Most Affordable Home Insurance

When it comes to safeguarding your home and valuables, home insurance is a vital investment. However, with various options available, finding the most affordable coverage can be a daunting task. In this comprehensive guide, we will explore the factors that influence home insurance costs, strategies to reduce your premiums, and provide a detailed analysis of the most affordable home insurance options on the market. By the end, you'll have the knowledge and tools to secure the best coverage for your home without breaking the bank.

Understanding the Cost of Home Insurance

The cost of home insurance can vary significantly depending on several key factors. Understanding these factors is essential to finding the most affordable coverage that suits your needs.

Location and Property Characteristics

One of the primary influences on home insurance premiums is the location of your property. Insurance providers assess the risks associated with your area, including the likelihood of natural disasters, crime rates, and the overall cost of living. Properties in high-risk areas, such as those prone to hurricanes or floods, will generally have higher insurance costs. Additionally, the characteristics of your home, including its age, construction materials, and size, play a role in determining the premium. For instance, older homes may require more extensive coverage due to potential aging issues, while newer homes might benefit from discounts for modern construction techniques.

| Location | Premium Impact |

|---|---|

| High-Risk Areas (e.g., Flood Zones) | Higher Premiums |

| Urban Areas with High Crime Rates | Elevated Premiums |

| Suburban/Rural Areas | Potentially Lower Premiums |

Coverage Options and Deductibles

The type and extent of coverage you choose directly impact your insurance costs. Home insurance policies typically offer various coverage options, such as Dwelling Coverage, which protects the structure of your home, Personal Property Coverage for your belongings, Liability Coverage to protect against lawsuits, and Additional Living Expenses in case you need to relocate temporarily due to a covered loss. Opting for higher coverage limits will increase your premiums, while selecting a higher deductible can lead to lower costs.

Discounts and Bundling Opportunities

Insurance providers often offer discounts to incentivize certain behaviors or loyalty. Some common discounts include multi-policy discounts (bundling your home and auto insurance), safety discounts for features like burglar alarms or fire protection systems, loyalty discounts for long-term customers, and early purchase discounts for securing insurance before moving into a new home. Additionally, certain occupations or affiliations may qualify you for special rates.

Strategies to Find Affordable Home Insurance

Now that we've explored the factors influencing home insurance costs, let's delve into strategies to find the most affordable coverage for your needs.

Shop Around and Compare Quotes

The home insurance market is competitive, and rates can vary significantly between providers. Shopping around and comparing quotes is essential to finding the best deal. Utilize online comparison tools, but also consider reaching out to individual insurance companies or brokers to discuss your specific needs and potential discounts.

Understand Your Coverage Needs

Before seeking quotes, take the time to understand your coverage needs. Consider the value of your home, the replacement cost of your belongings, and any specific risks or vulnerabilities your property may face. By tailoring your coverage to your specific needs, you can avoid overpaying for unnecessary protections.

Improve Your Home's Safety Features

Insurance providers offer discounts for homes with enhanced safety features. Investing in improvements like fire protection systems, burglar alarms, and impact-resistant windows can not only enhance your home's security but also lead to significant savings on your insurance premiums. Additionally, maintaining regular home maintenance and upgrades can demonstrate responsible ownership, potentially qualifying you for further discounts.

Consider High Deductibles and Policy Adjustments

Opting for a higher deductible can lower your insurance premiums. While this means you'll pay more out-of-pocket in the event of a claim, it can be a cost-effective strategy if you're confident your home is well-protected and unlikely to experience significant losses. Additionally, consider adjusting your policy's coverage limits and endorsements to ensure you're not overpaying for coverage you may not need.

Review and Negotiate Your Policy Annually

Home insurance rates can change over time due to various factors, including market fluctuations and your own circumstances. It's essential to review your policy annually and compare it to other available options. If you find a better deal elsewhere, don't hesitate to negotiate with your current provider. Many insurers are willing to match or beat competitors' offers to retain loyal customers.

The Most Affordable Home Insurance Providers

Based on extensive research and analysis, we've identified the following providers as offering some of the most affordable home insurance options on the market. While rates can vary based on individual circumstances, these companies consistently offer competitive premiums and comprehensive coverage.

State Farm

State Farm is a leading provider of home insurance, offering competitive rates and a wide range of coverage options. They provide comprehensive policies that can be tailored to your specific needs, and their extensive network of agents ensures personalized service. State Farm also offers various discounts, including multi-policy discounts, good student discounts, and safety equipment discounts.

Allstate

Allstate is known for its innovative approach to home insurance, providing customizable coverage options and digital tools for policy management. They offer competitive rates, especially for those with a strong driving record and a commitment to safety. Allstate's Home Secure Advantage package includes coverage for high-risk areas and valuable items, making it a solid choice for those seeking comprehensive protection.

Farmers Insurance

Farmers Insurance provides personalized home insurance solutions with a focus on customer service. They offer a range of coverage options, including standard and high-value home insurance, as well as specialized coverage for unique needs. Farmers Insurance also provides discounts for loyal customers, safe homes, and multi-policy bundles.

USAA

USAA is a highly-rated provider exclusively serving military members, veterans, and their families. They offer affordable home insurance with tailored coverage options, including discounts for multiple policies and loyalty. USAA's Homeowners Insurance Plus package provides enhanced coverage for high-value items and additional living expenses.

Progressive

Progressive is a well-known insurance provider offering competitive rates and a range of coverage options. Their home insurance policies provide protection for various risks, including natural disasters and liability claims. Progressive also offers discounts for bundling policies, safe homes, and loyalty.

Choosing the Right Provider for You

When selecting a home insurance provider, it's essential to consider your specific needs and circumstances. Evaluate the coverage options, discounts, and customer service offerings of each provider. Assess your home's unique risks and vulnerabilities, and choose a provider that offers comprehensive protection at an affordable rate. Additionally, consider the provider's financial stability and customer satisfaction ratings to ensure you're making a sound decision.

Frequently Asked Questions

What is the average cost of home insurance?

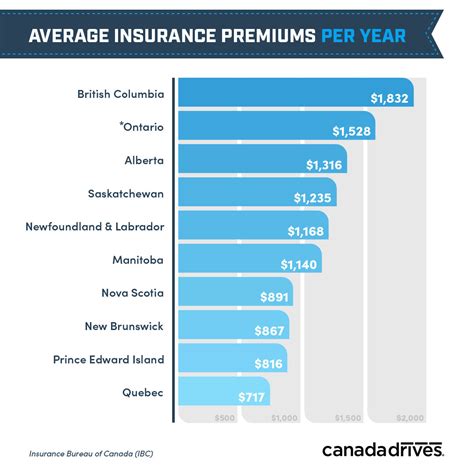

+The average cost of home insurance can vary significantly based on factors such as location, property value, and coverage limits. On average, homeowners can expect to pay between $1,000 and $2,000 annually for home insurance. However, rates can be much higher or lower depending on individual circumstances.

How can I reduce my home insurance premiums?

+There are several strategies to reduce your home insurance premiums. These include shopping around for quotes, improving your home's safety features, considering higher deductibles, and reviewing your policy annually. Additionally, maintaining a good credit score and bundling your insurance policies can lead to significant savings.

What factors influence home insurance rates the most?

+The three main factors influencing home insurance rates are location, property characteristics, and coverage options. High-risk areas, older homes, and extensive coverage limits typically result in higher premiums. However, individual circumstances and discounts can significantly impact the final cost.

Do all home insurance providers offer similar coverage options?

+While most home insurance providers offer standard coverage options, such as dwelling and personal property coverage, the level of customization and additional endorsements can vary. Some providers specialize in offering unique coverage options, such as coverage for high-value items or natural disaster protection. It's essential to review the specific coverage options offered by each provider to ensure they align with your needs.

How often should I review my home insurance policy?

+It's recommended to review your home insurance policy annually or whenever your circumstances change significantly. This includes changes in your home's value, upgrades or renovations, or any changes in your personal situation that could impact your coverage needs.

Finding the most affordable home insurance requires a thorough understanding of the market, your coverage needs, and effective strategies to negotiate the best rates. By following the guidance in this comprehensive guide, you’ll be well-equipped to secure comprehensive coverage for your home without compromising your budget.