California Insurance Workers Compensation

California's insurance industry is a vital component of the state's economy, and one of its key aspects is workers' compensation. Workers' compensation insurance provides coverage for employees who suffer work-related injuries or illnesses, ensuring they receive medical care and financial support. In California, this system is complex and unique, with specific regulations and guidelines that employers and employees must navigate. This article aims to delve into the intricacies of California insurance workers' compensation, exploring its history, regulations, and the impact it has on the state's workforce and economy.

The History and Evolution of California Workers’ Compensation

The roots of workers’ compensation in California can be traced back to the early 20th century. The state’s first workers’ compensation law, known as the Workmen’s Compensation Act of 1911, was a groundbreaking piece of legislation that established a no-fault system for workplace injuries. This act, influenced by similar reforms in other states and countries, aimed to provide a faster and more efficient process for injured workers to receive compensation, bypassing the lengthy and often unfair litigation process.

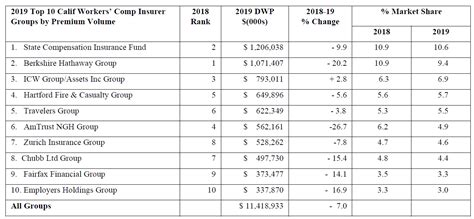

Over the years, California's workers' compensation system has undergone significant changes and updates. The California Workers' Compensation Act of 1937 further refined the process, introducing key provisions such as the exclusive remedy doctrine, which limits an employee's right to sue their employer for work-related injuries, in exchange for guaranteed compensation benefits. This act also established the State Compensation Insurance Fund (SCIF), a public enterprise providing insurance coverage to employers.

More recently, the Workers' Compensation Reform Act of 2004 brought about substantial changes to the system, addressing issues such as rising insurance costs and fraudulent claims. This reform aimed to strike a balance between providing adequate benefits to injured workers and ensuring affordability for employers.

Regulations and Requirements: A Comprehensive Overview

California has one of the most comprehensive and complex workers’ compensation systems in the nation. The California Division of Workers’ Compensation (DWC), a division of the Department of Industrial Relations, is responsible for overseeing and regulating the system. The DWC’s primary role is to ensure that employers provide adequate insurance coverage for their employees and that injured workers receive the benefits they are entitled to.

Employers in California are required by law to carry workers' compensation insurance, with a few exceptions for certain types of businesses. The coverage must meet the minimum standards set by the DWC, which include specific benefits for injured workers, such as medical treatment, temporary disability payments, permanent disability benefits, and vocational rehabilitation services.

The insurance market for workers' compensation in California is highly competitive, with numerous private insurance carriers and the State Compensation Insurance Fund offering coverage. Employers have the flexibility to choose their insurance provider, but they must ensure that the coverage meets the state's requirements.

Key Regulations and Guidelines:

- Injured Worker’s Rights: Employees who suffer work-related injuries or illnesses have the right to prompt medical treatment and compensation for lost wages. They are also protected from discrimination or retaliation for filing a workers’ compensation claim.

- Employer Responsibilities: Besides providing insurance coverage, employers must ensure a safe work environment, promptly report workplace injuries, and cooperate with insurance carriers and the DWC during the claims process.

- Medical Care and Treatment: Injured workers have the right to choose their own treating physician from a panel provided by the employer or insurance carrier. The insurance carrier is responsible for covering the cost of medical treatment and medications.

- Temporary Disability Benefits: If an injured worker is unable to work due to their injury, they are entitled to temporary disability payments, which are a portion of their regular wages. The amount and duration of these benefits are determined by state regulations.

- Permanent Disability Benefits: If an injury results in a permanent impairment, the injured worker may receive permanent disability benefits. The amount of these benefits depends on the severity of the impairment and the worker’s age and earnings.

- Vocational Rehabilitation: In cases where an injured worker cannot return to their previous job, the insurance carrier may provide vocational rehabilitation services to help them find suitable alternative employment.

The Impact on California’s Workforce and Economy

California’s workers’ compensation system has a significant impact on the state’s workforce and economy. By providing a safety net for injured workers, the system helps ensure that employees can recover from workplace injuries without facing financial hardship.

The system also plays a crucial role in maintaining a healthy and productive workforce. By encouraging employers to prioritize workplace safety and providing prompt medical care and financial support to injured workers, the system helps reduce the long-term impacts of workplace injuries and promotes a faster return to work.

Furthermore, the workers' compensation system contributes to California's economy by ensuring that employers have access to a stable and healthy workforce. It also provides a level of predictability for employers, as they can plan for insurance costs and potential claims, which can aid in long-term business planning and investment.

Key Economic Impacts:

- Workplace Safety: The workers’ compensation system encourages employers to implement safety measures and practices, reducing the likelihood of workplace injuries and illnesses. This, in turn, leads to improved productivity and reduced absenteeism.

- Prompt Medical Care: By ensuring that injured workers receive timely medical treatment, the system helps reduce the severity and long-term impacts of workplace injuries. This can lead to lower medical costs and a faster recovery for workers.

- Financial Support for Injured Workers: Workers’ compensation benefits provide financial stability for injured workers, allowing them to focus on their recovery without worrying about lost wages or mounting medical bills. This can improve overall worker satisfaction and loyalty.

- Economic Stability for Employers: The predictability of insurance costs and the efficient claims process provided by the workers’ compensation system can benefit employers. It allows them to budget for insurance expenses and plan for potential claims, reducing financial uncertainty.

- Investment and Growth: A stable and healthy workforce, along with a predictable insurance system, can encourage businesses to invest in California. This can lead to economic growth, job creation, and a more vibrant business environment.

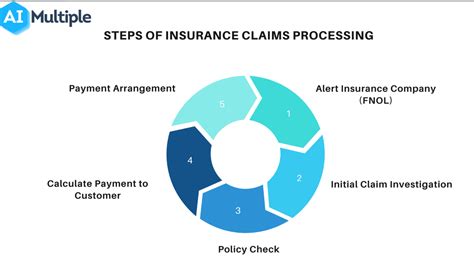

Navigating the Workers’ Compensation Process: A Step-by-Step Guide

Understanding the workers’ compensation process in California is crucial for both employers and employees. This section provides a step-by-step guide to help navigate the system effectively.

For Employers:

- Obtain Insurance Coverage: Ensure that your business has the required workers’ compensation insurance. You can choose from private insurance carriers or the State Compensation Insurance Fund.

- Post Notices and Information: Display posters and notices in your workplace to inform employees about their rights and the workers’ compensation process. These materials are available from the DWC.

- Report Workplace Injuries: Promptly report all workplace injuries or illnesses to your insurance carrier. This is crucial for initiating the claims process and ensuring injured workers receive the benefits they are entitled to.

- Cooperate with the Claims Process: Work closely with your insurance carrier and the DWC to ensure a smooth claims process. Provide necessary documentation and cooperate with any investigations or hearings.

- Encourage Workplace Safety: Implement safety measures and practices to reduce the likelihood of workplace injuries. This not only benefits your employees but can also lead to lower insurance costs.

For Injured Workers:

- Report the Injury: Promptly report your work-related injury or illness to your employer. This is crucial for initiating the claims process and receiving the benefits you are entitled to.

- Seek Medical Treatment: Obtain medical treatment for your injury. Your employer or insurance carrier will provide you with a panel of physicians from which you can choose your treating doctor.

- Understand Your Benefits: Familiarize yourself with the benefits you are entitled to, such as medical treatment, temporary disability payments, and permanent disability benefits. The DWC provides resources to help you understand these benefits.

- Cooperate with the Claims Process: Work closely with your employer and insurance carrier to ensure a smooth claims process. Attend medical appointments, provide necessary documentation, and participate in any required rehabilitation programs.

- Consider Legal Advice: If you have concerns or face challenges with your claim, consider seeking legal advice from an experienced workers’ compensation attorney. They can help protect your rights and ensure you receive the benefits you deserve.

Future Outlook and Innovations in Workers’ Compensation

California’s workers’ compensation system is constantly evolving to address emerging challenges and opportunities. As the state’s workforce and economy change, the system must adapt to ensure it remains effective and responsive to the needs of employers and employees.

Key Areas of Focus:

- Technology and Digital Innovations: The use of technology, such as online portals and mobile apps, can streamline the claims process and improve communication between injured workers, employers, and insurance carriers. These innovations can enhance efficiency and reduce administrative burdens.

- Prevention and Early Intervention: Focusing on preventing workplace injuries and illnesses through education, training, and proactive measures can reduce the need for compensation claims. Early intervention programs can also help manage minor injuries before they become more severe.

- Alternative Dispute Resolution: Encouraging the use of alternative dispute resolution methods, such as mediation and arbitration, can help resolve workers’ compensation disputes more efficiently and cost-effectively than traditional litigation.

- Data Analysis and Insights: Utilizing data analytics can provide valuable insights into trends and patterns in workplace injuries and illnesses. This data can inform preventive measures, improve safety protocols, and enhance the overall efficiency of the workers’ compensation system.

- Collaboration and Education: Fostering collaboration between employers, insurance carriers, healthcare providers, and workers’ compensation professionals can lead to better outcomes for injured workers. Education and training programs can ensure that all stakeholders understand their roles and responsibilities in the system.

How can I, as an employer, choose the right workers’ compensation insurance provider in California?

+When selecting a workers’ compensation insurance provider in California, consider factors such as the carrier’s financial stability, reputation, and the specific needs of your business. Compare rates and coverage options from multiple carriers, and don’t hesitate to seek advice from industry professionals or insurance brokers who can guide you through the process.

What should I do if I, as an employee, disagree with the decision made on my workers’ compensation claim in California?

+If you disagree with a decision made on your workers’ compensation claim, you have the right to appeal. You can request a review by the insurance carrier, or if necessary, file an appeal with the California Workers’ Compensation Appeals Board. It’s advisable to seek legal advice from an experienced workers’ compensation attorney to guide you through the appeals process.

Are there any exemptions or exceptions to the requirement for employers to carry workers’ compensation insurance in California?

+Yes, there are a few exceptions to the requirement for employers to carry workers’ compensation insurance in California. These include sole proprietors, partnerships, and certain family-owned businesses with no employees other than immediate family members. However, even in these cases, it’s important to understand the risks and consider obtaining coverage voluntarily.