Progressive Insurance Florida

Progressive Insurance, a well-known name in the insurance industry, has made significant strides in the Sunshine State, offering a range of innovative insurance solutions tailored to meet the diverse needs of Floridians. With its comprehensive coverage options and customer-centric approach, Progressive has become a trusted partner for many residents and businesses in Florida. This article explores the key aspects of Progressive Insurance's presence in Florida, delving into its products, services, and the impact it has on the local community.

Progressive’s Insurance Offerings in Florida

Progressive Insurance’s commitment to providing customized coverage solutions is evident in its extensive product portfolio in Florida. Here’s an overview of the key insurance offerings available to Floridians:

Auto Insurance

Progressive’s auto insurance plans in Florida offer a wide range of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. With its Snapshot program, Progressive rewards safe drivers with discounts based on their actual driving behavior. This innovative program utilizes a small device or an app to track driving habits, promoting safer roads and rewarding responsible drivers.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against bodily injury and property damage claims made against the policyholder. |

| Collision Coverage | Covers damage to the insured vehicle in the event of a collision. |

| Comprehensive Coverage | Provides protection against non-collision incidents, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Mandated in Florida, this coverage pays for medical expenses and lost wages resulting from an accident, regardless of fault. |

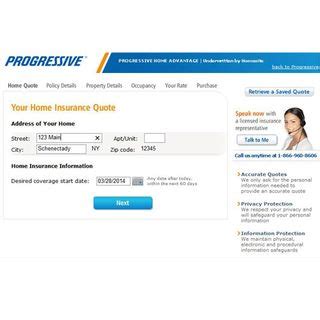

Homeowners Insurance

Progressive’s homeowners insurance policies in Florida are designed to protect property owners from various risks. These policies offer coverage for the structure of the home, personal belongings, and liability protection. With Florida’s unique weather conditions, Progressive’s policies also include protection against hurricane damage, ensuring residents have the necessary coverage for potential storm-related incidents.

Commercial Insurance

For businesses operating in Florida, Progressive provides a range of commercial insurance solutions. These policies are tailored to meet the specific needs of different industries, offering protection for commercial property, liability, workers’ compensation, and more. Progressive’s risk management services help businesses identify and mitigate potential risks, fostering a safer and more productive work environment.

Additional Insurance Products

In addition to the above, Progressive Insurance in Florida offers a variety of other insurance products, including:

- Motorcycle Insurance: Comprehensive coverage for bikers, including liability, collision, and comprehensive protection.

- RV Insurance: Specialized coverage for recreational vehicles, ensuring protection during travel and storage.

- Boat Insurance: Policies tailored to different types of boats, including yachts, sailboats, and personal watercraft.

- Travelers Insurance: Providing coverage for medical emergencies, trip cancellations, and lost luggage while traveling.

Community Engagement and Impact

Beyond its insurance offerings, Progressive Insurance has actively engaged with the Florida community, contributing to its growth and well-being. Here are some ways in which Progressive has made a positive impact:

Charitable Initiatives

Progressive has a strong commitment to giving back to the communities it serves. In Florida, the company has supported various charitable causes, including disaster relief efforts and initiatives focused on education and youth development. Through its philanthropic endeavors, Progressive has demonstrated its dedication to making a difference in the lives of Floridians.

Local Employment and Economic Growth

Progressive’s presence in Florida has contributed to the state’s economic landscape. The company has created numerous job opportunities, offering careers in various fields, such as insurance underwriting, customer service, and technology. These jobs have not only provided livelihoods for Floridians but have also stimulated economic growth in the region.

Educational Partnerships

Progressive has actively engaged with educational institutions in Florida, fostering a culture of learning and development. The company has partnered with local universities and colleges to offer internship programs and career development initiatives, providing students with valuable industry experience and skills. These partnerships have helped bridge the gap between academia and the real world, benefiting both students and the insurance industry.

Customer Satisfaction and Service

Progressive Insurance’s success in Florida can be attributed, in part, to its unwavering commitment to customer satisfaction and service excellence. Here’s how Progressive ensures a positive customer experience:

Digital Convenience

Progressive understands the importance of convenience in today’s digital age. Its online platform and mobile app offer customers the ability to manage their policies, file claims, and access important documents with ease. This digital convenience has streamlined the insurance process, making it more accessible and efficient for Floridians.

Claim Handling and Response

In the event of an insurance claim, Progressive’s claim handling process is designed to be efficient and customer-centric. The company’s dedicated claims adjusters work closely with policyholders to ensure a smooth and timely resolution. Progressive’s claim response times are a key differentiator, with a focus on prompt service and customer satisfaction.

Customer Support and Education

Progressive’s customer support team is readily available to assist Floridians with any insurance-related queries. Whether it’s understanding policy terms, seeking advice on coverage options, or resolving billing issues, the company’s representatives are trained to provide clear and helpful guidance. Additionally, Progressive offers a wealth of educational resources on its website, empowering customers to make informed insurance decisions.

Conclusion: Progressive Insurance’s Legacy in Florida

Progressive Insurance’s journey in Florida is a testament to its adaptability, innovation, and commitment to serving its customers. From its comprehensive insurance offerings to its active community involvement, Progressive has left a positive mark on the Sunshine State. As the company continues to evolve and innovate, Floridians can expect to benefit from its cutting-edge insurance solutions and unwavering dedication to customer satisfaction.

How does Progressive Insurance’s Snapshot program work in Florida?

+The Snapshot program utilizes a small device or an app to track driving behavior, including miles driven, time of day, and braking habits. Based on this data, Progressive offers discounts to drivers who exhibit safe driving habits. This program encourages safer driving and provides Floridians with an opportunity to save on their auto insurance premiums.

What sets Progressive’s homeowners insurance policies apart in Florida?

+Progressive’s homeowners insurance policies in Florida are tailored to address the unique risks associated with the state’s climate, particularly hurricanes. These policies offer comprehensive coverage, including protection against storm damage, ensuring that Floridians have the necessary safeguards for their homes.

How does Progressive support local communities in Florida beyond insurance services?

+Progressive actively engages with the Florida community through various charitable initiatives. The company supports disaster relief efforts, education programs, and youth development projects. By giving back to the community, Progressive strengthens its ties with Floridians and contributes to the overall well-being of the state.