Home Insurance Claims

Home insurance claims are an essential aspect of financial protection for homeowners and tenants alike. These claims play a crucial role in safeguarding individuals and their properties against various unforeseen events and damages. With the right understanding and knowledge, individuals can navigate the home insurance claims process efficiently and ensure they receive the coverage they deserve.

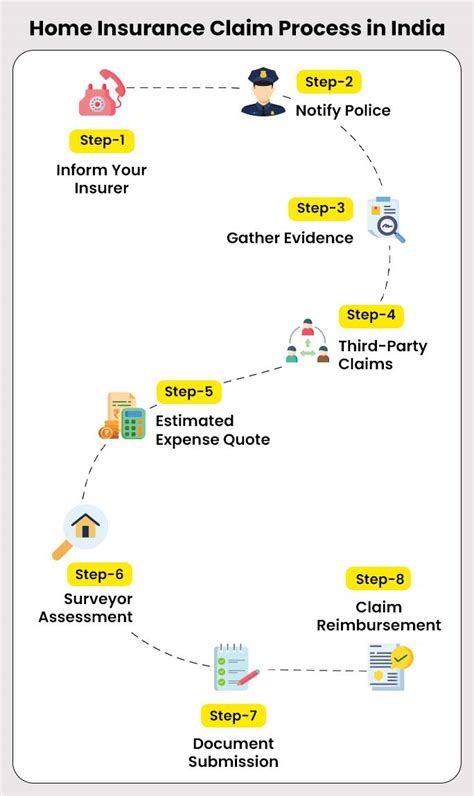

Understanding the Home Insurance Claims Process

The home insurance claims process can be intricate, but breaking it down into steps makes it more manageable. Here’s a simplified overview:

- Assessment of Damage: The first step involves a thorough assessment of the damage to your property. This is typically done by a professional adjuster who will inspect the affected areas and document the extent of the damage.

- Filing the Claim: Once the damage is assessed, you need to file a claim with your insurance provider. This process usually involves filling out forms and providing relevant documentation, such as photographs and repair estimates.

- Claim Review and Approval: The insurance company will review your claim, taking into account the policy terms and conditions. If the claim is approved, they will determine the amount of coverage applicable for the specific incident.

- Repairs and Compensation: With the claim approved, the insurance company will either facilitate the repairs directly or provide you with the necessary funds to cover the costs. This step ensures that your property is restored to its pre-loss condition.

Common Reasons for Home Insurance Claims

Homeowners often find themselves filing insurance claims due to a variety of reasons. Understanding these common causes can help you better prepare and protect your property.

Natural Disasters

Natural disasters, such as hurricanes, tornadoes, earthquakes, and floods, can cause extensive damage to homes. These events are often covered by comprehensive home insurance policies, providing much-needed financial relief during times of crisis.

Fire and Smoke Damage

Fire incidents, whether caused by electrical faults, cooking accidents, or external factors, can lead to significant property damage. Home insurance policies typically cover fire damage, including smoke and soot damage to belongings and structures.

Water Damage

Water damage is a prevalent issue, arising from various sources like burst pipes, appliance failures, roof leaks, or heavy rainfall. Home insurance can provide coverage for such incidents, ensuring that repairs and replacements are covered.

Theft and Vandalism

Unfortunately, theft and vandalism are common concerns for homeowners. Home insurance policies often offer protection against these incidents, covering the cost of replacing stolen items and repairing any structural damage.

Maximizing Your Home Insurance Coverage

To ensure you receive the most out of your home insurance coverage, it’s crucial to understand the specific terms and conditions of your policy. Here are some tips to help you maximize your coverage:

- Review Your Policy Regularly: Stay updated with the terms and conditions of your home insurance policy. Understand what is and isn't covered, and make adjustments as necessary to ensure you have adequate protection.

- Maintain Your Property: Regular maintenance and upgrades can reduce the risk of damage and the likelihood of claims. Simple measures like cleaning gutters, maintaining appliances, and addressing minor repairs promptly can go a long way.

- Document Your Belongings: Create a detailed inventory of your possessions, including photographs and receipts. This documentation will be invaluable in the event of a claim, providing evidence of the value of your belongings.

- Consider Additional Coverage: Depending on your specific needs and location, you may want to consider additional coverage options. For example, if you live in an area prone to floods, purchasing flood insurance can provide extra peace of mind.

The Role of Technology in Home Insurance Claims

Technology has revolutionized the home insurance claims process, making it more efficient and streamlined. Here’s how it’s making a difference:

Digital Claim Forms

Many insurance companies now offer digital claim forms, allowing policyholders to file claims online or through mobile apps. This convenient option eliminates the need for paper forms and provides a faster and more efficient claims process.

Drone Technology

Drones are increasingly being used by insurance companies to assess damage to properties. By capturing high-resolution images and videos, drones provide a detailed overview of the affected areas, helping adjusters make accurate assessments remotely.

Artificial Intelligence (AI)

AI is transforming the way insurance claims are processed. Advanced algorithms can analyze vast amounts of data, including claims history and policy details, to expedite the approval process and provide more accurate coverage estimates.

Real-Life Home Insurance Claims Examples

Let’s explore some real-life scenarios where home insurance claims made a significant difference in the lives of policyholders:

Hurricane Damage

In the aftermath of a devastating hurricane, a homeowner’s entire neighborhood was left in ruins. With their home suffering severe structural damage, the policyholder was able to file a successful claim. The insurance company provided the necessary funds to rebuild, allowing the family to start over and regain a sense of normalcy.

Smoke Damage from Wildfires

A family living in a wildfire-prone area experienced smoke damage to their home and belongings. Their home insurance policy covered the cost of cleaning and restoring the affected areas, ensuring that their home remained a safe and healthy environment.

Burst Pipe Incident

A frozen pipe burst in a homeowner’s basement, causing extensive water damage. The policyholder’s home insurance coverage included water damage protection, and they were able to receive compensation for the repairs and replacement of damaged belongings.

Tips for a Smooth Home Insurance Claims Process

To ensure a smooth and stress-free home insurance claims process, consider the following tips:

- Stay Organized: Keep all relevant documents, photographs, and receipts related to the incident organized and easily accessible. This will expedite the claims process and ensure a faster resolution.

- Communicate with Your Insurer: Maintain open and regular communication with your insurance provider. They can provide guidance and support throughout the claims process, ensuring you understand your rights and responsibilities.

- Seek Professional Help: If you're unsure about the extent of the damage or the claims process, consider hiring a public adjuster. These professionals can assist in navigating the claims process and ensure you receive the maximum compensation entitled to you.

Future Trends in Home Insurance Claims

The home insurance industry is continuously evolving, and several trends are shaping the future of claims management:

Smart Home Technology

The integration of smart home technology, such as smart sensors and leak detection systems, is expected to revolutionize home insurance claims. These devices can detect and prevent potential issues, reducing the likelihood of costly claims.

Blockchain Technology

Blockchain technology is gaining traction in the insurance industry, offering enhanced security and transparency. It can streamline the claims process by providing a secure and immutable record of all policy and claim-related data.

Data Analytics

Advanced data analytics will continue to play a crucial role in home insurance claims. By analyzing vast datasets, insurance companies can identify patterns and trends, leading to more accurate risk assessments and improved claim management.

Conclusion

Home insurance claims are a vital component of financial protection for homeowners. By understanding the claims process, staying informed about coverage options, and leveraging technology, individuals can effectively manage their home insurance policies and receive the support they need during challenging times. Remember, being proactive and well-prepared is key to navigating the home insurance landscape successfully.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually or whenever there are significant changes to your property or personal circumstances. This ensures that your coverage remains adequate and up-to-date.

What should I do if my claim is denied?

+If your claim is denied, it’s essential to understand the reasons for the denial. Review the policy terms and conditions, and consider seeking professional advice from a public adjuster or legal expert. They can guide you through the appeals process and help you obtain the coverage you’re entitled to.

How long does it typically take to process a home insurance claim?

+The processing time for home insurance claims can vary depending on the complexity of the incident and the insurance company’s workload. On average, it can take anywhere from a few days to several weeks. However, by staying in close communication with your insurer, you can expedite the process and ensure a timely resolution.