Cheap Car Insurances Near Me

When it comes to finding affordable car insurance, there are several factors to consider, including your location, driving history, and the coverage options you require. With a bit of research and by taking advantage of various discounts, you can secure a great deal on car insurance that meets your needs and budget. In this comprehensive guide, we'll explore the factors that influence car insurance costs, strategies to find cheap insurance options, and the steps to obtain the best quotes in your area.

Understanding the Factors that Affect Car Insurance Costs

Car insurance premiums are determined by a variety of factors, and understanding these elements can help you make informed decisions when seeking affordable coverage.

Location and Demographics

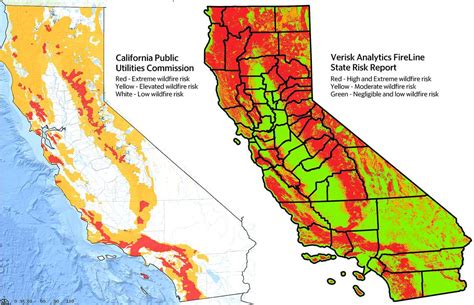

Your geographical location plays a significant role in determining car insurance rates. Insurance providers assess the risk associated with different areas based on factors such as traffic density, crime rates, and the frequency of natural disasters. For instance, urban areas with higher traffic volumes and theft rates may command higher insurance premiums compared to rural regions.

Additionally, your demographic characteristics, including age, gender, and marital status, can influence insurance costs. Young drivers, especially males, are often considered higher-risk groups due to their higher propensity for accidents and traffic violations. As a result, insurance companies may charge higher premiums for this demographic.

Driving History and Claims Record

Your driving record is a critical factor in determining car insurance rates. Insurance providers closely examine your history of accidents, traffic violations, and claims to assess your risk level. A clean driving record with no accidents or serious violations can lead to lower insurance premiums. Conversely, a history of accidents or frequent claims may result in higher rates or even policy denials.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. Insurance providers consider factors such as the make, model, and age of your vehicle, as well as its safety features and accident history. Sports cars and luxury vehicles, for example, often come with higher insurance premiums due to their higher repair costs and higher likelihood of theft.

Additionally, the purpose for which you use your vehicle can influence insurance rates. If you primarily use your car for commuting to work or running errands, your insurance premiums may be lower compared to those who frequently drive long distances or use their vehicles for commercial purposes.

Coverage Options and Deductibles

The level of coverage you choose and the associated deductibles can significantly affect your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, typically come with higher premiums. On the other hand, opting for higher deductibles can lower your monthly insurance payments but increase the out-of-pocket costs in the event of a claim.

Insurance Company and Discounts

Different insurance companies offer varying rates and discounts. Shopping around and comparing quotes from multiple providers can help you find the most affordable option. Additionally, insurance companies often provide discounts for various reasons, such as safe driving records, multiple policy holdings, and vehicle safety features. Taking advantage of these discounts can further reduce your insurance costs.

Strategies to Find Cheap Car Insurance Near You

Now that we’ve explored the factors that influence car insurance costs, let’s delve into some strategies to help you find the best and most affordable insurance options in your area.

Research and Compare Insurance Providers

Start by researching and comparing insurance providers in your region. Look for companies that specialize in offering affordable coverage for drivers with similar profiles and needs. Online comparison tools and insurance marketplaces can be valuable resources for gathering quotes and assessing the market.

When comparing providers, consider factors such as their financial stability, customer service ratings, and the range of coverage options they offer. Look for companies that provide clear and transparent pricing structures and flexible payment plans.

Assess Your Coverage Needs

Before obtaining quotes, it’s essential to assess your specific coverage needs. Consider the minimum insurance requirements in your state or region, as well as any additional coverage you may require based on your driving habits and vehicle usage. Understanding your coverage needs will help you find policies that offer the right balance of protection and affordability.

Explore Discount Opportunities

Insurance companies often provide a wide range of discounts to attract and retain customers. Some common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with other policies such as home or life insurance), good student discounts, and loyalty discounts for long-term customers.

Take the time to research and understand the discount opportunities available to you. Some insurance providers may offer discounts for specific professions, membership affiliations, or vehicle safety features. By taking advantage of these discounts, you can significantly reduce your insurance premiums.

Improve Your Driving Record

A clean driving record is a powerful tool in obtaining affordable car insurance. If you have a history of accidents or traffic violations, focus on improving your driving habits and adhering to traffic laws. Attend defensive driving courses, maintain a safe following distance, and avoid distractions while driving.

By demonstrating a commitment to safe driving, you can enhance your insurance profile and potentially qualify for lower rates. Many insurance companies offer programs that reward safe drivers with discounts or even forgive minor violations after a certain period of accident-free driving.

Consider Alternative Insurance Options

If traditional car insurance policies prove too expensive, explore alternative insurance options such as usage-based insurance (UBI) or pay-as-you-drive (PAYD) programs. These programs use telematics devices or smartphone apps to monitor your driving behavior and offer insurance rates based on your actual driving habits and mileage.

UBI and PAYD programs can be particularly beneficial for low-mileage drivers or those with a history of safe driving. By providing accurate data on your driving patterns, you may be eligible for significant discounts on your insurance premiums.

Steps to Obtain the Best Car Insurance Quotes in Your Area

To ensure you secure the most affordable car insurance options near you, follow these steps to obtain accurate and competitive quotes.

Gather Necessary Information

Before requesting quotes, gather all the necessary information about yourself, your vehicle, and your driving history. This includes your personal details, vehicle make and model, VIN number, driving record (including any accidents or violations), and current insurance coverage (if applicable). Having this information readily available will streamline the quote process and ensure accuracy.

Utilize Online Quote Tools

Online quote tools offered by insurance providers or comparison websites can be a convenient way to obtain multiple quotes quickly. These tools typically require you to input your personal and vehicle details, and they generate quotes based on the information provided. Compare the quotes from different providers to identify the most affordable options that meet your coverage needs.

Contact Local Insurance Agents

In addition to online quote tools, consider contacting local insurance agents or brokers. These professionals can provide personalized advice and assist you in finding the best insurance options tailored to your specific circumstances. They may have access to exclusive deals or discounts that are not available through online channels.

Review and Compare Quotes

Once you’ve obtained multiple quotes, take the time to carefully review and compare them. Assess the coverage limits, deductibles, and any additional features or benefits offered by each insurance provider. Look for policies that provide adequate coverage at the most competitive rates.

Consider factors such as the financial stability of the insurance company, their customer service reputation, and any additional perks or services they offer. Remember to read the fine print and understand any exclusions or limitations associated with the policies.

Negotiate and Finalize Your Policy

If you’re satisfied with the quotes you’ve received, don’t hesitate to negotiate with the insurance providers. Contact the companies offering the most competitive rates and inquire about potential discounts or special offers. Many insurance companies are willing to negotiate to secure your business.

Once you've finalized your choice, review the policy documents thoroughly and ensure that all the coverage details, deductibles, and premiums match the agreed-upon terms. Don't hesitate to ask questions or seek clarification if any aspect of the policy is unclear.

Conclusion: Navigating the Path to Affordable Car Insurance

Finding cheap car insurance near you requires a combination of research, understanding of the factors that influence insurance costs, and strategic decision-making. By assessing your coverage needs, exploring discount opportunities, and utilizing online tools and local agents, you can navigate the insurance market with confidence and secure the best rates for your circumstances.

Remember, affordable car insurance doesn't have to compromise on quality or coverage. By following the steps outlined in this guide and staying informed about your options, you can find the right balance between protection and affordability. So, embark on your journey towards affordable car insurance with the knowledge and strategies provided, and enjoy the peace of mind that comes with secure and budget-friendly coverage.

How can I find cheap car insurance with a bad driving record?

+While a bad driving record can impact your insurance premiums, there are still options to find affordable coverage. Consider researching insurance providers that specialize in high-risk drivers or those that offer programs to help improve your driving record. Additionally, focus on improving your driving habits and explore alternative insurance options such as usage-based insurance.

Are there any government programs or subsidies available for car insurance?

+Some governments offer assistance programs or subsidies for car insurance, particularly for low-income individuals or specific demographics. Research the programs available in your region and inquire about eligibility requirements. These programs can provide financial support or discounted insurance rates.

Can I switch insurance providers to save money on car insurance?

+Absolutely! Switching insurance providers is a common strategy to find more affordable coverage. Regularly review your insurance options and compare quotes from different companies. If you find a more competitive rate elsewhere, consider making the switch to save money on your car insurance premiums.