Quotes For Renters Insurance

Renters insurance is an essential yet often overlooked aspect of financial protection for individuals who rent their living spaces. This type of insurance provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. In this comprehensive guide, we will delve into the world of renters insurance, exploring the benefits, understanding coverage options, and discovering the best quotes to secure your rental life.

Understanding Renters Insurance

Renters insurance, also known as tenants insurance, is a policy designed specifically for individuals who rent apartments, condos, houses, or any other type of residence. It offers financial protection against various risks and perils that renters may face, providing peace of mind and security.

Benefits of Renters Insurance

Renters insurance offers a wide range of benefits, ensuring that your personal belongings and livelihood are safeguarded. Here are some key advantages:

- Personal Property Coverage: Renters insurance covers your personal items, including furniture, electronics, clothing, and other valuables. In case of theft, fire, or other covered events, you can receive compensation for the loss or damage.

- Liability Protection: This coverage is crucial as it safeguards you against legal liabilities. If someone gets injured in your rental unit or if your actions cause property damage, renters insurance can provide financial assistance for legal fees and settlements.

- Additional Living Expenses: In the event of a covered loss that makes your rental unit uninhabitable, renters insurance can cover the costs of temporary accommodation and additional living expenses until you can return to your home.

- Personal Injury Protection: Some policies offer personal injury coverage, which can provide financial support if you are injured on the rental property due to negligence on the part of the landlord or property owner.

- Loss of Use: This coverage helps you cover the costs associated with finding temporary housing and moving your belongings if your rental unit becomes unlivable due to a covered event.

Coverage Options and Considerations

When it comes to renters insurance, there are various coverage options available to customize your policy to fit your specific needs. Here are some key considerations:

- Actual Cash Value vs. Replacement Cost: Actual cash value coverage reimburses you for the value of your belongings at the time of loss, taking depreciation into account. Replacement cost coverage, on the other hand, pays the full cost of replacing your items without deducting for depreciation.

- Personal Property Limits: You can choose the limit of coverage for your personal belongings based on their total value. It is important to accurately assess the value of your possessions to ensure adequate coverage.

- Liability Limits: Liability coverage protects you against lawsuits and legal fees. Consider the amount of liability coverage you need based on your financial situation and potential risks.

- Additional Coverage Endorsements : Renters insurance policies often offer optional endorsements or riders to enhance your coverage. These can include coverage for high-value items, identity theft protection, or specific perils such as earthquake or flood.

- Deductibles: Like other insurance policies, renters insurance policies have deductibles. Choose a deductible amount that suits your budget and risk tolerance.

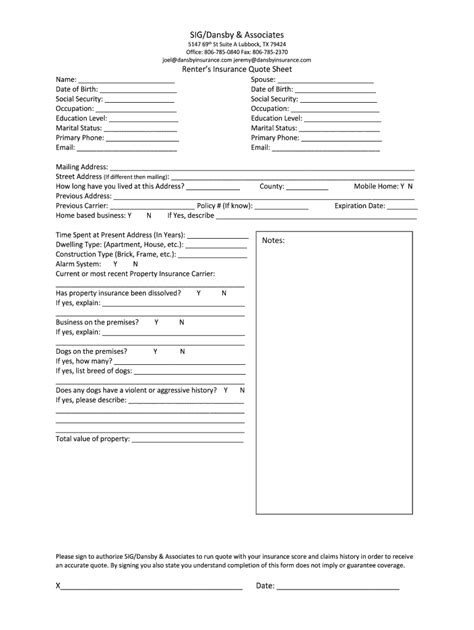

Finding the Best Quotes for Renters Insurance

Now that we understand the importance and coverage options of renters insurance, let’s explore how to find the best quotes to ensure you get the most value for your money.

Online Quote Comparison

One of the most convenient ways to find quotes for renters insurance is through online comparison platforms. These websites allow you to enter your information once and receive multiple quotes from different insurance providers. By comparing quotes, you can quickly assess the coverage, premiums, and additional benefits offered by each insurer.

Bundling with Other Policies

If you already have other insurance policies, such as auto insurance or homeowners insurance, consider bundling your renters insurance with these policies. Many insurance companies offer discounts when you combine multiple policies, making it more cost-effective.

Shop Around and Negotiate

Don’t settle for the first quote you receive. Shop around and compare quotes from different insurers. Reach out to insurance agents or brokers who can provide personalized recommendations and help you negotiate better rates. By discussing your specific needs and circumstances, you may be able to secure more favorable terms and discounts.

Discounts and Savings

Insurance companies often offer various discounts to attract customers. Look out for discounts based on factors such as:

- Loyalty: If you’ve been with the same insurance provider for a long time, you may be eligible for loyalty discounts.

- Safety Features: Installing security systems, smoke detectors, or fire extinguishers in your rental unit can qualify you for safety discounts.

- Payment Method: Some insurers offer discounts for electronic payments or automatic bill pay.

- Multiple Policies: Bundling your renters insurance with other policies can result in significant savings.

- Memberships and Affiliations: Certain professional organizations, alumni associations, or employee groups may have partnerships with insurance companies, offering exclusive discounts to their members.

Policy Deductibles and Coverage Limits

When comparing quotes, pay close attention to the policy deductibles and coverage limits. A higher deductible can lower your premium, but it means you’ll have to pay more out of pocket in the event of a claim. Similarly, higher coverage limits provide more financial protection but may result in a higher premium.

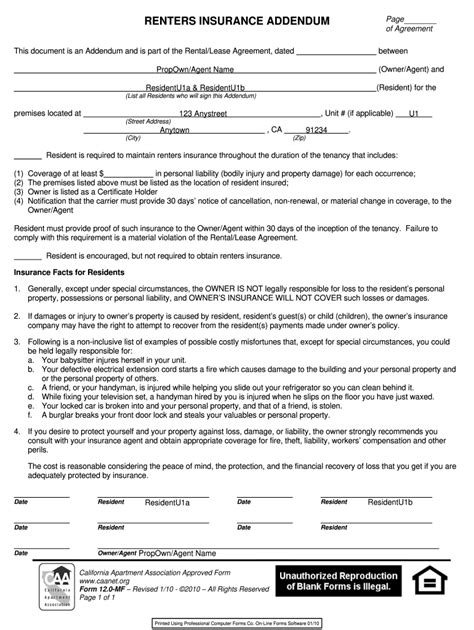

Review and Understand the Policy

Before finalizing your renters insurance policy, carefully review the terms and conditions. Ensure that you understand the coverage exclusions, limitations, and any specific conditions that may apply. Don’t hesitate to reach out to the insurance provider or an insurance professional if you have any questions or need clarification.

Sample Renters Insurance Policy

To provide a better understanding of what a renters insurance policy entails, let’s take a look at a sample policy:

| Coverage Type | Limit |

|---|---|

| Personal Property | $30,000 |

| Liability | $100,000 |

| Additional Living Expenses | $2,000 per occurrence |

| Medical Payments to Others | $1,000 per person |

| Personal Injury Protection | Included |

This sample policy offers coverage for personal belongings up to $30,000, liability protection of $100,000, and additional living expenses of $2,000 per occurrence. It also includes medical payments to others and personal injury protection.

Frequently Asked Questions

How much does renters insurance cost?

+The cost of renters insurance can vary based on factors such as the location of your rental property, the coverage limits you choose, and any additional endorsements or discounts. On average, renters insurance policies can range from 15 to 30 per month. However, it’s best to obtain quotes from multiple insurers to get a more accurate estimate for your specific situation.

Do I need renters insurance if my landlord has insurance?

+While your landlord may have insurance for the building, it typically covers the structure and the landlord’s liability. Renters insurance is necessary to protect your personal belongings and provide liability coverage for your actions. It is a separate policy that ensures your financial well-being in case of unforeseen events.

What is not covered by renters insurance?

+Renters insurance typically excludes certain types of losses and perils. Common exclusions include damage caused by earthquakes, floods, nuclear incidents, intentional acts, and war. It’s important to review the policy’s exclusions carefully to understand what is not covered.

Can I add high-value items to my renters insurance policy?

+Yes, you can add coverage for high-value items such as jewelry, art, or electronics that exceed the standard policy limits. This is often done through endorsements or riders, which provide additional coverage for specific items. Consult with your insurance provider to discuss your options and ensure adequate protection for your valuable possessions.

How often should I review my renters insurance policy?

+It is recommended to review your renters insurance policy annually or whenever there are significant changes in your personal circumstances. This includes changes in the value of your belongings, moving to a new rental property, getting married or divorced, or acquiring new assets. Regular policy reviews ensure that your coverage remains adequate and aligned with your needs.

Renters insurance is a vital investment for anyone renting a living space. By understanding the benefits, coverage options, and finding the best quotes, you can protect your belongings, secure your financial well-being, and enjoy peace of mind. Remember to shop around, compare quotes, and tailor your policy to fit your unique situation.