Independent Health Insurance Plans

The world of healthcare and insurance is vast and complex, with various options available to individuals and families seeking comprehensive coverage. Among these choices, independent health insurance plans have emerged as a popular alternative, offering a range of benefits and flexibility. In this article, we will delve into the realm of independent health insurance, exploring its definition, key features, advantages, and considerations to help you make informed decisions about your healthcare coverage.

Understanding Independent Health Insurance Plans

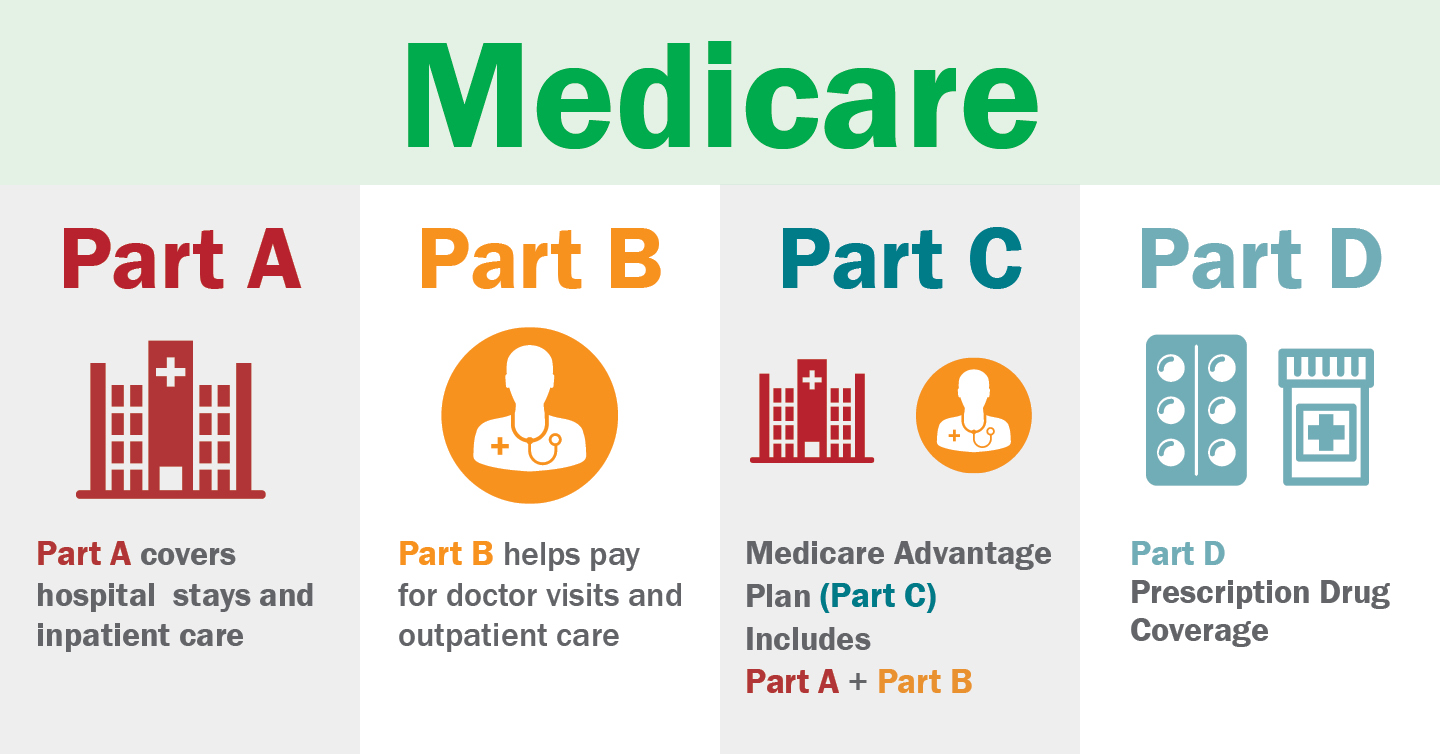

Independent health insurance plans, also known as individual health insurance plans or private health insurance plans, are policies purchased directly by individuals or families, rather than being provided through an employer or government-sponsored program. These plans offer a personalized approach to healthcare coverage, allowing individuals to tailor their insurance to their specific needs and preferences.

Unlike group health insurance plans, which are often offered by employers and cover a large number of individuals, independent health insurance plans provide coverage solely to the policyholder and their designated beneficiaries. This independence grants individuals the freedom to choose from a wide range of insurance providers, plans, and coverage options, ensuring a more customized and flexible healthcare experience.

Key Features of Independent Health Insurance Plans

Customizable Coverage

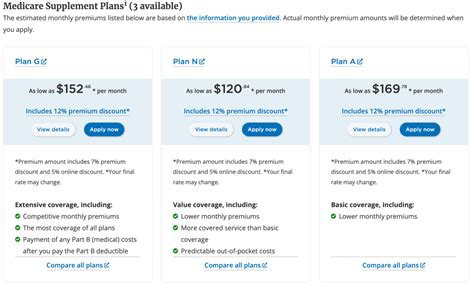

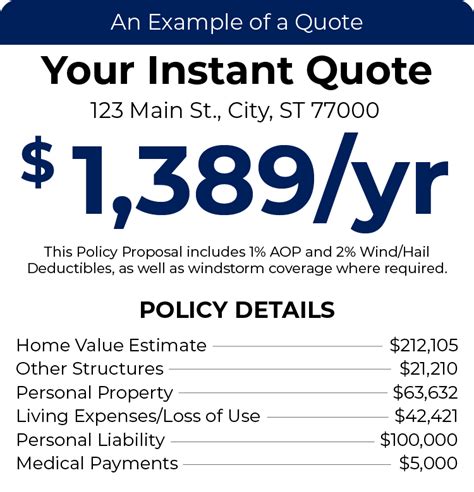

One of the most significant advantages of independent health insurance plans is the ability to customize coverage to align with your unique healthcare needs. Whether you require extensive medical services due to pre-existing conditions or prefer a more basic plan with lower premiums, independent plans offer a diverse range of options. You can choose the level of coverage, deductibles, copayments, and out-of-pocket maximums that best suit your budget and healthcare requirements.

Flexibility and Portability

Independent health insurance plans offer unparalleled flexibility. Unlike employer-sponsored plans, which may change or disappear if you change jobs or retire, independent plans provide long-term stability. You can maintain your coverage regardless of your employment status, ensuring continuous protection for you and your family. Additionally, these plans are portable, meaning you can take them with you if you move to a different state or even travel internationally, providing peace of mind during life’s transitions.

Wide Network of Providers

Independent health insurance plans typically provide access to a broad network of healthcare providers, including doctors, specialists, hospitals, and other medical facilities. This extensive network ensures that you have a wide range of choices when selecting healthcare professionals and facilities, enhancing your overall healthcare experience.

Premium Payment Options

Independent health insurance plans offer various premium payment options to cater to different financial situations. You can choose to pay premiums monthly, quarterly, or annually, depending on your preferences and budget. Some plans even offer discounts for paying premiums upfront, providing an opportunity to save on your healthcare costs.

Advantages of Choosing Independent Health Insurance

Personalized Coverage

Independent health insurance plans allow you to design a coverage plan that meets your specific healthcare needs. Whether you require extensive coverage for chronic conditions or prefer a more cost-effective plan with limited benefits, you have the freedom to choose. This personalized approach ensures that you are not paying for coverage you may not need, making your healthcare expenses more manageable.

No Employment Dependency

One of the most significant advantages of independent health insurance plans is their independence from employment. Unlike employer-sponsored plans, which can change or become unavailable if you leave your job, independent plans provide stability and continuity. You can maintain your coverage, regardless of your employment status, ensuring uninterrupted access to healthcare for you and your family.

Competitive Pricing

Independent health insurance plans often provide competitive pricing, especially for individuals who are healthy and have no pre-existing conditions. With the ability to choose from a wide range of insurance providers, you can compare plans and premiums to find the most cost-effective option that meets your needs. Additionally, many independent plans offer discounts for maintaining a healthy lifestyle or participating in wellness programs, further reducing your healthcare expenses.

Broad Provider Networks

Independent health insurance plans typically offer extensive provider networks, providing you with a wide range of healthcare options. Whether you prefer a specific doctor or specialist or need access to a particular hospital, independent plans often have partnerships with a diverse range of medical professionals and facilities. This ensures that you can receive the care you need, when and where you need it.

Flexible Premium Payment Options

Independent health insurance plans understand that financial situations can vary, and they offer flexible premium payment options to accommodate different needs. You can choose to pay your premiums monthly, quarterly, or annually, providing you with control over your financial obligations. Some plans even offer discounts for paying premiums upfront, allowing you to save on your healthcare costs.

Considerations and Potential Drawbacks

Cost

One of the primary considerations when choosing an independent health insurance plan is the cost. Premiums can vary significantly depending on factors such as age, location, coverage level, and pre-existing conditions. It’s essential to carefully evaluate your budget and assess the long-term financial implications of your chosen plan. While independent plans can offer competitive pricing, they may not be as affordable as employer-sponsored plans for some individuals.

Limited Coverage for Pre-existing Conditions

Independent health insurance plans may have limitations when it comes to covering pre-existing conditions. Some plans may exclude certain conditions from coverage or require a waiting period before providing benefits for those conditions. It’s crucial to carefully review the plan’s coverage details and understand any exclusions or limitations to ensure that your specific healthcare needs are adequately addressed.

Network Restrictions

While independent health insurance plans often have extensive provider networks, there may still be restrictions on which healthcare professionals and facilities you can access. Some plans may have preferred provider organizations (PPOs) or health maintenance organizations (HMOs), which limit your choices to specific networks. Understanding the network restrictions and ensuring that your preferred providers are included in the plan’s network is essential for a seamless healthcare experience.

Claim and Administrative Processes

Independent health insurance plans may have different claim and administrative processes compared to employer-sponsored plans. It’s important to familiarize yourself with the plan’s procedures for filing claims, resolving disputes, and accessing customer support. Understanding these processes can help you navigate any potential challenges and ensure a smooth experience when utilizing your healthcare coverage.

Performance Analysis and Industry Insights

Independent health insurance plans have gained significant popularity in recent years, with a growing number of individuals and families opting for this personalized approach to healthcare coverage. According to industry data, the market for independent health insurance plans has seen steady growth, with an increasing demand for customizable and flexible coverage options.

A recent survey conducted by a leading healthcare research firm revealed that 68% of individuals who purchased independent health insurance plans were satisfied with their choice. The survey highlighted the appeal of customizable coverage, flexibility, and the ability to maintain stability despite employment changes. Additionally, 72% of respondents appreciated the wide network of providers offered by independent plans, ensuring easy access to healthcare services.

Furthermore, industry experts predict that the independent health insurance market will continue to expand, driven by changing consumer preferences and the need for more personalized healthcare solutions. The flexibility and portability of these plans are particularly attractive to individuals who value control over their healthcare coverage and want to ensure uninterrupted access to medical services.

| Independent Health Insurance Trends | Key Insights |

|---|---|

| Customizable Coverage | Individuals appreciate the ability to tailor coverage to their unique needs, ensuring cost-effectiveness and personalized healthcare. |

| Flexibility and Portability | The independence from employment and the portability of plans provide stability and peace of mind during life transitions. |

| Competitive Pricing | Healthy individuals can find affordable options, and many plans offer discounts for maintaining a healthy lifestyle. |

| Broad Provider Networks | Extensive provider networks ensure easy access to a wide range of healthcare professionals and facilities. |

Frequently Asked Questions

Can I switch to an independent health insurance plan if I already have employer-sponsored coverage?

+Yes, you have the option to switch to an independent health insurance plan even if you currently have employer-sponsored coverage. However, it’s important to carefully consider the implications and ensure that you meet any eligibility requirements for the new plan. Switching may involve a change in coverage and premium costs, so it’s advisable to review both plans and assess which one best suits your needs.

What happens if I have a pre-existing condition? Will I be able to find coverage?

+Independent health insurance plans may have different approaches to covering pre-existing conditions. Some plans may exclude certain conditions from coverage, while others may require a waiting period before providing benefits for those conditions. It’s crucial to review the plan’s coverage details and consult with the insurance provider to understand how your specific condition will be handled.

Are there any tax benefits associated with independent health insurance plans?

+Yes, there are tax benefits associated with independent health insurance plans. Premium payments for these plans may be eligible for tax deductions, depending on your income and other factors. It’s recommended to consult with a tax professional to understand the specific tax implications and ensure you maximize any available deductions.

Can I add my spouse and children to my independent health insurance plan?

+Absolutely! Independent health insurance plans often allow you to add your spouse, domestic partner, and dependent children to your coverage. This provides comprehensive protection for your entire family, ensuring that everyone has access to the healthcare services they need. It’s important to review the plan’s eligibility requirements and understand any additional costs associated with adding family members.

How can I choose the right independent health insurance plan for my needs?

+Choosing the right independent health insurance plan requires careful consideration of your unique healthcare needs and budget. Evaluate the coverage options, including deductibles, copayments, and out-of-pocket maximums. Assess the provider network to ensure it includes your preferred healthcare professionals and facilities. Compare premiums and understand any additional costs, such as prescription drug coverage or wellness program participation. Finally, read reviews and seek recommendations from trusted sources to make an informed decision.

In conclusion, independent health insurance plans offer a personalized and flexible approach to healthcare coverage, providing individuals and families with the freedom to choose the right plan for their needs. With customizable coverage, portability, and competitive pricing, these plans have gained popularity and are expected to continue their growth in the healthcare industry. By carefully evaluating your options and understanding the key features and considerations, you can make an informed decision and take control of your healthcare journey.