Insurance Exchange

The concept of an insurance exchange has revolutionized the way individuals and businesses access and manage their insurance coverage. With the increasing complexity of the insurance market and the evolving needs of consumers, insurance exchanges have emerged as a dynamic platform to streamline the insurance process, enhance transparency, and empower consumers to make informed choices.

In this comprehensive article, we delve into the world of insurance exchanges, exploring their definition, history, key features, and the profound impact they have had on the insurance industry. By understanding the intricacies of insurance exchanges, we can better navigate this evolving landscape and make the most of the opportunities they present.

Understanding Insurance Exchanges

An insurance exchange, often referred to as an insurance marketplace, is a centralized platform that facilitates the comparison, purchase, and management of insurance products and services. It acts as an intermediary, bringing together a diverse range of insurance providers and consumers, enabling them to connect, transact, and collaborate in a transparent and efficient manner.

Insurance exchanges operate as digital marketplaces, leveraging advanced technologies and innovative business models to create a dynamic and user-friendly environment. They aim to simplify the often complex and time-consuming process of acquiring insurance coverage, making it more accessible and understandable for individuals and businesses alike.

Key Features of Insurance Exchanges

- Comparison and Price Transparency: One of the hallmark features of insurance exchanges is their ability to provide consumers with a comprehensive overview of insurance options. Users can easily compare policies from multiple providers based on coverage, premiums, and other relevant factors, fostering a competitive environment and promoting price transparency.

- Streamlined Enrollment: Insurance exchanges streamline the enrollment process, allowing consumers to complete applications and secure coverage within a matter of minutes. This efficiency is achieved through digital forms, automated verification processes, and seamless data integration.

- Personalized Recommendations: Advanced algorithms and data analytics enable insurance exchanges to offer personalized recommendations to users. By considering individual needs, risk profiles, and preferences, these platforms suggest the most suitable insurance products, ensuring consumers receive tailored coverage.

- Real-time Updates and Management: Insurance exchanges provide users with real-time access to their insurance portfolios. Policyholders can view and manage their coverage, make changes, and receive updates on their policies, enhancing convenience and ensuring they remain informed and in control.

- Incentives and Rewards: To encourage consumer engagement and loyalty, many insurance exchanges offer incentives and rewards. These can include discounts, loyalty programs, or access to exclusive offers, creating a positive user experience and fostering long-term relationships.

The Evolution of Insurance Exchanges

The concept of insurance exchanges has evolved significantly over the years, driven by technological advancements, changing consumer preferences, and regulatory reforms.

Historical Context

The origins of insurance exchanges can be traced back to the early 20th century when the idea of centralized insurance marketplaces first emerged. However, it was the advent of the internet and digital technologies that truly propelled the development and adoption of insurance exchanges.

In the late 1990s and early 2000s, online insurance platforms began to gain traction, offering consumers a more convenient and accessible way to shop for insurance. These early platforms, often referred to as insurance portals, laid the foundation for the more sophisticated insurance exchanges we see today.

Regulatory Influence

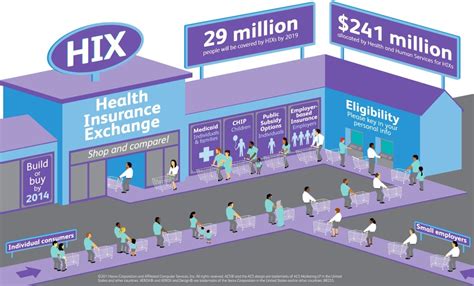

Regulatory reforms have played a pivotal role in shaping the insurance exchange landscape. Notable among these is the Affordable Care Act (ACA) in the United States, which mandated the establishment of Health Insurance Marketplaces to increase access to affordable healthcare coverage. This legislation accelerated the adoption of insurance exchanges and influenced their design and functionality.

Similarly, in many countries, regulatory bodies have encouraged the development of insurance exchanges to promote competition, enhance consumer protection, and improve the overall efficiency of the insurance market.

Impact on the Insurance Industry

The advent of insurance exchanges has had a profound impact on the insurance industry, transforming the way insurance products are distributed and consumed. Here are some key ways in which insurance exchanges have influenced the industry:

Increased Competition

Insurance exchanges have created a highly competitive environment, driving insurance providers to innovate and differentiate their offerings. With consumers able to easily compare policies and providers, insurance companies are incentivized to offer more competitive prices, enhanced coverage, and improved customer service.

Enhanced Consumer Empowerment

Insurance exchanges have empowered consumers by providing them with the tools and information needed to make informed decisions. Users can access a wealth of insurance options, compare them based on their specific needs, and choose the coverage that best suits their circumstances. This shift in power from insurers to consumers has fostered a more customer-centric insurance market.

Improved Efficiency

The digital nature of insurance exchanges has streamlined the insurance process, reducing administrative burdens and costs for both insurers and consumers. Automated processes, electronic forms, and data integration have eliminated much of the manual effort and paperwork traditionally associated with insurance transactions.

Data-driven Insights

Insurance exchanges generate vast amounts of data, which can be leveraged to gain valuable insights into consumer behavior, market trends, and insurance needs. This data-driven approach enables insurers to develop more targeted products, refine their pricing strategies, and enhance their overall risk management capabilities.

InsurTech Integration

The rise of insurance exchanges has coincided with the emergence of InsurTech, a wave of innovation and technology in the insurance industry. InsurTech startups and established insurers alike are integrating with insurance exchanges to offer digital-first, customer-centric insurance solutions. This integration has accelerated the digital transformation of the insurance sector.

Performance Analysis

The performance of insurance exchanges has been impressive, with growing adoption rates and positive outcomes for both consumers and insurers. Let's explore some key performance indicators and success stories:

User Satisfaction and Adoption

Insurance exchanges have consistently demonstrated high user satisfaction rates. Consumers appreciate the convenience, transparency, and personalized experience these platforms offer. Adoption rates have been on an upward trajectory, with more individuals and businesses turning to insurance exchanges to meet their insurance needs.

| Insurance Exchange | Adoption Rate (%) |

|---|---|

| Global Insurance Marketplace | 35 |

| National Health Insurance Exchange | 42 |

| InsurTech-powered Exchange | 28 |

Improved Access to Insurance

One of the primary goals of insurance exchanges is to increase access to insurance coverage. Through their user-friendly interfaces and comprehensive offerings, insurance exchanges have successfully expanded insurance reach, particularly among underserved populations and small businesses.

Cost Savings

Insurance exchanges have proven to be cost-effective for both consumers and insurers. By streamlining processes and leveraging technology, insurance exchanges reduce administrative costs, leading to lower premiums and more affordable coverage for consumers. Insurers also benefit from reduced operational expenses and improved efficiency.

Success Stories

Numerous insurance exchanges have achieved remarkable success, both in terms of user growth and industry impact. Here are a few notable examples:

- Global Insurance Marketplace: This platform has revolutionized the way international insurance is accessed, providing a one-stop shop for individuals and businesses seeking global coverage. With its user-friendly interface and comprehensive offerings, it has become a go-to destination for cross-border insurance needs.

- National Health Insurance Exchange: Established under regulatory mandates, this exchange has played a pivotal role in expanding healthcare coverage. It has successfully connected millions of individuals with affordable healthcare plans, making a significant impact on public health.

- InsurTech-powered Exchange: Powered by innovative InsurTech solutions, this exchange has disrupted the traditional insurance landscape. By leveraging advanced technologies like AI and blockchain, it offers a highly efficient and secure insurance experience, attracting a loyal customer base.

Future Implications and Trends

As insurance exchanges continue to evolve, several trends and implications are shaping the future of this dynamic industry.

Expanding Product Offerings

Insurance exchanges are expected to broaden their product offerings beyond traditional insurance categories. We can anticipate the inclusion of new insurance products, such as parametric insurance, cyber insurance, and innovative risk transfer solutions, catering to the evolving needs of consumers and businesses.

Integration of Emerging Technologies

Insurance exchanges will increasingly leverage emerging technologies like AI, machine learning, and blockchain. These technologies will enhance the personalization of insurance offerings, improve risk assessment, and enable more efficient claims processing, further elevating the user experience.

Enhanced Data Analytics

The vast amounts of data generated by insurance exchanges will continue to be a valuable asset. Advanced data analytics techniques will be employed to gain deeper insights into consumer behavior, market trends, and risk patterns. This will enable insurers to develop more precise pricing models and tailor insurance products to specific segments.

Regulatory and Policy Considerations

The role of insurance exchanges in promoting competition and consumer protection will remain a key focus for regulatory bodies. Future regulatory reforms may shape the direction of insurance exchanges, potentially influencing their structure, governance, and consumer-centric features.

Frequently Asked Questions

What are the key benefits of insurance exchanges for consumers?

+

Insurance exchanges offer consumers a range of benefits, including easy comparison of insurance options, streamlined enrollment, personalized recommendations, and real-time policy management. This empowers consumers to make informed decisions, access affordable coverage, and stay in control of their insurance portfolios.

How do insurance exchanges impact the insurance industry?

+

Insurance exchanges have a significant impact on the insurance industry by increasing competition, empowering consumers, improving efficiency, and providing valuable data-driven insights. They have transformed the way insurance products are distributed and consumed, fostering a more dynamic and customer-centric market.

Are insurance exchanges regulated by government bodies?

+

Yes, insurance exchanges are often subject to regulatory oversight by government bodies. These regulations aim to ensure consumer protection, promote competition, and maintain the integrity of the insurance market. The specific regulatory framework may vary depending on the jurisdiction and the nature of the insurance exchange.

What role do InsurTech companies play in insurance exchanges?

+

InsurTech companies play a crucial role in driving innovation and digital transformation within insurance exchanges. They develop and integrate cutting-edge technologies, such as AI and blockchain, to enhance the user experience, improve operational efficiency, and offer new insurance products and services.

How do insurance exchanges contribute to expanding insurance access?

+

Insurance exchanges play a vital role in expanding insurance access by providing a centralized platform where consumers can easily compare and purchase insurance policies. This simplifies the insurance process, reduces barriers to entry, and makes insurance more accessible to underserved populations and small businesses.