Humana Health Insurance Plans

In the vast landscape of healthcare, Humana stands as a prominent player, offering a diverse array of health insurance plans tailored to meet the unique needs of individuals and families across the United States. With a rich history spanning decades, Humana has solidified its position as a trusted provider, consistently delivering comprehensive coverage and exceptional customer service. This article delves into the intricate world of Humana health insurance plans, exploring their key features, benefits, and the impact they have on policyholders' lives.

Unraveling the Humana Health Insurance Ecosystem

Humana’s approach to health insurance is characterized by its commitment to accessibility and personalization. The company’s extensive network of healthcare providers, coupled with its innovative technology, ensures that policyholders have seamless access to quality medical care. From preventive services to specialized treatments, Humana aims to provide a holistic healthcare experience.

Plan Types: A Spectrum of Coverage Options

Humana recognizes that one-size-fits-all solutions are not feasible in healthcare. As such, they offer a comprehensive range of plan types to cater to diverse demographics and health requirements. These include:

- Individual Plans: Designed for single individuals, these plans offer flexibility and customization, allowing policyholders to choose coverage levels based on their unique needs.

- Family Plans: Tailored for families, these plans provide comprehensive coverage for multiple members, ensuring peace of mind and financial protection.

- Senior Plans: With a focus on the unique healthcare needs of seniors, Humana's Medicare plans offer specialized coverage, including prescription drug benefits and access to a vast network of healthcare providers.

- Employer-Sponsored Plans: Humana collaborates with employers to provide group health insurance plans, offering cost-effective solutions and tailored benefits to meet the needs of diverse workforces.

Each plan type is further subdivided into various coverage levels, ranging from basic to comprehensive, giving policyholders the power to choose the level of protection that aligns with their budget and health priorities.

Key Benefits: Empowering Policyholders

Humana’s health insurance plans are designed to empower policyholders by providing access to a wide range of benefits and services. These include:

- Preventive Care Services: Humana strongly advocates for preventive healthcare, offering coverage for annual check-ups, screenings, and vaccinations to help policyholders maintain their well-being and catch potential health issues early on.

- Prescription Drug Coverage: With a comprehensive formulary, Humana ensures that policyholders have access to the medications they need, often at discounted rates through their preferred pharmacy network.

- Specialty Care: For those requiring specialized treatments, Humana's plans cover a broad spectrum of services, from mental health counseling to advanced medical procedures, ensuring that policyholders receive the care they deserve.

- Wellness Programs: Humana promotes a holistic approach to health by offering wellness programs that encourage healthy lifestyles. These programs often include discounts on gym memberships, nutrition counseling, and stress management resources.

Additionally, Humana's plans often feature low deductibles and out-of-pocket maximums, ensuring that policyholders are not burdened with excessive financial obligations in the event of a medical emergency.

Network Providers: A Crucial Component

Humana’s expansive network of healthcare providers is a cornerstone of its health insurance plans. This network includes:

- Primary Care Physicians: Policyholders have the freedom to choose their preferred primary care doctor, ensuring continuity of care and a personalized healthcare experience.

- Specialists: Humana's network encompasses a wide range of specialists, from cardiologists to orthopedic surgeons, ensuring that policyholders can access the expertise they need.

- Hospitals and Medical Facilities: The network includes top-rated hospitals and medical centers, providing policyholders with access to state-of-the-art facilities and cutting-edge treatments.

- Urgent Care Centers: For non-emergency situations, Humana's network includes convenient urgent care centers, offering prompt medical attention without the need for an appointment.

Humana's network providers are carefully selected based on their quality of care and patient satisfaction, ensuring that policyholders receive the best possible healthcare experience.

Technology and Innovation: Enhancing the Healthcare Journey

Humana leverages technology to enhance the overall healthcare experience for its policyholders. Their digital platforms and mobile apps offer a range of features, including:

- Online Account Management: Policyholders can manage their insurance plans, view coverage details, and access digital versions of their insurance cards through secure online portals.

- Telehealth Services: Humana's telehealth offerings provide convenient access to medical advice and consultations, allowing policyholders to connect with healthcare professionals remotely.

- Health Tracking Tools: The Humana app often includes health tracking features, helping policyholders monitor their fitness levels, set wellness goals, and receive personalized recommendations.

- Prescription Refill Reminders: Through its digital platforms, Humana sends reminders for prescription refills, ensuring that policyholders never run out of their essential medications.

These technological innovations not only streamline the healthcare experience but also empower policyholders to take an active role in managing their health.

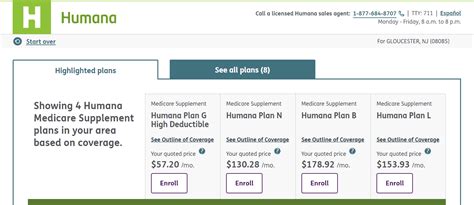

Cost Considerations: Affordable Healthcare Solutions

Humana understands the importance of affordability in healthcare. Their plans are designed to provide comprehensive coverage at competitive rates, ensuring that policyholders can access the care they need without financial strain. The cost of Humana health insurance plans varies based on factors such as:

- Plan Type: As mentioned earlier, different plan types offer varying levels of coverage, with corresponding price points.

- Coverage Level: Policyholders can choose between basic, standard, and comprehensive coverage levels, with premiums reflecting the chosen level of protection.

- Age and Health Status: Younger, healthier individuals may qualify for lower premiums, while those with pre-existing conditions or advanced age may face slightly higher costs.

- Location: The cost of healthcare services and insurance plans can vary by region, with urban areas often incurring higher costs than rural areas.

Despite these variations, Humana strives to maintain competitive pricing and offers a range of cost-saving measures, such as discounts for enrolling in wellness programs and incentives for maintaining a healthy lifestyle.

Enrolling in Humana Health Insurance Plans

Enrolling in a Humana health insurance plan is a straightforward process. Policyholders can choose to enroll directly through Humana’s website, where they can compare plans, get instant quotes, and complete the enrollment process online. Alternatively, they can seek assistance from licensed insurance agents or brokers who can guide them through the enrollment process and help them choose the most suitable plan.

During the enrollment process, policyholders will need to provide personal and health-related information, such as their date of birth, gender, and any pre-existing conditions. It's important to note that open enrollment periods apply to individual plans, allowing policyholders to make changes or enroll in new plans during designated periods. Outside of these periods, policyholders may still be able to enroll due to certain qualifying life events, such as marriage, birth of a child, or loss of other health coverage.

Conclusion: Empowering Health and Well-being

Humana’s health insurance plans represent a commitment to empowering individuals and families to take control of their health and well-being. With a diverse range of plan types, comprehensive benefits, and an expansive network of healthcare providers, Humana offers a holistic approach to healthcare. Through its innovative use of technology and focus on affordability, Humana ensures that policyholders can access the care they need without compromising their financial stability.

As the healthcare landscape continues to evolve, Humana remains at the forefront, continuously improving its plans and services to meet the changing needs of its policyholders. With Humana's health insurance plans, individuals and families can rest assured that they have a trusted partner in their pursuit of a healthy and fulfilling life.

What are the key benefits of choosing Humana health insurance plans?

+Humana health insurance plans offer a range of benefits, including comprehensive coverage for preventive care, prescription drugs, and specialty services. Additionally, their expansive network of healthcare providers ensures policyholders have access to quality care. Humana’s focus on technology and innovation enhances the overall healthcare experience, offering convenient features like online account management and telehealth services.

How does Humana ensure affordability in its health insurance plans?

+Humana strives to maintain competitive pricing by offering various cost-saving measures. These include discounts for enrolling in wellness programs, incentives for maintaining a healthy lifestyle, and tailored plan options to meet different budget needs. Despite these variations, Humana aims to provide comprehensive coverage at affordable rates.

Can I enroll in a Humana health insurance plan outside of the open enrollment period?

+While open enrollment periods apply to individual plans, there are certain qualifying life events that allow policyholders to enroll outside of these periods. These events include marriage, birth of a child, or loss of other health coverage. It’s important to consult with Humana or a licensed insurance agent to understand the specific eligibility requirements for enrollment outside of the open enrollment period.