Progressive Insurance Customer Service

In today's fast-paced world, exceptional customer service is a key differentiator for businesses, and the insurance industry is no exception. Among insurance providers, Progressive Insurance stands out for its innovative approach to customer support. With a focus on accessibility, efficiency, and personalized experiences, Progressive has set a new standard for customer service in the insurance sector.

Revolutionizing Customer Support with Technology

Progressive Insurance has embraced technology to enhance its customer service, leveraging digital tools and platforms to streamline processes and deliver a seamless experience. One of the standout features is the Progressive Snapshot, a usage-based insurance program that utilizes telematics technology.

Snapshot offers policyholders the opportunity to save on their car insurance premiums by providing data on their driving habits. Progressive's innovative use of telematics not only encourages safer driving but also provides customers with a personalized insurance experience. By analyzing driving behavior, Progressive can offer customized insurance plans, catering to the unique needs of each driver.

The Snapshot program has been a game-changer, allowing Progressive to gather valuable insights into customer behavior and preferences. This data-driven approach has enabled the company to tailor its services, providing customers with insurance plans that align with their specific driving patterns and preferences.

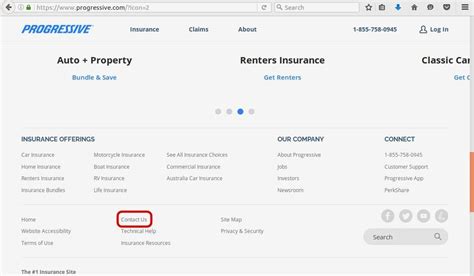

In addition to Snapshot, Progressive has invested in robust online platforms and mobile apps, making it convenient for customers to manage their policies, make payments, and file claims. The Progressive Mobile App, available for iOS and Android, offers a range of features, including real-time policy management, claim tracking, and even the ability to take and submit photos directly from the app.

| Feature | Description |

|---|---|

| Policy Management | View and update policy details, make payments, and manage coverage. |

| Claims Center | File new claims, track existing claims, and communicate with claims adjusters. |

| Photo Submission | Take and upload photos of accidents, damage, or other relevant documentation. |

| Roadside Assistance | Request roadside services such as towing, battery jumps, or flat tire changes. |

| Agent Locator | Find local Progressive agents for in-person assistance. |

By digitizing these processes, Progressive has made insurance management more accessible and efficient, allowing customers to take control of their policies and reducing the need for time-consuming phone calls or in-person visits.

Snapshot Program: A Deeper Dive

The Snapshot program is a prime example of Progressive’s commitment to innovation and customer-centricity. By offering discounts based on driving behavior, Progressive incentivizes safer driving practices and fosters a culture of responsible motoring.

Here's how Snapshot works: policyholders receive a small device that plugs into their vehicle's diagnostic port. This device collects data on driving habits, including mileage, speed, and braking patterns. After a 30-day period, Progressive analyzes the data and provides a discount based on the driver's safety profile.

The program has been a huge success, with millions of policyholders enrolling and benefiting from discounts. Moreover, Snapshot has contributed to a reduction in accidents and claims, as drivers become more conscious of their driving habits and strive to maintain a safer driving record.

Progressive's use of telematics technology not only benefits customers but also enhances the company's underwriting capabilities. By collecting real-time driving data, Progressive can more accurately assess risk and offer fairer insurance rates, which ultimately leads to greater customer satisfaction and loyalty.

Exceptional Service Through Human Touch

While technology plays a vital role in Progressive’s customer service strategy, the company also recognizes the importance of human interaction. Progressive’s dedicated team of customer service representatives is trained to provide personalized assistance, offering guidance and support throughout the insurance journey.

The Progressive Claims Team, in particular, has garnered praise for its efficiency and empathy. In the event of an accident or claim, policyholders can expect a swift response from the claims team, who work diligently to process claims and ensure customers receive fair compensation.

Progressive's claims process is designed to be as seamless as possible, with a focus on transparency and communication. Policyholders are kept informed at every stage, from the initial claim submission to the final settlement. The company's use of digital tools, such as online claim tracking and photo submission, further enhances the efficiency of the claims process, reducing processing times and minimizing disruptions for customers.

In addition to its claims team, Progressive also offers a range of other support services, including dedicated agents for policy inquiries and adjustments, roadside assistance, and educational resources to help customers better understand their insurance coverage.

Personalized Experiences: A Competitive Advantage

Progressive’s emphasis on personalized experiences sets it apart from its competitors. By leveraging technology and data analytics, the company can offer tailored insurance solutions that cater to individual needs and preferences.

For instance, Progressive's HomeQuote Explorer tool allows customers to quickly and easily obtain home insurance quotes by providing a few key details about their home and its location. This tool not only saves customers time but also provides a personalized quote based on their specific circumstances.

Similarly, Progressive's Auto Insurance Quote tool offers a fast and accurate way to obtain car insurance quotes. By inputting information about their vehicle, driving history, and desired coverage, customers can receive a customized quote that takes into account their unique needs and budget.

These personalized experiences not only streamline the insurance shopping process but also build trust and loyalty. Customers feel valued and understood, knowing that Progressive is committed to providing insurance solutions that fit their individual circumstances.

Future Prospects: Continuous Innovation

As the insurance landscape continues to evolve, Progressive remains committed to staying at the forefront of customer service innovation. The company’s focus on technology and data-driven insights positions it well to adapt to changing customer expectations and market trends.

Looking ahead, Progressive is likely to further enhance its digital offerings, leveraging emerging technologies such as artificial intelligence (AI) and machine learning to improve efficiency and personalization. AI-powered chatbots, for example, could provide instant support and assistance to customers, handling a range of inquiries and even assisting with basic policy adjustments.

Additionally, Progressive may explore opportunities to integrate its services with emerging mobility trends, such as ride-sharing and electric vehicles. By understanding the unique insurance needs of these emerging markets, Progressive can position itself as a trusted partner, offering tailored insurance solutions that support the changing mobility landscape.

In conclusion, Progressive Insurance's customer service is a shining example of how technology and human touch can come together to deliver exceptional experiences. By embracing innovation, data analytics, and personalized solutions, Progressive has set a new standard for the insurance industry, offering customers convenience, efficiency, and peace of mind.

How does Progressive’s Snapshot program work, and what are the benefits for policyholders?

+Progressive’s Snapshot program uses a small device that plugs into your vehicle’s diagnostic port to collect data on your driving habits, including mileage, speed, and braking patterns. After a 30-day period, Progressive analyzes this data to offer discounts based on your safety profile. The program encourages safer driving and provides policyholders with personalized insurance rates.

What features are available on the Progressive Mobile App, and how do they enhance the customer experience?

+The Progressive Mobile App offers a range of features, including policy management, claims tracking, photo submission, and roadside assistance. These features provide customers with convenient access to their policies, streamline the claims process, and offer immediate support in case of emergencies, enhancing overall customer satisfaction and efficiency.

How does Progressive ensure a seamless and transparent claims process for its policyholders?

+Progressive’s claims process is designed with transparency and efficiency in mind. Policyholders can track their claims online or through the mobile app, receiving real-time updates. The company’s dedicated claims team works diligently to process claims swiftly and fairly, ensuring customers are kept informed at every stage.