What Is Gap Insurance

Gap insurance, also known as "Guaranteed Asset Protection" insurance, is a specialized form of coverage designed to bridge the financial gap that can arise when a vehicle is declared a total loss due to an accident, theft, or other covered event. This type of insurance provides an extra layer of protection for vehicle owners, ensuring they are not left with a substantial financial burden should they find themselves in such a situation.

Understanding Gap Insurance

When an insured vehicle is deemed a total loss, the insurance company typically reimburses the policyholder based on the vehicle’s actual cash value (ACV). The ACV is calculated by considering factors such as the vehicle’s age, mileage, condition, and market value. However, this value may not always align with the outstanding loan or lease balance on the vehicle.

This is where gap insurance comes into play. It covers the difference, or the "gap," between the ACV of the vehicle and the amount still owed on the loan or lease. By doing so, gap insurance ensures that policyholders are not held financially responsible for the difference, which can often be a significant sum.

Key Features of Gap Insurance

- Total Loss Protection: Gap insurance primarily covers situations where the vehicle is declared a total loss. This includes instances of severe accidents, natural disasters, or theft where the vehicle is unrecoverable.

- Lease and Loan Coverage: Gap insurance is particularly beneficial for individuals who lease their vehicles or have outstanding loans. It ensures that, in the event of a total loss, they are not responsible for the remaining payments or a large balloon payment.

- Additional Coverage: Some gap insurance policies also provide coverage for situations where the vehicle is stolen and not recovered within a certain timeframe or if the policyholder voluntarily terminates the lease due to a job loss or disability.

- Cost-Effectiveness: Despite offering comprehensive protection, gap insurance is typically affordable, with premiums ranging from a few dollars to a few hundred dollars, depending on the policy and the vehicle.

Who Needs Gap Insurance?

Gap insurance is highly recommended for individuals who have recently purchased or leased a vehicle, especially if they have taken out a loan or lease with a high loan-to-value ratio. This is because new vehicles depreciate rapidly in the first few years of ownership, and the gap between the vehicle’s value and the loan amount can be significant.

Additionally, individuals who have made a small down payment or are financing a large portion of the vehicle's value may find gap insurance beneficial. It provides peace of mind, knowing that they are protected from unexpected financial liabilities in the event of a total loss.

Real-World Scenarios

Consider the following examples to better understand how gap insurance works:

-

Accident Scenario: John purchases a new car for 30,000 and finances 28,000 over 60 months. After a year, his car is involved in an accident and is declared a total loss. The insurance company assesses the ACV of the vehicle at 25,000. Without gap insurance, John would have to pay the 3,000 difference out of pocket. However, with gap insurance, the policy covers this gap, ensuring John is not financially burdened.

-

Lease Termination: Sarah leases a luxury SUV for three years. Due to a job relocation, she needs to terminate the lease early. Without gap insurance, she would be responsible for the remaining lease payments and a potential early termination fee. However, with gap insurance, the policy covers these costs, providing her with financial relief during a transitional period.

Considerations and Limitations

While gap insurance offers valuable protection, it’s important to note its limitations. Gap insurance typically does not cover situations where the vehicle is stolen and then recovered in a damaged state. In such cases, the standard comprehensive insurance policy would cover the damage, and the gap insurance would not apply.

Additionally, gap insurance is designed to cover the gap at the time of the total loss. If the policyholder's financial situation changes, such as taking out a new loan or extending the lease, the gap insurance may not cover the additional amount owed. It's essential to review the policy terms and conditions to understand the specific coverage and limitations.

The Future of Gap Insurance

As the automotive industry evolves, gap insurance is likely to adapt and expand its coverage to meet the changing needs of vehicle owners. With the rise of electric vehicles (EVs) and autonomous driving technologies, the insurance landscape is already shifting. Gap insurance providers may need to consider the unique challenges and benefits associated with these new technologies, such as the potential for reduced accidents or the impact of battery degradation on vehicle value.

Furthermore, with the increasing popularity of subscription-based mobility services and vehicle sharing platforms, gap insurance may need to evolve to cater to these new ownership models. This could involve developing policies that cover a wider range of vehicles and situations, ensuring that individuals who utilize these services are adequately protected.

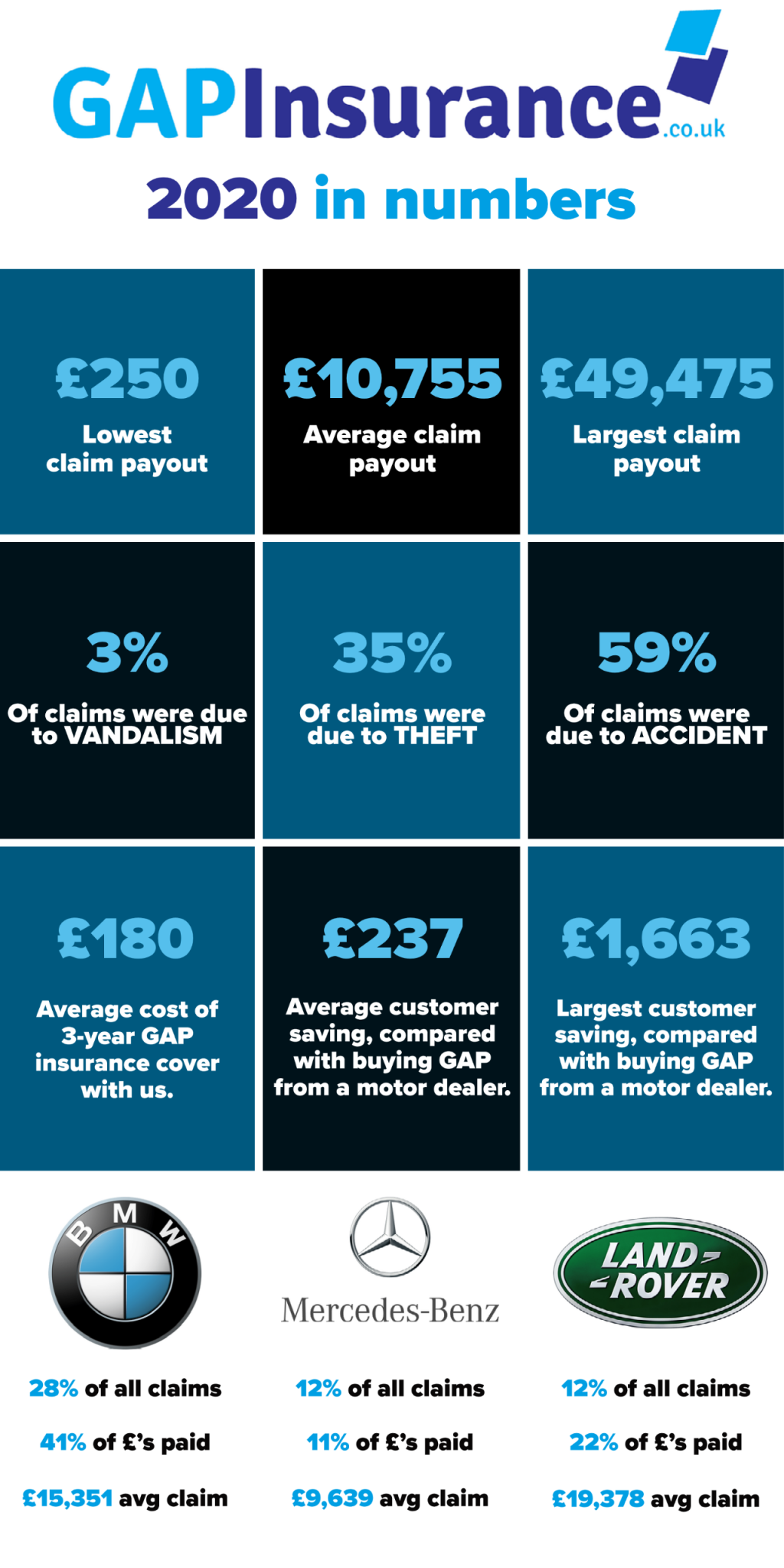

How much does gap insurance cost?

+The cost of gap insurance can vary depending on several factors, including the make and model of the vehicle, the length of the loan or lease, and the insurance provider. On average, gap insurance premiums range from a few dollars to a few hundred dollars annually. However, it’s important to note that the cost is typically much lower than the potential financial liability it protects against.

Is gap insurance available for all types of vehicles?

+Yes, gap insurance is available for a wide range of vehicles, including cars, trucks, SUVs, and even motorcycles. However, the availability and specific terms may vary depending on the insurance provider and the type of vehicle. It’s always recommended to check with your insurance company or broker to understand the coverage options for your specific vehicle.

Can gap insurance be added to an existing auto insurance policy?

+In most cases, gap insurance can be added as an endorsement or rider to an existing auto insurance policy. This allows policyholders to enhance their coverage without having to purchase a separate policy. However, it’s essential to review the terms and conditions of your auto insurance policy to ensure that gap insurance is an available option.