your typical healthcare usage. Do you visit the doctor frequently, require regular medications, or have ongoing health conditions? Understanding your needs will help you choose a plan with appropriate coverage.

- Compare Premiums and Out-of-Pocket Costs: While premiums are important, don't forget to consider out-of-pocket costs like deductibles and copayments. A plan with a lower premium but higher out-of-pocket costs might not be as affordable as it seems.

- Check Provider Networks: Ensure that your preferred healthcare providers are in-network with the plan you choose. Out-of-network care can be significantly more expensive.

- Understand Plan Limitations: Read the fine print to understand any limitations or exclusions in the plan. This includes understanding what's covered, any waiting periods, and any restrictions on pre-existing conditions.

- Consider Additional Benefits: Some plans offer additional benefits like wellness programs or discounts on gym memberships. These can add value to your overall healthcare experience.

Frequently Asked Questions

What is the Affordable Care Act (ACA)?

+

The Affordable Care Act, or ACA, is a comprehensive healthcare reform law in the United States. It aims to make health insurance more accessible and affordable, and to reduce the number of uninsured Americans. The ACA introduced changes like the individual mandate, the expansion of Medicaid, and the creation of the Health Insurance Marketplace.

How do I know if I’m eligible for financial assistance on the ACA Marketplace?

+

Eligibility for financial assistance on the ACA Marketplace depends on your income and family size. If your household income is below a certain threshold (often 400% of the federal poverty level), you may qualify for premium tax credits to reduce your monthly insurance costs. You can use the Marketplace’s eligibility calculator to determine if you’re eligible.

Can I enroll in a health insurance plan outside of the open enrollment period?

+

Generally, you can only enroll in a health insurance plan during the open enrollment period, which typically lasts for a few months each year. However, if you experience a qualifying life event like losing your job, getting married, or having a baby, you may qualify for a special enrollment period, allowing you to enroll outside of the regular open enrollment timeframe.