Buy Long Term Care Insurance

In today's rapidly changing world, planning for the future is more crucial than ever. One aspect that often goes overlooked is the necessity of long-term care insurance (LTCI). This form of insurance provides financial protection and peace of mind for individuals facing the potential need for extended care services, which can be both physically and financially demanding.

The decision to purchase long-term care insurance is a significant one, and it requires careful consideration of various factors. From understanding the costs and benefits to choosing the right policy, there are numerous aspects to navigate. This comprehensive guide aims to demystify the process and empower you to make an informed decision about your future well-being.

Understanding Long-Term Care Insurance

Long-term care insurance is a specialized type of coverage designed to address the unique financial challenges associated with extended care needs. Unlike traditional health insurance, which primarily covers acute medical conditions, LTCI focuses on providing coverage for a wide range of services related to long-term care, such as:

- Nursing Home Care: This includes residential care facilities that offer 24-hour medical supervision and assistance with daily activities.

- Assisted Living: Assisted living facilities provide support for individuals who require assistance with daily tasks but do not need constant medical attention.

- Home Care Services: LTCI can cover the cost of in-home care, including personal care aides, home health aides, and skilled nursing care.

- Adult Day Care: This type of care provides a structured environment for seniors during the day, offering social interaction and supervision while family caregivers work or take a break.

- Respite Care: Respite care services provide temporary relief for family caregivers, allowing them to take a break while ensuring their loved ones receive proper care.

The primary purpose of long-term care insurance is to ensure that individuals have access to the care they need without facing financial ruin. It provides a safety net, enabling individuals to maintain their standard of living and receive the necessary care services without depleting their savings or relying solely on government programs.

Why Consider Long-Term Care Insurance?

The decision to purchase long-term care insurance is a proactive step towards safeguarding your future and that of your loved ones. Here are some key reasons why it's worth considering:

Rising Healthcare Costs

Healthcare expenses have been steadily increasing over the years, and long-term care services are no exception. The cost of nursing home care, for instance, can quickly become a significant financial burden. According to a recent study, the average cost of a private room in a nursing home exceeds $100,000 per year. Long-term care insurance can help mitigate these costs, providing financial stability during a time when it's needed most.

Preserving Assets and Savings

One of the primary goals of LTCI is to protect your hard-earned assets and savings. Without insurance, the cost of long-term care can quickly deplete your retirement funds, leaving you with limited options. By purchasing a policy, you can ensure that your financial security is maintained, allowing you to enjoy your retirement without the worry of unexpected care expenses.

Family Peace of Mind

Having long-term care insurance in place provides peace of mind not only for yourself but also for your family. It ensures that your care needs will be met without placing a heavy financial burden on your loved ones. This can alleviate the stress and anxiety associated with planning for potential future care requirements, allowing you to focus on living your life to the fullest.

Customizable Coverage

Long-term care insurance policies are highly customizable, allowing you to tailor your coverage to your specific needs and budget. You can choose the daily benefit amount, the elimination period (the time you must pay for care before the insurance kicks in), and the duration of coverage. This flexibility ensures that you receive the right level of protection without unnecessary financial strain.

Choosing the Right Policy

When selecting a long-term care insurance policy, there are several key factors to consider to ensure you choose the right coverage for your needs:

Daily Benefit Amount

The daily benefit amount refers to the maximum dollar amount the insurance company will pay for your care each day. This amount should be sufficient to cover the cost of the type of care you anticipate needing. It's essential to research the average costs of care in your area and choose a benefit amount that aligns with your needs.

Elimination Period

The elimination period, also known as the waiting period, is the number of days you must pay for care out-of-pocket before your insurance coverage begins. This period can range from a few days to several months. A longer elimination period typically results in lower premiums, but it's important to consider your financial situation and the potential cost of care during this period.

Benefit Duration

The benefit duration is the length of time your insurance coverage will last once it begins. Policies typically offer coverage durations ranging from a few months to several years. It's crucial to assess your potential long-term care needs and choose a benefit duration that provides adequate coverage without being excessive.

Inflation Protection

Long-term care insurance policies often include an inflation protection feature, which adjusts your benefit amount annually to keep pace with rising healthcare costs. This ensures that your coverage remains sufficient over time. There are various types of inflation protection, such as simple inflation protection, compound inflation protection, and future purchase option. Each option has its advantages and considerations, so it's essential to understand them before making a decision.

Tax Considerations

Long-term care insurance premiums may be tax-deductible, depending on your individual circumstances and the policy you choose. It's important to consult with a tax professional to understand the potential tax benefits associated with your policy.

Evaluating Long-Term Care Insurance Providers

With numerous insurance companies offering long-term care insurance, it's crucial to evaluate their reputation, financial stability, and track record of claims handling. Consider the following factors when choosing a provider:

- Financial Strength: Look for companies with strong financial ratings from reputable agencies like Standard & Poor's, Moody's, or A.M. Best. This ensures that the company will be able to fulfill its financial obligations in the long term.

- Claims Process: Research the provider's claims process and reputation for prompt and fair claim settlements. Read reviews and seek recommendations from trusted sources to gain insight into the company's customer service and claims handling.

- Policy Flexibility: Evaluate the provider's ability to offer customizable policies that align with your specific needs. Some companies may have more comprehensive coverage options or unique features that cater to different care scenarios.

- Pricing and Discounts: Compare pricing across different providers to ensure you're getting a competitive rate. Additionally, look for potential discounts, such as those for early enrollment or policy bundling.

Applying for Long-Term Care Insurance

The application process for long-term care insurance typically involves completing a comprehensive health questionnaire and, in some cases, undergoing a medical examination. The insurance company will assess your health status and pre-existing conditions to determine your eligibility and premium amount.

It's important to be truthful and accurate in your application to avoid potential issues with your coverage in the future. Any misrepresentation or omission of health information can lead to claim denials or policy cancellations.

Health Assessment

The health assessment is a critical step in the application process. It helps the insurance company understand your current health status and assess your risk level. The assessment may include questions about your medical history, current medications, and any ongoing health conditions. In some cases, a paramedical exam may be required, where a nurse or technician visits your home to collect vital signs and perform a physical assessment.

Underwriting Process

Once your application and health assessment are complete, the insurance company's underwriting department will review your information to determine your eligibility and premium rate. The underwriting process can vary between companies, but it typically involves a thorough review of your health history and the potential risks associated with your care needs.

During the underwriting process, the insurance company may request additional medical records or information to make an informed decision. It's essential to respond promptly to any requests to avoid delays in the approval process.

Tips for a Smooth Application Process

- Gather Information: Before starting the application process, gather all necessary documents, such as medical records, prescription lists, and financial information. Having this information readily available can streamline the application and reduce the risk of delays.

- Be Transparent: It's crucial to provide accurate and honest information on your application and during the health assessment. Any misrepresentation can lead to future complications, such as claim denials or policy cancellations.

- Understand the Policy: Take the time to thoroughly review the policy details, including the benefits, exclusions, and limitations. Ask questions and seek clarification on any confusing aspects to ensure you fully understand the coverage you're purchasing.

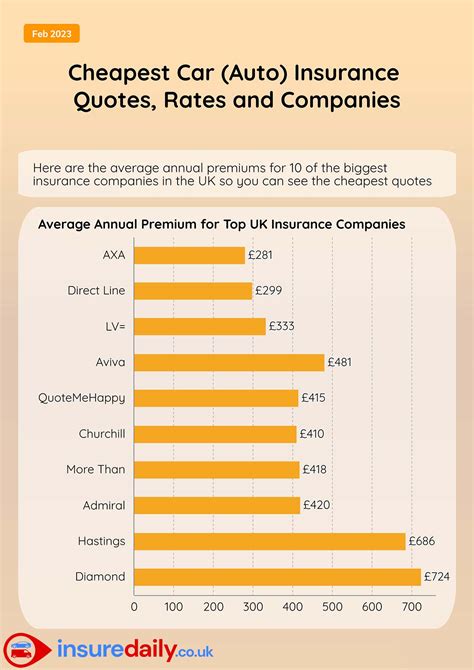

- Compare Quotes: Obtain quotes from multiple insurance providers to compare pricing, coverage options, and additional benefits. This will help you find the best value for your specific needs.

- Seek Professional Advice: Consider consulting with a financial advisor or insurance broker who specializes in long-term care insurance. They can provide expert guidance tailored to your situation and help you navigate the complex world of LTCI.

Common Misconceptions about Long-Term Care Insurance

Despite its importance, long-term care insurance is often misunderstood. Here are some common misconceptions and the reality behind them:

Misconception: Long-Term Care Insurance is Only for the Elderly

Reality: While the need for long-term care often increases with age, it's not exclusively an elderly concern. Younger individuals can also benefit from LTCI, especially those with pre-existing conditions or a family history of chronic illnesses. Purchasing a policy at a younger age can result in lower premiums and provide peace of mind for the future.

Misconception: Government Programs Cover All Long-Term Care Needs

Reality: Government programs like Medicaid do provide some long-term care coverage, but they often have strict eligibility requirements and may not cover the full range of care services. Additionally, Medicaid is a means-tested program, meaning it's primarily intended for individuals with limited financial resources. Long-term care insurance, on the other hand, offers more comprehensive coverage and allows individuals to maintain their financial independence.

Misconception: Long-Term Care Insurance is Too Expensive

Reality: While LTCI premiums can vary based on factors like age, health status, and coverage options, they are often more affordable than many people realize. By purchasing a policy earlier in life and customizing the coverage to your needs, you can secure a reasonable rate and ensure your future financial security.

The Future of Long-Term Care Insurance

As the healthcare landscape continues to evolve, so too does the world of long-term care insurance. Here are some key trends and developments to watch for in the future:

Increasing Demand for Home Care

There is a growing preference for receiving care in the comfort of one's own home, and this trend is expected to continue. As a result, long-term care insurance policies are likely to place greater emphasis on covering home care services, providing individuals with more flexibility and control over their care options.

Technological Advancements

Technology is playing an increasingly important role in healthcare, and long-term care insurance is no exception. From telemedicine services to remote patient monitoring, these advancements can enhance the efficiency and quality of care while potentially reducing costs. Insurance companies may begin offering policies that incorporate these technologies, providing additional benefits to policyholders.

Focus on Prevention and Wellness

The future of long-term care insurance is likely to place a greater emphasis on preventive care and wellness initiatives. By encouraging policyholders to maintain healthy lifestyles and manage chronic conditions, insurance companies can help reduce the likelihood and severity of long-term care needs. This shift towards prevention can lead to more cost-effective care and improved overall well-being.

Collaborative Care Models

The traditional model of healthcare, where various providers work in silos, is gradually giving way to more collaborative care models. Insurance companies may partner with healthcare providers to offer integrated care plans, ensuring a seamless and coordinated approach to long-term care. This collaboration can lead to better care outcomes and more efficient use of resources.

Conclusion

Purchasing long-term care insurance is a responsible decision that can provide invaluable financial protection and peace of mind. By understanding the costs and benefits, choosing the right policy, and evaluating reputable providers, you can ensure that you have the coverage you need for your future care requirements. Remember, the earlier you start planning, the more affordable and comprehensive your coverage can be.

As the healthcare industry continues to evolve, long-term care insurance will play an increasingly vital role in safeguarding the well-being of individuals and their families. By staying informed and proactive, you can make informed choices about your future and ensure that you receive the care you deserve when you need it most.

What is the average cost of long-term care insurance premiums?

+The cost of long-term care insurance premiums can vary widely depending on factors such as age, health status, and the coverage options chosen. On average, a 55-year-old purchasing a comprehensive policy can expect to pay around 2,000 to 3,000 per year. However, it’s important to note that premiums can be significantly lower for individuals who purchase a policy at a younger age.

Can I purchase long-term care insurance if I have pre-existing conditions?

+Yes, individuals with pre-existing conditions can still purchase long-term care insurance. However, the insurance company may require additional medical information or adjust the premium rate to reflect the increased risk. It’s important to be transparent about your health status during the application process to avoid future complications.

How long does the application and underwriting process typically take?

+The application and underwriting process can vary depending on the insurance company and the complexity of your health history. On average, it can take anywhere from a few weeks to several months. It’s important to respond promptly to any requests for additional information to avoid delays in the approval process.

Are there any tax benefits associated with long-term care insurance premiums?

+Yes, long-term care insurance premiums may be tax-deductible under certain circumstances. The deductibility depends on factors such as your age, the type of policy, and the amount of premiums paid. It’s recommended to consult with a tax professional to understand the specific tax benefits associated with your policy.

What happens if I need long-term care but my policy’s benefit duration has expired?

+If your long-term care insurance policy’s benefit duration has expired, you will be responsible for covering the cost of your care out-of-pocket. However, it’s important to note that many policies offer the option to renew or extend the coverage period, allowing you to continue receiving benefits. It’s crucial to review your policy terms and understand your renewal options.