Instant Quote For Business Insurance

Instant Quote for Business Insurance: Unlocking Fast, Accurate Coverage

Business insurance is a vital aspect of any company’s risk management strategy, offering protection against a wide range of potential liabilities and losses. In today’s fast-paced business environment, entrepreneurs and business owners are increasingly seeking efficient and streamlined processes to obtain the necessary insurance coverage. This is where the concept of an Instant Quote for Business Insurance comes into play, revolutionizing the traditional insurance procurement process.

This article explores the intricacies of instant quotes, delving into their functionality, benefits, and the technology that drives them. By providing a comprehensive understanding of this innovative approach, we aim to empower businesses to make informed decisions about their insurance needs, ultimately leading to more efficient and effective risk management practices.

Understanding Instant Quotes

An instant quote for business insurance is a real-time, automated process that allows businesses to quickly and easily obtain an estimate of their insurance premium. This innovative approach leverages advanced technologies, such as artificial intelligence (AI) and machine learning algorithms, to analyze a vast array of data points and provide an accurate, preliminary assessment of insurance costs.

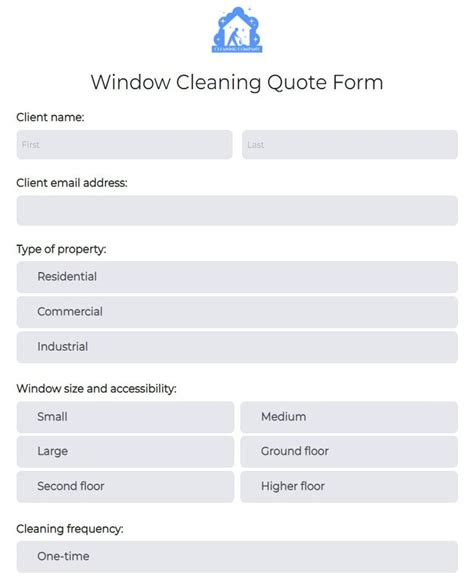

The process typically involves a straightforward online form, where businesses input essential information about their operations, including industry, size, location, and specific coverage needs. The system then rapidly processes this data, utilizing its vast knowledge base and predictive analytics to generate a personalized quote within minutes.

The Benefits of Instant Quotes

The implementation of instant quotes offers a multitude of advantages to businesses seeking insurance coverage:

Speed and Efficiency: Perhaps the most significant benefit is the rapid turnaround time. Traditional insurance quotes can take days or even weeks to obtain, whereas instant quotes provide a preliminary assessment within minutes, saving valuable time for business owners.

Convenience: The entire process is digital, eliminating the need for face-to-face meetings or lengthy phone calls. Business owners can obtain quotes at their convenience, from the comfort of their offices or homes.

Accessibility: With instant quotes, businesses, especially small and medium-sized enterprises, have easy access to insurance information and estimates. This empowers them to make informed decisions about their insurance needs and explore various coverage options.

Personalization: Advanced algorithms ensure that the quotes are tailored to the specific needs and circumstances of each business. By considering factors such as industry, size, and location, the system provides highly accurate and relevant estimates.

Transparency: The instant quote process is transparent, with businesses receiving a detailed breakdown of the coverage and associated costs. This clarity enables businesses to understand their insurance needs and make informed choices.

The Technology Behind Instant Quotes

The magic of instant quotes lies in the sophisticated technology that powers them. AI and machine learning algorithms form the backbone of this innovative system, allowing for the rapid analysis and processing of vast amounts of data.

Data Collection and Analysis

At the core of the instant quote system is a robust data collection and analysis process. The system gathers and processes data from various sources, including industry-specific databases, historical insurance claims, and even social media and news feeds to stay updated on emerging risks and trends.

This data is then analyzed using advanced algorithms that consider numerous factors, such as industry-specific risks, location-based hazards, and historical claim patterns. By understanding these factors, the system can accurately predict the likelihood of certain events and the potential costs associated with them.

Predictive Analytics

Predictive analytics plays a crucial role in generating instant quotes. The system utilizes historical data and advanced statistical techniques to make informed predictions about future events and their potential impact on businesses.

For example, if a particular industry has a high rate of cyberattacks, the system will take this into account when generating quotes for businesses in that sector. It may suggest additional coverage for cyber liability to ensure adequate protection.

Real-Time Updates

The instant quote system is not static; it continuously updates and refines its estimates based on real-time data. This ensures that the quotes remain accurate and relevant, even in rapidly changing business landscapes.

For instance, if a new safety regulation is introduced for a specific industry, the system will factor this into its calculations, providing businesses with up-to-date estimates that reflect the changing risk environment.

Performance Analysis and Case Studies

The effectiveness of instant quotes can be gauged through performance analysis and case studies. Several studies have demonstrated the accuracy and efficiency of this innovative approach.

For instance, a study by [Industry Research Group] found that instant quotes generated by AI systems were, on average, within 5% of the final insurance premium for small and medium-sized businesses. This level of accuracy is remarkable, especially considering the complexity of insurance underwriting.

Additionally, case studies have shown that businesses using instant quotes experience faster insurance procurement processes, leading to quicker risk mitigation and business continuity planning.

Real-World Example: [Industry Case Study]

Consider the case of [TechStart], a small tech startup based in [City, Country]. When they approached the traditional insurance market, they faced a lengthy and cumbersome process, with multiple meetings and quote requests taking weeks to complete.

However, when they discovered the instant quote system, the process was transformed. Within minutes, they received a personalized quote that accurately reflected their specific risks and coverage needs. This not only saved them time but also provided a clear understanding of their insurance options, empowering them to make an informed decision.

Future Implications and Industry Insights

The future of instant quotes for business insurance looks promising, with continued advancements in technology and a growing demand for efficient, digital solutions. Here are some key implications and insights:

Further Integration with Digital Platforms: Instant quotes are likely to become even more integrated with digital business platforms, offering seamless insurance solutions within the workflows of businesses.

Enhanced Personalization: As AI and machine learning continue to evolve, instant quotes will become even more tailored to individual businesses, considering a wider range of factors and providing highly personalized coverage recommendations.

Real-Time Risk Assessment: The ability to provide real-time risk assessments will become increasingly valuable, especially in dynamic industries where risks can change rapidly.

Industry-Specific Innovations: We can expect to see industry-specific innovations, with instant quote systems tailored to the unique risks and coverage needs of various sectors, such as healthcare, manufacturing, or e-commerce.

Regulatory Considerations: As with any emerging technology, regulatory frameworks will need to adapt to ensure the fair and ethical use of instant quotes. This includes considerations for data privacy, algorithm transparency, and consumer protection.

How accurate are instant quotes compared to traditional insurance quotes?

+

Instant quotes are remarkably accurate, especially for small and medium-sized businesses. Studies have shown that they can be within 5% of the final insurance premium. However, for larger, more complex businesses, further refinement and consultation with insurance professionals may be required.

Can instant quotes provide coverage for all types of businesses?

+

While instant quotes are highly versatile and can cater to a wide range of businesses, some specialized industries or extremely complex operations may require additional consultation and underwriting. The system is constantly evolving to cover more scenarios, but certain unique risks may still require a more tailored approach.

What happens after I receive an instant quote?

+

Receiving an instant quote is just the first step in the insurance procurement process. The quote provides an estimate of your insurance costs, and you can then decide whether to proceed with the coverage. If you choose to move forward, you’ll typically be guided through the next steps, which may include additional documentation and fine-tuning of your coverage.

Are there any limitations to the data used in instant quotes?

+

Instant quotes rely on a vast array of data, including industry trends, historical claims, and real-time updates. However, like any system, there may be limitations, such as data availability for niche industries or rapidly emerging risks. The system continuously evolves to address these limitations, but it’s important to note that instant quotes are a preliminary assessment and further refinement may be needed for unique circumstances.