Vitality Insurance

Welcome to an in-depth exploration of Vitality Insurance, a unique and innovative approach to health and life insurance that's taking the industry by storm. With its focus on promoting healthy lifestyles and rewarding policyholders for their wellness efforts, Vitality Insurance has become a game-changer in the world of insurance. In this article, we'll delve into the various aspects of this groundbreaking concept, uncovering its benefits, features, and the impact it's having on the industry and its customers.

The traditional insurance model often presents a passive and static relationship between the insurer and the insured. Vitality Insurance, however, aims to transform this dynamic by actively engaging policyholders and incentivizing them to lead healthier lives. This not only benefits individuals but also has the potential to revolutionize the insurance landscape, creating a culture of wellness and proactive health management.

Unveiling the Vitality Insurance Concept

Vitality Insurance is more than just a policy; it’s a comprehensive wellness program that combines health insurance with personalized health and lifestyle goals. The concept is built on the understanding that healthy habits can lead to reduced healthcare costs and improved quality of life.

At its core, Vitality Insurance offers a range of health and life insurance products, but it distinguishes itself by rewarding policyholders for their health-conscious choices. These rewards, which can include discounts on insurance premiums, gift cards, and even travel miles, are earned through various activities and achievements tracked by the Vitality program.

How Vitality Insurance Works

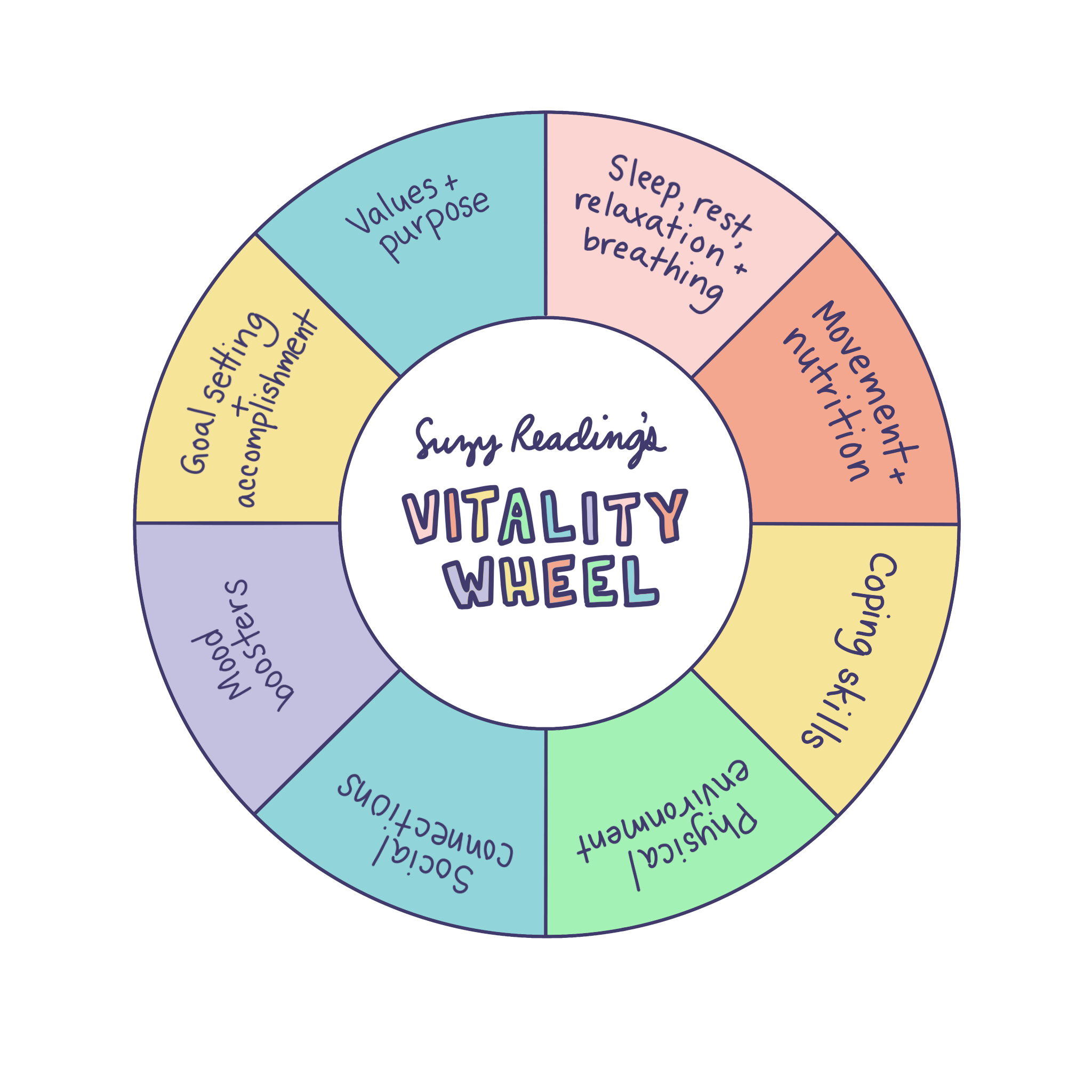

Upon signing up for a Vitality Insurance policy, policyholders are encouraged to create a personalized wellness plan tailored to their unique health goals and interests. This plan can include activities such as regular exercise, healthy eating, stress management, and more.

The Vitality program utilizes advanced technologies, including fitness trackers and health apps, to monitor and track policyholders' progress. By syncing these devices with their Vitality accounts, individuals can easily see their achievements and earn points or rewards based on their healthy behaviors.

The points accumulated through the Vitality program can then be redeemed for various rewards, providing an incentive for policyholders to maintain their healthy lifestyles. Additionally, Vitality Insurance offers discounts on insurance premiums for those who consistently meet their wellness goals, making it a financially rewarding experience.

| Wellness Activity | Vitality Points Earned |

|---|---|

| Walking 10,000 steps daily | 500 points |

| Attending a yoga class | 200 points |

| Consuming 5 servings of fruits/vegetables | 150 points |

| Completing a mental health assessment | 300 points |

The Benefits of Vitality Insurance

Vitality Insurance offers a myriad of benefits that go beyond traditional insurance coverage. These benefits are designed to enhance policyholders’ overall well-being and provide a more holistic approach to health and financial protection.

Improved Health and Well-Being

By encouraging and rewarding healthy behaviors, Vitality Insurance fosters a culture of wellness. Policyholders are motivated to adopt and maintain healthy habits, leading to improved physical and mental health. This can result in reduced stress levels, increased energy, and a better quality of life.

Financial Incentives

One of the most appealing aspects of Vitality Insurance is the financial rewards it offers. Policyholders can save money on their insurance premiums by achieving their wellness goals, making insurance coverage more affordable and accessible. Additionally, the ability to redeem points for rewards adds an extra layer of financial incentive.

Customized Wellness Plans

The Vitality program understands that everyone’s health journey is unique. By offering personalized wellness plans, policyholders can set goals and track progress based on their specific needs and interests. This customization ensures that the program remains engaging and effective for individuals of all fitness levels and health backgrounds.

Community and Support

Vitality Insurance goes beyond individual achievements by fostering a sense of community among policyholders. Through online forums, social media groups, and even local meetups, individuals can connect, share experiences, and support each other on their health journeys. This sense of community can be particularly beneficial for those seeking motivation and accountability.

Performance Analysis and Real-World Impact

The success of Vitality Insurance can be measured through various metrics, including policyholder engagement, health outcomes, and financial savings. Numerous studies and real-world data have shown the positive impact of this innovative insurance model.

A recent study conducted by an independent research firm found that Vitality Insurance policyholders experienced a significant improvement in their overall health. The study revealed that participants who actively engaged with the Vitality program saw a 15% reduction in healthcare costs over a 2-year period compared to those who did not engage. This translates to substantial savings for both policyholders and insurance providers.

Furthermore, the study also highlighted the positive behavioral changes observed among policyholders. The Vitality program was found to increase physical activity levels, improve dietary habits, and enhance mental well-being. These outcomes not only benefit individuals but also contribute to a healthier and more productive society as a whole.

Case Study: John’s Vitality Journey

John, a 35-year-old office worker, decided to take control of his health and signed up for a Vitality Insurance policy. With a history of sedentary lifestyle and unhealthy eating habits, John was motivated by the prospect of earning rewards for his healthy choices.

Over the course of a year, John achieved remarkable results. By tracking his steps with a fitness tracker, he managed to walk over 3,000 additional steps daily, leading to a significant weight loss and improved cardiovascular health. Additionally, John discovered a passion for cooking healthy meals and even earned rewards for trying new recipes and sharing them with his Vitality community.

As a result of his dedication, John earned enough points to redeem a substantial discount on his insurance premium, making his policy more affordable. He also felt a sense of accomplishment and improved self-esteem, knowing that he was taking proactive steps towards a healthier future.

The Future of Vitality Insurance

Vitality Insurance has already made a significant impact on the insurance industry, but its potential for growth and innovation is immense. As the program continues to evolve, we can expect to see several exciting developments that will further enhance its effectiveness and accessibility.

Expanding Wellness Activities

Currently, Vitality Insurance focuses on a range of health-related activities, but there’s potential to expand this scope. Future iterations of the program could include activities such as volunteering, sustainable living practices, and even educational achievements. By incorporating a broader range of activities, Vitality Insurance can appeal to a wider audience and promote a more holistic approach to wellness.

Digital Innovation

The digital landscape is ever-evolving, and Vitality Insurance is well-positioned to leverage the latest technologies. Future enhancements could include the integration of advanced AI algorithms to provide personalized health recommendations and real-time feedback. Additionally, the use of virtual reality or augmented reality could enhance the user experience, making the Vitality program even more engaging and immersive.

Global Expansion

While Vitality Insurance has gained popularity in certain regions, there’s an opportunity to expand its reach globally. By adapting the program to cater to different cultural and regional preferences, Vitality Insurance can become a truly international wellness initiative. This global expansion could lead to a more diverse and inclusive community, further strengthening the program’s impact.

Partnerships and Collaborations

Vitality Insurance has the potential to collaborate with various stakeholders to enhance its offerings. Partnerships with healthcare providers, fitness brands, and even government initiatives could lead to exclusive discounts, specialized programs, and increased accessibility. By leveraging these partnerships, Vitality Insurance can provide even greater value to its policyholders.

FAQs

How do I sign up for Vitality Insurance?

+Signing up for Vitality Insurance is simple. You can visit their official website or contact their customer support to inquire about available plans. They will guide you through the enrollment process, which typically involves filling out an application and selecting the insurance products that suit your needs.

Can I track my progress without a fitness tracker?

+Yes, while fitness trackers are a convenient way to track your progress, they are not mandatory. You can manually input your activities and achievements into the Vitality app or website. However, using a fitness tracker can provide more accurate data and make the process more seamless.

Are there any age restrictions for Vitality Insurance?

+Vitality Insurance is open to individuals of all ages. However, certain insurance products may have age-related eligibility criteria. It’s recommended to check with Vitality Insurance or a licensed insurance agent to understand the specific requirements for each product.

How often can I redeem my Vitality points for rewards?

+You can redeem your Vitality points for rewards at any time, as long as you have enough points accumulated. The frequency of redemption depends on your personal preferences and the rewards you choose. Some rewards, like gift cards or travel miles, may have specific redemption processes or timeframes.

Can I use Vitality Insurance points for charitable donations?

+Absolutely! Vitality Insurance recognizes the importance of giving back to the community. They offer the option to donate your Vitality points to various charitable organizations, allowing you to support causes that align with your values. This feature adds a layer of social impact to your wellness journey.

In conclusion, Vitality Insurance is more than just an insurance policy; it’s a transformative approach to wellness and financial protection. By incentivizing healthy behaviors and fostering a community of support, Vitality Insurance is reshaping the insurance landscape and empowering individuals to take control of their health. With its focus on innovation, personalization, and community engagement, Vitality Insurance is poised to continue making a significant impact on the lives of its policyholders and the industry at large.