Insurance For Disability

Understanding the Vital Role of Insurance for Disability: A Comprehensive Guide

In the realm of personal finance and risk management, few topics are as crucial yet often overlooked as disability insurance. This comprehensive guide aims to shed light on the significance of insurance for disability, exploring its intricacies and highlighting why it should be a fundamental component of every individual's financial plan.

Disability, whether short-term or long-term, can strike unexpectedly, disrupting an individual's ability to work and earn an income. The financial implications can be devastating, making it essential to have adequate protection in place. This article delves into the world of disability insurance, providing an in-depth analysis of its importance, the various types available, and the key factors to consider when selecting the right coverage.

The Significance of Disability Insurance

Disability insurance serves as a financial safety net, providing income protection during periods of disability. It offers peace of mind, ensuring that individuals can continue to meet their financial obligations, maintain their standard of living, and cover essential expenses such as medical bills, mortgages, and daily living costs.

The need for disability insurance is underscored by the fact that disabilities can arise from a myriad of causes, including accidents, illnesses, or even mental health conditions. According to a report by the Council for Disability Awareness, the average length of disability absence is 2.5 years, and nearly one in four of today's 20-year-olds will experience a disability before reaching retirement age. These statistics emphasize the very real and present risk that disability poses.

Without adequate insurance for disability, individuals may find themselves facing financial hardship, potentially leading to debt, foreclosure, or even bankruptcy. Moreover, the stress of managing finances during a period of disability can exacerbate the emotional and physical challenges already being faced. Disability insurance acts as a buffer, helping individuals focus on their recovery and rehabilitation without the added burden of financial worries.

Types of Disability Insurance

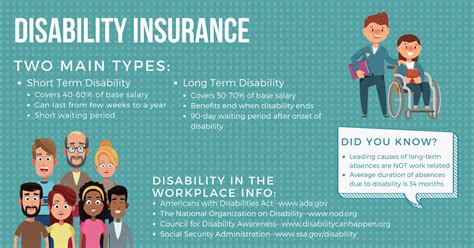

Disability insurance comes in various forms, each designed to cater to specific needs and circumstances. Understanding the different types is crucial in making an informed decision about coverage.

Short-Term Disability Insurance (STD)

Short-term disability insurance provides temporary income replacement for a specified period, typically ranging from a few weeks to a few months. It is designed to cover disabilities resulting from accidents or illnesses that prevent individuals from performing their job duties for a short duration. STD policies often offer a percentage of the insured's regular income, providing financial support during the recovery period.

Short-term disability insurance is particularly beneficial for individuals who have short-term financial obligations or those who anticipate a quick recovery. It can help bridge the gap between the onset of disability and the activation of longer-term disability benefits or other financial resources.

Long-Term Disability Insurance (LTD)

Long-term disability insurance, as the name suggests, provides income replacement for an extended period, often lasting several years or until the insured reaches retirement age. It is designed to cover more severe and prolonged disabilities that prevent individuals from working indefinitely. LTD policies typically offer a monthly benefit, which can be a fixed amount or a percentage of the insured's pre-disability income.

Long-term disability insurance is crucial for individuals whose disabilities may have long-lasting effects on their ability to work. It provides a vital source of income, ensuring financial stability and security during an uncertain and potentially prolonged period of disability.

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance is a federal program administered by the Social Security Administration. It provides monthly benefits to individuals who have a disability that is expected to last at least one year or result in death. SSDI is funded through payroll taxes and is designed to replace a portion of the insured's income, with benefits determined based on their work history and earnings.

While SSDI can be a valuable source of disability benefits, it is important to note that the application process can be complex and time-consuming. Additionally, the eligibility criteria are stringent, and the benefit amounts may not fully cover an individual's financial needs.

Private Disability Insurance

Private disability insurance, also known as individual disability insurance (IDI), is purchased directly from an insurance company. It offers a more flexible and customizable approach to disability coverage, allowing individuals to choose the level of benefits, the benefit period, and other policy features that best suit their needs. Private disability insurance can be tailored to provide coverage for specific occupations or industries and often offers more comprehensive benefits than group insurance plans.

One of the key advantages of private disability insurance is the ability to maintain coverage even if an individual changes jobs or retires. This portability ensures that the insured's financial protection remains intact regardless of their employment status.

Key Considerations for Selecting Disability Insurance

When navigating the complex world of disability insurance, several factors should be carefully considered to ensure the chosen policy aligns with individual needs and circumstances.

Occupation and Income

The nature of one's occupation plays a significant role in determining the level of disability insurance required. Individuals in high-risk occupations, such as construction workers or firefighters, may require more comprehensive coverage to protect against the increased likelihood of injury or disability. On the other hand, those in less physically demanding jobs may opt for more moderate coverage.

Income is another crucial factor. Disability insurance policies typically provide a benefit amount that replaces a percentage of the insured's pre-disability income. It is essential to choose a policy that offers sufficient coverage to maintain one's standard of living and meet financial obligations during a period of disability.

Benefit Period and Waiting Period

The benefit period refers to the length of time for which the insurance company will pay benefits. This period can vary widely, from a few months to several years or even until retirement age. Choosing the right benefit period depends on one's financial goals and the potential duration of their disability.

The waiting period, also known as the elimination period, is the duration an insured must wait before benefits kick in. This period can range from a few days to several months. A longer waiting period often results in lower premium costs, while a shorter waiting period provides faster access to benefits but may incur higher premiums.

Policy Features and Exclusions

Disability insurance policies come with a range of features and exclusions that can significantly impact the level of protection provided. Some policies may offer additional benefits, such as cost-of-living adjustments, residual disability benefits, or rehabilitation benefits. Understanding these features and how they align with individual needs is crucial.

Additionally, it is essential to review the policy's exclusions carefully. Some policies may exclude certain conditions or events from coverage, such as pre-existing conditions, self-inflicted injuries, or disabilities resulting from war or military service. Being aware of these exclusions ensures that individuals are not caught off guard if a disability occurs under circumstances not covered by the policy.

Cost and Affordability

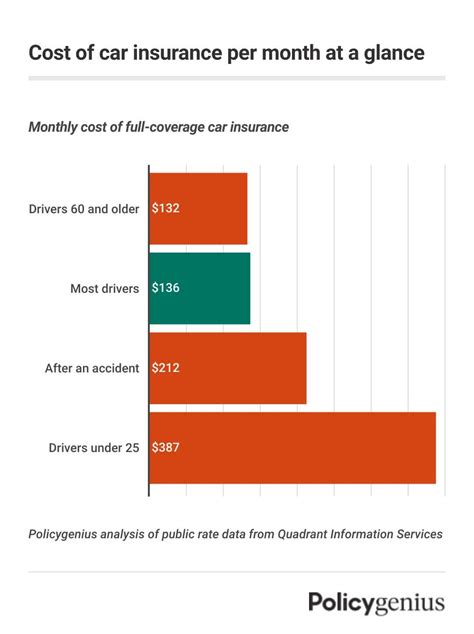

The cost of disability insurance is a critical consideration. Premiums can vary widely based on factors such as the insured's age, occupation, health status, and the level of coverage chosen. It is important to strike a balance between the desired level of protection and financial affordability.

Comparing quotes from multiple insurers and seeking the advice of a financial professional can help individuals find the most cost-effective coverage that meets their needs. Additionally, some employers offer group disability insurance plans, which can provide more affordable coverage options.

The Impact of Disability Insurance on Financial Planning

Incorporating disability insurance into one's financial plan is a strategic move that can significantly enhance overall financial security. By mitigating the risk of income loss due to disability, individuals can better protect their assets, savings, and retirement plans.

Disability insurance plays a crucial role in preserving an individual's financial stability and independence. It allows for the continuation of essential financial commitments, such as mortgage payments, education funds, and investment strategies. Moreover, it provides the flexibility to make informed decisions about one's career and retirement, without the burden of financial uncertainty hanging over their heads.

In the event of a disability, having adequate insurance coverage can also prevent the need to dip into emergency funds or retirement savings prematurely. This preservation of financial resources ensures that individuals can maintain their long-term financial goals and objectives, providing a sense of security and peace of mind.

Conclusion

Insurance for disability is an essential component of a comprehensive financial plan. It offers a crucial layer of protection against the unforeseen challenges that disability can bring. By understanding the various types of disability insurance and the key considerations for selecting coverage, individuals can make informed decisions to safeguard their financial future.

As with any financial decision, it is always advisable to consult with a qualified financial advisor or insurance professional who can provide personalized guidance based on individual circumstances. With the right disability insurance in place, individuals can face the future with confidence, knowing that they have taken proactive steps to protect their income and financial well-being.

How much disability insurance coverage do I need?

+The amount of disability insurance coverage you need depends on your personal circumstances and financial obligations. As a general rule, aim to replace at least 60-70% of your pre-disability income to maintain your standard of living. Consider your fixed expenses, such as mortgage or rent, utilities, and debt payments, as well as variable expenses like groceries and entertainment. It’s advisable to consult with a financial professional to determine the right coverage amount for your specific situation.

Can I get disability insurance if I have a pre-existing condition?

+Yes, it is possible to obtain disability insurance even if you have a pre-existing condition. However, the availability and cost of coverage may be impacted. Some insurance providers offer policies that specifically cater to individuals with pre-existing conditions, known as “guaranteed issue” policies. These policies may have limitations or exclusions, so it’s important to carefully review the terms and conditions. Consulting with an insurance specialist can help you navigate your options and find the best coverage available.

What happens if I need to make a disability insurance claim?

+Making a disability insurance claim typically involves a few steps. First, you will need to notify your insurance provider and provide documentation of your disability, such as medical records and proof of income. The insurance company will then review your claim and determine whether you meet the policy’s eligibility criteria. If your claim is approved, you will receive the agreed-upon benefit amount, which can be paid out as a lump sum or in regular installments, depending on your policy terms.