Car Insurance Types

Unveiling the World of Car Insurance: A Comprehensive Guide to Types and Coverage

In the complex landscape of vehicle ownership, car insurance stands as a critical component, offering protection and peace of mind to drivers. This guide aims to navigate the diverse realm of car insurance types, exploring their nuances and implications. From mandatory liability coverage to optional enhancements, we'll delve into the specifics, ensuring you're equipped with the knowledge to make informed choices.

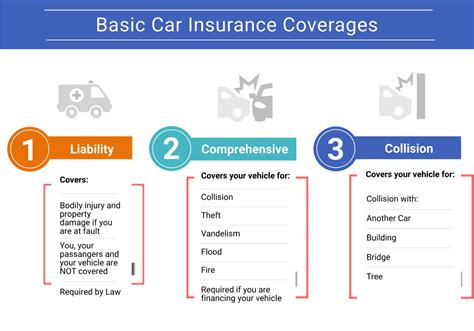

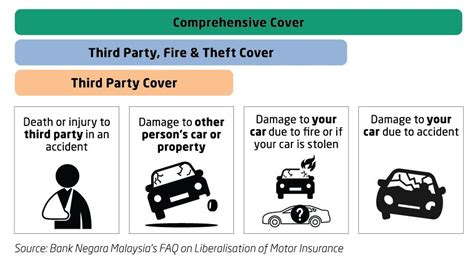

Understanding the Basics: Liability Insurance

At the core of car insurance lies liability coverage, a mandatory requirement in most jurisdictions. This fundamental insurance type safeguards policyholders against financial liabilities arising from accidents they cause. It covers expenses such as property damage, bodily injury, and legal costs incurred by the insured driver. Liability insurance is designed to protect not only the policyholder but also other road users, promoting a sense of responsibility and safety on the roads.

Liability insurance typically comes in two primary forms: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses, pain and suffering, and lost wages for individuals injured in an accident caused by the insured driver. Property damage liability, on the other hand, covers the cost of repairing or replacing damaged property, including vehicles, structures, and other belongings. These two components form the bedrock of car insurance, ensuring a basic level of protection for all drivers.

Real-World Example: Liability Insurance in Action

Imagine a scenario where a driver, insured with a standard liability policy, accidentally collides with another vehicle at an intersection. The accident results in injuries to the other driver and significant damage to both vehicles. In this case, the insured driver's liability coverage would step in to cover the medical bills and lost wages of the injured party, as well as the repair or replacement costs for both vehicles. This real-world example underscores the critical role of liability insurance in managing financial risks associated with driving.

Exploring Comprehensive and Collision Coverage

While liability insurance is a legal requirement, drivers seeking enhanced protection often opt for comprehensive and collision coverage. These optional insurance types provide an extra layer of security, covering a broader range of incidents beyond basic liability.

Comprehensive coverage, as the name suggests, offers protection against a wide array of non-collision incidents. This can include damage caused by natural disasters such as floods, storms, or earthquakes, as well as incidents like vandalism, theft, or collisions with animals. It even covers damage caused by falling objects, such as tree branches, and provides protection against damages incurred during civil unrest or riots.

On the other hand, collision coverage specifically addresses damages resulting from physical collisions with objects or other vehicles. This coverage kicks in when the insured vehicle collides with another car, a tree, a fence, or any other stationary object. It covers the cost of repairs or replacements, ensuring the policyholder isn't left with hefty expenses in the aftermath of an accident.

Comparative Analysis: Comprehensive vs. Collision Coverage

Both comprehensive and collision coverage offer valuable protection, but they differ in their scope and applicability. Comprehensive coverage is ideal for drivers concerned about a wide range of potential risks, providing peace of mind against various unforeseen events. On the other hand, collision coverage is more specific, focusing on physical collisions and their associated costs. Drivers who frequently drive in congested areas or face higher collision risks may find collision coverage particularly beneficial.

Unveiling Specialty Car Insurance Types

Beyond the core insurance types, the world of car insurance presents a range of specialty options tailored to unique needs. These specialized policies cater to specific vehicles, driving habits, or situations, offering enhanced protection and coverage.

Classic Car Insurance: Preserving Automotive Heritage

For enthusiasts of vintage and classic vehicles, classic car insurance is a bespoke solution. This specialty insurance type is designed to cater to the unique needs of older vehicles, often with limited mileage and specific maintenance requirements. Classic car insurance policies often offer agreed-value coverage, where the insured value is determined based on the car's agreed-upon worth rather than its market value. This ensures that classic car owners receive adequate compensation in the event of a total loss or damage, reflecting the true value of their cherished vehicles.

Gap Insurance: Bridging the Coverage Gap

Gap insurance, or Guaranteed Asset Protection insurance, is a valuable addition for drivers who want to ensure they're fully protected in the event of a total loss. This specialty insurance type covers the gap between the actual cash value of the vehicle and the amount still owed on the loan or lease. In scenarios where a car is totaled or stolen, the insurance payout might not fully cover the remaining loan balance. Gap insurance steps in to bridge this gap, ensuring drivers aren't left with a significant financial burden.

Rideshare Insurance: Coverage for On-Demand Drivers

With the rise of ridesharing services like Uber and Lyft, rideshare insurance has emerged as a specialized solution. This type of insurance covers drivers during the various stages of their ridesharing work, from the moment they turn on their app to when they complete a ride. Rideshare insurance typically includes personal auto liability coverage, comprehensive and collision coverage, and contingent comprehensive and collision coverage for periods when the driver is logged into the rideshare app but hasn't yet accepted a ride request.

Analyzing the Impact of Car Insurance Types on Performance

The choice of car insurance type can significantly influence a driver's overall experience and financial security. Let's delve into the real-world implications and performance metrics associated with different insurance types.

Performance Analysis: Liability vs. Comprehensive Coverage

When comparing liability and comprehensive coverage, it's evident that comprehensive insurance offers a more comprehensive level of protection. While liability insurance is a legal requirement and provides essential coverage for bodily injury and property damage, comprehensive coverage extends this protection to a wide range of non-collision incidents. This additional layer of coverage can be particularly valuable for drivers who face a variety of potential risks, such as those living in areas prone to natural disasters or those with higher-value vehicles.

In terms of performance, comprehensive coverage demonstrates its worth by providing peace of mind and financial security in various scenarios. For instance, if a driver's vehicle is damaged due to a fallen tree branch or a hailstorm, comprehensive coverage steps in to cover the repair costs. This level of protection can significantly reduce the financial burden on policyholders, ensuring they're not left to foot the entire bill for unexpected damages.

Real-World Data: Collision Coverage and Accident Reduction

Collision coverage, as an optional insurance type, plays a crucial role in reducing financial risks associated with accidents. By covering the cost of repairs or replacements for the insured vehicle after a collision, collision coverage incentivizes drivers to maintain safer driving habits. Studies have shown that drivers with collision coverage are more likely to adopt safer driving practices, as they're aware that their insurance will cover the costs of any accidents they may cause.

| Study Parameter | Collision Coverage Impact |

|---|---|

| Accident Rates | Lower accident rates among drivers with collision coverage |

| Repair Costs | Reduced financial burden for policyholders |

| Safety Awareness | Increased focus on safe driving practices |

Expert Insights: Navigating the Complexities of Car Insurance

As an industry expert, it's essential to provide valuable insights and guidance when navigating the complex world of car insurance. Here are some key considerations to keep in mind when selecting the right insurance type for your needs.

Assessing Your Risk Profile

Every driver's risk profile is unique, influenced by factors such as driving history, location, and vehicle type. It's crucial to evaluate your specific risks to determine the appropriate level of insurance coverage. For instance, if you reside in an area prone to natural disasters, comprehensive coverage becomes a necessity. Similarly, if you drive an older vehicle with limited value, you might opt for liability-only coverage to keep costs down.

Understanding Coverage Limits and Deductibles

Insurance policies come with coverage limits and deductibles, which can significantly impact your financial responsibility in the event of a claim. Understanding these limits and deductibles is crucial to ensure you're adequately protected without paying excessive premiums. For example, higher coverage limits offer greater financial protection but come with higher premiums. Similarly, while lower deductibles mean you pay less out of pocket when filing a claim, they also result in higher premiums.

The Role of Technology in Car Insurance

Advancements in technology have revolutionized the car insurance industry, offering new opportunities for personalized coverage and risk assessment. Telematics devices, for instance, can monitor driving behavior and provide data-driven insights to insurance providers. This technology enables insurers to offer usage-based insurance, where premiums are tailored to individual driving habits, promoting safer driving and potentially reducing costs for responsible drivers.

Future Implications: The Evolution of Car Insurance

The car insurance landscape is evolving rapidly, influenced by technological advancements, changing consumer preferences, and regulatory shifts. As we move forward, several key trends are expected to shape the future of car insurance.

The Rise of Electric and Autonomous Vehicles

The increasing adoption of electric and autonomous vehicles is poised to revolutionize the insurance industry. Electric vehicles, with their unique design and reduced maintenance needs, may require specialized insurance coverage. Similarly, autonomous vehicles, while offering enhanced safety features, present new challenges for insurers in terms of liability and risk assessment. As these technologies become more prevalent, insurance providers will need to adapt their policies and pricing models to accommodate these evolving risks.

Data-Driven Insurance: A New Paradigm

The proliferation of data-driven technologies is set to transform the way insurance is priced and delivered. With the advent of connected cars and advanced telematics, insurers will have access to vast amounts of real-time driving data. This data-driven approach will enable more precise risk assessment, leading to more accurate pricing and potentially lower premiums for safe drivers. Additionally, insurers will be able to offer personalized coverage options, catering to the unique needs of individual policyholders.

Regulation and Industry Adaptation

Regulatory changes will continue to play a significant role in shaping the car insurance industry. Governments and regulatory bodies are likely to introduce new measures to address emerging risks associated with technological advancements. These regulations may impact everything from data privacy to liability frameworks, prompting insurance providers to adapt their policies and practices accordingly. Staying informed about these regulatory developments will be crucial for both insurers and policyholders.

What is the main difference between liability and comprehensive insurance?

+Liability insurance covers damages and injuries caused by the policyholder to others, while comprehensive insurance provides broader coverage for a wide range of non-collision incidents, including theft, natural disasters, and collisions with animals.

Is collision coverage necessary for all drivers?

+While collision coverage is optional, it can be highly beneficial for drivers who want to ensure they’re fully protected in the event of an accident. It covers the cost of repairs or replacements for the insured vehicle, providing peace of mind and financial security.

How does classic car insurance differ from standard auto insurance?

+Classic car insurance is tailored to the unique needs of vintage and classic vehicles. It often includes agreed-value coverage, ensuring the vehicle’s true worth is reflected in the insurance payout. This type of insurance also accommodates the limited mileage and specific maintenance requirements of classic cars.