Auto Insurance Quotes Car Insurance

In the vast landscape of the insurance industry, auto insurance quotes are a crucial aspect for anyone seeking car insurance coverage. The process of obtaining quotes can be intricate, but understanding the key factors involved can make it a more manageable and rewarding experience. This comprehensive guide will delve into the world of auto insurance quotes, shedding light on the essential aspects, and offering valuable insights to help you navigate this essential financial decision.

Understanding Auto Insurance Quotes: The Basics

Auto insurance quotes are the estimated costs provided by insurance companies for covering a vehicle and its driver(s). These quotes are tailored to individual needs and circumstances, taking into account various factors to determine the level of risk and, consequently, the insurance premium. Here’s a closer look at the key elements that influence auto insurance quotes.

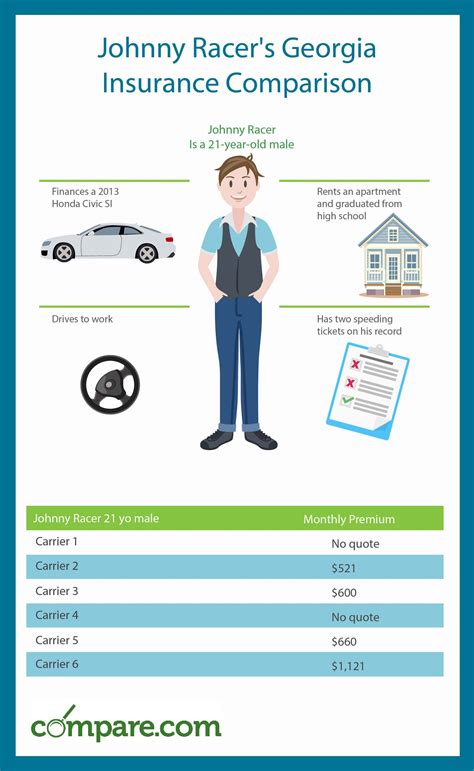

1. Personal Information and Driving History

Insurance companies meticulously assess personal details such as age, gender, marital status, and driving history. Young drivers, for instance, are often associated with higher premiums due to their perceived risk level. Similarly, a clean driving record can work in your favor, leading to more favorable quotes. In contrast, a history of accidents or traffic violations might result in higher insurance costs.

2. Vehicle Details

The type of vehicle you drive plays a significant role in determining insurance quotes. Factors like the make, model, year, and even the safety features of your car can impact the quote. For instance, a luxury sports car with a high-performance engine might attract a higher premium compared to a standard sedan.

| Vehicle Category | Average Insurance Premium |

|---|---|

| Sports Cars | $1,800 - $2,500 annually |

| Sedans | $1,200 - $1,600 annually |

| SUVs | $1,300 - $1,800 annually |

3. Coverage Types and Limits

The type and extent of coverage you opt for significantly influence your insurance quote. Common coverage types include liability, collision, comprehensive, and personal injury protection. The higher the coverage limits, the more expensive your insurance policy will likely be.

4. Location and Usage

Your geographical location and how you use your vehicle are other vital considerations. Areas with higher crime rates or a history of frequent accidents might attract higher insurance premiums. Similarly, using your vehicle for personal or commercial purposes can affect the quote. Commercial use, for example, often comes with a higher risk and, consequently, a higher premium.

5. Discounts and Bundles

Insurance companies often provide discounts to encourage safe driving practices and loyalty. Common discounts include safe driver discounts, multi-policy discounts (for bundling multiple insurance types with the same provider), and loyalty discounts for long-term customers. These can significantly reduce your overall insurance costs.

The Quote Process: A Step-by-Step Guide

Obtaining auto insurance quotes is a straightforward process, thanks to the advancements in online technology. Here’s a simplified breakdown of the steps involved.

1. Gather Necessary Information

Before requesting quotes, ensure you have all the relevant details handy. This includes your personal information, driving history, vehicle details, and an idea of the coverage types and limits you require.

2. Compare Multiple Quotes

It’s advisable to obtain quotes from several insurance providers. Online comparison tools can be immensely helpful in this regard, allowing you to quickly gather and compare quotes from multiple companies.

3. Assess the Quotes

When evaluating quotes, consider not just the premium but also the coverage offered. A lower premium might seem attractive, but it could indicate limited coverage. Strike a balance between affordability and comprehensive protection.

4. Discuss with an Agent

If you have specific questions or concerns, consider reaching out to an insurance agent. They can provide personalized advice and clarify any doubts you might have about the quote.

5. Choose and Purchase

Once you’ve found a quote that meets your needs and budget, you can proceed with the purchase. This typically involves filling out an application and providing payment details. Ensure you understand the terms and conditions of the policy before finalizing the purchase.

Maximizing Your Auto Insurance Experience

Auto insurance is an essential aspect of vehicle ownership, and understanding the quote process can empower you to make informed decisions. By considering the factors that influence quotes and following the step-by-step guide provided, you can navigate the insurance landscape with confidence.

1. Regularly Review Your Policy

Insurance needs can change over time. It’s essential to review your policy annually to ensure it still meets your requirements. This might involve adjusting coverage limits or adding new drivers to the policy.

2. Practice Safe Driving

Safe driving practices not only reduce the risk of accidents but also lead to more favorable insurance quotes. Avoid traffic violations and prioritize defensive driving to maintain a clean driving record.

3. Explore Discount Opportunities

Insurance companies offer a variety of discounts to attract customers. From safe driver discounts to loyalty rewards, explore all the opportunities available to you. Bundle multiple policies with the same provider to potentially save more.

4. Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach that tailors your premium based on your actual driving behavior. This can be an attractive option for low-mileage drivers or those with safe driving habits.

Conclusion

Auto insurance quotes are a fundamental aspect of the insurance landscape, offering a gateway to comprehensive vehicle coverage. By understanding the factors that influence quotes and following the steps outlined in this guide, you can navigate the insurance world with confidence and make informed decisions that align with your needs and budget.

How often should I review my auto insurance policy?

+It’s recommended to review your policy annually to ensure it aligns with your current needs and circumstances. This allows you to make necessary adjustments, such as adding new drivers or updating coverage limits.

Can I negotiate my auto insurance quote?

+While insurance quotes are primarily based on calculated risk factors, you can discuss potential discounts and offers with your insurance agent. They might be able to provide insights on how to optimize your policy for better value.

What are some common discounts available with auto insurance?

+Common discounts include safe driver discounts, multi-policy discounts (for bundling multiple insurance types), loyalty discounts for long-term customers, and usage-based insurance discounts for low-mileage drivers.