Car Insurance Quote Geico

Navigating the world of car insurance can be a daunting task, especially when you're seeking the best coverage at an affordable rate. That's where GEICO, one of the leading insurance providers in the United States, steps in to simplify the process and offer competitive quotes tailored to your needs. In this comprehensive guide, we'll delve into the specifics of obtaining a car insurance quote from GEICO, exploring the factors that influence your premium, the coverage options available, and the steps you can take to secure the best possible deal.

Understanding the GEICO Car Insurance Quote Process

GEICO, short for Government Employees Insurance Company, has established itself as a trusted provider of auto insurance, offering coverage to over 17 million policyholders across the nation. Their comprehensive range of insurance products, coupled with their renowned customer service, has made them a go-to choice for many vehicle owners.

Obtaining a car insurance quote from GEICO is a straightforward process that can be completed online, over the phone, or even via their mobile app. The quote is based on a variety of factors, including your personal details, the vehicle you drive, and your driving history. Here's a closer look at the key elements that influence your GEICO car insurance quote.

Personal Information

When requesting a quote, GEICO will ask for essential personal details such as your name, date of birth, and contact information. They may also inquire about your marital status, as married individuals often receive discounts on their insurance premiums. Additionally, your gender and occupation can impact your quote, as certain professions may be associated with lower risk profiles.

Vehicle Details

The make, model, and year of your vehicle are crucial factors in determining your insurance premium. GEICO takes into account the vehicle’s safety features, its overall value, and the likelihood of it being involved in accidents or theft. For instance, a luxury sports car with advanced safety systems may attract a lower premium compared to an older model with limited safety features.

Furthermore, GEICO considers the primary use of your vehicle. If you primarily use your car for commuting to work, your premium may differ from someone who uses their vehicle for business purposes or long-distance travel. The more miles you drive annually, the higher the risk of accidents, which can impact your insurance rate.

Driving History

Your driving record is a significant factor in determining your insurance premium. GEICO assesses your history of accidents, traffic violations, and claims to assess your level of risk. A clean driving record with no recent accidents or violations typically results in lower insurance rates. Conversely, multiple accidents or serious violations can lead to higher premiums or even difficulty in securing insurance coverage.

Credit Score

In many states, insurance providers are permitted to use credit-based insurance scores when determining premiums. GEICO is no exception, and they may take your credit score into account when calculating your quote. Generally, a higher credit score is associated with lower insurance rates, as individuals with better credit are often seen as more responsible and less likely to file claims.

Coverage Options and Add-Ons

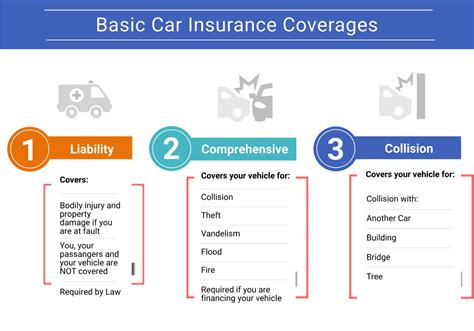

GEICO offers a range of coverage options to suit your specific needs. The most common types of car insurance include liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects you against claims arising from accidents you cause, while collision and comprehensive coverage provide protection for your own vehicle in the event of accidents, theft, or other covered perils.

In addition to these standard coverages, GEICO offers a variety of add-ons and endorsements to enhance your policy. These can include rental car reimbursement, emergency road service, mechanical breakdown insurance, and more. The choice of coverage options and add-ons will impact your overall premium, so it's important to carefully consider your needs and budget when selecting these features.

Factors Influencing Your GEICO Car Insurance Quote

Beyond the personal, vehicle, and driving-related factors mentioned above, several other elements can influence your GEICO car insurance quote. Understanding these factors can help you make informed decisions when selecting your coverage and potentially lower your premium.

Discounts and Savings

GEICO is renowned for its extensive range of discounts, which can significantly reduce your insurance premium. Some of the most common discounts include multi-policy discounts (when you bundle your car insurance with other GEICO policies), good student discounts (for young drivers with good academic records), and military discounts (for active-duty military personnel, veterans, and their families). Additionally, GEICO offers discounts for vehicle safety features, such as anti-theft devices and advanced driver assistance systems.

Location and Usage

The location where you primarily drive your vehicle can impact your insurance premium. Urban areas with higher populations and traffic congestion often carry higher risk profiles, leading to increased insurance rates. Conversely, rural areas with lower traffic volumes and reduced risk of accidents may result in lower premiums. GEICO takes into account the specific zip code where your vehicle is garaged when calculating your quote.

Payment Options

The method you choose to pay your insurance premium can also influence your overall cost. GEICO offers various payment options, including monthly, semi-annual, or annual payments. While monthly payments provide flexibility, they may incur additional fees or interest charges. Paying your premium annually or semi-annually can often result in savings, as insurance providers may offer discounts for these payment methods.

Policy Deductibles

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to a lower insurance premium, as you’re essentially assuming more financial responsibility in the event of a claim. However, it’s important to select a deductible that aligns with your financial capabilities, as a higher deductible may prove challenging to cover in the event of an accident or other insured loss.

Performance and Customer Satisfaction

When considering GEICO for your car insurance needs, it’s essential to evaluate their performance and customer satisfaction ratings. GEICO consistently ranks highly in customer satisfaction surveys, with J.D. Power awarding them the top spot in their 2022 U.S. Auto Insurance Study. Their reputation for excellent customer service, efficient claims handling, and competitive pricing has contributed to their success and made them a preferred choice for many vehicle owners.

In terms of financial stability, GEICO is backed by Berkshire Hathaway, one of the world's largest and most respected investment companies. This partnership ensures GEICO's financial strength and ability to meet its policy obligations, providing peace of mind to its policyholders.

The Future of GEICO Car Insurance

As the insurance industry continues to evolve, GEICO remains at the forefront of innovation. They are constantly exploring new technologies and strategies to enhance their services and improve the customer experience. One notable initiative is their embrace of telematics, which involves the use of technology to monitor driving behavior and provide personalized insurance rates based on real-time data.

GEICO's telematics program, known as "InstaDrive," offers policyholders the opportunity to install a small device in their vehicle that tracks driving habits. By voluntarily participating in this program, drivers can potentially lower their insurance premiums by demonstrating safe driving behaviors. This innovative approach to insurance pricing is just one example of GEICO's commitment to staying ahead of the curve and providing customers with the best possible value.

Conclusion: GEICO - Your Trusted Partner for Car Insurance

Obtaining a car insurance quote from GEICO is a straightforward and transparent process. By understanding the factors that influence your premium and exploring the various coverage options and discounts available, you can make informed decisions and secure the best possible deal. With their reputation for excellent customer service, competitive pricing, and innovative approaches to insurance, GEICO continues to be a top choice for vehicle owners seeking reliable and affordable coverage.

Key Takeaways

- GEICO offers a range of coverage options and add-ons to tailor your policy to your specific needs.

- Their extensive range of discounts can significantly reduce your insurance premium.

- Factors such as location, payment options, and policy deductibles can impact your premium.

- GEICO’s reputation for customer satisfaction and financial stability make them a trusted partner for car insurance.

- Their embrace of telematics technology showcases their commitment to innovation and providing customers with personalized insurance rates.

FAQ

Can I get a GEICO car insurance quote without providing my Social Security number?

+Yes, you can obtain a GEICO car insurance quote without providing your Social Security number. While it may be required for the final policy application, it is not necessary for the initial quote process.

Does GEICO offer insurance for classic or vintage cars?

+Yes, GEICO offers specialized insurance coverage for classic and vintage cars. Their Classic Car program provides tailored coverage for vehicles that are at least 25 years old and meet certain criteria.

Can I bundle my car insurance with other GEICO policies to save money?

+Absolutely! GEICO encourages policyholders to bundle their car insurance with other policies, such as homeowners or renters insurance, to take advantage of multi-policy discounts. Bundling can result in significant savings on your overall insurance costs.