Costco Visa Rental Car Insurance

Navigating Rental Car Insurance with Your Costco Visa Card

When planning a trip, renting a car can be an essential part of the experience, offering freedom and flexibility to explore new destinations. However, navigating the world of rental car insurance can be a complex and confusing process, with numerous options and potential pitfalls. Fortunately, your Costco Visa card can provide a valuable layer of protection, offering benefits that may save you time, money, and hassle.

In this comprehensive guide, we'll delve into the details of rental car insurance coverage provided by Costco Visa cards, exploring the specific benefits, limitations, and potential savings. We'll also offer insights and strategies to help you maximize the value of your Costco Visa card while renting a car, ensuring a smooth and stress-free travel experience.

Understanding Rental Car Insurance Basics

Before we dive into the specifics of Costco Visa's rental car insurance benefits, let's quickly review the different types of insurance typically offered by rental car companies.

- Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW): This coverage typically protects you from costs associated with damage to the rental car, including collision, theft, and vandalism.

- Liability Insurance: Covers injuries or property damage you may cause to others while driving the rental car.

- Personal Accident Insurance (PAI): Provides coverage for medical expenses and death benefits for the driver and passengers in the event of an accident.

- Personal Effects Coverage (PEC): Protects personal belongings left in the rental car against theft or damage.

It's important to note that rental car companies often try to upsell additional insurance coverages, which can significantly increase the total cost of your rental. Understanding the basics of rental car insurance empowers you to make informed decisions and potentially save money.

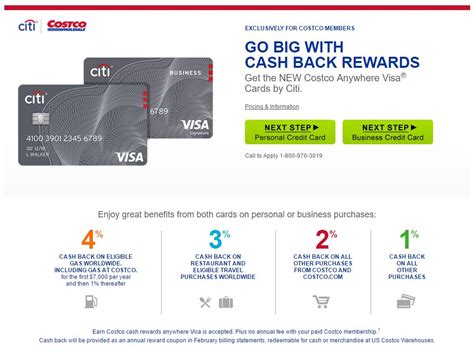

Costco Visa Card Benefits for Rental Car Insurance

Now, let's explore the specific benefits that your Costco Visa card offers when it comes to rental car insurance. These benefits can vary slightly depending on the specific type of Costco Visa card you hold, so it's essential to review the terms and conditions for your particular card.

Primary Collision Damage Waiver (CDW) Coverage

One of the most valuable benefits of using your Costco Visa card for rental car insurance is the primary Collision Damage Waiver (CDW) coverage it provides. This coverage typically applies to most rental cars worldwide, offering protection against damage to the rental vehicle. Here's a breakdown of the key aspects of this benefit:

- Coverage Amount: The CDW coverage provided by Costco Visa typically covers up to $50,000 in damages. This includes damage to the rental car itself, as well as any third-party vehicles involved in an accident.

- Deductible: In the event of a claim, you may be responsible for a deductible, which can range from $0 to $1,000, depending on the rental car company and the specific terms of your rental agreement.

- Exclusions: It's important to note that CDW coverage typically excludes certain types of vehicles, such as luxury or exotic cars, and may not cover damage to items like tires, windshields, or undercarriages.

- Rental Period: CDW coverage is valid for the duration of your rental, as long as you pay for the entire rental with your Costco Visa card and decline the rental car company's CDW or LDW coverage.

💡 Expert Tip: When renting a car, be sure to carefully review the rental agreement and terms and conditions to understand any potential exclusions or limitations to the CDW coverage provided by your Costco Visa card.

Secondary Liability Insurance

In addition to CDW coverage, your Costco Visa card also offers secondary liability insurance. This coverage kicks in to cover any damages or injuries you cause to others while driving the rental car. Here's what you need to know about this benefit:

- Coverage Amount: The secondary liability insurance provided by Costco Visa typically offers coverage of up to $100,000 per person and $300,000 per accident for bodily injury, and up to $50,000 for property damage.

- Deductible: There is typically no deductible associated with the secondary liability insurance coverage provided by Costco Visa.

- Primary vs. Secondary Coverage: It's important to understand that the liability insurance provided by Costco Visa is considered secondary coverage. This means that if you have personal auto insurance, your policy will be the primary source of coverage, and the Costco Visa liability insurance will only kick in if your personal insurance limits are exceeded.

Additional Benefits and Considerations

Beyond the primary CDW and secondary liability insurance coverage, your Costco Visa card may offer additional benefits and considerations when it comes to rental car insurance. These can include:

- Personal Accident Insurance (PAI) and Personal Effects Coverage (PEC): Some Costco Visa cards offer PAI and PEC coverage, providing benefits for medical expenses and death benefits for the driver and passengers, as well as coverage for personal belongings left in the rental car.

- Rental Car Damage Protection (RCDP): This benefit, offered by certain Costco Visa cards, provides coverage for damage to the rental car, similar to CDW, but with a lower deductible option.

- Travel Assistance Services: Many Costco Visa cards offer travel assistance services, which can include emergency roadside assistance, trip interruption coverage, and more.

Maximizing the Value of Your Costco Visa Card for Rental Car Insurance

Now that we've explored the specific benefits and coverage provided by Costco Visa cards for rental car insurance, let's discuss some strategies to help you maximize the value of your card while renting a car.

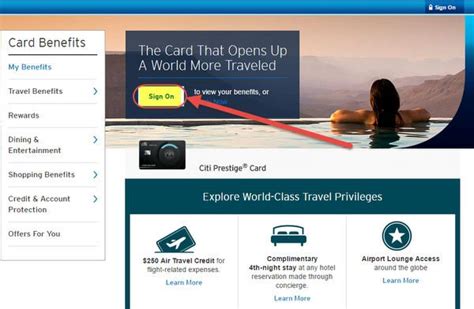

Always Use Your Costco Visa Card for the Entire Rental

To take full advantage of the rental car insurance benefits provided by your Costco Visa card, it's essential to use your card for the entire rental transaction. This means paying for the rental car, any additional services or upgrades, and any optional insurance coverages with your Costco Visa card. By doing so, you ensure that you're eligible for the full range of benefits and protections offered by your card.

Understand and Compare Coverage Options

Before renting a car, take the time to carefully review the insurance coverage options offered by the rental car company. Compare these options with the benefits provided by your Costco Visa card to determine which coverage gaps, if any, you may need to fill. This comparative analysis can help you make informed decisions and potentially save money on your rental.

Decline the Rental Car Company's Insurance

When picking up your rental car, the rental car company will likely try to upsell you on various insurance coverages. It's important to remember that if you've already paid for the rental with your Costco Visa card and understand the coverage it provides, you can confidently decline the rental car company's insurance offerings. This can save you a significant amount of money and ensure you're not paying for duplicate coverage.

Review and Understand Your Rental Agreement

Always take the time to carefully review the rental agreement provided by the rental car company. Pay close attention to the insurance coverage sections, as well as any exclusions or limitations that may apply. By thoroughly understanding the terms of your rental agreement, you can ensure that you're fully protected and avoid any unexpected surprises or additional costs.

Potential Savings and Value of Costco Visa Rental Car Insurance

By utilizing the rental car insurance benefits provided by your Costco Visa card, you can potentially save a significant amount of money on your rental. The primary CDW coverage alone can save you the cost of purchasing this coverage from the rental car company, which can often be quite expensive. Additionally, the secondary liability insurance coverage provided by your Costco Visa card can offer peace of mind, knowing that you're protected in the event of an accident.

| Coverage Type | Estimated Savings |

|---|---|

| Primary CDW | $20 - $40 per day (average) |

| Secondary Liability Insurance | Varies based on personal auto insurance coverage |

These savings can quickly add up, especially for longer rental periods or when renting a car for multiple trips throughout the year. Additionally, the peace of mind and convenience provided by the Costco Visa rental car insurance benefits can make your travel experience more enjoyable and stress-free.

Frequently Asked Questions

How do I activate the rental car insurance benefits on my Costco Visa card?

+To activate the rental car insurance benefits on your Costco Visa card, you must pay for the entire rental car transaction with your card and decline any additional insurance offered by the rental car company. By doing so, you automatically receive the benefits outlined in your card's terms and conditions.

Are there any exclusions or limitations to the rental car insurance coverage provided by Costco Visa cards?

+Yes, there may be certain exclusions and limitations to the rental car insurance coverage provided by Costco Visa cards. These can include exclusions for certain types of vehicles (e.g., luxury or exotic cars), specific locations, and damage to certain parts of the rental car (e.g., tires, windshields). It's important to carefully review the terms and conditions of your specific Costco Visa card to understand any potential exclusions or limitations.

Can I use my Costco Visa card's rental car insurance benefits if I already have personal auto insurance coverage?

+Yes, you can still utilize the rental car insurance benefits provided by your Costco Visa card even if you have personal auto insurance coverage. However, it's important to understand that the liability insurance coverage provided by your Costco Visa card is considered secondary coverage. This means that your personal auto insurance will be the primary source of coverage, and the Costco Visa liability insurance will only kick in if your personal insurance limits are exceeded.

What should I do if I'm involved in an accident while renting a car with my Costco Visa card?

+If you're involved in an accident while renting a car with your Costco Visa card, it's important to follow the standard procedures outlined by the rental car company. This typically includes reporting the accident to the rental car company, providing them with any necessary information, and obtaining a copy of the accident report. Additionally, be sure to carefully document any damage to the rental car and contact your Costco Visa card issuer to initiate a claim, if necessary.

Are there any additional fees or charges associated with using my Costco Visa card's rental car insurance benefits?

+Using your Costco Visa card's rental car insurance benefits typically does not incur any additional fees or charges. However, it's important to review the terms and conditions of your specific card to ensure there are no unexpected fees or limitations. Additionally, be aware that there may be a deductible associated with certain types of coverage, such as the primary CDW coverage, which you may need to pay out of pocket in the event of a claim.

By understanding the rental car insurance benefits provided by your Costco Visa card and implementing the strategies outlined in this guide, you can maximize the value of your card while renting a car. This can lead to significant savings, peace of mind, and a more enjoyable travel experience overall.