Insurance Costs For Small Business

Starting and running a small business comes with a unique set of challenges, and one of the key considerations for entrepreneurs is understanding and managing insurance costs. Insurance is an essential aspect of any business operation, providing protection against a range of risks and potential liabilities. For small businesses, the right insurance coverage can mean the difference between weathering a storm and facing devastating financial consequences.

Understanding Insurance Essentials for Small Businesses

Insurance is a vital tool for managing risks and uncertainties that can impact a small business’s operations, finances, and reputation. It offers a financial safety net, ensuring that businesses can recover from unexpected events and continue their operations smoothly. However, the world of insurance can be complex, with numerous types of policies and coverage options available. For small business owners, it’s crucial to have a clear understanding of the essential insurance policies that can provide the necessary protection.

General Liability Insurance

General liability insurance is often considered the cornerstone of small business insurance. It provides coverage for a wide range of common risks, including bodily injury, property damage, and personal and advertising injury claims. For instance, if a customer slips and falls on your business premises, general liability insurance can help cover the resulting medical expenses and legal fees.

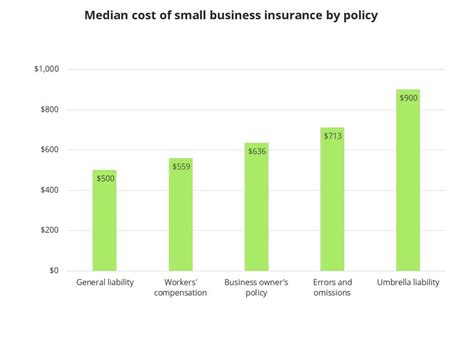

The cost of general liability insurance varies based on factors such as the nature of your business, the number of employees, and the location. On average, small businesses can expect to pay anywhere from $500 to $1,500 annually for this coverage. However, high-risk industries or businesses with a history of claims may face higher premiums.

Commercial Property Insurance

Commercial property insurance is crucial for businesses that own or lease physical spaces. It provides protection against damage or loss to your business property, including buildings, inventory, and equipment. Whether it’s a fire, storm, or vandalism, this insurance can help cover the costs of repairs or replacement.

The cost of commercial property insurance depends on the value of your property and the level of coverage you require. On average, small businesses can expect to pay around $1,000 to $3,000 annually for this coverage. However, the cost can vary significantly based on factors like the location of your business and the specific risks it faces.

Business Owner’s Policy (BOP)

A Business Owner’s Policy, or BOP, is a cost-effective option that combines general liability and commercial property insurance into one package. It’s designed specifically for small businesses and can provide a comprehensive insurance solution. By bundling these essential coverages, a BOP can often offer significant savings compared to purchasing separate policies.

The cost of a BOP will depend on the specific needs and risks of your business. On average, small businesses can expect to pay around $1,200 to $2,500 annually for a BOP. However, the exact cost will vary based on factors like the size and nature of your business, the coverage limits you choose, and any additional endorsements or riders you add to the policy.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, professional liability insurance is essential for businesses that provide professional services or advice. It protects against claims of negligence, errors, or omissions that may lead to financial loss for your clients. For example, if a client suffers a financial loss due to your advice or services, professional liability insurance can help cover the resulting legal costs and any settlements or judgments.

The cost of professional liability insurance varies significantly based on the nature of your business and the level of risk involved. On average, small businesses in low-risk professions can expect to pay around $500 to $1,000 annually for this coverage. However, high-risk professions like legal services or medical practices may face premiums of $2,000 or more.

Workers’ Compensation Insurance

Workers’ compensation insurance is a legal requirement for most businesses with employees. It provides coverage for work-related injuries or illnesses, ensuring that employees receive medical treatment and compensation for lost wages. This insurance also protects businesses from potential lawsuits related to workplace injuries.

The cost of workers' compensation insurance is determined by a variety of factors, including the number of employees, their job roles and duties, and the industry in which the business operates. High-risk industries like construction or manufacturing tend to have higher premiums due to the increased likelihood of workplace injuries. On average, small businesses can expect to pay around $1,000 to $3,000 annually for workers' compensation insurance, but the cost can vary significantly based on these factors.

Factors Influencing Insurance Costs for Small Businesses

The cost of insurance for small businesses can vary significantly based on a multitude of factors. Understanding these factors can help business owners make informed decisions about their insurance coverage and potentially negotiate better rates.

Industry and Business Type

The industry in which your business operates plays a significant role in determining insurance costs. High-risk industries, such as construction or manufacturing, generally face higher insurance premiums due to the increased likelihood of accidents, injuries, or property damage. On the other hand, low-risk industries, like consulting or retail, tend to have lower insurance costs.

Additionally, the specific type of business you run can influence insurance rates. For instance, a home-based business may have different insurance needs and costs compared to a retail store or an online e-commerce business.

Business Size and Location

The size of your business, in terms of revenue and number of employees, is another critical factor in determining insurance costs. Larger businesses often have higher insurance premiums due to the increased exposure to risks and potential liabilities. However, economies of scale can sometimes lead to lower per-employee insurance costs for larger businesses.

The location of your business also matters. Insurance rates can vary significantly based on regional factors, such as crime rates, weather patterns, and the cost of living. Areas with higher crime rates or a history of natural disasters may have higher insurance premiums to account for the increased risk.

Claims History

Your business’s claims history is a key factor that insurance providers consider when determining premiums. Businesses with a history of frequent or costly claims may face higher insurance rates, as they are seen as a higher risk. Conversely, businesses with a clean claims record may enjoy lower premiums or even receive discounts for their good standing.

Policy Coverage and Deductibles

The level of coverage you choose for your insurance policies can significantly impact your premiums. Higher coverage limits generally result in higher premiums, as the insurance provider assumes more risk. On the other hand, opting for lower coverage limits can lead to lower premiums but may leave your business underinsured in the event of a major loss.

The deductibles you choose for your insurance policies can also affect your premiums. Higher deductibles typically result in lower premiums, as you're agreeing to bear more of the financial burden in the event of a claim. However, it's essential to strike a balance, as a high deductible may be difficult to afford in the event of a major loss.

Strategies to Reduce Insurance Costs for Small Businesses

While insurance is an essential expense for small businesses, there are strategies that entrepreneurs can employ to potentially reduce their insurance costs without compromising on necessary coverage.

Shop Around and Compare Quotes

One of the most effective ways to find the best insurance rates is to shop around and compare quotes from multiple insurance providers. Each insurer has its own underwriting guidelines and pricing structures, so quotes can vary significantly. By obtaining multiple quotes, you can identify the most competitive rates and choose the provider that offers the best combination of coverage and cost.

Bundle Policies

Bundling multiple insurance policies with the same provider can often lead to significant savings. Many insurance providers offer discounts when you purchase multiple policies from them. For instance, if you have both general liability and commercial property insurance with the same provider, you may be eligible for a bundle discount. This strategy can help you save money while also simplifying your insurance management.

Improve Risk Management Practices

Insurance providers often reward businesses that demonstrate a commitment to risk management. By implementing robust risk management practices, you can reduce the likelihood of claims and potentially negotiate lower insurance premiums. This may include measures such as improving workplace safety, installing security systems, or implementing comprehensive data backup and cybersecurity protocols.

Review and Adjust Coverage Regularly

Insurance needs can change over time as your business evolves. Regularly reviewing your insurance coverage and making adjustments as necessary can help ensure that you’re not overpaying for coverage you don’t need or underinsured in critical areas. This may involve increasing coverage limits as your business grows or reducing coverage for risks that are no longer relevant.

Consider Captive Insurance Companies

Captive insurance companies are owned by the businesses they insure, and they offer an alternative to traditional insurance providers. By forming a captive, small businesses can have more control over their insurance costs and coverage. Captives can provide customized insurance solutions tailored to the specific needs of the business, potentially offering cost savings and greater flexibility.

Conclusion

Insurance is a critical aspect of running a small business, providing essential protection against a wide range of risks. By understanding the various types of insurance policies available and the factors that influence insurance costs, small business owners can make informed decisions about their insurance coverage. Additionally, implementing strategies to reduce insurance costs can help entrepreneurs save money without compromising on the protection their businesses need.

FAQs

What is the average cost of insurance for a small business?

+

The average cost of insurance for a small business can vary significantly based on factors such as industry, business size, location, and coverage needs. General liability insurance, a common coverage for small businesses, typically ranges from 500 to 1,500 annually. Commercial property insurance can cost around 1,000 to 3,000 per year, while professional liability insurance may range from 500 to 1,000 or more, depending on the profession.

How can I reduce insurance costs for my small business?

+

There are several strategies to reduce insurance costs for small businesses. These include shopping around for quotes from multiple insurers, bundling policies with the same provider to receive discounts, improving risk management practices to demonstrate a lower risk profile, reviewing and adjusting coverage regularly to ensure it aligns with your business’s needs, and considering captive insurance companies for more control over coverage and costs.

What is the difference between general liability and professional liability insurance?

+

General liability insurance covers a broad range of common risks, including bodily injury, property damage, and personal and advertising injury claims. It’s suitable for a wide range of businesses. Professional liability insurance, also known as errors and omissions (E&O) insurance, is specifically designed for businesses that provide professional services or advice. It protects against claims of negligence, errors, or omissions that may lead to financial loss for clients.

Do I need workers’ compensation insurance if I have fewer than 5 employees?

+

Workers’ compensation insurance requirements vary by state and the nature of your business. In some states, businesses with fewer than 5 employees may be exempt from carrying workers’ compensation insurance. However, it’s essential to check your state’s specific regulations, as exemptions can vary based on factors like the type of business and the nature of the work performed.

How often should I review my insurance coverage as a small business owner?

+

As a small business owner, it’s beneficial to review your insurance coverage at least annually, or whenever there are significant changes to your business operations, such as expansion, relocation, or changes in the number of employees. Regular reviews ensure that your coverage remains adequate and aligned with your business’s evolving needs.