Consumer Reports Best Auto Insurance

Choosing the right auto insurance can be a daunting task, with numerous options and factors to consider. Consumer Reports plays a crucial role in providing valuable insights and recommendations to help consumers make informed decisions. In this article, we delve into the world of auto insurance, exploring the key considerations, and presenting the best options based on Consumer Reports' extensive research and analysis.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is an essential financial protection for vehicle owners. It provides coverage for various risks and liabilities associated with owning and operating a motor vehicle. From accidents and theft to natural disasters, auto insurance offers peace of mind and financial security. However, with the multitude of insurance providers and coverage options available, navigating the auto insurance landscape can be challenging.

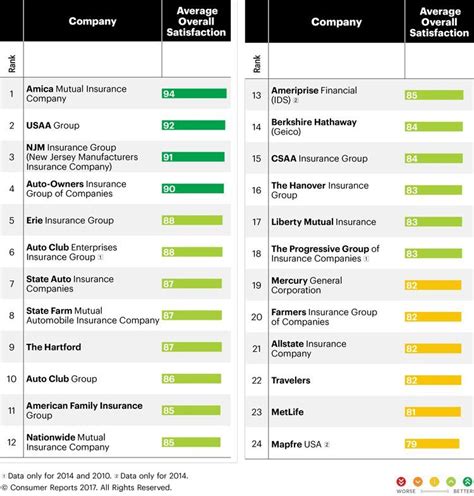

Consumer Reports serves as a trusted guide, evaluating and ranking insurance companies based on a range of factors. Their comprehensive reports consider coverage options, customer satisfaction, claims handling, and financial stability. By analyzing these aspects, Consumer Reports empowers consumers to make educated choices and select insurance providers that best meet their specific needs.

Key Factors to Consider in Auto Insurance

- Coverage Options: Different insurance providers offer varying coverage levels. It is crucial to understand the different types of coverage, such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage. Assessing your specific needs and preferences will help you determine the appropriate level of coverage.

- Premiums and Discounts: Auto insurance premiums can vary significantly between providers. Factors like age, driving record, vehicle type, and location influence the cost of insurance. Exploring discounts, such as those for safe driving, multiple policies, or loyalty, can help reduce premiums.

- Claims Handling and Customer Service: In the event of an accident or claim, efficient and responsive claims handling is vital. Consumer Reports assesses insurance companies' claims processes, including their reputation for fair and timely settlements. Additionally, excellent customer service ensures a positive experience throughout the insurance journey.

- Financial Stability: The financial stability of an insurance company is essential for long-term security. Consumer Reports evaluates providers' financial strength and ratings, ensuring they can fulfill their obligations and provide reliable coverage.

- Additional Features and Benefits: Some insurance companies offer unique features and benefits that set them apart. These may include roadside assistance, rental car coverage, accident forgiveness, or usage-based insurance programs. Assessing these additional perks can enhance your overall insurance experience.

Consumer Reports' Top Picks: The Best Auto Insurance Providers

Based on Consumer Reports' rigorous evaluation process, several auto insurance providers have consistently ranked highly and earned their recommendation. Let's explore some of the top choices in the industry.

1. State Farm: Comprehensive Coverage and Excellent Service

State Farm is a well-known and trusted name in the auto insurance industry. With a long-standing reputation for comprehensive coverage and exceptional customer service, State Farm consistently ranks among the top providers. Consumer Reports highlights their extensive range of coverage options, including liability, collision, comprehensive, and additional benefits like rental car coverage and roadside assistance.

State Farm's commitment to customer satisfaction is evident through their efficient claims handling process and responsive customer service. They offer personalized attention and guidance, ensuring a seamless experience for policyholders. Additionally, State Farm's financial stability is strong, providing peace of mind for long-term policyholders.

One of the standout features of State Farm is their usage-based insurance program, Drive Safe & Save. This program allows drivers to save on premiums by demonstrating safe driving habits. By installing a small device in their vehicle, drivers can receive personalized feedback and potential discounts based on their driving behavior.

2. GEICO: Affordable Coverage with a Focus on Customer Convenience

GEICO, an acronym for Government Employees Insurance Company, has gained popularity for its competitive pricing and customer-centric approach. Consumer Reports recognizes GEICO for its affordability, making it an attractive option for budget-conscious consumers. Despite their low premiums, GEICO maintains a strong focus on customer satisfaction and offers a wide range of coverage options.

GEICO's online platform and mobile app provide convenient access to policy management, claims filing, and customer support. Their digital tools make it easy for policyholders to navigate their insurance journey and obtain assistance whenever needed. Furthermore, GEICO offers additional benefits such as accident forgiveness and rental car coverage, enhancing their overall value proposition.

In addition to their affordable rates, GEICO stands out for their commitment to customer education. They provide valuable resources and tools to help policyholders understand their coverage and make informed decisions. This focus on education empowers consumers to make the most of their insurance policies.

3. USAA: Exceptional Coverage for Military Members and Their Families

USAA is a unique auto insurance provider that exclusively serves active military members, veterans, and their families. Consumer Reports highly recommends USAA for its exceptional coverage and tailored offerings. USAA understands the unique needs and circumstances of military personnel and their families, providing specialized insurance solutions.

USAA's auto insurance policies offer comprehensive coverage, including liability, collision, and comprehensive protection. They also provide additional benefits such as rental car coverage, roadside assistance, and accident forgiveness. What sets USAA apart is their exceptional customer service, designed to cater to the specific needs of military members.

USAA's claims handling process is efficient and military-friendly, ensuring a smooth experience for policyholders. Their commitment to supporting military members and their families extends beyond insurance, as they offer a range of financial services and resources to help them manage their finances effectively.

4. Progressive: Innovative Coverage Options and Customizable Plans

Progressive is known for its innovative approach to auto insurance, offering a wide range of coverage options and customizable plans. Consumer Reports appreciates Progressive's commitment to providing personalized insurance solutions that meet the diverse needs of its customers.

Progressive offers a comprehensive suite of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP). They also provide additional benefits such as rental car coverage, gap insurance, and roadside assistance. What sets Progressive apart is their focus on customization, allowing policyholders to tailor their coverage to their specific requirements.

Progressive's Snapshot program is a standout feature, offering policyholders the opportunity to save on premiums by monitoring their driving behavior. Through a small device installed in their vehicle, Snapshot collects data on driving habits such as mileage, braking, and time of day. Based on this data, Progressive provides personalized premium rates, rewarding safe driving.

Performance Analysis: Evaluating the Top Auto Insurance Providers

To provide a comprehensive understanding of the top auto insurance providers, let's delve into a performance analysis, comparing key aspects such as coverage options, customer satisfaction, claims handling, and financial stability.

| Provider | Coverage Options | Customer Satisfaction | Claims Handling | Financial Stability |

|---|---|---|---|---|

| State Farm | Comprehensive range of coverage, including liability, collision, comprehensive, and additional benefits. | Excellent customer service and efficient claims handling. | Timely and fair settlements, with a focus on personalized attention. | Strong financial stability and ratings. |

| GEICO | Affordable rates and a wide range of coverage options. | Convenient digital platform and responsive customer support. | Efficient claims process and customer education resources. | Solid financial stability and competitive pricing. |

| USAA | Specialized coverage for military members and their families, including comprehensive protection. | Exceptional customer service tailored to military needs. | Efficient and military-friendly claims handling process. | Strong financial stability and support for military financial management. |

| Progressive | Innovative and customizable coverage options, including liability, collision, comprehensive, and additional benefits. | Focus on customization and personalized insurance solutions. | Efficient claims process and Snapshot program for driving behavior monitoring. | Stable financial position and commitment to customer satisfaction. |

Each of these top auto insurance providers excels in different aspects, catering to the diverse needs of consumers. State Farm stands out for its comprehensive coverage and excellent customer service, while GEICO offers affordable rates and convenient digital tools. USAA provides specialized coverage for military members and their families, and Progressive shines with its innovative and customizable plans.

Future Implications and Trends in Auto Insurance

The auto insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. As we look ahead, several key trends and implications emerge that will shape the future of auto insurance.

1. Telematics and Usage-Based Insurance

Telematics technology, which collects and analyzes driving data, is expected to play a significant role in the future of auto insurance. Usage-based insurance programs, such as State Farm's Drive Safe & Save and Progressive's Snapshot, are becoming increasingly popular. These programs offer policyholders the opportunity to save on premiums by demonstrating safe driving habits. As telematics technology advances, we can expect more insurance providers to adopt usage-based insurance models, rewarding safe drivers and promoting safer roads.

2. Digital Transformation and Customer Experience

The digital transformation of the insurance industry is well underway, and auto insurance providers are investing in innovative technologies to enhance the customer experience. Online platforms and mobile apps, as exemplified by GEICO, allow policyholders to manage their policies, file claims, and access customer support with ease. This digital convenience not only improves customer satisfaction but also streamlines the insurance process, making it more efficient and accessible.

3. Personalized Coverage and Customization

The future of auto insurance lies in personalized coverage and customization. Insurance providers like Progressive are leading the way by offering customizable plans that cater to the unique needs of their customers. This trend allows policyholders to tailor their coverage to their specific circumstances, whether it's based on driving behavior, vehicle usage, or personal preferences. Personalized coverage ensures that consumers receive the right level of protection at a fair price, fostering a more transparent and customer-centric insurance market.

4. Sustainable and Ethical Insurance Practices

As environmental and social consciousness continues to grow, the insurance industry is also embracing sustainable and ethical practices. Auto insurance providers are exploring ways to reduce their environmental impact and support sustainable initiatives. This includes offering incentives for eco-friendly vehicles, promoting safe driving practices to reduce accidents, and investing in community initiatives. Additionally, insurance companies are focusing on ethical business practices, ensuring fair treatment of customers and supporting social causes.

Frequently Asked Questions

How do I choose the right auto insurance provider for my needs?

+When selecting an auto insurance provider, consider your specific needs and preferences. Assess the coverage options, premiums, and additional benefits offered by different providers. Read reviews and seek recommendations from trusted sources like Consumer Reports. Evaluate their customer satisfaction ratings, claims handling processes, and financial stability. By comparing these factors, you can make an informed decision that aligns with your requirements.

Are there any discounts available for auto insurance?

+Yes, many auto insurance providers offer a variety of discounts to help reduce premiums. Common discounts include safe driver discounts, multiple policy discounts (bundling auto and home insurance), loyalty discounts, and good student discounts. Additionally, some providers offer usage-based insurance programs, where policyholders can save by demonstrating safe driving habits. It’s worth exploring the available discounts and discussing them with your insurance provider to potentially lower your insurance costs.

What should I do in case of an accident or claim?

+In the event of an accident or claim, it’s important to remain calm and take the necessary steps to protect yourself and others involved. First, ensure the safety of all individuals and provide any necessary medical attention. Contact the police and file a report if required. Then, notify your insurance provider promptly and provide them with all relevant details. Follow their instructions and cooperate with their claims handling process. Remember to gather evidence, such as photographs and witness statements, to support your claim.

How can I save money on my auto insurance premiums?

+There are several strategies to potentially save money on your auto insurance premiums. Shop around and compare quotes from different providers to find the most competitive rates. Explore the available discounts, such as safe driver discounts or multiple policy discounts, and inquire about any applicable discounts. Maintain a good driving record and avoid accidents or traffic violations, as this can lead to higher premiums. Additionally, consider increasing your deductible, as a higher deductible can result in lower premiums. However, it’s important to strike a balance between savings and the financial protection you need.

What are the key factors to consider when comparing auto insurance providers?

+When comparing auto insurance providers, consider the following key factors: coverage options (liability, collision, comprehensive, and additional benefits), premiums and discounts, claims handling reputation and efficiency, customer service and satisfaction ratings, financial stability and ratings, and any unique features or benefits offered by the provider. Evaluating these factors will help you make an informed decision and choose an insurance provider that best suits your needs and offers the level of protection you require.