Commerial Auto Insurance

Commercial auto insurance is a vital component of any business's risk management strategy, especially for companies that rely heavily on vehicles for their operations. From delivery services to construction firms and everything in between, having the right coverage can mean the difference between a minor setback and a devastating financial loss. In this comprehensive guide, we'll delve into the intricacies of commercial auto insurance, exploring its various facets, the benefits it offers, and how to choose the best policy for your business needs.

Understanding Commercial Auto Insurance

Commercial auto insurance, also known as business auto insurance, provides coverage for vehicles owned or operated by a business. It differs from personal auto insurance in several key ways, catering to the unique risks and requirements of commercial entities. This type of insurance is essential for businesses to protect themselves from the financial consequences of accidents, theft, and other incidents involving company vehicles.

The scope of commercial auto insurance extends beyond traditional cars and trucks. It can cover a wide range of vehicles, including:

- Delivery vans

- Trucks (small, medium, and large)

- Trailers

- Taxis and ride-sharing vehicles

- Buses and shuttles

- Mobile equipment and machinery

Key Coverage Types

Commercial auto insurance policies offer a range of coverage options to address different risks. Here are some of the key types of coverage available:

- Liability Coverage: This is the cornerstone of any commercial auto policy. It provides protection against claims arising from bodily injury or property damage caused by your business vehicle. Liability coverage can include bodily injury liability, property damage liability, and medical payments.

- Physical Damage Coverage: This coverage protects the insured vehicles in case of accidents, theft, or other physical damage. It includes collision coverage, which pays for repairs or the replacement cost of the vehicle, and comprehensive coverage, which covers damages from events like vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects your business and its employees in case of an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Personal Injury Protection (PIP) or Medical Payments: These coverages provide compensation for medical expenses, lost wages, and other related costs for the policyholder and their employees injured in an accident, regardless of fault.

- Rental Reimbursement: If your vehicle is being repaired or is rendered unusable due to an insured event, this coverage provides a rental car allowance to keep your business operations running smoothly.

Benefits of Commercial Auto Insurance

Commercial auto insurance offers a multitude of benefits to businesses, ensuring their financial stability and providing peace of mind. Here are some of the key advantages:

Protection Against Financial Loss

Accidents can happen at any time, and when they do, the financial consequences can be severe. Commercial auto insurance safeguards your business from the potentially catastrophic costs associated with vehicle-related incidents. Whether it’s repairing or replacing damaged vehicles, covering medical expenses, or dealing with legal claims, insurance provides a vital financial safety net.

Legal Compliance and Peace of Mind

Most states require businesses to carry commercial auto insurance to operate legally. By obtaining the appropriate coverage, you ensure that your business meets these regulatory requirements. Additionally, knowing that you’re adequately insured brings peace of mind, allowing you to focus on running your business without worrying about unforeseen accidents or incidents.

Risk Management and Business Continuity

Commercial auto insurance is an integral part of a comprehensive risk management strategy. It helps businesses identify and mitigate potential risks associated with their vehicles. By having the right coverage in place, you can minimize the impact of accidents or other incidents, ensuring your business can continue operations with minimal disruption.

Choosing the Right Commercial Auto Insurance

Selecting the appropriate commercial auto insurance policy is crucial to ensuring your business is adequately protected. Here are some key considerations to guide your decision-making process:

Assessing Your Business Needs

Start by evaluating your business’s unique requirements. Consider the types of vehicles you use, the nature of your operations, and the potential risks associated with your industry. For instance, a delivery service may require different coverage limits and types compared to a construction company.

Coverage Limits and Deductibles

Choose coverage limits that align with your business’s financial capacity and potential risks. Higher limits provide greater protection but also come with higher premiums. Additionally, consider the deductibles you’re comfortable with. While higher deductibles can lower your premium, they also mean you’ll pay more out of pocket in the event of a claim.

Customizing Your Policy

Most commercial auto insurance policies are customizable to meet your specific needs. You can add endorsements or riders to tailor the coverage to your business. For example, you might want to include coverage for hired and non-owned autos if your employees occasionally use their personal vehicles for work purposes.

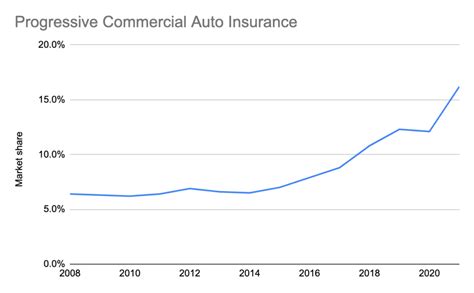

Comparing Insurers and Premiums

Shop around and compare quotes from different insurers. Premiums can vary significantly based on factors like your business’s location, the type of vehicles insured, and your driving record. Consider the insurer’s reputation, financial stability, and customer service ratings to ensure you’re getting the best value for your money.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against claims for bodily injury and property damage caused by your vehicles. |

| Physical Damage Coverage | Covers repairs or replacement costs for insured vehicles due to accidents or other damages. |

| Uninsured/Underinsured Motorist Coverage | Provides protection for your business and employees when involved in an accident with an uninsured or underinsured driver. |

| PIP or Medical Payments | Covers medical expenses and related costs for insured individuals injured in an accident. |

| Rental Reimbursement | Provides an allowance for rental cars when insured vehicles are being repaired. |

Conclusion

Commercial auto insurance is a vital component of any business’s risk management strategy, offering protection, legal compliance, and peace of mind. By understanding the different coverage options and tailoring your policy to your unique needs, you can ensure your business is well-protected against the financial impacts of vehicle-related incidents. Regularly reassessing and updating your insurance coverage ensures your business remains resilient and prepared for whatever the road may bring.

Frequently Asked Questions

How much does commercial auto insurance cost?

+

The cost of commercial auto insurance varies widely depending on factors such as the type of business, the number and type of vehicles insured, the business’s location, and the driving record of employees. Premiums can range from a few hundred to several thousand dollars per vehicle annually. It’s essential to shop around and obtain quotes from multiple insurers to find the best coverage at a competitive price.

What happens if I don’t have commercial auto insurance and my business vehicle is involved in an accident?

+

Operating a business vehicle without commercial auto insurance is illegal in most states and can result in significant fines and penalties. Additionally, if your vehicle is involved in an accident, you’ll be responsible for all costs associated with the accident, including repairs, medical expenses, and legal fees. This can quickly lead to substantial financial losses and potentially jeopardize the future of your business.

Can I include my personal vehicle on my business auto insurance policy?

+

It depends on the insurer and the specific policy. Some insurers may allow you to include your personal vehicle on your business auto insurance policy if it’s occasionally used for business purposes. However, it’s crucial to declare any personal vehicle usage to your insurer to ensure accurate coverage and avoid potential issues in the event of a claim.

What should I do if my business vehicle is involved in an accident?

+

If your business vehicle is involved in an accident, the first step is to ensure the safety of everyone involved. Contact the police to report the accident and obtain a report. Notify your insurance company as soon as possible to initiate the claims process. Take detailed notes and photographs of the accident scene, including any visible damage to vehicles and the surrounding area. Exchange information with the other driver(s) involved, including their insurance details.

How often should I review and update my commercial auto insurance policy?

+

It’s recommended to review your commercial auto insurance policy annually or whenever there are significant changes to your business, such as adding or removing vehicles, changing locations, or hiring new employees. Regular reviews ensure that your coverage remains adequate and aligned with your business’s evolving needs and risk profile.