Bestcarinsurancequotes

Welcome to the comprehensive guide on navigating the complex world of car insurance quotes. In today's fast-paced digital age, obtaining the best car insurance coverage has become an essential yet often confusing task. With countless providers and an array of coverage options, finding the most suitable car insurance can be a daunting challenge. This expert-crafted guide aims to simplify the process, offering an in-depth analysis of the factors that influence car insurance quotes and providing valuable insights to help you make an informed decision.

Understanding Car Insurance Quotes: A Deep Dive

Car insurance quotes are more than just a number; they are a reflection of your unique driving profile, vehicle specifications, and the coverage you require. These quotes serve as a gateway to understanding the cost and scope of your car insurance policy, which can significantly impact your financial well-being and peace of mind on the road.

Factors Influencing Car Insurance Quotes

A multitude of factors come into play when determining car insurance quotes. From your age and driving history to the make and model of your vehicle, each aspect contributes to the overall quote. For instance, younger drivers with less experience on the road may face higher premiums due to statistical trends suggesting a higher risk of accidents.

| Factor | Impact on Quote |

|---|---|

| Age | Younger drivers may pay more due to higher risk. |

| Driving History | A clean record can lead to lower premiums. |

| Vehicle Type | Sports cars or luxury vehicles often attract higher rates. |

| Location | Urban areas with higher accident rates may result in increased quotes. |

Additionally, the coverage options you choose play a pivotal role. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, typically costs more than basic liability coverage. However, it's crucial to strike a balance between cost and the level of protection you need.

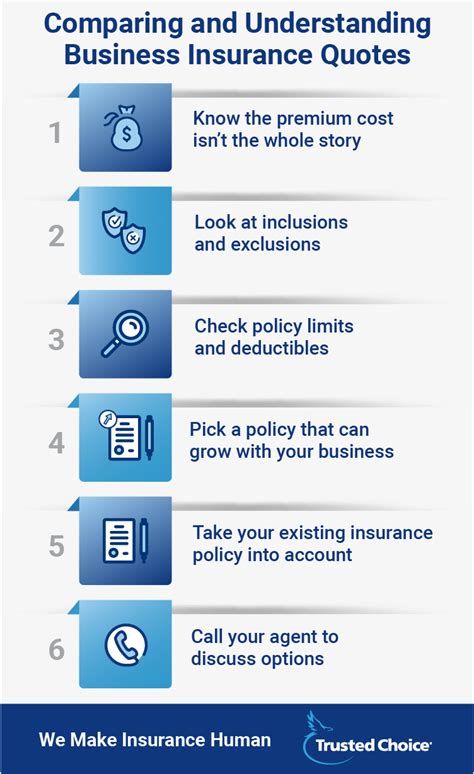

Tips for Obtaining the Best Car Insurance Quotes

Securing the best car insurance quotes requires a strategic approach. Here are some expert tips to guide you:

- Compare Multiple Quotes: Don’t settle for the first quote you receive. Explore various providers to compare rates and coverage.

- Understand Your Coverage Needs: Assess your specific requirements, whether it’s comprehensive coverage, liability, or a tailored package.

- Bundle Policies: Combining car insurance with other policies like home or life insurance can often lead to discounts.

- Maintain a Clean Driving Record: A spotless driving history can significantly impact your premiums for the better.

- Explore Discounts: Many providers offer discounts for safe driving, good grades (for young drivers), and loyalty.

Analyzing Coverage Options: A Comprehensive Breakdown

Car insurance coverage extends beyond the basic liability requirement. It’s crucial to understand the various types of coverage available to make an informed decision about your policy.

Liability Coverage

Liability coverage is a fundamental component of car insurance. It covers the costs associated with damages you cause to others’ property or injuries you inflict on others in an accident. This coverage is typically divided into bodily injury liability and property damage liability.

Collision and Comprehensive Coverage

Collision coverage steps in when your vehicle is damaged in an accident, regardless of fault. It covers repairs or replacements, ensuring your vehicle is back on the road promptly. On the other hand, comprehensive coverage provides protection against a range of non-collision incidents, including theft, vandalism, natural disasters, and animal collisions.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a crucial coverage option, especially in states where it’s mandatory. PIP covers medical expenses and lost wages resulting from injuries sustained in an accident, regardless of fault. This coverage can provide much-needed financial relief during recovery.

Uninsured/Underinsured Motorist Coverage

In the unfortunate event of an accident with an uninsured or underinsured driver, this coverage steps in to protect you. It covers your medical expenses and vehicle repairs, ensuring you’re not left financially burdened by another driver’s lack of insurance.

Additional Coverages

Depending on your needs and location, there are various additional coverages to consider. These might include rental car reimbursement, roadside assistance, gap insurance, and more. These coverages can provide added peace of mind and financial protection in specific situations.

Comparative Analysis: Top Car Insurance Providers

The car insurance market is teeming with providers, each offering unique benefits and coverage options. To help you navigate this landscape, we’ve conducted a comparative analysis of some of the top providers in the industry.

Provider A: Focus on Customer Service

Provider A has built its reputation on exceptional customer service. With a dedicated team of agents, they offer personalized assistance and a streamlined claims process. Their policies are comprehensive and customizable, allowing you to tailor your coverage to your specific needs. However, their premiums may be slightly higher than average due to the added customer service benefits.

Provider B: Competitive Pricing

Provider B is known for its competitive pricing, making it an attractive option for budget-conscious consumers. They offer a range of discounts, including loyalty discounts, safe driver incentives, and multi-policy bundles. While their policies may not offer the same level of customization as Provider A, they provide solid coverage at a great value.

Provider C: Innovative Technology

Provider C stands out for its innovative use of technology. They offer a range of digital tools and apps to enhance the customer experience, including real-time claims tracking and virtual accident assistance. Their policies are designed with a modern approach, offering flexible coverage options and seamless digital interactions. However, their focus on technology may not appeal to those who prefer traditional insurance methods.

Future Trends in Car Insurance

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of car insurance:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance models are gaining traction. These technologies track driving behavior, offering discounts to safe drivers and providing real-time feedback for improvement. This shift towards data-driven insurance could revolutionize the way premiums are calculated, rewarding responsible driving habits.

Autonomous Vehicles and Insurance

As autonomous vehicles become more prevalent, the insurance landscape will adapt. The focus may shift from driver liability to vehicle and system liability, with policies covering potential failures in autonomous technology. This shift could lead to more complex and specialized insurance policies.

Digital Transformation

The digital transformation of the insurance industry is well underway. From online quote comparisons to digital claims processing, the entire insurance journey is becoming more streamlined and efficient. This digital shift will continue to enhance the customer experience, making insurance more accessible and transparent.

Conclusion: Empowering Your Car Insurance Journey

Obtaining the best car insurance quotes and coverage is a critical aspect of financial planning and road safety. By understanding the factors that influence quotes, exploring various coverage options, and staying abreast of industry trends, you can make informed decisions that align with your needs and budget. Remember, car insurance is more than just a legal requirement—it’s a vital safeguard for your financial well-being and peace of mind on the road.

How often should I review my car insurance policy?

+It’s recommended to review your policy annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and up-to-date.

What factors can lead to an increase in my car insurance premiums?

+Premiums can increase due to factors like age, driving history, location, and the type of vehicle you drive. Additionally, making a claim can sometimes result in higher premiums.

Are there any ways to reduce my car insurance costs?

+Yes, you can explore discounts, such as safe driver discounts, good student discounts, or loyalty discounts. Additionally, maintaining a clean driving record and comparing quotes regularly can help reduce costs.