Ca Fire Insurance

California, known for its diverse landscapes and vibrant cities, also faces unique challenges when it comes to natural disasters. Wildfires, in particular, have become an increasingly prevalent concern for residents and policymakers alike. With the state's changing climate and urban development patterns, the risk of devastating fires has grown significantly. As a result, understanding the importance of fire insurance has become crucial for homeowners and business owners across California.

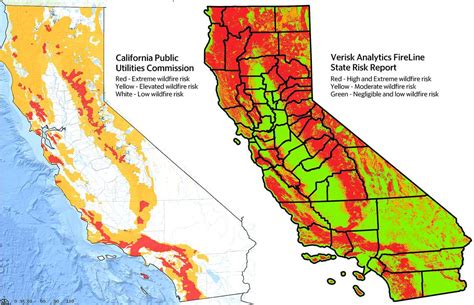

Understanding the Risk: California’s Wildfire Landscape

California’s climate and topography create a perfect storm for wildfires. The state experiences long, dry summers, providing ample fuel for fires to ignite and spread rapidly. The Mediterranean climate, characterized by wet winters and hot, dry summers, contributes to the growth of dense vegetation that serves as a fuel source during the fire season. Additionally, the state’s diverse ecosystems, from coastal forests to mountainous regions, present unique challenges in fire management and suppression.

Urban development has also played a significant role in increasing the risk of wildfires. As cities and suburbs expand into previously untouched areas, the interface between human settlements and natural landscapes becomes more complex. This "wildland-urban interface" often leads to a higher likelihood of human-caused ignitions and an increased potential for property damage.

The impact of wildfires on communities is far-reaching. Beyond the immediate destruction of homes and businesses, wildfires can disrupt lives, displace residents, and have long-lasting economic and environmental consequences. The recovery process is often lengthy and costly, making adequate insurance coverage a critical aspect of financial preparedness.

The Role of Fire Insurance in California

Fire insurance is a vital tool for individuals and businesses to mitigate the financial risks associated with wildfires. It provides a safety net, ensuring that policyholders can rebuild and recover after a fire incident. In California, where the threat of wildfires is a reality, having comprehensive fire insurance is not just a wise choice but a necessary one.

Coverage Options and Benefits

Fire insurance policies in California typically offer a range of coverage options to suit different needs. These may include:

- Dwelling Coverage: This provides protection for the physical structure of a home, including attached structures like garages and porches.

- Personal Property Coverage: Reimburses policyholders for the loss or damage to personal belongings such as furniture, clothing, and electronics.

- Additional Living Expenses: Covers the cost of temporary housing and other necessary expenses if a home becomes uninhabitable due to a fire.

- Liability Coverage: Protects homeowners from legal claims and lawsuits resulting from fire-related incidents on their property.

- Debris Removal: Assists with the cost of removing ash, debris, and charred remains after a fire.

Additionally, some policies may offer extended coverage for specific risks, such as wildfire smoke damage or ashfall, which can cause significant harm to homes and businesses even if the fire itself doesn't reach the property.

The Importance of Customized Policies

Given the diverse nature of California’s landscapes and the varying levels of wildfire risk across the state, it is crucial to have a fire insurance policy that is tailored to individual needs. Factors such as the proximity to wildfire-prone areas, the age and construction of the building, and the presence of fire-resistant features can all impact the level of risk and, consequently, the cost and coverage of insurance.

Working with an insurance agent who understands the unique challenges of California's wildfire landscape can be invaluable. They can help policyholders navigate the complex world of fire insurance, ensuring that they have the right coverage at a competitive rate. This includes regularly reviewing policies to ensure they keep pace with changing risks and personal circumstances.

Real-Life Impact: Case Studies of Fire Insurance in Action

Understanding the abstract concept of fire insurance becomes more tangible when we examine real-life case studies. Here are a few examples of how fire insurance has made a difference for California residents and businesses:

Residential Fire Recovery

Imagine a family living in a suburban neighborhood of San Diego. A fast-moving wildfire ignites nearby, and despite the best efforts of firefighters, the fire spreads to their community. The family’s home, along with many others, is tragically lost to the flames. However, due to their foresight in securing comprehensive fire insurance, they are able to rebuild their home and replace their belongings. The insurance coverage provides the financial stability they need to start over, covering the cost of temporary housing, rebuilding their home, and replacing their personal possessions.

Business Continuity After a Wildfire

A small business owner in the Sierra Nevada foothills finds themselves in the path of a devastating wildfire. The fire burns through the area, destroying many businesses and homes. However, this business owner had taken the initiative to secure business interruption insurance as part of their fire insurance policy. This coverage ensures that they receive financial support to cover lost income and additional expenses incurred during the recovery process. With this support, they are able to maintain their operations, keep their staff employed, and eventually reopen their doors to the community.

Ashfall Damage Claims

In certain instances, it’s not just the fire itself that causes damage but the aftermath. A homeowner in the city of Redding experiences this firsthand when a nearby wildfire sends a thick layer of ashfall onto their property. The ash infiltrates the home, causing damage to the HVAC system, appliances, and furniture. Fortunately, their fire insurance policy includes coverage for ashfall damage, allowing them to file a claim and receive compensation for the necessary repairs and replacements.

Performance Analysis: Fire Insurance Providers in California

When it comes to choosing a fire insurance provider in California, it’s important to consider their track record and performance. Here’s a comparative analysis of some of the top providers in the state:

| Insurance Provider | Policy Coverage | Customer Satisfaction | Financial Strength |

|---|---|---|---|

| State Farm | Comprehensive coverage options, including extended wildfire smoke and ashfall coverage. | High customer satisfaction ratings, with a focus on personalized service. | A++ rating, indicating excellent financial stability. |

| Allstate | Offers a range of customizable policies with optional endorsements for wildfire-specific risks. | Above-average customer satisfaction, with a reputation for responsive claims handling. | A+ rating, reflecting strong financial security. |

| Farmers Insurance | Provides specialized wildfire protection plans with additional living expense coverage. | Strong customer service, with a commitment to community involvement. | A- rating, indicating good financial strength. |

| USAA | Designed specifically for military families, offering comprehensive fire insurance with flexible payment options. | Exceptional customer satisfaction, particularly among military service members. | A++ rating, ensuring superior financial stability. |

| Liberty Mutual | Provides a range of fire insurance options with additional coverage for wildfire debris removal. | High customer loyalty, with a focus on digital innovation for policy management. | A rating, reflecting good financial strength and stability. |

When selecting a fire insurance provider, it's essential to consider factors such as coverage options, customer satisfaction, and the financial strength of the insurer. By researching and comparing providers, individuals and businesses can make informed decisions to ensure they have the best protection against the risks of California's wildfire landscape.

Future Implications: Navigating California’s Wildfire Landscape

As California continues to face the challenges of a changing climate and an increased risk of wildfires, the importance of fire insurance will only grow. The state’s policymakers, insurance providers, and residents will need to work together to develop innovative solutions and ensure adequate coverage for all. Here are some key considerations for the future:

Climate Adaptation and Mitigation

Climate change is expected to exacerbate the frequency and intensity of wildfires in California. As such, insurance providers and policymakers must collaborate to develop strategies that adapt to these changing risks. This may involve revisiting coverage limits, exploring new technologies for risk assessment, and implementing proactive mitigation measures to reduce the impact of wildfires.

Community Resilience and Preparedness

Building community resilience is crucial for minimizing the impact of wildfires. This includes educating residents about fire safety, promoting the use of fire-resistant building materials, and implementing community-wide fire prevention and preparedness plans. By fostering a culture of preparedness, communities can reduce the risk of ignition and minimize the potential for widespread damage.

Technological Innovations in Insurance

Advancements in technology can play a significant role in enhancing fire insurance coverage and claims management. For example, the use of drones and satellite imagery can provide real-time data on fire behavior and damage assessment, aiding in more accurate risk assessments and claims processing. Additionally, digital tools can streamline the insurance process, making it more efficient and accessible for policyholders.

Policyholder Education and Awareness

Ensuring that policyholders understand their coverage and the potential risks they face is vital. Insurance providers should invest in educational resources and outreach programs to help individuals and businesses make informed decisions about their fire insurance coverage. This includes providing clear and concise information on policy exclusions, deductibles, and the steps to take in the event of a fire incident.

Conclusion

In the face of California’s wildfire landscape, fire insurance serves as a critical safeguard for homeowners and businesses. By understanding the unique risks posed by wildfires and taking proactive measures to secure adequate coverage, individuals can protect their financial stability and ensure a smoother recovery process. As the state continues to grapple with the challenges of climate change and urban development, the role of fire insurance will only become more crucial in safeguarding communities and promoting resilience.

How much does fire insurance typically cost in California?

+The cost of fire insurance can vary significantly based on factors such as the location, size, and construction of the property, as well as the chosen coverage limits and deductibles. On average, fire insurance premiums in California range from a few hundred to a few thousand dollars annually. It’s important to note that areas with a higher risk of wildfires may have higher premiums to reflect the increased likelihood of claims.

What should I look for when choosing a fire insurance provider?

+When selecting a fire insurance provider, consider factors such as their financial strength and stability, the range of coverage options they offer, and their reputation for customer satisfaction. It’s also crucial to work with an insurance agent who understands your specific needs and can guide you in tailoring your policy to your circumstances.

Are there any government programs or assistance available for fire insurance in California?

+Yes, California does offer some government-backed programs to assist with fire insurance. The California Fair Access to Insurance Requirements (FAIR) Plan provides basic property insurance coverage for homeowners who cannot obtain coverage in the standard market due to wildfire risk. Additionally, the California Earthquake Authority (CEA) offers earthquake insurance, which can be a valuable addition to fire insurance policies, as earthquakes can sometimes trigger wildfires.

How often should I review my fire insurance policy?

+It’s recommended to review your fire insurance policy annually, or whenever there are significant changes to your property, such as renovations or additions. Regular reviews ensure that your coverage remains adequate and up-to-date with your needs and the evolving risks in your area. It’s also a good idea to review your policy after a wildfire event to ensure it still meets your requirements for recovery.