Affordable Insurance In Georgia

When it comes to finding affordable insurance options in the state of Georgia, there are various factors to consider. The insurance landscape in Georgia is diverse, offering a range of coverage types and providers to cater to the needs of its residents. From auto insurance to health plans and homeowners' policies, understanding the market and your options is key to securing the best value for your insurance needs.

Understanding the Insurance Market in Georgia

Georgia’s insurance market is highly competitive, which is good news for consumers seeking affordable coverage. The state has implemented various measures to ensure a fair and transparent insurance environment, making it easier for residents to access and understand their insurance options. Here’s an overview of the key aspects of the Georgia insurance market.

Regulation and Oversight

The Georgia Department of Insurance plays a crucial role in regulating the insurance industry within the state. Their responsibilities include enforcing insurance laws, protecting consumer rights, and ensuring insurance companies operate fairly and financially sound. This regulatory body provides valuable resources for consumers, offering guidance on various insurance topics and assisting with consumer complaints.

Auto Insurance

Auto insurance is a legal requirement for all drivers in Georgia. The state’s minimum liability coverage requirements are 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $25,000 for property damage. However, it’s important to note that these minimums may not provide sufficient coverage for many drivers. Georgia’s competitive insurance market allows residents to explore various options, including comprehensive and collision coverage, to find the best fit for their needs.

Health Insurance

Health insurance is a vital aspect of financial protection for individuals and families. Georgia residents have access to a range of health insurance plans, including those offered through the Affordable Care Act (ACA) marketplace. The ACA marketplace provides an opportunity for individuals and families to compare and enroll in health plans during the annual open enrollment period. Additionally, those who qualify may be eligible for premium tax credits, further reducing the cost of their health insurance.

| Health Insurance Plans in Georgia | Details |

|---|---|

| Blue Cross Blue Shield of Georgia | Offers a range of health plans, including PPO, HMO, and Medicare Advantage. |

| UnitedHealthcare | Provides comprehensive health insurance options, including dental and vision coverage. |

| Aetna | Offers affordable health plans with a focus on preventative care and wellness. |

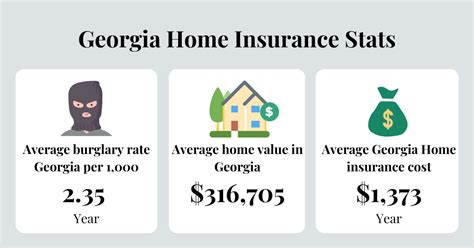

Homeowners’ Insurance

For homeowners in Georgia, securing adequate insurance coverage is essential to protect their investment. The state’s insurance market offers a wide range of homeowners’ insurance policies, providing coverage for various risks, including fire, theft, and natural disasters. It’s important for homeowners to carefully review their policy to ensure it meets their specific needs and provides sufficient coverage for their home and its contents.

Tips for Finding Affordable Insurance in Georgia

Navigating the insurance market in Georgia to find affordable coverage can be a challenging task. Here are some tips to help you in your search:

-

Shop Around: Don't settle for the first insurance quote you receive. Take the time to compare quotes from multiple providers to find the best rates. Online comparison tools can be a valuable resource for this process.

-

Understand Your Needs: Before seeking insurance quotes, assess your specific needs. Consider the level of coverage you require and any additional benefits or features that are important to you. This will help you find policies that align with your requirements.

-

Bundle Your Policies: Many insurance providers offer discounts when you bundle multiple policies, such as auto and homeowners' insurance. Bundling can be a cost-effective way to secure comprehensive coverage.

-

Review Your Coverage Annually: Insurance needs can change over time. It's important to review your policies annually to ensure they still meet your requirements. This review process may also uncover opportunities for cost savings.

-

Consider High Deductibles: Opting for higher deductibles can reduce your insurance premiums. However, it's essential to ensure you can afford the deductible in the event of a claim.

-

Take Advantage of Discounts: Many insurance providers offer discounts for various reasons, such as good driving records, loyalty, or safety features in your home or vehicle. Ask your insurance provider about available discounts to maximize your savings.

Example: Affordable Auto Insurance in Georgia

Let’s consider an example to illustrate the process of finding affordable auto insurance in Georgia. Imagine you’re a resident of Atlanta, Georgia, and you’re seeking auto insurance coverage. Here’s a step-by-step guide to help you find the best deal:

-

Assess Your Needs: Determine the level of coverage you require. Consider factors such as the age and value of your vehicle, your driving record, and any additional coverage options you may need (e.g., comprehensive or collision coverage).

-

Research Insurance Providers: Explore the insurance market in Atlanta. Look for reputable providers with a strong presence in the area. Consider factors such as their financial stability, customer satisfaction ratings, and the range of coverage options they offer.

-

Compare Quotes: Obtain quotes from multiple insurance providers. Online comparison tools can simplify this process. Ensure you're comparing apples to apples by requesting quotes for the same level of coverage from each provider.

-

Negotiate and Bundle: If you find a provider offering competitive rates, consider negotiating for a better deal. Additionally, inquire about bundling your auto insurance with other policies, such as homeowners' or renters' insurance, to potentially save more.

-

Review the Fine Print: Before finalizing your insurance purchase, carefully review the policy details. Ensure you understand the coverage limits, deductibles, and any exclusions or limitations. Don't hesitate to ask questions to clarify any uncertainties.

The Future of Insurance in Georgia

The insurance landscape in Georgia is constantly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of insurance in the state:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction in the insurance industry. Usage-based insurance (UBI) policies, which utilize telematics data to calculate insurance premiums, are becoming more popular. This technology has the potential to reward safe drivers with lower premiums, offering a more personalized and fair insurance experience.

Digital Transformation

The insurance industry in Georgia is embracing digital transformation. Insurance providers are investing in online platforms and mobile apps to enhance the customer experience. From online policy management to digital claims processing, these advancements are making insurance more accessible and convenient for Georgia residents.

Focus on Prevention

There’s a growing emphasis on preventative measures in the insurance industry. Insurers are increasingly offering incentives and discounts for policyholders who take steps to reduce their risk exposure. This may include incentives for safe driving, home security measures, or healthy lifestyle choices. By encouraging prevention, insurers can reduce claims costs and pass on these savings to policyholders.

Data Analytics and Personalization

Advanced data analytics is transforming the insurance industry, enabling insurers to offer more personalized coverage options. By analyzing vast amounts of data, insurers can identify trends and patterns to better understand consumer needs and risks. This personalized approach allows insurers to tailor policies and pricing to individual circumstances, potentially leading to more affordable coverage for Georgia residents.

FAQ

What are the minimum auto insurance requirements in Georgia?

+

The minimum auto insurance requirements in Georgia are 25,000 for bodily injury per person, 50,000 for bodily injury per accident, and $25,000 for property damage.

How can I find affordable health insurance in Georgia?

+

You can find affordable health insurance in Georgia by comparing plans through the ACA marketplace during the open enrollment period. Additionally, consider exploring options from major providers like Blue Cross Blue Shield, UnitedHealthcare, and Aetna.

Are there any discounts available for homeowners’ insurance in Georgia?

+

Yes, homeowners’ insurance providers in Georgia often offer discounts for various reasons, such as loyalty, safety features, and bundling policies. It’s worth inquiring about available discounts to potentially reduce your premiums.