Whole Life Insurance As An Investment

Maximizing Wealth: Unlocking the Power of Whole Life Insurance as an Investment

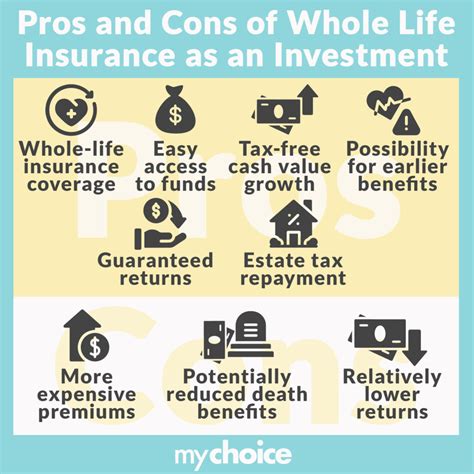

In the realm of financial planning, the concept of whole life insurance often transcends its traditional role as a safety net for loved ones. It emerges as a versatile financial tool, offering a unique blend of security and investment opportunities. This comprehensive guide delves into the intricacies of whole life insurance, unveiling its potential as a strategic investment vehicle.

Whole life insurance policies are designed to provide lifelong coverage, ensuring financial protection for your beneficiaries. However, beneath this surface lies a complex financial instrument that can be leveraged to grow wealth and secure your financial future. As we navigate the world of personal finance, it becomes imperative to explore the hidden depths of whole life insurance and its ability to serve as a robust investment strategy.

The Evolution of Whole Life Insurance: Beyond Protection

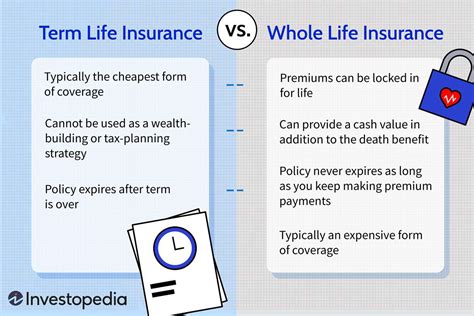

Whole life insurance has evolved significantly over the years, transforming from a simple protection plan into a multifaceted financial tool. While its primary purpose remains to provide a financial safety net for your family in the event of an untimely demise, the modern whole life insurance policy offers much more.

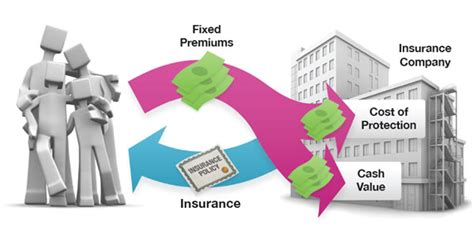

The key feature that sets whole life insurance apart from its term insurance counterpart is the cash value accumulation component. This cash value, often referred to as the policy's cash surrender value, acts as a savings account that grows over time. It provides a unique opportunity for policyholders to build wealth, offering a blend of security and investment potential.

Unveiling the Investment Potential: A Deep Dive into Cash Value

The cash value within a whole life insurance policy is a powerful financial tool. It accumulates over time, typically at a guaranteed rate, offering a stable and predictable growth trajectory. This cash value can be accessed through various means, providing policyholders with a range of financial options.

Policy Loans

Policyholders can take out loans against the cash value of their whole life insurance policy. These loans are typically interest-free, providing a flexible source of funds. The policy serves as collateral, ensuring the loan is secured and can be repaid at the policyholder's convenience. This feature allows individuals to access funds for various financial needs without incurring high-interest debt.

Withdrawing Cash

In addition to loans, policyholders can also withdraw cash from the policy's cash value. This withdrawal can be used for a variety of purposes, from covering unexpected expenses to funding specific investments. While cash withdrawals do reduce the policy's death benefit, they offer a flexible way to access funds when needed.

Investment Opportunities

Whole life insurance policies often come with investment options within the policy itself. These options allow policyholders to invest a portion of their premiums in various financial instruments, such as stocks, bonds, or mutual funds. This feature provides an opportunity to grow wealth within the policy, leveraging the potential of the financial markets.

The investment options within a whole life insurance policy are typically managed by the insurance company, offering a level of expertise and security. Policyholders can choose from a range of investment options, allowing them to align their financial goals with their risk tolerance.

| Investment Option | Description |

|---|---|

| Stock Funds | These funds invest in a portfolio of stocks, providing the potential for higher returns but also carrying higher risk. |

| Bond Funds | Bond funds invest in a variety of bonds, offering a more stable and conservative investment option. |

| Balanced Funds | Balanced funds aim to provide a balance between growth and stability by investing in a mix of stocks and bonds. |

| Money Market Funds | Money market funds invest in short-term, low-risk securities, offering a stable but modest return. |

Tax Benefits: The Advantage of Whole Life Insurance Investments

One of the key advantages of using whole life insurance as an investment vehicle is the tax benefits it offers. The cash value within the policy grows on a tax-deferred basis, meaning that any gains or interest earned are not taxed until they are withdrawn or used.

This tax-deferred growth can significantly boost the policy's value over time, allowing for more substantial returns. Additionally, when it comes to policy loans or withdrawals, the tax implications are favorable. Any loan taken against the policy's cash value is not considered taxable income, and as long as the policy remains in force, the loan can be repaid without triggering any tax consequences.

Furthermore, the death benefit of a whole life insurance policy is typically tax-free to the beneficiaries. This means that, in addition to the policy's investment potential, the death benefit provides a substantial financial advantage for loved ones without any tax burden.

Case Study: Real-World Success Stories

To illustrate the potential of whole life insurance as an investment, let's explore a real-world case study. Meet John, a successful entrepreneur who, at the age of 40, decided to explore the investment potential of whole life insurance.

John, with a substantial income and a desire to maximize his wealth, purchased a whole life insurance policy with a $1 million death benefit. Over the years, he consistently paid his premiums and utilized the policy's investment options to grow his cash value. By age 60, John's policy had accumulated a substantial cash value of $500,000.

At this point, John decided to leverage his policy's cash value to fund his retirement. He took out a policy loan, using the funds to invest in a portfolio of stocks and bonds. This strategy allowed him to access his wealth without incurring any immediate tax liability. Additionally, the loan was interest-free, providing a cost-effective way to finance his retirement goals.

John's story highlights the flexibility and financial potential of whole life insurance. By treating his policy as an investment vehicle, he was able to build wealth, secure his financial future, and ultimately enjoy a comfortable retirement.

Maximizing Your Whole Life Insurance Investment

To make the most of your whole life insurance policy as an investment, consider the following strategies:

- Consistent Premium Payments: Ensure you maintain consistent premium payments to build your policy's cash value over time.

- Explore Investment Options: Work with your insurance provider to understand the available investment options within your policy. Choose options that align with your financial goals and risk tolerance.

- Utilize Policy Loans: Consider taking out policy loans to access funds for specific financial needs. This can be a cost-effective way to finance major purchases or investments without incurring high-interest debt.

- Monitor Performance: Regularly review the performance of your policy's investment options. Stay informed about market trends and consider adjusting your investment strategy as needed.

- Seek Professional Advice: Consult with financial advisors who specialize in insurance and investment strategies. They can provide personalized guidance to help you maximize the potential of your whole life insurance policy.

Conclusion: Empowering Your Financial Future

Whole life insurance, when leveraged effectively, can be a powerful tool for wealth accumulation and financial security. By understanding its investment potential and utilizing the various features it offers, individuals can maximize their financial opportunities. From tax-deferred growth to flexible access to funds, whole life insurance provides a unique and advantageous avenue for building wealth.

As you navigate the world of personal finance, consider the potential of whole life insurance as an investment vehicle. With its blend of security and growth potential, it offers a comprehensive approach to financial planning. Embrace the opportunities it presents, and take control of your financial future.

FAQ

Can I access the cash value of my whole life insurance policy at any time?

+Yes, you can access the cash value of your whole life insurance policy through loans or withdrawals. However, it’s important to note that withdrawals will reduce the policy’s death benefit, so it’s advisable to carefully consider your financial needs and goals before accessing the cash value.

Are there any tax implications when taking out a policy loan or making withdrawals from my whole life insurance policy’s cash value?

+Policy loans are typically interest-free and do not have any immediate tax consequences. Withdrawals, on the other hand, may have tax implications, especially if they exceed the amount of premiums paid into the policy. It’s essential to consult with a tax professional to understand the specific tax implications in your situation.

How does the investment component of whole life insurance work, and what are the potential risks and rewards?

+The investment component of whole life insurance allows policyholders to allocate a portion of their premiums into various investment options, such as stocks, bonds, or mutual funds. While this offers the potential for higher returns, it also carries investment risks. It’s crucial to carefully consider your risk tolerance and financial goals when selecting investment options within your policy.