Insurance Progressive Quote

Insurance is an essential aspect of our lives, providing financial protection and peace of mind. Progressive, a leading insurance provider, offers comprehensive coverage options to cater to various needs. In this article, we will delve into the world of Progressive Insurance, exploring its offerings, benefits, and the process of obtaining a quote tailored to your requirements.

Understanding Progressive Insurance

Progressive Insurance, established in 1937, has become a prominent player in the insurance industry. With a rich history of innovation and customer-centric approaches, Progressive has grown to serve millions of customers across the United States. The company’s commitment to providing affordable, flexible insurance solutions has made it a trusted name in the market.

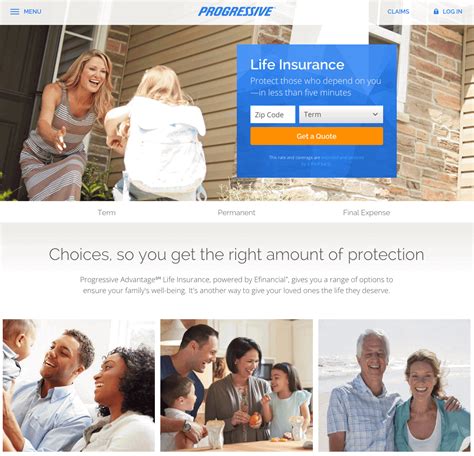

Progressive offers a wide range of insurance products, including auto insurance, home insurance, renters insurance, and commercial insurance. Their comprehensive coverage options ensure that individuals and businesses can find the right protection for their specific needs. Whether you're looking for liability coverage, comprehensive protection, or specialized policies, Progressive has a tailored solution.

Key Features of Progressive Insurance

- Customizable Coverage: Progressive allows customers to build their insurance policies by selecting the coverage types and limits that suit their requirements. This flexibility ensures that policyholders only pay for the coverage they truly need.

- Discounts and Savings: The company offers a variety of discounts to help customers save on their insurance premiums. These include multi-policy discounts, good driver discounts, and loyalty rewards. Progressive’s Name Your Price® tool lets customers set their desired price and explore coverage options to match.

- Digital Convenience: Progressive embraces digital technology, providing an easy-to-use online platform for policy management. Customers can access their policies, make payments, file claims, and manage their insurance needs conveniently through the Progressive app or website.

- Claims Handling: Progressive is known for its efficient claims process. The company offers 24⁄7 claims support, ensuring that policyholders can quickly report and resolve claims. Their Claims Journal® provides real-time updates on claim progress, keeping customers informed every step of the way.

By combining these features with a customer-focused approach, Progressive has earned a reputation for delivering reliable insurance solutions. Now, let's explore how you can obtain a Progressive quote tailored to your specific needs.

Getting a Progressive Insurance Quote

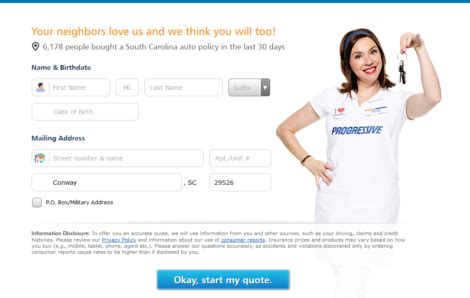

Obtaining a Progressive insurance quote is a straightforward process designed to be user-friendly and efficient. Here’s a step-by-step guide to help you get started:

Step 1: Gather Information

Before requesting a quote, it’s beneficial to gather some essential information. This includes details about the vehicle or property you want to insure, such as make, model, year, and any existing coverage. For auto insurance, you’ll also need information about your driving record and any previous claims.

Step 2: Choose Your Coverage

Progressive offers a wide range of coverage options, allowing you to customize your policy. Consider your specific needs and decide on the types of coverage you require. For auto insurance, this may include liability coverage, collision coverage, comprehensive coverage, and additional options like rental car reimbursement or roadside assistance.

Step 3: Explore Discounts

Progressive provides various discounts to help you save on your insurance premiums. Explore the different discount categories to see if you’re eligible for any savings. These discounts may include:

- Multi-Policy Discount: Save by bundling your auto and home insurance policies with Progressive.

- Good Driver Discount: Qualify for discounts based on your safe driving record.

- Loyalty Rewards: Progressive rewards long-term customers with additional savings.

- Paperless Discount: Opt for paperless billing and policy management to save a few bucks.

- Snapshot® Discount: Enroll in Progressive’s usage-based insurance program to potentially lower your rates based on your driving habits.

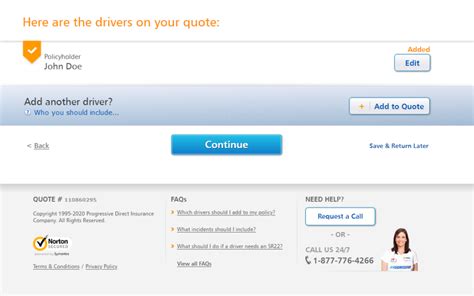

Step 4: Get Your Quote

With your coverage choices and potential discounts in mind, it’s time to request a quote. You can do this online, over the phone, or by visiting a local Progressive agent. The quote process typically involves answering a series of questions about your vehicle, driving history, and desired coverage.

Progressive's online quote tool is user-friendly and provides real-time quotes based on the information you provide. You can also connect with a licensed agent who can guide you through the process and answer any questions you may have.

Step 5: Review and Customize

Once you receive your quote, take the time to review it thoroughly. Ensure that the coverage limits and options align with your needs. Progressive’s quote tool allows you to make adjustments and explore different scenarios to find the best fit for your budget and requirements.

If you have any questions or concerns, don't hesitate to reach out to Progressive's customer support team. They can provide additional insights and help you make an informed decision.

Step 6: Finalize Your Policy

After reviewing and customizing your quote, you can finalize your Progressive insurance policy. This typically involves providing payment information and selecting a coverage start date. Progressive offers flexible payment options, including monthly, quarterly, or annual payments, to suit your preferences.

Progressive Insurance: Benefits and Considerations

Choosing Progressive Insurance comes with several advantages, but it’s essential to consider all factors before making a decision. Here’s a closer look at the benefits and some considerations to keep in mind:

Benefits of Progressive Insurance

- Flexibility: Progressive’s customizable coverage options allow you to tailor your policy to your specific needs, ensuring you only pay for the protection you require.

- Discounts: The variety of discounts available can help you save significantly on your insurance premiums, making Progressive a cost-effective choice.

- Digital Convenience: Progressive’s online platform and mobile app provide easy access to your policy, allowing you to manage your insurance needs on the go.

- Claims Handling: Progressive’s efficient claims process and 24⁄7 support ensure that you receive timely assistance when you need it most.

- Customer-Centric Approach: Progressive prioritizes customer satisfaction, offering a range of resources and tools to help you understand your coverage and make informed decisions.

Considerations

While Progressive Insurance offers many benefits, it’s important to consider a few factors before finalizing your decision:

- Coverage Limitations: While Progressive provides a wide range of coverage options, certain specialized policies or unique circumstances may require additional research to ensure adequate protection.

- Rate Changes: Like many insurance providers, Progressive may adjust rates periodically based on various factors. It’s essential to stay informed about any potential rate changes and assess their impact on your budget.

- Customer Service: While Progressive is known for its customer-centric approach, individual experiences may vary. Researching customer reviews and ratings can provide insights into the overall satisfaction levels of Progressive’s policyholders.

Conclusion: Progressive Insurance - A Customized Approach

Progressive Insurance stands out for its commitment to providing customizable, affordable insurance solutions. By offering a wide range of coverage options, discounts, and a user-friendly online platform, Progressive empowers customers to take control of their insurance needs. Whether you’re seeking auto, home, or commercial insurance, Progressive’s tailored approach ensures you receive the protection you deserve.

Remember, when obtaining a Progressive insurance quote, take the time to gather the necessary information, explore your coverage options, and review the quote thoroughly. By doing so, you can make an informed decision and secure the right insurance coverage for your unique circumstances.

FAQ

Can I get a Progressive insurance quote online?

+

Yes, Progressive offers a convenient online quote tool. You can access it through their website or mobile app. The online quote process is straightforward and provides real-time quotes based on the information you provide.

What types of insurance does Progressive offer?

+

Progressive offers a wide range of insurance products, including auto insurance, home insurance, renters insurance, and commercial insurance. They also provide specialized policies for boats, motorcycles, and recreational vehicles.

How can I save on my Progressive insurance premiums?

+

Progressive offers various discounts to help you save on your insurance premiums. These include multi-policy discounts, good driver discounts, loyalty rewards, and discounts for paperless billing. Additionally, you can enroll in their Snapshot® program, which uses a small device to track your driving habits and potentially lower your rates.