Insurance Car Progressive

In the vast landscape of the insurance industry, Progressive stands out as a pioneer and a household name, especially when it comes to automotive coverage. With a rich history and a commitment to innovation, Progressive has shaped the way we perceive and interact with car insurance. This article delves into the intricate world of Progressive car insurance, exploring its features, benefits, and the unique value it brings to policyholders.

A Legacy of Innovation: Progressive’s Journey in Car Insurance

Progressive Insurance, founded in 1937 by Joseph Lewis and Jack Green, has revolutionized the car insurance industry with its forward-thinking approach. From its early days, Progressive challenged traditional insurance models by introducing the concept of pay-as-you-drive insurance, a game-changer that offered customers more flexibility and control over their premiums. This innovative spirit has driven the company’s growth and established it as a leading provider of auto insurance solutions.

One of Progressive's key milestones was the launch of its Snapshot program in 2008. This program utilized telematics technology, allowing drivers to customize their insurance rates based on their actual driving behavior. Snapshot not only empowered customers with more affordable options but also encouraged safer driving habits, making roads safer for everyone. This innovative initiative positioned Progressive as a leader in leveraging technology for the benefit of its policyholders.

Comprehensive Coverage: Tailoring Protection to Your Needs

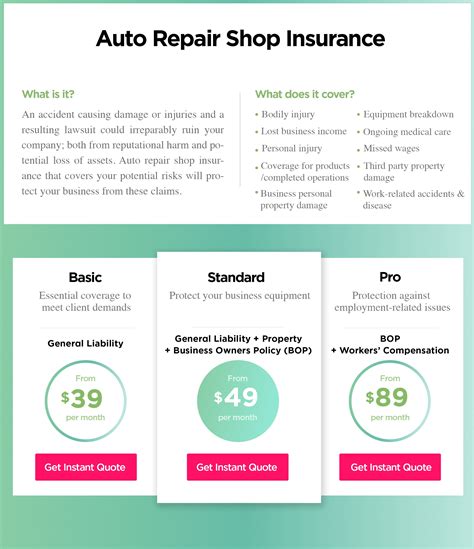

Progressive’s car insurance offerings are designed to cater to a wide range of drivers and their unique requirements. Whether you’re a cautious commuter, a youthful enthusiast, or a seasoned driver, Progressive provides customizable coverage options to ensure you’re adequately protected. Here’s a glimpse into the comprehensive range of policies Progressive has to offer:

Liability Coverage

This essential coverage safeguards you from financial liability in the event of an accident where you’re at fault. Progressive’s liability coverage ensures that the costs of bodily injury and property damage claims are covered, providing you with peace of mind.

Collision and Comprehensive Coverage

Progressive’s comprehensive and collision coverage options protect your vehicle from a wide array of risks. Collision coverage covers damages to your car resulting from collisions with other vehicles or objects, while comprehensive coverage extends protection to include damages caused by theft, vandalism, weather events, and other perils not related to collisions.

Medical Payments and Personal Injury Protection (PIP)

These coverages focus on providing medical benefits to you and your passengers in the event of an accident, regardless of fault. Medical payments coverage assists with the cost of medical treatment, while PIP coverage goes a step further, providing broader coverage for medical expenses, lost wages, and funeral costs.

Uninsured and Underinsured Motorist Coverage

With Progressive’s uninsured and underinsured motorist coverage, you’re protected in situations where the at-fault driver doesn’t have adequate insurance coverage. This coverage ensures you’re not left financially burdened in such circumstances.

Additional Coverages and Add-Ons

Progressive offers a range of optional coverages and add-ons to further customize your policy. These include rental car reimbursement, gap coverage, roadside assistance, and custom parts and equipment coverage, ensuring you can tailor your insurance to your specific needs and preferences.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you from financial liability in accidents you cause. |

| Collision Coverage | Covers damages to your car from collisions with other vehicles or objects. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and weather damage. |

| Medical Payments | Assists with medical costs for you and your passengers after an accident. |

| Uninsured/Underinsured Motorist Coverage | Provides coverage when the at-fault driver has inadequate insurance. |

The Progressive Advantage: Going Beyond Traditional Insurance

Progressive’s commitment to innovation extends beyond its coverage options. The company has consistently leveraged technology to enhance the customer experience and provide added value. Here’s a look at some of the unique advantages Progressive offers:

Progressive Snapshot

As mentioned earlier, Progressive’s Snapshot program is a game-changer in the insurance industry. By installing a small device in your vehicle or using a smartphone app, Snapshot tracks your driving habits, such as miles driven, time of day, and braking patterns. Based on this data, you can earn discounts on your insurance, making it a win-win for both safer drivers and Progressive.

Online and Mobile Tools

Progressive understands the importance of convenience and accessibility. Their online platform and mobile app offer a seamless experience, allowing customers to manage their policies, make payments, and file claims with just a few clicks. This digital approach streamlines the insurance process and keeps customers in control.

Claims Handling Excellence

When it matters most, Progressive’s claims handling process shines. With a dedicated team of claims adjusters and a commitment to quick response times, Progressive ensures that policyholders receive the support they need when filing a claim. Their efficient and empathetic approach to claims handling has earned them a reputation for excellence in customer service.

Discounts and Savings Opportunities

Progressive is known for its competitive pricing and a range of discounts to help customers save. From multi-policy discounts for bundling your auto insurance with other Progressive policies to loyalty rewards for long-term customers, there are numerous ways to reduce your insurance costs without compromising on coverage.

Progressive’s Impact on the Industry and Future Outlook

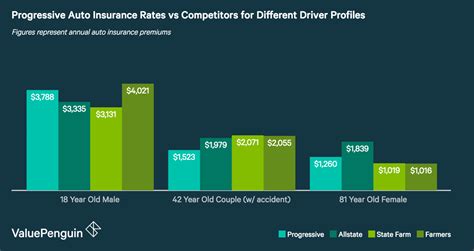

Progressive’s innovative spirit and customer-centric approach have not only benefited its policyholders but have also influenced the broader insurance industry. The company’s focus on technology and data-driven insights has pushed other insurers to follow suit, leading to a more competitive and customer-friendly market. As the insurance landscape continues to evolve, Progressive’s commitment to staying at the forefront of innovation ensures that it will remain a leader in the industry.

Looking ahead, Progressive is well-positioned to continue its growth trajectory. With a strong financial foundation, a diverse range of insurance products, and a commitment to meeting the evolving needs of its customers, Progressive is set to remain a dominant force in the car insurance market. Its ability to adapt and innovate ensures that policyholders can trust Progressive to provide reliable coverage and exceptional service, year after year.

How does Progressive determine insurance rates?

+Progressive uses a combination of factors to determine insurance rates, including the make and model of your vehicle, your driving record, the number of miles driven annually, and your location. Additionally, their Snapshot program allows drivers to customize their rates based on their actual driving behavior.

What sets Progressive apart from other car insurance providers?

+Progressive stands out for its innovative approach to car insurance, with offerings like the Snapshot program and a strong focus on technology and customer experience. Their comprehensive coverage options, competitive pricing, and excellent claims handling further differentiate them in the market.

Can I get a quote from Progressive online?

+Absolutely! Progressive offers a convenient online quoting process. You can get a personalized quote by providing some basic information about yourself, your vehicle, and your driving history. It’s a quick and easy way to explore your insurance options with Progressive.