How Much Health Insurance Cost

Understanding the cost of health insurance is crucial for individuals and families, especially in the context of rising healthcare expenses. The price of health insurance can vary significantly based on numerous factors, making it essential to delve into the specifics to gain a comprehensive understanding. In this article, we will explore the key determinants of health insurance costs, provide real-world examples, and offer insights into optimizing coverage while managing expenses.

Factors Influencing Health Insurance Costs

Several critical factors contribute to the overall cost of health insurance, each playing a unique role in determining the premium an individual or family pays. These factors include age, location, coverage type, provider network, and the specific plan’s benefits and exclusions.

Age as a Determining Factor

Age is one of the most significant variables in health insurance costs. Insurance companies use age as a risk assessment tool, as younger individuals tend to have fewer health issues and are less likely to require extensive medical care. Consequently, health insurance premiums are typically lower for younger adults compared to older individuals.

For instance, a 25-year-old healthy individual may pay an average of $200-$300 per month for a basic health insurance plan, while a 60-year-old with pre-existing conditions could face premiums of $500-$1,000 or more for the same coverage. This disparity underscores the impact of age on insurance costs.

The Impact of Location

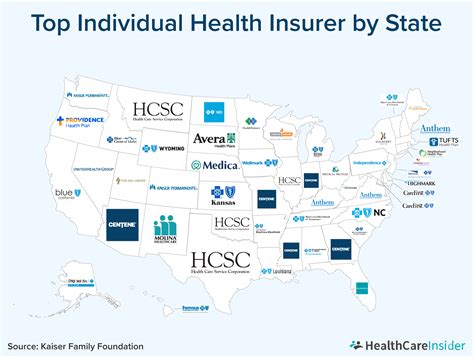

The cost of health insurance also varies based on geographical location. Healthcare expenses can differ significantly between urban and rural areas, and even between different states or regions within the same country. These variations are influenced by factors such as the cost of living, the availability of healthcare facilities, and the prevalence of specific health conditions in a given area.

Consider the example of health insurance premiums in two major U.S. cities: New York City and Los Angeles. Due to the high cost of living and advanced medical facilities, health insurance premiums in these cities can be substantially higher than in more rural areas. A comprehensive health insurance plan in New York City might cost $600-$800 per month for an individual, whereas the same coverage in a rural area could be as low as $400-$500 per month.

Coverage Types and Provider Networks

The type of health insurance coverage chosen also significantly impacts the cost. There are various coverage options available, including HMO (Health Maintenance Organization), PPO (Preferred Provider Organization), EPO (Exclusive Provider Organization), and POS (Point of Service) plans. Each type offers different levels of coverage and flexibility, with varying provider networks and out-of-pocket expenses.

For instance, an HMO plan typically has a more limited provider network and lower out-of-pocket costs but may require referrals for specialist care. In contrast, a PPO plan offers more flexibility in choosing healthcare providers but often comes with higher premiums and out-of-pocket expenses.

Plan Benefits and Exclusions

The specific benefits and exclusions of a health insurance plan are crucial determinants of its cost. Plans vary widely in terms of the services and treatments they cover, as well as any exclusions or limitations they may have. Some plans may provide comprehensive coverage for a wide range of services, while others may have more restrictive policies.

As an example, a health insurance plan that covers extensive prescription drug benefits, mental health services, and specialized medical procedures is likely to have higher premiums compared to a plan with more limited coverage. Understanding the specific benefits and exclusions of a plan is essential for individuals to make informed decisions about their health insurance coverage.

Optimizing Health Insurance Coverage

Given the significant variations in health insurance costs, it is essential to explore strategies for optimizing coverage while managing expenses. Here are some practical tips to consider:

Assess Your Healthcare Needs

Before choosing a health insurance plan, carefully evaluate your healthcare needs and priorities. Consider your past medical history, any ongoing conditions or treatments, and the likelihood of future healthcare requirements. By understanding your unique healthcare needs, you can select a plan that provides adequate coverage without unnecessary expenses.

Compare Multiple Plans

Take the time to compare different health insurance plans offered by various providers. Review the plan details, including coverage limits, provider networks, and out-of-pocket expenses. Online resources and insurance brokers can be valuable tools for comparing plans and identifying the best options for your specific needs.

Consider High-Deductible Plans

High-deductible health insurance plans, often paired with a Health Savings Account (HSA), can be a cost-effective option for individuals with limited healthcare needs. These plans typically have lower premiums but higher deductibles, meaning you pay less upfront but may incur higher out-of-pocket expenses if you require extensive medical care.

Utilize Preventive Care

Many health insurance plans offer preventive care services at no additional cost. Taking advantage of these services, such as annual check-ups, vaccinations, and screenings, can help identify potential health issues early on and prevent more significant medical problems down the line. Preventive care not only improves your health but can also reduce future healthcare costs.

Stay Informed about Plan Changes

Health insurance plans can undergo changes annually, including adjustments to premiums, coverage limits, and provider networks. Stay informed about these changes and evaluate whether your current plan remains the best fit for your needs. Regularly reviewing your coverage options can help you make informed decisions and ensure you are getting the most value for your insurance premiums.

Conclusion

Understanding the cost of health insurance is a complex but essential aspect of managing healthcare expenses. By recognizing the key factors that influence insurance premiums, such as age, location, coverage type, and plan benefits, individuals can make informed decisions about their health insurance coverage. Additionally, by optimizing coverage through strategic choices and staying informed about plan changes, individuals can navigate the healthcare system effectively while managing their financial well-being.

Can I find affordable health insurance if I have pre-existing conditions?

+Yes, it is possible to find affordable health insurance even with pre-existing conditions. Under the Affordable Care Act (ACA), insurance companies cannot deny coverage or charge higher premiums based solely on pre-existing conditions. However, the cost of insurance may still vary depending on the severity of the condition and the type of plan chosen. It is advisable to research and compare different insurance options to find the most suitable and affordable coverage.

What is the average monthly cost of health insurance for a family?

+The average monthly cost of health insurance for a family can vary significantly based on factors such as location, coverage type, and the number of family members. According to recent data, the average monthly premium for family coverage in the United States is around 1,100-1,500. However, it’s important to note that this is just an average, and actual costs can be higher or lower depending on individual circumstances.

Are there any ways to reduce the cost of health insurance premiums?

+Yes, there are several strategies to reduce health insurance premiums. These include opting for a higher deductible plan, enrolling in a health savings account (HSA) if eligible, taking advantage of employer-sponsored wellness programs, and maintaining a healthy lifestyle to qualify for potential premium discounts. Additionally, comparing quotes from different insurance providers can help identify more affordable options.