Insurance Pays

Insurance, a cornerstone of modern society, plays a pivotal role in safeguarding individuals, businesses, and assets against unforeseen events and risks. The concept of insurance is deeply ingrained in our daily lives, providing a sense of security and peace of mind. From protecting our health and well-being to securing our financial futures, insurance policies are designed to mitigate the impact of unexpected circumstances.

In this comprehensive article, we delve into the intricate world of insurance, exploring its diverse facets, benefits, and real-world applications. By examining the role of insurance in various sectors and personal situations, we aim to shed light on its significance and offer valuable insights into how it can pay off for individuals and businesses alike.

Understanding the Basics of Insurance

Insurance is a contractual agreement between an individual or entity (the policyholder) and an insurance company. This contract, known as an insurance policy, outlines the terms and conditions under which the insurer agrees to provide financial protection or reimbursement to the policyholder in the event of a covered loss, damage, or liability.

The core principle of insurance revolves around risk pooling. By bringing together a large group of individuals or entities who share similar risks, insurance companies can effectively spread the financial burden of losses. Each policyholder pays a premium, which is determined based on the level of risk they present. In return, the insurer assumes the financial responsibility for covered losses, ensuring that policyholders are not overwhelmed by unexpected expenses.

Insurance policies are tailored to meet the specific needs and circumstances of the policyholder. Whether it's health insurance to cover medical expenses, auto insurance to protect against vehicle-related incidents, or property insurance to safeguard homes and businesses, insurance provides a customized safety net.

Key Components of an Insurance Policy

Every insurance policy consists of several essential components that define the coverage, exclusions, and terms:

- Coverage: This outlines the specific risks or events that are covered by the policy. For instance, a health insurance policy may cover hospital stays, doctor visits, and prescription medications.

- Premiums: Policyholders pay regular premiums, typically monthly or annually, to maintain their coverage. The premium amount is influenced by factors such as the level of coverage, the policyholder’s age, and the risk profile.

- Deductibles: A deductible is the amount the policyholder must pay out of pocket before the insurance coverage kicks in. It acts as a cost-sharing mechanism, encouraging policyholders to be cautious and preventing minor claims.

- Exclusions: Insurance policies often contain exclusions, which are specific events or circumstances that are not covered. Understanding these exclusions is crucial to avoid any surprises when making a claim.

- Policy Limits: Policies have maximum limits on the amount of coverage provided. These limits vary based on the type of insurance and the policyholder’s needs.

The Impact of Insurance in Health and Well-being

Health insurance is perhaps the most critical aspect of insurance for individuals. It ensures that people have access to essential medical care without facing financial ruin. In many countries, health insurance is a fundamental right, providing coverage for a wide range of medical services, including:

- Hospitalization and surgical procedures

- Doctor consultations and specialist visits

- Prescription medications

- Diagnostic tests and screenings

- Mental health services

The impact of health insurance extends beyond individual well-being. It contributes to the overall health and stability of a society by:

- Promoting early detection and treatment of diseases

- Reducing financial barriers to healthcare access

- Lowering the burden on public healthcare systems

- Encouraging preventive care and healthy lifestyles

Moreover, health insurance plays a vital role in managing chronic conditions and long-term illnesses. It ensures that individuals with ongoing health needs have the necessary support and resources to manage their conditions effectively.

Case Study: The Power of Health Insurance

Let’s consider the story of Emma, a young professional who was diagnosed with a serious medical condition. Without health insurance, the cost of her treatment would have been prohibitively expensive, potentially forcing her into financial distress.

However, Emma's comprehensive health insurance policy covered the majority of her medical expenses, including hospital stays, surgeries, and ongoing medication. This not only relieved her of the financial burden but also allowed her to focus on her recovery without the added stress of financial worries.

Emma's experience highlights the transformative power of health insurance, enabling individuals to navigate challenging health situations with greater resilience and peace of mind.

Protecting Assets: Property and Auto Insurance

Insurance extends its protective umbrella to our valuable assets, ensuring that our homes, vehicles, and businesses are safeguarded against unforeseen events.

Property Insurance

Property insurance is designed to provide financial protection for homeowners, renters, and business owners. It covers a wide range of potential risks, including:

- Fire and natural disasters (e.g., hurricanes, earthquakes)

- Theft and vandalism

- Water damage and burst pipes

- Liability claims (e.g., injuries on the property)

For homeowners, property insurance offers peace of mind, knowing that their largest investment is protected. Renters, on the other hand, can secure their personal belongings and liability coverage with renters' insurance.

Business owners rely on property insurance to protect their commercial properties, inventory, and equipment, ensuring continuity in the face of unexpected losses.

Auto Insurance

Auto insurance is a legal requirement in most jurisdictions and is essential for anyone who owns or operates a motor vehicle. It provides coverage for a variety of incidents, such as:

- Vehicle damage in accidents

- Liability for injuries or property damage caused to others

- Theft or vandalism of the insured vehicle

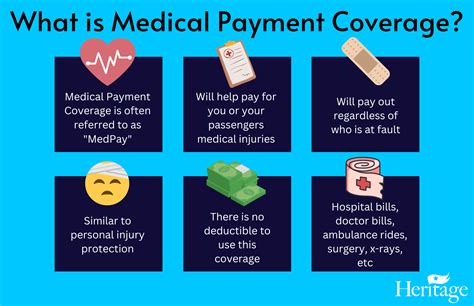

- Medical expenses for the insured driver and passengers

Auto insurance policies can be customized to meet the specific needs of the policyholder, including options for comprehensive coverage, collision coverage, and uninsured/underinsured motorist protection.

Business Insurance: Securing the Foundation

For businesses, insurance is not just a legal obligation but a strategic necessity. It provides a safety net against potential risks and liabilities that could threaten the very existence of a company.

Common Types of Business Insurance

Business insurance comes in various forms, each tailored to specific industry needs:

- General Liability Insurance: This coverage protects businesses from third-party claims, such as slips and falls on company premises or product-related lawsuits.

- Professional Liability Insurance (Errors and Omissions): Essential for professionals like lawyers, accountants, and consultants, this insurance covers legal expenses and damages arising from professional mistakes or negligence.

- Workers’ Compensation Insurance: Mandated by law in many places, this insurance provides coverage for employees’ medical expenses and lost wages in the event of work-related injuries or illnesses.

- Business Interruption Insurance: This policy steps in when a business is forced to suspend operations due to covered perils, such as fires or natural disasters, ensuring financial support during the recovery period.

- Cyber Liability Insurance: In an increasingly digital world, this insurance is crucial for businesses to mitigate the risks of cyberattacks, data breaches, and online reputation damage.

Real-World Business Insurance Success Stories

Consider the story of TechPro, a small IT consulting firm. A cyberattack crippled their systems, rendering them unable to operate for several weeks. Fortunately, their cyber liability insurance policy covered the costs of data recovery, legal fees, and business interruption, allowing them to resume operations swiftly and minimize financial losses.

Similarly, GreenHouse, a local gardening supply store, experienced a severe storm that caused extensive damage to their storefront and inventory. Their property insurance policy provided the financial support needed to repair the damage, replace inventory, and keep their business running during the recovery process.

The Evolution of Insurance: Digital Innovations

The insurance industry is undergoing a digital transformation, leveraging technology to enhance customer experiences, streamline processes, and offer innovative solutions.

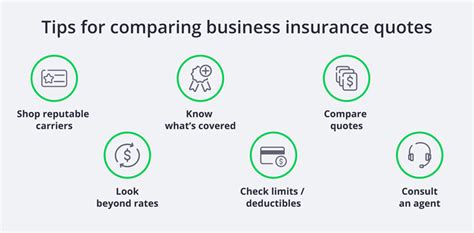

Online Insurance Platforms

Online insurance platforms have emerged as a convenient and efficient way for individuals and businesses to compare policies, obtain quotes, and purchase coverage. These platforms often provide real-time quotes, personalized recommendations, and user-friendly interfaces, making the insurance shopping experience more accessible and transparent.

Telematics and Usage-Based Insurance

In the realm of auto insurance, telematics devices and usage-based insurance programs are gaining traction. These technologies track driving behavior, such as speed, acceleration, and mileage, allowing insurance companies to offer personalized premiums based on actual driving habits. This approach rewards safe drivers with lower premiums, encouraging safer road practices.

Blockchain and Smart Contracts

Blockchain technology is revolutionizing the insurance industry by introducing smart contracts. These self-executing contracts automatically trigger insurance payouts when predefined conditions are met, reducing administrative burdens and accelerating claim settlements. Additionally, blockchain enhances data security and transparency, building trust between insurers and policyholders.

Future Outlook: Insurance Trends and Innovations

The insurance landscape is poised for continued evolution, driven by technological advancements and changing consumer expectations. Here are some key trends and innovations to watch:

Artificial Intelligence and Data Analytics

Insurance companies are harnessing the power of AI and data analytics to improve risk assessment, fraud detection, and personalized policy offerings. Advanced algorithms can analyze vast amounts of data, from driving behavior to health metrics, to deliver more accurate and tailored insurance solutions.

Parametric Insurance

Parametric insurance is an innovative approach that pays out based on predefined parameters, such as weather conditions or seismic activity. This type of insurance provides rapid payouts, often within minutes of an event, making it particularly beneficial for industries like agriculture and renewable energy, where quick recovery is crucial.

Microinsurance and On-Demand Coverage

Microinsurance initiatives aim to provide affordable insurance coverage to underserved populations, offering small-scale policies that cater to specific needs. Additionally, on-demand insurance platforms allow individuals to purchase coverage for short-term needs, such as event liability or travel insurance, on a per-use basis.

Conclusion: The Value of Insurance in Our Lives

Insurance is more than just a financial tool; it is a cornerstone of modern life, providing stability, security, and peace of mind. From protecting our health and assets to safeguarding businesses against unforeseen risks, insurance plays a vital role in shaping our lives and the world around us.

As we navigate an increasingly complex and unpredictable future, insurance will continue to evolve, adapting to new challenges and opportunities. By embracing technological advancements and innovative solutions, the insurance industry will remain a vital force in building a more resilient and secure society.

What are the benefits of health insurance for individuals and society as a whole?

+Health insurance provides individuals with access to essential medical care, financial protection, and peace of mind. It ensures that people can receive timely and adequate healthcare without facing devastating financial consequences. From a societal perspective, health insurance promotes early detection and treatment of diseases, reduces the burden on public healthcare systems, and encourages a focus on preventive care, ultimately contributing to a healthier and more stable population.

How does property insurance protect homeowners and renters?

+Property insurance safeguards homeowners and renters by providing financial coverage for various risks, including fire, theft, water damage, and liability claims. It ensures that individuals can recover and rebuild their homes and replace personal belongings in the event of an insured loss. Renters’ insurance, in particular, offers peace of mind by protecting their personal property and providing liability coverage for accidents that may occur on the rental property.

What is the role of auto insurance, and why is it important for drivers?

+Auto insurance is crucial for drivers as it provides financial protection in the event of vehicle-related incidents. It covers a range of risks, such as accidents, theft, and liability claims. By having auto insurance, drivers can avoid significant financial burdens and ensure they are able to meet their legal obligations, including covering medical expenses and property damage for themselves and others involved in an accident.