What Is A Term Policy Life Insurance

Term policy life insurance is a type of life insurance that offers financial protection for a specified period of time, typically ranging from 10 to 30 years. Unlike permanent life insurance policies, which provide coverage for the insured's entire life, term life insurance focuses on providing affordable coverage during specific stages of life when financial responsibilities are high. It is designed to offer a cost-effective solution for individuals and families seeking temporary protection against unforeseen events, such as the untimely death of the primary income earner.

Understanding Term Life Insurance

Term life insurance policies are straightforward and offer a simple approach to life insurance coverage. The policyholder pays a fixed premium for a predetermined period, known as the term. During this term, the policy provides a death benefit to the named beneficiaries in the event of the insured’s passing. The death benefit can be used to cover a variety of expenses, including funeral costs, outstanding debts, daily living expenses, or even college tuition for dependents.

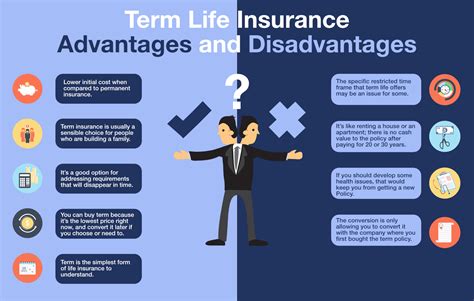

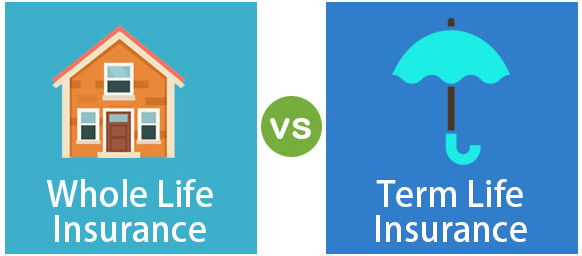

One of the key advantages of term life insurance is its affordability. The premiums for term policies are generally lower compared to permanent life insurance options like whole life or universal life insurance. This makes term life insurance an accessible choice for individuals who may have budget constraints but still wish to secure financial protection for their loved ones.

Term life insurance policies often offer flexibility in terms of coverage amounts and durations. Policyholders can choose coverage levels that align with their specific financial needs and responsibilities. For instance, a young couple with growing children may opt for a higher coverage amount to ensure their family's financial security during their children's formative years. As their children grow older and become more independent, they can adjust their coverage or even consider transitioning to a different type of life insurance policy.

Key Features of Term Life Insurance

-

Fixed Premiums: Term life insurance policies typically offer level premiums for the duration of the term. This means the policyholder pays the same premium amount each month or year, providing financial predictability and ease of budgeting.

-

Guaranteed Death Benefit: If the insured passes away during the policy term, the named beneficiaries receive the death benefit as specified in the policy. This benefit can provide much-needed financial support to cover immediate and long-term expenses.

-

Renewable and Convertible Options: Many term life insurance policies allow for renewal at the end of the term, often at a higher premium to account for increased age and potential health changes. Additionally, some policies offer the option to convert the term policy into a permanent life insurance policy without requiring additional medical underwriting.

-

Rider Options: Riders are optional additions to the base policy that can enhance coverage. Common riders include waiver of premium (which waives premium payments if the insured becomes disabled), accelerated death benefit (which allows for a portion of the death benefit to be received while the insured is still alive in the case of a terminal illness), and child rider (which provides a small death benefit for the insured’s children in the event of their untimely passing).

| Term Length | Average Annual Premium for $500,000 Coverage |

|---|---|

| 10-year term | $350 |

| 20-year term | $450 |

| 30-year term | $600 |

Common Applications of Term Life Insurance

Term life insurance serves a variety of purposes and is often utilized in the following scenarios:

Mortgage Protection

A term life insurance policy can be an effective tool for ensuring that a family’s home is protected in the event of the primary income earner’s death. The death benefit can be used to pay off the remaining mortgage balance, allowing the surviving family members to remain in their home without the burden of a large mortgage payment.

Income Replacement

For individuals who are the primary source of income for their household, term life insurance can provide a crucial income replacement for their dependents. The death benefit can cover daily living expenses, such as groceries, utilities, and childcare, ensuring that the family’s standard of living is maintained even in the absence of the primary income earner.

Education Funding

Many parents utilize term life insurance to secure their children’s future education. By selecting a term that covers the years leading up to their children’s college enrollment, they can ensure that the death benefit will be available to cover tuition fees and other education-related expenses.

Business Continuity

Term life insurance is also commonly used in business settings to protect against the loss of key personnel. For example, a business owner might take out a term policy on a key employee, ensuring that the business has the financial means to hire and train a replacement should that employee pass away unexpectedly.

The Bottom Line

Term life insurance is a valuable tool for individuals and families seeking affordable, temporary life insurance coverage. Its flexibility, affordability, and simplicity make it an attractive option for those with specific financial protection needs during defined periods of their lives. Whether it’s protecting your mortgage, ensuring your family’s financial stability, or securing your children’s future, term life insurance can provide the peace of mind that comes with knowing your loved ones are financially protected.

Can I renew my term life insurance policy when the term expires?

+Yes, many term life insurance policies offer the option to renew at the end of the term. However, it’s important to note that the renewal premium may be higher, as it will reflect your increased age and potential changes in health status.

What happens if I need life insurance coverage beyond the term of my policy?

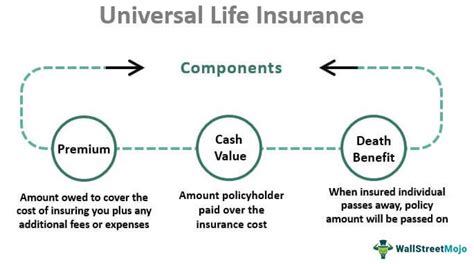

+If you anticipate needing life insurance coverage beyond the term of your policy, you may want to consider a convertible term policy. These policies allow you to convert your term life insurance into a permanent life insurance policy, often without requiring additional medical underwriting.

How do I know if term life insurance is the right choice for me?

+Determining the right type of life insurance involves considering your specific needs and financial situation. If you’re seeking affordable coverage for a defined period, such as to protect your family’s financial stability while your children are young or to cover a mortgage, term life insurance may be a suitable choice. However, if you’re looking for lifetime coverage or have specific estate planning needs, permanent life insurance options like whole life or universal life may be more appropriate.