Basic Auto Insurance Coverage

Welcome to our comprehensive guide on understanding the essentials of basic auto insurance coverage. Navigating the world of car insurance can be complex, but we're here to break it down and help you make informed decisions. Whether you're a seasoned driver or a first-time car owner, this article will provide you with the knowledge to choose the right coverage for your needs.

Unraveling the Basics of Auto Insurance

Auto insurance is a vital aspect of responsible vehicle ownership. It provides financial protection and covers a range of scenarios, ensuring you’re prepared for the unexpected. From accidents to natural disasters, having the right coverage can mean the difference between a smooth recovery and a financial headache.

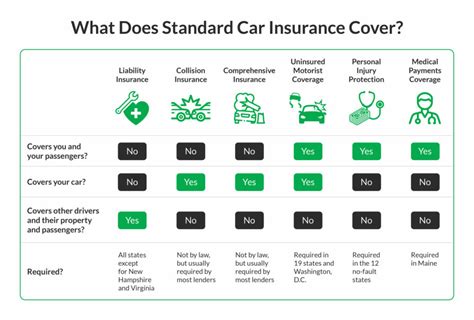

At its core, basic auto insurance consists of several key components, each designed to address specific risks and liabilities. These components include liability coverage, personal injury protection, and property damage coverage. Let's delve into each of these to understand their significance.

Liability Coverage: Protecting Others

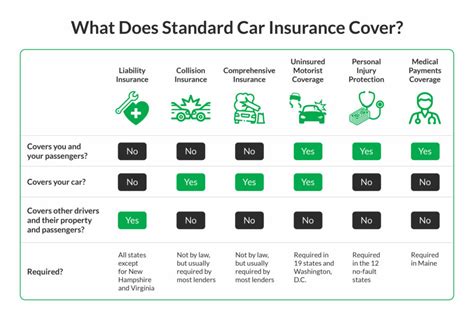

Liability coverage is the cornerstone of any auto insurance policy. It safeguards you financially in the event you’re found at fault for an accident that causes injury or damage to others. This coverage is essential, as it helps cover medical expenses, property damage, and even legal costs that may arise from such incidents.

Within liability coverage, there are two main types: bodily injury liability and property damage liability. Bodily injury liability covers the medical bills and lost wages of injured individuals, while property damage liability covers repairs or replacements for damaged vehicles or property. Both of these aspects are crucial in ensuring you're not left with overwhelming financial burdens.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical costs and lost wages of injured individuals. |

| Property Damage Liability | Covers repairs or replacements for damaged vehicles or property. |

Personal Injury Protection: Caring for Yourself

Personal injury protection, often referred to as PIP, is a vital component of basic auto insurance. It provides coverage for your own medical expenses and those of your passengers, regardless of who is at fault in an accident. This coverage ensures you have the necessary financial support to address any injuries sustained during a collision.

PIP coverage can include a range of benefits, such as:

- Medical expenses: Covers doctor visits, hospital stays, and rehabilitation costs.

- Lost wages: Reimburses a portion of your income if you're unable to work due to injuries.

- Funeral expenses: Provides financial assistance in the unfortunate event of a fatality.

- Rehabilitation and therapy costs: Covers the expenses associated with recovering from injuries.

Property Damage Coverage: Repairing Your Vehicle

Property damage coverage is an essential part of basic auto insurance, as it helps repair or replace your vehicle in the event of an accident. This coverage is particularly crucial for vehicle owners, as it ensures you're not left with the entire financial burden of repairing or replacing your car after a collision.

Property damage coverage typically includes:

- Collision coverage: Pays for repairs or replacements if your vehicle collides with another vehicle or object.

- Comprehensive coverage: Covers damages from non-collision events like theft, vandalism, natural disasters, or collisions with animals.

Understanding Additional Coverage Options

While basic auto insurance provides a solid foundation, there are additional coverage options to consider, depending on your specific needs and the value of your vehicle.

Uninsured/Underinsured Motorist Coverage

This coverage comes into play when you’re involved in an accident with a driver who has insufficient or no insurance. It ensures you’re protected financially and can receive compensation for damages and injuries sustained.

Medical Payments Coverage

Medical payments coverage, often called MedPay, provides additional medical expense coverage beyond PIP. It can cover co-pays, deductibles, and other medical costs associated with an accident.

Rental Car Reimbursement

If your vehicle is in the shop for repairs, rental car reimbursement coverage can provide financial assistance to cover the cost of renting a temporary vehicle.

Roadside Assistance

Roadside assistance coverage offers peace of mind by providing services like towing, flat tire changes, and battery jumps when you’re stranded on the road.

Choosing the Right Coverage: A Personalized Approach

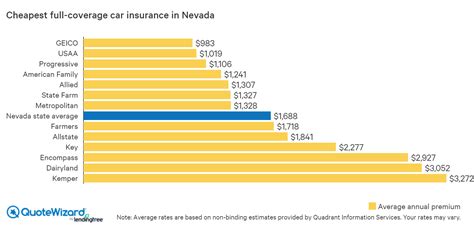

Selecting the appropriate auto insurance coverage involves considering several factors, including your state’s legal requirements, the value of your vehicle, and your personal financial situation. It’s essential to strike a balance between adequate coverage and affordability.

Consulting with insurance professionals can be invaluable. They can guide you through the process, helping you understand the nuances of different coverage options and tailor a policy that suits your needs perfectly.

Tips for Choosing Coverage:

- Research and compare quotes from multiple insurers to find the best rates.

- Understand your state’s minimum liability requirements but consider opting for higher limits for added protection.

- Assess your financial situation to determine the level of coverage you can comfortably afford.

- Consider adding optional coverages like uninsured motorist protection for added peace of mind.

The Future of Auto Insurance: Innovations and Trends

The world of auto insurance is evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into some of the trends shaping the future of basic auto insurance coverage.

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are gaining popularity. These innovative approaches to insurance allow drivers to provide real-time data on their driving habits, offering personalized premiums based on actual usage and driving behavior.

AI and Machine Learning

Artificial intelligence and machine learning are being leveraged to enhance claims processing and fraud detection, improving the overall efficiency of the insurance process.

Connected Car Technology

As vehicles become increasingly connected, insurers are exploring ways to integrate this technology into insurance policies, offering discounts for safe driving behaviors and providing real-time data for more accurate risk assessments.

Conclusion: Empowering Your Auto Insurance Journey

Understanding the fundamentals of basic auto insurance coverage is the first step towards making informed decisions about your vehicle’s protection. By exploring the various components of auto insurance, considering additional coverage options, and staying informed about industry trends, you can navigate the complex world of insurance with confidence.

Remember, your auto insurance policy is a personalized safety net, designed to protect you and your loved ones on the road. Take the time to assess your needs, research your options, and consult with experts to ensure you have the coverage that best suits your unique circumstances.

What is the average cost of basic auto insurance coverage?

+The average cost of basic auto insurance coverage can vary significantly depending on factors such as your location, driving record, and the make and model of your vehicle. On average, drivers can expect to pay anywhere from 500 to 1,500 annually for basic liability coverage. However, this range can fluctuate widely based on individual circumstances.

Is it mandatory to have auto insurance?

+Yes, in most states, it is mandatory to have auto insurance. Each state has its own specific laws regarding minimum liability coverage requirements. Failing to have the required insurance can result in fines, license suspension, or even legal consequences.

How can I lower my auto insurance premiums?

+There are several strategies to reduce your auto insurance premiums. These include maintaining a clean driving record, bundling multiple insurance policies with the same provider, increasing your deductible, and taking advantage of discounts for safe driving behaviors or vehicle safety features.