Day Insurance Car

In the dynamic world of automotive insurance, there's a growing demand for flexible coverage options that cater to the unique needs of modern drivers. Enter day insurance, a revolutionary concept that offers car owners temporary coverage for specific periods, often as short as a day. This innovative approach challenges the traditional yearly or monthly insurance models, providing a personalized solution for drivers with varying requirements. It's an idea that's gained significant traction, especially among those seeking flexibility and cost-effectiveness in their insurance plans.

Understanding Day Insurance

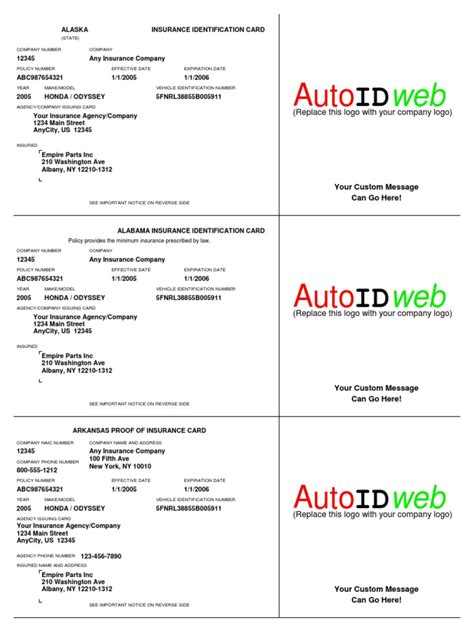

Day insurance, also known as short-term car insurance or temporary car insurance, is a type of automotive coverage designed for short-term use. Unlike traditional insurance policies that span a year or more, day insurance policies offer protection for specific periods, typically ranging from a single day to a few weeks. This unique model allows drivers to purchase coverage only when they need it, making it an attractive option for various scenarios.

Ideal Scenarios for Day Insurance

- Borrowing a Vehicle: If you plan to borrow a friend’s or family member’s car for a day or two, day insurance can provide the necessary coverage.

- Renting Out Your Vehicle: With the rise of peer-to-peer car rental platforms, day insurance is perfect for covering your vehicle during rental periods.

- Short-Term Trips: If you’re planning a road trip or need a car for a specific event, day insurance offers a cost-effective solution.

- Temporary Replacement: In case your regular vehicle is undergoing repairs or maintenance, day insurance can ensure you’re covered while driving a replacement.

| Coverage Period | Cost |

|---|---|

| 1 Day | $10 - $20 |

| 3 Days | $25 - $35 |

| 1 Week | $40 - $55 |

The cost of day insurance can vary based on factors like the type of vehicle, the driver's age and experience, and the coverage level. It's typically more expensive per day than a standard annual policy, but for short-term needs, it offers a flexible and economical solution.

How Day Insurance Works

The process of acquiring day insurance is straightforward and convenient. Most providers offer online platforms where you can select your desired coverage period, input your vehicle’s details, and choose the level of coverage you require. The policy is often delivered digitally, allowing for immediate activation. Here’s a step-by-step guide:

- Select Your Coverage Period: Choose the duration of coverage, ranging from a day to a few weeks.

- Provide Vehicle Details: Input your car's make, model, and registration number.

- Choose Coverage Level: Select the type and extent of coverage you need, including liability, collision, and comprehensive coverage.

- Review and Purchase: Carefully review the policy details, including terms and conditions, and proceed with the payment.

- Receive and Activate: Once purchased, you'll receive the policy via email or a digital platform. Follow the instructions to activate it before driving.

Benefits of Day Insurance

Day insurance offers several advantages, particularly for drivers with intermittent needs. Firstly, it provides cost-effectiveness as you only pay for the coverage you use. This can be significantly cheaper than maintaining a full-year policy, especially if you don’t drive frequently. Secondly, it offers flexibility, allowing you to adjust your coverage based on your needs and circumstances. Lastly, day insurance provides convenience, as it can be easily purchased and activated online, often within minutes.

Performance and Customer Experience

Customer feedback on day insurance has been largely positive, with many appreciating the convenience and flexibility it offers. Users find it especially useful for short-term trips or when borrowing or renting out vehicles. The ability to tailor coverage to specific needs and the ease of online purchasing are frequently cited as key benefits. However, some customers have noted that the process can be slightly more complex than traditional insurance, requiring careful attention to detail when selecting coverage options.

Customer Testimonials

“Day insurance was a lifesaver when I needed to borrow my friend’s car for a weekend trip. It was easy to purchase and gave me peace of mind during my journey.”

- Sarah, 32

"I rented my car out for a week, and day insurance provided the perfect coverage. It was affordable and gave my renter confidence in the vehicle's safety."

- David, 45

The Future of Day Insurance

As the automotive industry continues to evolve, day insurance is poised to play a significant role in meeting the changing needs of drivers. With the rise of shared mobility and short-term rental services, the demand for flexible insurance options is expected to increase. Day insurance providers are also exploring partnerships with car rental companies and peer-to-peer platforms to offer integrated coverage solutions.

Potential Developments

- Integration with Rental Platforms: Day insurance providers may partner with car rental apps to offer seamless coverage for renters and owners.

- Customizable Packages: The development of customizable day insurance packages could allow drivers to tailor their coverage even further, based on specific trip or usage needs.

- Real-Time Coverage: The concept of ‘on-demand’ insurance, where coverage can be activated and deactivated in real-time, could revolutionize short-term insurance.

FAQs

Can I drive any vehicle with day insurance?

+

Day insurance policies are typically vehicle-specific. You’ll need to provide the details of the car you wish to insure, and the coverage will be tailored to that vehicle. If you plan to drive multiple vehicles, you may need separate policies for each.

What happens if I need to extend my coverage beyond the initial period?

+

Most day insurance providers offer the option to extend your coverage. You can usually do this online or by contacting the provider. It’s important to note that extending your policy may involve additional costs and could impact the overall premium.

Are there any restrictions on the types of vehicles that can be insured with day insurance?

+

Yes, some day insurance providers may have restrictions on the types of vehicles they cover. These restrictions could be based on factors such as the vehicle’s age, make, model, or its intended use. It’s important to check with the provider to ensure your vehicle is eligible for coverage.

Can I get day insurance if I’m a young or inexperienced driver?

+

Many day insurance providers have age restrictions, typically requiring drivers to be at least 21 or 25 years old. Some providers may also consider factors like driving experience and the driver’s history when determining eligibility and pricing.