Health Insurance Nj State

Health insurance is a crucial aspect of healthcare access and financial security, especially in a state as diverse and populous as New Jersey. With a wide range of options available, understanding the intricacies of health insurance in NJ is essential for residents to make informed choices about their coverage.

Understanding Health Insurance in New Jersey

New Jersey offers a comprehensive health insurance market, providing residents with a variety of plans and options to meet their specific needs. The state’s insurance landscape is regulated by the New Jersey Department of Banking and Insurance, ensuring that all plans meet certain standards and cover a range of essential health benefits.

One unique aspect of health insurance in NJ is the New Jersey Health Insurance Marketplace, also known as the Get Covered New Jersey platform. This online marketplace, established under the Affordable Care Act (ACA), allows individuals and families to compare and purchase qualified health plans. The marketplace offers a user-friendly interface, making it easier for residents to navigate their insurance options.

New Jersey also has a robust Medicaid program, which provides health coverage to eligible low-income individuals and families. The state's Medicaid program, known as NJ FamilyCare, offers a range of benefits, including doctor visits, hospital care, prescription drugs, and more. Additionally, the state has expanded its Medicaid coverage under the ACA, making it more accessible to a larger portion of the population.

Health Insurance Plans and Providers in New Jersey

New Jersey boasts a competitive health insurance market with numerous reputable providers offering a wide array of plans. Some of the prominent insurance carriers in the state include:

- Horizon Blue Cross Blue Shield of New Jersey: This is the state's largest health insurer, offering a comprehensive range of plans, including individual, family, and employer-sponsored options. Horizon BCBSNJ is known for its extensive provider network and innovative wellness programs.

- AmeriHealth New Jersey: A subsidiary of Independence Health Group, AmeriHealth NJ provides a diverse selection of health plans, including HMO, PPO, and EPO options. The company focuses on preventive care and has a strong presence in the state's Medicaid program.

- UnitedHealthcare: With a national reach, UnitedHealthcare offers a variety of health insurance plans in New Jersey, catering to individuals, families, and businesses. Their plans often include access to a vast network of healthcare providers and innovative digital health tools.

- Oscar Health: Oscar Health is a relatively new entrant in the New Jersey market, offering tech-forward health insurance plans. They provide user-friendly mobile apps, virtual care options, and personalized health plans tailored to individual needs.

Each of these providers offers a range of plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and more. These plan types differ in their provider networks, coverage areas, and out-of-pocket costs, giving New Jersey residents a variety of options to choose from based on their healthcare needs and preferences.

Choosing the Right Health Insurance Plan

Selecting the right health insurance plan in New Jersey can be a complex decision, as it involves evaluating various factors such as coverage, cost, and provider networks. Here are some key considerations to help you make an informed choice:

Assess Your Healthcare Needs

Begin by evaluating your personal healthcare needs and those of your family. Consider factors such as chronic conditions, prescription medications, anticipated healthcare utilization, and preferred healthcare providers. Understanding your unique healthcare situation will help narrow down the most suitable plan options.

Compare Plan Types and Networks

Research and compare the different plan types offered by insurance providers in New Jersey. HMOs, PPOs, and EPOs each have their advantages and limitations. For instance, HMOs typically offer lower premiums but have more restricted provider networks, while PPOs provide more flexibility but may come with higher costs.

Explore the provider networks of each plan to ensure that your preferred doctors, specialists, and hospitals are included. Some plans may have more limited networks, which can impact your out-of-pocket costs and access to healthcare services.

Evaluate Coverage and Benefits

Review the coverage and benefits offered by each plan. Essential health benefits, as mandated by the ACA, should be included in all qualified health plans. These benefits typically cover ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and pediatric services, including oral and vision care.

Additionally, consider any specific benefits that are important to you, such as dental, vision, or alternative medicine coverage. Some plans may offer additional perks like wellness programs, telemedicine services, or fitness incentives.

Consider Out-of-Pocket Costs

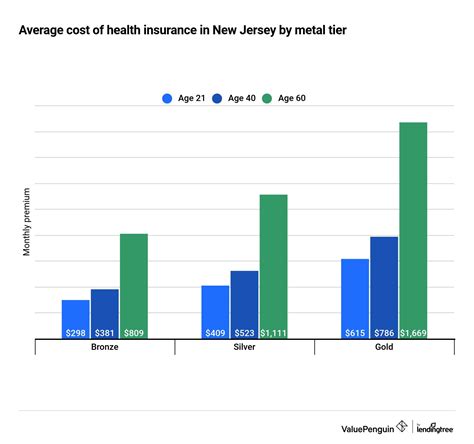

Out-of-pocket costs, including deductibles, copayments, and coinsurance, can significantly impact your healthcare expenses. Compare the out-of-pocket maximums and other cost-sharing provisions across different plans. Keep in mind that lower premiums often come with higher out-of-pocket costs, so strike a balance that aligns with your budget and healthcare needs.

Explore Subsidies and Tax Credits

If you’re purchasing health insurance through the New Jersey Health Insurance Marketplace, you may be eligible for premium tax credits and cost-sharing reductions. These subsidies can lower your monthly premiums and out-of-pocket expenses, making health insurance more affordable. Use the marketplace’s calculator to estimate your potential savings and choose a plan that maximizes these benefits.

Health Insurance and Cost-Saving Strategies

Health insurance in New Jersey, as in any state, can be a significant expense. Here are some strategies to help you save on your healthcare costs:

Take Advantage of Preventive Care

Many health insurance plans in New Jersey cover preventive care services at no cost to the insured. These services include annual check-ups, immunizations, cancer screenings, and counseling for various health conditions. By utilizing these services, you can catch potential health issues early on, potentially saving you from more costly treatments down the line.

Opt for Generic Drugs

Prescription medications can be a substantial expense. Whenever possible, opt for generic drugs, which are typically much more affordable than brand-name medications. Many insurance plans offer incentives or lower copays for generic drugs, so be sure to check your plan’s formulary and take advantage of these savings.

Consider High-Deductible Health Plans (HDHPs)

High-deductible health plans have lower premiums but higher deductibles. If you’re generally healthy and don’t anticipate high healthcare costs, an HDHP can be a cost-effective option. These plans often pair well with a Health Savings Account (HSA), which allows you to save pre-tax dollars for qualified medical expenses. HSAs can provide long-term savings and tax benefits.

Negotiate Medical Bills

Medical bills can sometimes be negotiable. If you receive a large medical bill, don’t hesitate to contact the provider’s billing department and inquire about potential discounts or payment plans. Many healthcare providers are willing to work with patients to make their bills more manageable.

Utilize In-Network Providers

Staying within your insurance plan’s provider network can significantly reduce your out-of-pocket costs. Out-of-network providers may not be covered by your plan or may come with higher costs. Check your plan’s network directory regularly to ensure you’re utilizing in-network providers and avoiding surprise bills.

Navigating the Enrollment Process

Enrolling in a health insurance plan in New Jersey can be a straightforward process, especially with the assistance of the New Jersey Health Insurance Marketplace. Here’s a step-by-step guide to help you through the enrollment process:

Step 1: Determine Your Eligibility

Start by determining whether you’re eligible for health insurance coverage through the marketplace. You can be eligible if you’re a U.S. citizen, permanent resident, or legally present in the United States. Additionally, you must not be incarcerated and not be eligible for Medicare.

Step 2: Gather Necessary Documents

Before beginning the enrollment process, gather the necessary documents. This may include your social security number, income information (such as pay stubs or tax returns), policy numbers for any current health insurance plans, and information about your household members (such as birthdates and social security numbers).

Step 3: Create an Account

Visit the Get Covered New Jersey website and create an account. This will allow you to save your progress and return to the application at a later time if needed.

Step 4: Complete the Application

Fill out the application, providing accurate and up-to-date information. The application will guide you through the process, asking questions about your household, income, and desired coverage.

Step 5: Compare and Select a Plan

Once you’ve completed the application, you’ll be able to compare the available health insurance plans based on your eligibility and preferences. Consider factors such as coverage, cost, and provider networks to select the plan that best meets your needs.

Step 6: Enroll and Pay Premiums

After choosing your plan, you’ll need to enroll and pay your first month’s premium. You can typically pay online or by mail. Keep in mind that your coverage will not become effective until you’ve made the first premium payment.

The Future of Health Insurance in New Jersey

The health insurance landscape in New Jersey is constantly evolving, with ongoing efforts to improve access, affordability, and quality of care. Here are some key trends and initiatives to watch:

Expansion of Medicaid

New Jersey’s Medicaid expansion under the ACA has significantly increased access to healthcare for low-income residents. The state continues to advocate for further expansion and improvements to the program, ensuring that more residents can receive the care they need.

Focus on Value-Based Care

Value-based care models are gaining traction in New Jersey, aiming to improve healthcare outcomes while reducing costs. These models incentivize healthcare providers to deliver high-quality, efficient care, often through bundled payments or other innovative reimbursement methods.

Emphasis on Telehealth

Telehealth services have become increasingly popular, especially in the wake of the COVID-19 pandemic. New Jersey is embracing telehealth as a way to enhance access to care, particularly for residents in rural or underserved areas. Insurance providers are expanding their coverage of telehealth services, making it easier for patients to receive remote consultations and treatment.

Advancements in Digital Health

The integration of digital health technologies is transforming the healthcare landscape in New Jersey. Insurance providers are offering digital tools and platforms to enhance the patient experience, improve care coordination, and provide convenient access to healthcare services.

Continued Advocacy for Affordable Care

New Jersey’s Department of Banking and Insurance, along with various advocacy groups, continues to advocate for policies that promote affordable health insurance for all residents. This includes efforts to stabilize the individual insurance market, support small businesses in offering coverage, and ensure that all residents have access to essential healthcare services.

Can I qualify for Medicaid in New Jersey if I’m not a U.S. citizen?

+Yes, certain non-citizens can qualify for Medicaid in New Jersey. The eligibility requirements vary based on factors such as immigration status and length of residency. It’s recommended to check with the New Jersey Department of Human Services or consult an immigration attorney for specific guidelines.

What is the open enrollment period for health insurance in New Jersey?

+The annual open enrollment period for the New Jersey Health Insurance Marketplace typically runs from November 1st to December 15th. During this time, individuals and families can enroll in or change their health insurance plans for the upcoming year. Outside of this period, you may still be able to enroll if you qualify for a special enrollment period due to certain life events.

Are there any resources available to help me understand my health insurance benefits in New Jersey?

+Yes, the New Jersey Department of Banking and Insurance offers a Consumer Guide to Health Insurance that provides comprehensive information about understanding and using your health insurance benefits in New Jersey. Additionally, insurance providers often have dedicated customer service teams to assist with benefit inquiries.