Life Quote Insurance

Life Quote Insurance is a specialized insurance service that offers individuals and families a tailored approach to securing their financial future. In an ever-changing world, where life's uncertainties can arise unexpectedly, having a robust life insurance policy is paramount. This comprehensive guide will delve into the intricacies of Life Quote Insurance, exploring its benefits, features, and how it can provide peace of mind during challenging times.

Understanding Life Quote Insurance

Life Quote Insurance is an innovative concept designed to revolutionize the traditional life insurance landscape. It goes beyond the one-size-fits-all approach, offering personalized insurance solutions that cater to the unique needs of each policyholder. By conducting a thorough assessment of an individual’s circumstances, including their financial goals, family obligations, and health status, Life Quote Insurance providers create tailored policies that offer comprehensive coverage.

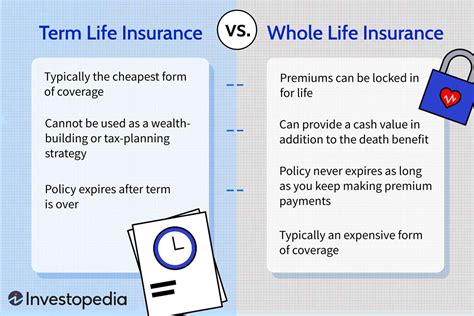

One of the key advantages of Life Quote Insurance is its flexibility. Policyholders can choose from a range of coverage options, including term life insurance, whole life insurance, and various riders that address specific concerns such as critical illness or accidental death. This adaptability ensures that individuals can customize their insurance plan to align with their current and future financial needs.

Key Features of Life Quote Insurance

- Personalized Coverage: Life Quote Insurance providers work closely with clients to understand their specific requirements. Whether it’s protecting their family’s financial stability, covering mortgage payments, or ensuring sufficient funds for a child’s education, the policy can be tailored to meet these unique needs.

- Competitive Premiums: By offering personalized plans, Life Quote Insurance often provides competitive premium rates. The detailed assessment process ensures that policyholders are not overpaying for coverage they may not need, making it an affordable option for individuals at various life stages.

- Flexible Payment Options: Policyholders can choose from a variety of payment plans, including monthly, quarterly, or annual premiums. This flexibility allows individuals to manage their finances more effectively and select a payment schedule that aligns with their income and budget.

- Accelerated Benefit Riders: Life Quote Insurance often includes the option to add riders that provide additional benefits. For instance, an accelerated benefit rider allows policyholders to access a portion of their death benefit if they are diagnosed with a terminal illness, providing much-needed financial support during challenging times.

| Coverage Type | Description |

|---|---|

| Term Life Insurance | Offers coverage for a specific period, typically ranging from 10 to 30 years. It is ideal for individuals seeking temporary coverage to protect their loved ones during key financial commitments. |

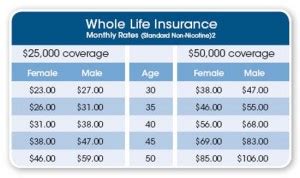

| Whole Life Insurance | Provides lifelong coverage, ensuring that policyholders and their beneficiaries are protected for the long term. Whole life insurance also accumulates cash value over time, which can be borrowed against or used for various financial needs. |

| Critical Illness Rider | This rider provides a lump-sum payment if the policyholder is diagnosed with a critical illness, such as cancer or heart disease. It offers financial support during treatment and recovery, allowing individuals to focus on their health. |

| Accidental Death Benefit Rider | In the unfortunate event of an accidental death, this rider provides an additional payout to the beneficiary, ensuring they receive extra financial assistance during a difficult time. |

The Process of Obtaining Life Quote Insurance

The journey towards securing Life Quote Insurance is designed to be efficient and personalized. Here’s a step-by-step breakdown of the process:

Step 1: Initial Consultation

The first step involves a comprehensive consultation with a licensed insurance advisor. During this meeting, the advisor will discuss the client’s financial goals, family situation, and any specific concerns they may have. This initial conversation sets the foundation for creating a personalized insurance plan.

Step 2: Policy Assessment and Quoting

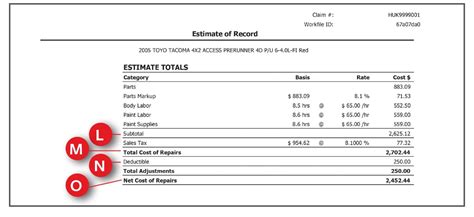

Based on the information gathered during the consultation, the insurance advisor will assess the client’s needs and provide a detailed quote. This quote will outline the coverage options, premiums, and any additional riders that may be beneficial. The advisor will also explain the terms and conditions of the policy to ensure the client fully understands their coverage.

Step 3: Policy Selection and Customization

With a clear understanding of their options, the client can then select the policy that best aligns with their needs. At this stage, they can also choose to customize their coverage by adding or removing riders to create a plan that is truly unique to their circumstances. This level of customization is a key advantage of Life Quote Insurance.

Step 4: Application and Underwriting

Once the policy has been selected, the client will need to complete an application form. This form will require detailed information about the client’s health, lifestyle, and financial situation. The application will then undergo an underwriting process, where the insurance provider assesses the risk associated with the policy. This step may involve medical examinations or additional health assessments, depending on the client’s age and health status.

Step 5: Policy Issuance and Review

After the underwriting process is complete, the insurance provider will issue the policy. The client will receive a policy document outlining the terms, conditions, and coverage details. It is essential to thoroughly review this document to ensure all the desired coverage is included. If any changes are required, the client can work with their insurance advisor to make the necessary adjustments.

The Benefits of Choosing Life Quote Insurance

Life Quote Insurance offers a range of advantages that set it apart from traditional insurance providers. Here are some key benefits:

- Tailored Coverage: Life Quote Insurance ensures that individuals receive a policy that is customized to their specific needs. Whether it's protecting their family's future, covering business expenses, or securing their legacy, the coverage can be tailored to address these concerns.

- Expert Guidance: Licensed insurance advisors play a crucial role in the process. They provide valuable guidance, ensuring that clients understand their options and make informed decisions. Their expertise helps individuals navigate the complex world of insurance with ease.

- Flexible Payment Options: Life Quote Insurance providers offer flexible payment plans, allowing policyholders to choose a schedule that suits their financial situation. This flexibility ensures that individuals can maintain their coverage without straining their finances.

- Competitive Premiums: By assessing an individual's unique circumstances, Life Quote Insurance providers can offer competitive premium rates. This personalized approach ensures that policyholders are not overpaying for coverage they may not need.

- Comprehensive Coverage: Life Quote Insurance policies can include a range of benefits, from term life insurance to critical illness coverage. This comprehensive approach ensures that policyholders are protected against various life events, providing a safety net for their loved ones.

Life Quote Insurance: A Secure Future

In an unpredictable world, Life Quote Insurance offers a beacon of financial security and peace of mind. By tailoring insurance policies to individual needs, it ensures that policyholders can protect their loved ones, secure their financial future, and navigate life’s challenges with confidence. With its personalized approach, competitive premiums, and comprehensive coverage, Life Quote Insurance is a smart choice for anyone seeking to safeguard their future.

How does Life Quote Insurance differ from traditional life insurance policies?

+Life Quote Insurance stands out by offering personalized coverage tailored to an individual’s unique needs. It provides a flexible and customizable approach, allowing policyholders to choose the coverage that best suits their financial goals and family obligations. This level of customization is often lacking in traditional life insurance policies, which tend to offer more generic coverage options.

What are the main advantages of choosing Life Quote Insurance over other providers?

+Life Quote Insurance offers several key advantages. Firstly, it provides a comprehensive assessment of an individual’s financial situation, ensuring that the policy aligns with their specific needs. Secondly, it offers competitive premiums due to its personalized approach, which means policyholders are not overpaying for coverage they may not require. Lastly, the flexibility to choose from various coverage options and payment plans makes it an attractive choice for individuals at different life stages.

Can I add riders to my Life Quote Insurance policy, and what benefits do they offer?

+Absolutely! Life Quote Insurance policies often come with the option to add riders, which provide additional benefits. For instance, a critical illness rider can provide a lump-sum payment if the policyholder is diagnosed with a critical illness, offering financial support during treatment. An accidental death benefit rider provides an extra payout in the event of an accidental death, ensuring added financial security for the beneficiary.