Fha Insured Mortgage

The Federal Housing Administration (FHA) is a government agency that has been insuring mortgages for over 80 years, helping millions of Americans achieve homeownership. One of the most popular mortgage programs offered by the FHA is the FHA-insured mortgage, which provides numerous benefits to borrowers, especially those with lower credit scores or limited down payment funds. This article will delve into the details of FHA-insured mortgages, exploring their advantages, eligibility criteria, the application process, and how they can help aspiring homeowners realize their dream.

Understanding FHA-Insured Mortgages

FHA-insured mortgages, often simply referred to as FHA loans, are a type of home loan backed by the Federal Housing Administration. This backing provides a layer of protection to lenders, making it easier for borrowers to secure mortgage financing. Here’s a closer look at the key aspects of FHA-insured mortgages:

Benefits of FHA-Insured Mortgages

FHA loans offer a range of advantages that make them an attractive option for many homebuyers, particularly first-time buyers and those with unique financial circumstances.

- Lower Credit Score Requirements: One of the most significant benefits of FHA loans is their flexibility regarding credit scores. Unlike conventional loans, which often require higher credit scores, FHA loans can be approved with FICO scores as low as 580. This makes homeownership accessible to a broader range of borrowers.

- Lower Down Payment: Another notable advantage is the low down payment requirement. Borrowers can qualify for an FHA loan with as little as 3.5% down, which is substantially lower than the 20% down payment typically required for conventional loans. This means that aspiring homeowners can enter the property market sooner without having to save for years.

- Flexible Income and Employment Requirements: FHA loans also have more lenient income and employment criteria. They consider a wider range of income sources, including part-time work, commissions, and self-employment income. This flexibility allows a diverse range of individuals to qualify for homeownership.

- Seller-Paid Closing Costs: In some cases, sellers can contribute towards the buyer’s closing costs, further reducing the financial burden on the borrower.

- Refinancing Options: FHA loans also offer refinancing opportunities, such as the FHA Streamline Refinance program, which allows borrowers to lower their interest rates or switch from an adjustable-rate mortgage to a fixed-rate mortgage without extensive underwriting.

Eligibility Criteria

While FHA loans are known for their flexibility, there are certain eligibility requirements that borrowers must meet. These criteria ensure that borrowers are capable of handling the financial responsibilities of homeownership.

- Credit Score: As mentioned earlier, FHA loans generally require a minimum FICO score of 580. However, borrowers with scores between 500 and 579 may still be eligible if they can make a 10% down payment.

- Down Payment: Borrowers must have sufficient funds for the down payment, which can be as low as 3.5% of the purchase price for those with a credit score of 580 or higher. The down payment can come from various sources, including personal savings, gifts from family members, or certain approved assistance programs.

- Debt-to-Income Ratio: FHA loans typically require a maximum debt-to-income ratio of 43%, which means that no more than 43% of your monthly gross income can go towards repaying debts, including the proposed mortgage.

- Employment and Income Stability: FHA loans favor borrowers with a stable employment history. They require that borrowers have been consistently employed for the past two years, although there may be exceptions for certain circumstances, such as military service or career changes.

- Property Requirements: The property being purchased must meet FHA standards, ensuring it is safe, sound, and sanitary. This includes passing an inspection to verify that the home is in good condition and does not require extensive repairs.

The FHA Loan Application Process

The process of applying for an FHA-insured mortgage is similar to that of any other mortgage loan. However, there are a few unique steps involved due to the nature of the program.

- Pre-Approval: The first step is to obtain a pre-approval letter from an FHA-approved lender. This letter confirms that you are eligible for an FHA loan and provides an estimate of the loan amount you qualify for based on your financial situation.

- Choose a Property: Once you have your pre-approval letter, you can begin searching for a suitable property within your budget. Keep in mind that the property must meet FHA standards, so you may need to consider factors such as the condition of the home and any necessary repairs.

- Make an Offer: When you find a property you wish to purchase, you will need to make an offer to the seller. Your real estate agent will guide you through this process, ensuring that your offer is competitive and includes any necessary contingencies.

- Loan Application: After your offer is accepted, you will officially apply for the FHA loan. This involves providing detailed financial information, including income verification, tax returns, and bank statements. You will also need to disclose any outstanding debts and provide documentation for any gifts or assistance programs you are using for the down payment.

- Property Appraisal: The lender will order an appraisal of the property to ensure that it meets FHA standards and is worth at least the purchase price. If the appraisal comes in lower than the purchase price, you may need to renegotiate the sale price or provide additional funds to cover the difference.

- Underwriting and Final Approval: The loan application will then go through the underwriting process, where the lender carefully reviews all the provided information to assess your financial stability and the property’s suitability. If the loan is approved, you will receive a closing disclosure, which outlines the final terms of the loan.

- Closing: The final step is the closing, where you will sign all the necessary paperwork and officially become the homeowner. At closing, you will also need to pay any remaining closing costs and the down payment.

Performance and Impact

FHA-insured mortgages have had a significant impact on the housing market and have played a crucial role in promoting homeownership, particularly among first-time buyers and those with lower incomes. According to the National Association of Realtors, FHA loans accounted for approximately 11% of all purchase mortgages in 2022, which is a substantial portion of the market.

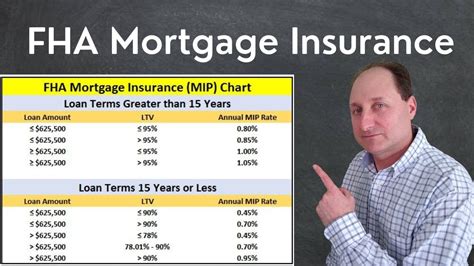

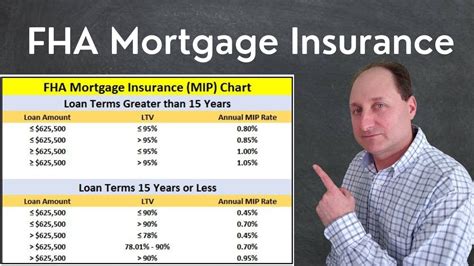

The performance of FHA loans has been generally positive, with default rates remaining relatively low despite the program’s focus on borrowers with lower credit scores and smaller down payments. This is largely due to the rigorous underwriting process and the various protections in place, such as mortgage insurance, which protects lenders in the event of default.

Furthermore, FHA loans have been particularly beneficial for revitalizing communities and stabilizing local housing markets. By providing access to mortgage financing for a wider range of borrowers, FHA loans have helped increase homeownership rates and contribute to the overall economic growth and stability of neighborhoods.

Future Outlook and Considerations

The future of FHA-insured mortgages looks promising, as the program continues to evolve and adapt to the changing needs of the housing market. Here are some key considerations and potential developments:

- Loan Limits: The FHA adjusts its loan limits annually, typically based on housing market conditions and local median home prices. These limits determine the maximum amount borrowers can borrow with an FHA loan. As housing prices continue to rise in many areas, the FHA may need to increase its loan limits to keep up with market trends.

- Credit Score Requirements: While FHA loans have traditionally been more flexible with credit score requirements, there have been discussions about potentially tightening these criteria to reduce the risk of defaults. However, any changes are likely to be gradual and balanced with the program’s mission of promoting homeownership.

- Down Payment Assistance Programs: FHA loans often work hand-in-hand with down payment assistance programs offered by various government agencies, non-profits, and local initiatives. These programs can further reduce the financial barrier to homeownership by providing grants or low-interest loans for down payments and closing costs. Expanding and promoting these programs could significantly increase the accessibility of FHA loans.

- Digital Mortgage Solutions: The FHA is embracing digital transformation to streamline the mortgage process and enhance the borrower experience. This includes the development of online platforms and tools that allow borrowers to apply for loans, track their application status, and communicate with lenders more efficiently.

- Refinancing Opportunities: FHA loans continue to offer attractive refinancing options, especially for borrowers with adjustable-rate mortgages or those seeking to reduce their interest rates. The FHA Streamline Refinance program, in particular, is expected to remain a popular choice for homeowners looking to stabilize their monthly payments.

Frequently Asked Questions

What is the difference between an FHA loan and a conventional loan?

+FHA loans and conventional loans are two distinct types of mortgage programs. FHA loans are backed by the Federal Housing Administration and are designed to make homeownership more accessible, particularly for borrowers with lower credit scores or limited down payment funds. They offer more lenient credit score and down payment requirements. Conventional loans, on the other hand, are not insured by the government and typically require higher credit scores and larger down payments. They may offer more flexibility in terms of loan terms and conditions but are generally more suitable for borrowers with strong financial profiles.

Can I use an FHA loan to purchase a vacation home or investment property?

+No, FHA loans are primarily intended for primary residences. They are not typically used for vacation homes or investment properties. FHA loans are designed to promote homeownership and provide access to mortgage financing for borrowers who might not qualify for conventional loans. The program focuses on ensuring that borrowers have a stable place to live, so it restricts the use of FHA loans for non-primary residences.

Are there any restrictions on the type of properties eligible for FHA loans?

+Yes, there are certain restrictions on the type of properties that can be purchased with an FHA loan. The property must meet FHA standards, which include requirements for safety, soundness, and sanitation. This means that the home must be in good condition and not require extensive repairs. Additionally, FHA loans are typically limited to single-family homes, although there are specific programs for condominiums, manufactured homes, and multifamily properties.

How much can I borrow with an FHA loan?

+The amount you can borrow with an FHA loan depends on several factors, including your credit score, income, and the location of the property. The FHA sets loan limits based on housing market conditions and local median home prices. These limits determine the maximum loan amount you can receive. As of 2023, the FHA loan limits range from 420,680 to 970,800, depending on the county where the property is located. It’s important to consult with an FHA-approved lender to determine the specific loan amount you qualify for based on your financial situation and the property you wish to purchase.

What are the interest rates for FHA loans, and how do they compare to other mortgage types?

+Interest rates for FHA loans, like any other mortgage type, can vary depending on market conditions, your credit score, and other factors. As of [current date], the average interest rate for a 30-year fixed-rate FHA loan is [current rate]%, which is generally slightly higher than the average rate for a conventional loan. However, FHA loans often provide more competitive rates for borrowers with lower credit scores or limited down payment funds. It’s important to shop around and compare rates from multiple lenders to find the best deal for your specific financial situation.