Whole Life Insurance Quote

Securing financial protection for yourself and your loved ones is a responsible and thoughtful step. Whole life insurance is a popular choice among policyholders, offering a combination of death benefit coverage and cash value accumulation. However, finding the right whole life insurance policy and understanding the associated costs can be a complex process. This comprehensive guide aims to provide an in-depth analysis of whole life insurance quotes, helping you make an informed decision.

Understanding Whole Life Insurance

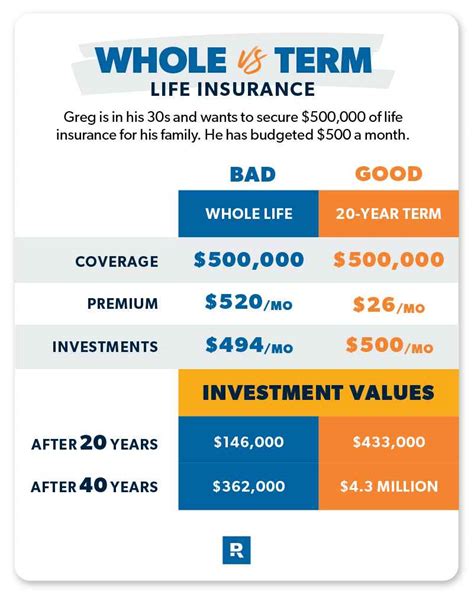

Whole life insurance, also known as permanent life insurance, is a type of coverage that remains active for the insured's entire life, provided premiums are paid. This form of insurance differs from term life insurance, which offers coverage for a specified period, typically ranging from 10 to 30 years. Whole life insurance offers a guaranteed death benefit, meaning that the policy will pay out to your beneficiaries upon your passing, regardless of when that occurs.

One of the key features of whole life insurance is the cash value component. This cash value grows over time and can be accessed by the policyholder through loans or withdrawals. The cash value can be used for various purposes, such as supplementing retirement income, paying for unexpected expenses, or even covering policy premiums. It's important to note that withdrawing or borrowing against the cash value may have tax implications and could reduce the death benefit payout.

The Importance of Whole Life Insurance Quotes

Obtaining whole life insurance quotes is a crucial step in the policy selection process. Quotes provide an estimate of the premium you can expect to pay for a specific policy, based on your age, health, and other factors. These quotes allow you to compare different insurance providers and policies, ensuring you find the most suitable and cost-effective option for your needs.

When requesting quotes, you'll typically be asked to provide personal information such as your date of birth, gender, health status, and desired coverage amount. Based on this information, insurance companies can assess your risk level and provide an accurate quote. It's essential to be honest and accurate when providing this information, as any discrepancies could lead to policy denial or increased premiums down the line.

Factors Influencing Whole Life Insurance Quotes

Several factors influence the cost of whole life insurance, and understanding these can help you navigate the quote process more effectively. Here are some key factors to consider:

Age

Age is one of the most significant factors in determining whole life insurance quotes. Generally, the younger you are when you purchase a policy, the lower your premiums will be. This is because younger individuals are considered lower risk, as they are less likely to require the death benefit payout soon.

Health Status

Your health status plays a crucial role in the quote process. Insurance companies will evaluate your medical history, including any pre-existing conditions, to assess your risk level. Individuals with good health and no significant medical issues may qualify for preferred rates, while those with health complications may face higher premiums or even policy denial.

Lifestyle Factors

Certain lifestyle choices can impact your whole life insurance quotes. For example, smoking or engaging in high-risk activities like extreme sports may result in higher premiums. Insurance companies often use lifestyle factors to assess the overall risk associated with insuring an individual.

Coverage Amount

The amount of coverage you desire will directly impact your premiums. Whole life insurance policies with higher death benefit payouts will generally have higher premiums. It's essential to carefully consider your financial needs and the coverage amount that will adequately protect your loved ones.

Gender

In some cases, gender can be a factor in whole life insurance quotes. Historically, men have paid higher premiums than women due to statistical differences in life expectancy and mortality rates. However, this practice is becoming less common, and many insurance companies now offer gender-neutral pricing.

Obtaining Whole Life Insurance Quotes

There are several ways to obtain whole life insurance quotes. Here are some common methods:

Online Quote Tools

Many insurance companies offer online quote tools on their websites. These tools allow you to input your personal information and receive an estimated quote within minutes. Online quotes provide a convenient and efficient way to compare rates from multiple providers.

Insurance Agents or Brokers

Working with an insurance agent or broker can provide a more personalized quote experience. These professionals can guide you through the quote process, explaining the various policy options and helping you find the best fit. Agents and brokers often have access to multiple insurance companies, allowing them to shop around for the most competitive rates.

Direct Insurance Companies

Some insurance companies offer direct quotes, either over the phone or through their websites. These quotes are often more detailed and may require additional information or a health examination. Direct quotes can provide a more accurate estimate of your premium costs.

Analyzing and Comparing Quotes

Once you've obtained several whole life insurance quotes, it's essential to analyze and compare them carefully. Here are some key considerations:

Premium Costs

Compare the premium costs across different quotes. While it's tempting to choose the lowest premium, it's important to ensure that the policy offers the coverage and benefits you need. Consider the long-term cost of the policy and whether you can afford the premiums over time.

Coverage Options

Review the coverage options provided by each quote. Ensure that the policy offers the desired death benefit amount and any additional riders or benefits you require. Some policies may offer unique features, such as accelerated death benefits or waiver of premium riders, which can be valuable additions.

Cash Value Growth

Evaluate the projected cash value growth for each policy. Whole life insurance policies with higher cash value growth rates can provide additional financial flexibility in the future. Consider your long-term financial goals and how the cash value component can support them.

Company Reputation and Financial Strength

Research the reputation and financial strength of the insurance companies providing the quotes. Choose a company with a solid track record and a strong financial rating. This ensures that the company will be able to fulfill its obligations and pay out claims when needed.

Future Implications and Considerations

Whole life insurance is a long-term commitment, and understanding the potential implications and considerations can help you make an informed decision.

Policy Flexibility

Consider the flexibility of the policy. Some whole life insurance policies allow for changes in coverage amounts or premium payments over time. This flexibility can be beneficial if your financial situation or needs change in the future.

Tax Implications

Be aware of the tax implications associated with whole life insurance. While the death benefit payout is generally tax-free, withdrawals or loans against the cash value may have tax consequences. Consult with a tax professional to understand the potential impact on your specific situation.

Policy Duration

Whole life insurance policies are designed to last a lifetime. Consider the long-term commitment and ensure that you can maintain the premiums over time. If your financial situation changes, some policies may offer reduced paid-up options or extended term insurance, allowing you to continue coverage with reduced benefits.

Rider Options

Review the rider options available with each policy. Riders are additional benefits or protections that can be added to your policy for an extra cost. Common rider options include accelerated death benefits, which provide access to a portion of the death benefit if you become terminally ill, or waiver of premium riders, which waive premium payments if you become disabled.

FAQs

How do I know if whole life insurance is the right choice for me?

+

Whole life insurance may be suitable if you seek lifelong coverage and the potential for cash value accumulation. It’s often a good choice for individuals who want to ensure their loved ones are financially protected, even if they pass away at an advanced age. However, it’s essential to carefully consider your financial situation, coverage needs, and long-term goals before committing to a whole life insurance policy.

Can I change my mind after receiving whole life insurance quotes?

+

Absolutely! Obtaining quotes is a crucial step in the process, but it doesn’t commit you to any specific policy. You can continue to explore different options, compare quotes, and make an informed decision based on your needs and budget. It’s important to take your time and thoroughly understand the terms and conditions of any policy you’re considering.

Are there any alternatives to whole life insurance?

+

Yes, there are alternative types of life insurance, such as term life insurance, universal life insurance, and variable life insurance. Term life insurance offers coverage for a specific period, often at lower premiums, making it a popular choice for those seeking temporary coverage. Universal life insurance offers flexibility in premium payments and coverage amounts, while variable life insurance allows for investment-linked returns. Each type of insurance has its own set of benefits and considerations, so it’s essential to evaluate your needs and preferences before making a decision.