Insurance Benefits

Insurance benefits are a crucial aspect of financial planning and risk management. They provide individuals and businesses with a safety net, offering protection against various uncertainties and potential losses. With a wide range of insurance policies available, understanding the benefits and features is essential to make informed decisions and ensure adequate coverage.

Unraveling the World of Insurance Benefits

The insurance industry offers a plethora of benefits designed to safeguard policyholders from a multitude of risks. These benefits can vary significantly depending on the type of insurance and the specific policy chosen. From comprehensive health coverage to asset protection, insurance benefits play a pivotal role in securing one’s financial well-being.

Health Insurance: A Lifeline for Well-being

Health insurance stands as one of the most critical insurance benefits, offering coverage for medical expenses. With rising healthcare costs, this benefit is a financial lifeline for many individuals and families. It ensures access to essential medical services, medications, and treatments, alleviating the financial burden associated with unexpected illnesses or injuries.

A typical health insurance policy provides coverage for:

- Hospitalization and medical procedures

- Doctor consultations and specialist visits

- Diagnostic tests and screenings

- Prescription medications

- Emergency care and ambulance services

Furthermore, some policies offer additional benefits such as:

- Maternity and newborn care

- Mental health coverage

- Dental and vision care

- Alternative therapy options

The level of coverage and benefits can vary based on the policy's premium, deductible, and co-payment structure. It's essential to carefully review the policy terms and understand the scope of coverage to ensure it aligns with one's specific healthcare needs.

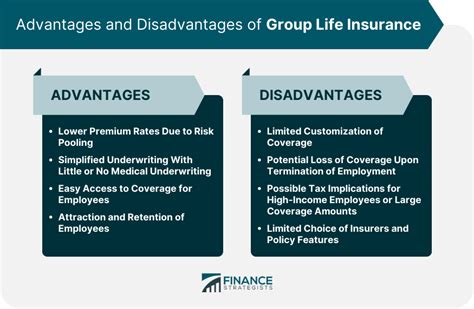

Life Insurance: Securing Your Legacy

Life insurance is another vital benefit, providing financial protection to beneficiaries upon the policyholder’s death. This benefit ensures that loved ones are financially secure, even in the event of an untimely demise. It can cover various expenses, including funeral costs, outstanding debts, and ongoing living expenses for dependents.

There are primarily two types of life insurance:

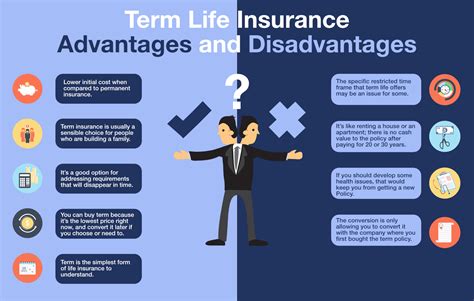

- Term Life Insurance: Offers coverage for a specific term, typically 10-30 years. It provides a death benefit to beneficiaries if the policyholder passes away during the term.

- Permanent Life Insurance: Provides lifetime coverage and typically includes a cash value component that grows over time. It offers both a death benefit and the potential for financial growth.

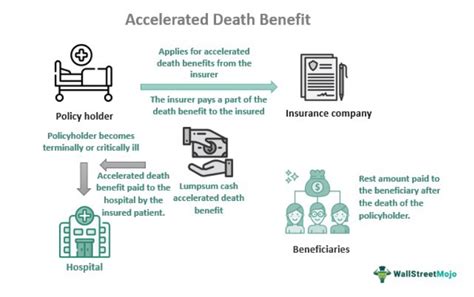

Life insurance benefits can also extend to cover critical illnesses, such as cancer or heart disease, providing a lump sum payment to assist with treatment and living expenses during a challenging time.

Property and Casualty Insurance: Protecting Your Assets

Property and casualty insurance benefits are designed to protect policyholders’ assets, such as homes, vehicles, and personal belongings, from various risks and perils. This category of insurance includes:

- Homeowners Insurance: Provides coverage for the structure of the home, personal belongings, and liability protection. It can also offer additional living expenses if the home becomes uninhabitable due to a covered loss.

- Renters Insurance: Protects tenants’ personal belongings and provides liability coverage, ensuring financial protection in case of accidents or damage caused by the renter.

- Auto Insurance: Covers vehicles against accidents, theft, and other perils. It typically includes liability coverage, collision coverage, and comprehensive coverage to protect against a range of risks.

These insurance benefits not only safeguard assets but also provide peace of mind, knowing that one is financially prepared to handle unforeseen circumstances.

Business Insurance: Shielding Commercial Ventures

Business insurance benefits are tailored to protect commercial enterprises from a wide array of risks. These policies are essential for entrepreneurs and business owners to mitigate potential losses and ensure continuity.

Key business insurance benefits include:

- General Liability Insurance: Covers a business against third-party claims, such as bodily injury or property damage, providing protection from lawsuits and legal expenses.

- Professional Liability Insurance (Errors and Omissions): Protects businesses offering professional services from claims of negligence or failure to perform adequately.

- Product Liability Insurance: Insures manufacturers and sellers against claims arising from defective products.

- Workers' Compensation Insurance: Provides coverage for employees who suffer work-related injuries or illnesses, ensuring medical care and wage replacement.

Business insurance benefits are customizable, allowing businesses to select the coverage that best aligns with their specific needs and industry risks.

Travel Insurance: Safeguarding Your Adventures

Travel insurance benefits offer protection while traveling, covering a range of potential issues that may arise during a trip. Whether it’s a leisure vacation or a business trip, travel insurance provides peace of mind and financial security.

Key travel insurance benefits include:

- Trip Cancellation and Interruption: Provides reimbursement for non-refundable trip expenses if the trip is canceled or interrupted due to covered reasons, such as illness or severe weather.

- Medical Emergency Coverage: Covers emergency medical treatment and evacuation while traveling, ensuring access to necessary healthcare services.

- Baggage and Personal Effects: Offers compensation for lost, stolen, or damaged luggage and personal items.

- Travel Delay: Provides reimbursement for additional expenses incurred due to delays, such as accommodation and meals.

Travel insurance benefits can vary based on the policy and the destination, so it's crucial to review the coverage and understand any exclusions before purchasing.

Maximizing Insurance Benefits: A Strategic Approach

Understanding and maximizing insurance benefits requires a strategic approach. Here are some key considerations:

- Tailored Coverage: Review your specific needs and risks to ensure your insurance policies provide adequate coverage. Don’t settle for a one-size-fits-all approach.

- Understand Policy Terms: Carefully read and comprehend the policy documents. Be aware of exclusions, deductibles, and any specific conditions that may impact your coverage.

- Regular Policy Review: As your circumstances change, review your insurance policies annually to ensure they still align with your needs. Life events, such as marriage, childbirth, or career changes, may require adjustments to your coverage.

- Compare Providers: Shop around and compare insurance providers to find the best value and coverage. Different companies offer varying benefits and price points.

- Utilize Additional Benefits: Many insurance policies offer additional benefits, such as wellness programs, discounts, or access to specialized services. Take advantage of these perks to enhance your overall experience.

Conclusion

Insurance benefits are a powerful tool to mitigate risks and secure one’s financial future. From health and life insurance to property and business coverage, these benefits provide a safety net during uncertain times. By understanding the available options and customizing policies to individual needs, policyholders can navigate life’s challenges with greater confidence and peace of mind.

How do I choose the right insurance policy for my needs?

+Selecting the right insurance policy involves assessing your unique needs and risks. Consider factors such as your age, health status, family situation, assets, and business requirements. Compare policies from different providers to find the best coverage and value. It’s also beneficial to consult with an insurance professional who can guide you through the process.

What are some common exclusions in insurance policies?

+Common exclusions vary depending on the type of insurance. For health insurance, pre-existing conditions or certain treatments may be excluded. In property insurance, damage caused by floods or earthquakes may require additional coverage. It’s crucial to review the policy’s exclusions to understand what’s not covered.

Can I customize my insurance policy to include specific benefits?

+Yes, many insurance policies offer customization options. You can often add endorsements or riders to tailor the policy to your specific needs. For example, you can enhance your health insurance policy with maternity coverage or include coverage for specific sports or hobbies in your homeowners insurance.