What Is Policy Term In Life Insurance

Understanding the intricacies of life insurance is essential for anyone seeking financial protection for their loved ones. One crucial aspect that often raises questions is the concept of the policy term, a fundamental component that defines the duration and nature of coverage provided by a life insurance policy.

In the world of life insurance, the policy term acts as the backbone, determining the longevity and characteristics of the coverage offered. It outlines the specific time frame during which the policy remains active and in force, ensuring the insured individual and their beneficiaries receive the promised benefits.

The Policy Term: Unlocking the Fundamentals

At its core, the policy term refers to the predetermined duration for which a life insurance policy remains valid and active. It signifies the period for which the insurance company agrees to provide coverage to the policyholder, ensuring financial support to the designated beneficiaries upon the insured's death.

Policy terms are typically expressed in years and can range from as short as a few years to several decades, depending on the type of policy and the preferences of the policyholder. The selected term length influences the overall cost, coverage amount, and flexibility of the policy.

Types of Policy Terms

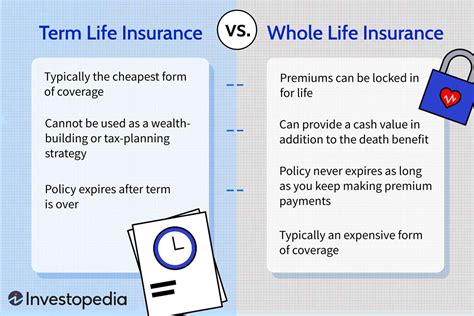

Life insurance policies generally fall into two main categories based on their policy terms: term life insurance and permanent life insurance. Each type offers distinct advantages and caters to different financial needs and goals.

Term Life Insurance

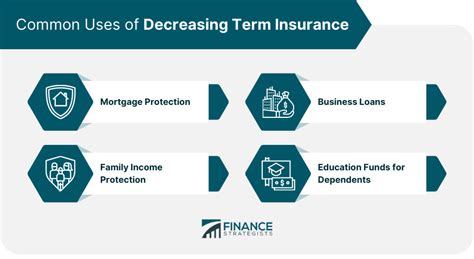

Term life insurance, as the name suggests, provides coverage for a specific term or period. This type of policy is designed to offer financial protection for a defined timeframe, often chosen to coincide with significant life events or financial responsibilities.

For instance, a young family might opt for a 20-year term life insurance policy to ensure their children's education and mortgage payments are covered in the event of the primary breadwinner's untimely demise. Once the term expires, the policyholder can renew the policy or opt for a different plan, considering their changing needs and circumstances.

| Term Length | Coverage |

|---|---|

| 10 Years | Short-term protection for specific goals like debt repayment. |

| 20 Years | Common choice for covering children's education and home loans. |

| 30 Years | Provides long-term protection for families with young children. |

Permanent Life Insurance

Permanent life insurance, on the other hand, offers coverage that lasts a lifetime, ensuring financial security for the insured and their beneficiaries as long as premiums are paid. This type of policy includes whole life, universal life, and variable life insurance.

Whole life insurance provides a guaranteed death benefit, cash value accumulation, and fixed premium payments. Universal life insurance offers flexibility in premium payments and death benefit amounts, with the potential for cash value growth. Variable life insurance allows policyholders to invest a portion of their premiums in different investment options, providing the opportunity for higher returns but also carrying more risk.

| Type | Key Features |

|---|---|

| Whole Life | Guaranteed death benefit, cash value accumulation, fixed premiums. |

| Universal Life | Flexible premiums and death benefit, potential for cash value growth. |

| Variable Life | Investment-linked policy, offers potential for higher returns but carries more risk. |

Choosing the Right Policy Term

Selecting the appropriate policy term is a critical decision that should align with an individual's unique financial situation and goals. Factors such as age, financial responsibilities, family commitments, and long-term financial plans all play a role in determining the ideal policy term.

Young professionals starting their careers might opt for a shorter term policy to cover immediate needs, while those with growing families and long-term financial goals may choose a permanent life insurance policy for lifetime coverage and the opportunity to build cash value.

Policy Term Renewal and Conversion

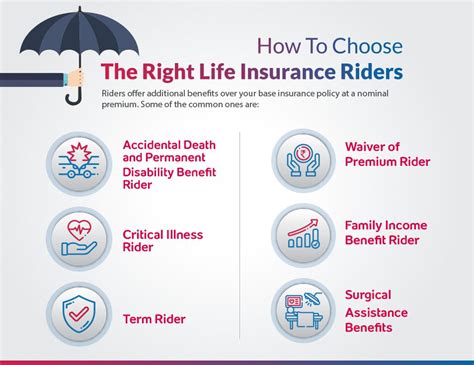

Life insurance policies often come with the option for renewal or conversion, allowing policyholders to extend or modify their coverage as their circumstances change.

Renewal

Renewal refers to the process of extending the policy term beyond its initial expiration date. This is typically done by paying an additional premium, and the new term length is subject to the insurer's guidelines and the policyholder's age and health status.

Conversion

Conversion is the process of changing the type of life insurance policy from a term policy to a permanent one. This option is usually available during the initial term of the policy and allows policyholders to switch to a permanent policy without undergoing a new medical exam or providing additional evidence of insurability.

Considerations for Renewal and Conversion

Renewal and conversion options provide flexibility to policyholders, but they come with certain considerations. Renewing a policy often results in higher premiums due to the increased age and potential health risks of the insured. Conversion, while offering the advantage of guaranteed acceptance, may also lead to higher premiums compared to starting a new permanent policy at a younger age.

Policy Term and Premium Payments

The policy term significantly influences the premium payments associated with a life insurance policy. Generally, longer policy terms and permanent life insurance policies come with higher premiums compared to shorter term policies.

Premiums can be paid on a monthly, quarterly, semi-annual, or annual basis, and the frequency of payment is chosen by the policyholder. It's essential to consider the financial implications of premium payments when selecting a policy term, as it directly impacts the overall cost of the insurance coverage.

Policy Term and Coverage Amount

The policy term and the coverage amount, or the death benefit, are closely intertwined. In term life insurance, the coverage amount is typically set for the duration of the policy term, ensuring that the beneficiaries receive the agreed-upon sum upon the insured's death during that period.

In permanent life insurance, the coverage amount is usually guaranteed for life, offering peace of mind to the policyholder and their beneficiaries. However, the coverage amount can also be adjusted during the policy term, subject to the insurer's guidelines and the policyholder's needs.

Policy Term and Policy Flexibility

The policy term also plays a role in determining the flexibility of a life insurance policy. Term life insurance policies are generally more straightforward and offer limited flexibility, while permanent life insurance policies provide a higher degree of flexibility in terms of premium payments, coverage amounts, and potential cash value accumulation.

For instance, universal life insurance policies allow policyholders to adjust their premium payments and death benefit amounts, making them suitable for those with changing financial needs or goals. On the other hand, term life insurance policies are more rigid, with the coverage amount and term length set at the outset of the policy.

Policy Term and Future Implications

Understanding the policy term and its implications is crucial for making informed decisions about life insurance coverage. It's essential to consider not only the immediate needs but also the long-term financial goals and potential life changes that may occur over the policy term.

As life circumstances evolve, the policy term can be a critical factor in ensuring adequate coverage and financial security. Regular reviews of the policy term and overall coverage are recommended to align with changing needs and ensure that the policy continues to provide the desired level of protection.

Conclusion

The policy term is a fundamental aspect of life insurance that defines the duration and nature of coverage. It influences the cost, flexibility, and overall financial security provided by the policy. Whether opting for a term life or permanent life insurance policy, understanding the policy term is key to making informed decisions and securing the future well-being of loved ones.

Can I change the policy term once the policy is in force?

+Changing the policy term after the policy is active can be challenging. It typically requires a new application and a new medical exam, and the insurer may not offer the same terms as the original policy. Renewal and conversion options provide more flexibility during the initial policy term.

Are there any age limits for purchasing life insurance with a specific policy term?

+Yes, age limits vary depending on the insurer and the type of policy. Term life insurance often has upper age limits for the policy term, while permanent life insurance may have more flexible options for older individuals. It’s best to consult with an insurance agent to understand the specific age limits and options available.

What happens if I outlive the policy term in a term life insurance policy?

+If you outlive the policy term in a term life insurance policy, the coverage expires, and you no longer have insurance coverage. However, some insurers offer conversion options, allowing you to convert your term policy into a permanent life insurance policy without undergoing a new medical exam.