List Of Health Insurance Companies

The health insurance industry plays a vital role in providing financial protection and access to healthcare services for individuals and families. With a wide range of options available, it's essential to explore the various health insurance companies and their offerings to make informed decisions about coverage. In this comprehensive guide, we will delve into the world of health insurance, highlighting some of the prominent players and shedding light on the factors to consider when choosing the right provider.

Exploring the Landscape: Key Health Insurance Companies

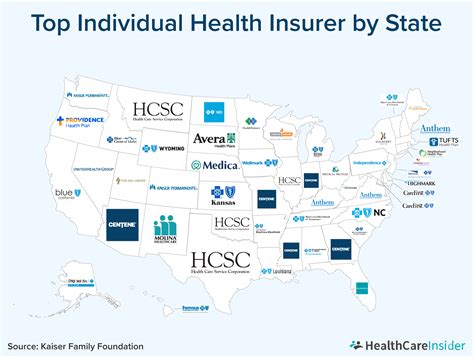

The health insurance market is diverse, featuring both established giants and emerging players. Here’s an overview of some of the notable health insurance companies, along with insights into their unique offerings and market presence:

1. UnitedHealthcare

UnitedHealthcare is a leading health insurance provider in the United States, offering a comprehensive range of plans and services. With a vast network of healthcare professionals and facilities, UnitedHealthcare provides coverage for millions of individuals and employers. Their plans often include preventive care benefits, telemedicine options, and a focus on wellness and disease management.

2. Aetna

Aetna, a subsidiary of CVS Health, is known for its innovative approach to healthcare coverage. They offer a wide array of plans, including traditional health insurance and specialty products like dental, vision, and pharmacy benefits. Aetna’s unique offerings include their “Aetna Navigator” tool, which provides personalized guidance and support for members.

3. Blue Cross Blue Shield

Blue Cross Blue Shield is a trusted name in the health insurance industry, with a strong presence across the United States. Their plans are known for their flexibility and customization options, catering to various needs. Blue Cross Blue Shield often partners with local healthcare providers, ensuring a robust network of doctors and hospitals.

4. Cigna

Cigna is a global health service company that provides a wide range of insurance and wellness solutions. They offer comprehensive health plans, including dental and vision coverage. Cigna’s approach focuses on personalized care, with tools like “Cigna Wellbeing,” which provides members with resources for managing their health and well-being.

5. Humana

Humana is a prominent health insurance company known for its focus on Medicare and Medicaid plans. They offer a variety of coverage options, including Medicare Advantage plans and prescription drug coverage. Humana’s “Humana Vitality” program encourages members to adopt healthy habits through rewards and incentives.

6. Kaiser Permanente

Kaiser Permanente operates as an integrated healthcare system, providing both insurance coverage and medical services. They are known for their coordinated care approach, where members have access to a dedicated team of healthcare professionals. Kaiser Permanente’s plans often include comprehensive benefits and a focus on preventive care.

7. Health Net

Health Net is a leading health insurance provider, particularly in the western United States. They offer a wide range of plans, including individual and family coverage, as well as Medicare and Medicaid options. Health Net’s network includes a diverse range of healthcare providers, ensuring accessibility for its members.

8. Anthem Blue Cross

Anthem Blue Cross is part of the larger Anthem, Inc. family of companies. They offer a variety of health insurance plans, including individual and group coverage. Anthem Blue Cross is known for its strong network of healthcare providers and its commitment to improving the overall health and well-being of its members.

Factors to Consider When Choosing a Health Insurance Company

When navigating the health insurance landscape, it’s crucial to evaluate various factors to find the best fit for your needs. Here are some key considerations:

- Coverage Options: Assess the range of plans offered by each company, including individual, family, and specialty coverage. Consider the specific benefits and limitations of each plan.

- Network of Providers: Evaluate the company's network of healthcare professionals and facilities. A robust network ensures easier access to preferred doctors and hospitals.

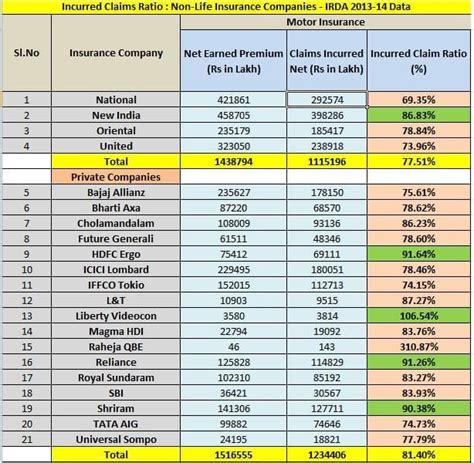

- Cost and Premiums: Compare the costs and premiums associated with different plans. Consider not only the monthly premiums but also deductibles, copayments, and out-of-pocket maximums.

- Benefits and Coverage: Review the specific benefits provided by each plan, including preventive care, prescription drug coverage, and specialty services. Ensure the plan aligns with your healthcare needs.

- Customer Service and Support: Assess the company's reputation for customer service and member support. Look for reviews and ratings to gauge their responsiveness and member satisfaction.

- Digital Tools and Resources: Evaluate the availability of digital tools and resources offered by the company. These can include online portals, mobile apps, and telehealth services, enhancing convenience and accessibility.

- Personalized Care and Wellness Programs: Consider companies that offer personalized care approaches and wellness programs. These initiatives can help you manage your health and potentially reduce overall healthcare costs.

Comparative Analysis: Health Insurance Companies in Focus

To provide a deeper understanding of the key health insurance companies, let’s delve into a comparative analysis, highlighting their unique features and market strengths:

| Health Insurance Company | Key Features | Market Strengths |

|---|---|---|

| UnitedHealthcare | Comprehensive plans, preventive care focus, telemedicine options | Large network, innovative digital tools, strong employer partnerships |

| Aetna | Innovative approaches, specialty products, personalized guidance | Strong focus on member engagement, diverse plan options |

| Blue Cross Blue Shield | Flexible plans, local partnerships, robust network | Trusted brand, wide coverage across the US |

| Cigna | Personalized care, wellness programs, global reach | Comprehensive health services, strong international presence |

| Humana | Medicare and Medicaid focus, wellness incentives | Specialized expertise in senior healthcare, robust Medicare plans |

| Kaiser Permanente | Integrated healthcare system, coordinated care | Comprehensive benefits, focus on preventive care |

| Health Net | Diverse plan options, western US presence | Strong network in specific regions, accessible care |

| Anthem Blue Cross | Individual and group plans, focus on member well-being | Strong network, commitment to improving member health |

Future Trends and Implications

The health insurance industry is evolving, driven by technological advancements, changing consumer preferences, and policy reforms. Here are some key trends and their potential implications:

- Telehealth and Digital Health: The integration of telehealth services and digital health tools is expected to continue growing. This trend offers increased accessibility and convenience for members, particularly in rural areas.

- Value-Based Care: The shift towards value-based care models is gaining momentum. This approach focuses on the quality of care and outcomes, rather than simply the quantity of services provided. It has the potential to improve patient outcomes and reduce costs.

- Personalized Medicine: Advances in genetic testing and precision medicine are paving the way for more personalized healthcare. Health insurance companies may adapt their coverage to include these emerging technologies, enhancing patient-centric care.

- AI and Data Analytics: Artificial intelligence and data analytics are being utilized to improve risk assessment, predict health trends, and personalize healthcare plans. This technology can enhance efficiency and accuracy in healthcare delivery.

- Consumer Engagement: Health insurance companies are increasingly focusing on engaging members in their own healthcare journey. This includes providing educational resources, incentives for healthy behaviors, and personalized support.

Conclusion: Navigating the Health Insurance Landscape

Choosing the right health insurance company is a critical decision that impacts your access to healthcare and financial well-being. By exploring the diverse landscape of health insurance providers, evaluating their unique offerings, and considering key factors, you can make an informed choice. Remember to assess your specific needs, review plan details, and compare options to find the best fit. Stay informed about industry trends and advancements to ensure you remain up-to-date with the latest developments in health insurance.

What is the average cost of health insurance premiums in the United States?

+The average cost of health insurance premiums can vary significantly based on factors such as location, age, and the specific plan chosen. According to recent data, the average monthly premium for an individual plan in the United States is around 450, while family plans can cost upwards of 1,500 per month. It’s important to note that these averages can fluctuate based on regional and demographic variations.

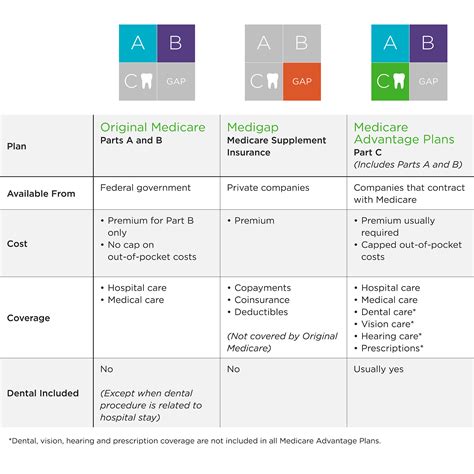

Are there any government programs that provide health insurance coverage?

+Yes, there are several government-funded health insurance programs in the United States. Medicare provides coverage for individuals aged 65 and older, as well as those with certain disabilities. Medicaid, on the other hand, is a joint federal and state program that offers coverage for low-income individuals and families. Additionally, the Children’s Health Insurance Program (CHIP) provides coverage for children in families who don’t qualify for Medicaid.

What should I look for when comparing health insurance plans?

+When comparing health insurance plans, it’s important to consider factors such as the network of providers, coverage benefits, cost (including premiums, deductibles, and copayments), and any additional services or perks offered. Additionally, pay attention to the plan’s reputation, customer service, and any reviews or ratings available. Finally, ensure that the plan aligns with your specific healthcare needs and preferences.