How To Purchase Life Insurance

Purchasing life insurance is a crucial financial decision that can provide security and peace of mind for you and your loved ones. With various types of life insurance policies available, it's essential to understand the process and considerations to make an informed choice. This comprehensive guide will walk you through the steps of buying life insurance, helping you navigate the options and make the right decision for your specific needs.

Understanding Life Insurance Policies

Life insurance is a contract between you (the policyholder) and an insurance company. In exchange for premium payments, the insurer promises to pay a benefit to your designated beneficiaries upon your death. Life insurance policies come in different forms, each with its unique features and benefits.

Term Life Insurance

Term life insurance is the most basic and affordable type of coverage. It provides protection for a specified period, typically ranging from 10 to 30 years. During the term, the policy pays a death benefit to your beneficiaries if you pass away. Term life insurance is ideal for individuals seeking coverage for a specific period, such as while their children are dependent or to cover a mortgage.

Key Features:

- Affordable premiums.

- Flexibility to choose the term length.

- No cash value accumulation.

- Renewable or convertible options.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for your entire life, as long as premiums are paid. It offers a guaranteed death benefit and accumulates cash value over time, which can be accessed through loans or withdrawals.

Key Features:

- Lifetime coverage.

- Fixed premiums that remain the same throughout the policy.

- Cash value growth potential.

- Borrowing against the policy’s cash value.

Universal Life Insurance

Universal life insurance is a flexible permanent life insurance policy that allows you to adjust your premium payments and death benefit amounts within certain limits. It offers more flexibility than whole life insurance and typically has a higher cash value growth potential.

Key Features:

- Flexible premium payments.

- Adjustable death benefit.

- Potential for higher cash value growth.

- Option to invest a portion of the cash value.

Indexed Universal Life Insurance

Indexed universal life insurance is a type of universal life policy that ties the policy’s cash value growth to a stock market index, such as the S&P 500. While it offers the potential for higher returns, it also carries more risk compared to traditional universal life insurance.

Key Features:

- Linked to stock market index performance.

- Potential for higher cash value growth.

- Caps on returns to protect against market downturns.

- Guaranteed minimum interest rate.

Assessing Your Life Insurance Needs

Before purchasing life insurance, it’s crucial to assess your specific needs and financial goals. Consider the following factors to determine the right amount and type of coverage:

Financial Obligations

Evaluate your current and future financial obligations, such as mortgage payments, outstanding debts, and the cost of living for your dependents. Ensure that your life insurance policy can cover these expenses in the event of your untimely demise.

Income Replacement

Life insurance can serve as a replacement for your income, ensuring that your loved ones can maintain their standard of living if you are no longer able to provide for them. Calculate the amount of income your family would need to sustain their current lifestyle and consider that as a starting point for your coverage amount.

Educational Expenses

If you have children or plan to have them, life insurance can help fund their education. Consider the cost of higher education and the number of children you have or plan to have when determining the coverage amount.

Retirement Planning

Life insurance can also be a valuable tool for retirement planning. The cash value accumulation in permanent life insurance policies can be used to supplement your retirement income or fund retirement goals.

Tax Benefits

Certain life insurance policies offer tax advantages. For instance, the cash value growth in permanent life insurance policies is tax-deferred, and death benefits are generally tax-free. Consult with a financial advisor to understand the tax implications of different policy types.

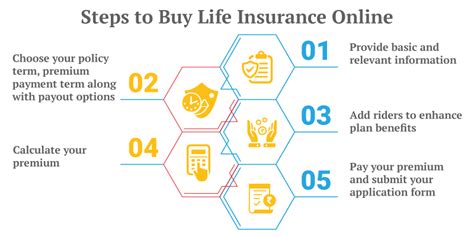

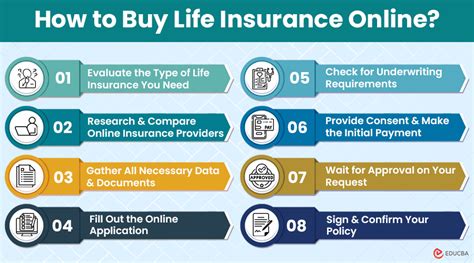

Shopping for Life Insurance

Once you’ve assessed your needs and determined the type and amount of coverage you require, it’s time to shop for the right life insurance policy. Here are some steps to guide you through the process:

Research Insurers

Start by researching reputable life insurance companies. Look for companies with a strong financial rating, as this indicates their ability to pay claims. Consider factors such as customer service, claim settlement history, and policy features offered.

Compare Policies

Compare the features and benefits of different policies from multiple insurers. Evaluate the premium costs, coverage amounts, and any additional riders or benefits offered. Consider your specific needs and choose policies that align with your priorities.

Obtain Quotes

Request quotes from several insurers to get an idea of the premium costs for the coverage you desire. Remember that premiums can vary significantly based on your age, health, and lifestyle factors.

Seek Professional Advice

Consider consulting with a qualified financial advisor or insurance broker who can provide expert guidance tailored to your situation. They can help you navigate the complex world of life insurance and ensure you make the right choice.

Understand Policy Terms

Read the policy documents carefully to understand the terms and conditions, including any exclusions or limitations. Ensure that you are comfortable with the policy’s fine print before making a commitment.

The Application Process

Once you’ve selected the right life insurance policy, you’ll need to complete an application process. Here’s what you can expect:

Personal Information

You’ll be required to provide personal details, including your name, date of birth, contact information, and social security number. The insurer will use this information to assess your eligibility and calculate your premium.

Health Examination

Most life insurance policies require a medical examination to assess your health and determine your risk profile. The examination may include blood tests, urine samples, and a physical assessment. Be prepared to answer questions about your medical history and current health status.

Financial Information

You may also need to provide financial information, such as your income, assets, and liabilities. This information helps the insurer understand your financial situation and determine the appropriate coverage amount.

Policy Review and Acceptance

After submitting your application, the insurer will review your information and decide whether to offer you a policy. If approved, you’ll receive a policy document outlining the terms, conditions, and benefits of your coverage.

Maintaining Your Life Insurance Policy

Once you’ve purchased your life insurance policy, it’s essential to maintain it to ensure its effectiveness. Here are some tips for keeping your policy up-to-date:

Regularly Review Your Coverage

Life circumstances can change, so it’s important to review your life insurance policy periodically. Major life events such as marriage, divorce, birth of a child, or career changes may impact your coverage needs. Adjust your policy accordingly to ensure it aligns with your current situation.

Keep Your Insurer Informed

Inform your insurer about any significant changes in your health or lifestyle that may impact your risk profile. Failure to disclose relevant information could result in a denied claim in the future.

Pay Premiums Consistently

Ensure that you pay your premiums on time to keep your policy active. Late or missed payments can result in policy lapse, leaving you without coverage.

Understand Your Policy’s Benefits

Familiarize yourself with the benefits and features of your life insurance policy. Know how to access the cash value, if applicable, and understand the process for making claims.

Future Considerations

As you progress through different stages of life, your life insurance needs may evolve. Consider the following future implications when planning your life insurance strategy:

Changing Family Dynamics

As your family grows or changes, your life insurance coverage should adapt accordingly. Review your policy regularly to ensure it aligns with your family’s current and future needs.

Retirement Planning

Life insurance can be a valuable tool for retirement planning. If you have a permanent life insurance policy with cash value, consider using it to supplement your retirement income or fund specific retirement goals.

Long-Term Care Planning

Some life insurance policies offer long-term care riders, which provide benefits for long-term care expenses. Consider adding this rider if you anticipate the need for long-term care in the future.

Estate Planning

Life insurance can be a crucial component of your estate plan. It can help ensure that your assets are distributed according to your wishes and provide liquidity to pay for estate taxes and other expenses.

Frequently Asked Questions

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on your specific financial obligations, income replacement needs, and future goals. As a general guideline, aim for coverage that is at least 10 times your annual income, but it’s essential to assess your unique situation. Consider factors such as mortgage payments, outstanding debts, educational expenses, and retirement planning when determining the coverage amount.

Is term life insurance better than permanent life insurance?

+The choice between term and permanent life insurance depends on your individual needs and financial goals. Term life insurance is more affordable and suitable for covering temporary needs, such as providing for dependent children or paying off a mortgage. Permanent life insurance, on the other hand, offers lifelong coverage and accumulates cash value, making it a valuable tool for retirement planning and estate building. Assess your priorities and consult with a financial advisor to determine which type of policy is best for you.

Can I purchase life insurance if I have pre-existing health conditions?

+Yes, you can still purchase life insurance even if you have pre-existing health conditions. However, it may impact the cost and availability of coverage. Some insurers offer specialized policies for individuals with health issues, while others may require a medical examination to assess your risk profile. Be transparent about your health conditions during the application process to ensure accurate coverage and avoid future claim denials.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy at least once a year or whenever there is a significant change in your life circumstances. Major life events such as marriage, divorce, birth of a child, or career changes may impact your coverage needs. Regularly reviewing your policy ensures that it remains aligned with your current financial obligations and goals.

Can I add additional riders to my life insurance policy?

+Yes, many life insurance policies offer optional riders that can enhance your coverage. Common riders include waiver of premium, which waives premium payments if you become disabled, and accelerated death benefit, which allows you to access a portion of the death benefit if you are diagnosed with a terminal illness. Consult with your insurer to understand the available riders and their costs.

Purchasing life insurance is a significant decision that requires careful consideration and planning. By understanding the different types of policies, assessing your needs, and shopping around for the best options, you can secure the financial protection your loved ones deserve. Remember to regularly review and maintain your policy to ensure it remains effective throughout your lifetime.